Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Demand for Animal Nutrients in Livestock Production

Global consumption of livestock products continues to rise, pushing feed manufacturers to boost nutrient profiles, especially trace minerals. Recent data shows that world meat consumption per capita now averages 45kg annually, up from 40kg just five years ago. This uptick has placed greater emphasis on balanced animal nutrition, with zinc, iron, and selenium becoming critical supplements in modern feed formulations to support meat quality and animal health.Corresponding with rising meat demand, egg and dairy output have also surged - global egg production recently exceeded 90 million tonnes, marking a 12% increase compared to the previous quinquennial average. Dairy output has similarly climbed, heightening the need for efficient micro-nutrient inclusion. Trace minerals like manganese and copper are being added to feed blends to enhance reproduction, shell strength, and milk composition, ensuring production keeps pace with demand.

Livestock systems are transitioning from subsistence to intensive and commercial operations, particularly in Asia, Latin America, and parts of Africa. In these regions, livestock population growth surpasses 3% annually, with producers adopting fortified feeds to reduce mortality and boost growth rates. Trace mineral supplementation is recognized as essential for reducing disease susceptibility and improving feed conversion ratios, making it a staple in modernized feed regimens.

Key Market Challenges

Fluctuating Raw Material Prices

One of the most pressing challenges in the trace minerals in feed market is the volatility in raw material prices, especially for essential minerals such as zinc, copper, iron, and manganese. These minerals are heavily dependent on global mining outputs, which are influenced by geopolitical instability, trade restrictions, environmental regulations, and energy costs.For instance, copper prices saw significant swings in the past two years due to supply chain disruptions and policy changes in major producing countries. Such fluctuations make it difficult for feed manufacturers to maintain stable procurement costs, which in turn affects production planning and pricing strategies. As a result, feed producers often struggle to offer competitively priced products, especially in emerging markets where cost sensitivity is high. This pricing instability can deter adoption and weaken long-term supplier-farmer relationships, undermining overall market consistency.

Key Market Trends

Precision Nutrition & Tech Integration

The rising focus on precision nutrition is reshaping the trace minerals in feed market, as producers aim to fine-tune animal diets to optimize health, productivity, and sustainability. Unlike conventional supplementation methods, precision nutrition employs real-time data analytics, AI, and IoT-based sensors to determine exact nutrient needs based on species, age, weight, genetics, and environmental conditions. This allows for individualized trace mineral dosing, reducing waste and improving feed efficiency. With the integration of smart farming platforms, nutritionists can remotely monitor and adjust formulations, ensuring animals receive the right mineral mix at the right time. As livestock operations become more digitized, precision nutrition enables producers to meet higher performance benchmarks while aligning with environmental regulations and animal welfare standards.Key Market Players

- Titan Biotech Limited

- Balchem Inc.

- Novus International, Inc.

- Alltech, Inc.

- Kemin Industries, Inc.

- Global Animal Products, Inc.

- Società San Marco S.R.L.

- BASF SE

- Zinpro Corp.

- Orffa International Holding B.V.

Report Scope:

In this report, Global Trace Minerals in Feed market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Trace Minerals in Feed Market, By Type:

- Zinc

- Iron

- Cobalt

- Copper

- Manganese

- Others

Trace Minerals in Feed Market, By Livestock:

- Poultry

- Ruminants

- Swine

- Aquatic Animals

- Others

Trace Minerals in Feed Market, By Form:

- Dry

- Liquid

Trace Minerals in Feed Market, By Chelate Type:

- Amino Acids

- Proteinates

- Polysaccharide Complexes

- Others

Trace Minerals in Feed Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Spain

- Italy

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive landscape

Company Profiles: Detailed analysis of the major companies in Global Trace Minerals in Feed market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Titan Biotech Limited

- Balchem Inc.

- Novus International, Inc.

- Alltech, Inc.

- Kemin Industries, Inc.

- Global Animal Products, Inc.

- Società San Marco S.R.L.

- BASF SE

- Zinpro Corp.

- Orffa International Holding B.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

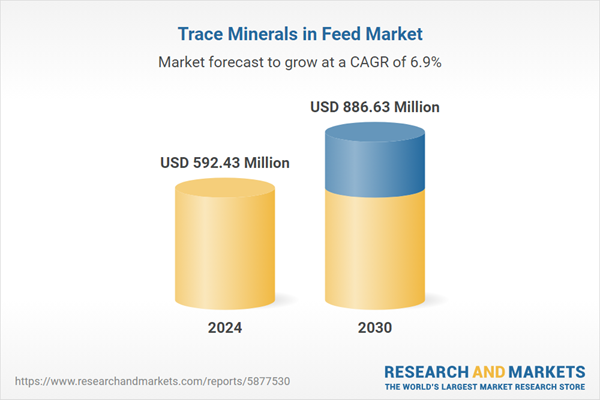

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 592.43 Million |

| Forecasted Market Value ( USD | $ 886.63 Million |

| Compound Annual Growth Rate | 6.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |