Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Hyperlipidemia, or high cholesterol, refers to a medical ailment characterized by prominent levels of fats in the bloodstream. It is the abnormal rise of lipids and/or lipoprotein levels that can lead to stroke, peripheral vascular disease, atherosclerosis, diabetes, obesity, hypertension, and cardiovascular diseases. It is usually caused by genetic factors, unhealthy lifestyles, and inadequate diet. Some of the commonly used hyperlipidemia drugs include statins, proprotein convertase subtilisin/kexin type 9 (PCSK9) inhibitors, bile acid sequestrants, fibric acid derivatives or fibrates, and combination and miscellaneous antihyperlipidemic agents. These drugs reduce cholesterol production levels in the liver while further removing it from the bloodstream. Thereby, propels the growth of Israel hyperlipidemia drugs market.

Development of New and Improved Drugs

Israel hyperlipidemia drugs market has benefited from the development of new and improved drugs to manage cholesterol levels. For example, PCSK9 inhibitors are a newer class of drugs that have been effective in reducing LDL cholesterol levels. As more effective drugs are being developed and approved, the Israel hyperlipidemia drugs market is expected to continue to grow. The development of improved drugs for hyperlipidemia seems to be a critical area of research, as current therapies, such as statins, may not be effective for all patients and can have side effects. For instance, proprotein convertase subtilisin/kexin type 9 (PCSK9) inhibitors are a new class of drugs that work by blocking the PCSK9 protein, which participates in the metabolism of LDL cholesterol. These drugs have been shown to significantly reduce LDL cholesterol levels in patients with hyperlipidemia, including those with familial hypercholesterolemia, and are well-tolerated. Additionally, bempedoic acid is a new drug that works by inhibiting ATP citrate lyase, an enzyme involved in the synthesis of cholesterol in the liver. Clinical trials have shown that bempedoic acid can significantly reduce LDL cholesterol levels in patients with hyperlipidemia, including those who are statin-intolerant or have other risk factors.Moreover, therapies like RNA based therapies, gene therapy, and combination therapy are cooperating to the growth of Israel hyperlipidemic drugs market. For instance, RNA-based therapies, including antisense oligonucleotides and small interfering RNAs (siRNAs), are being developed to target specific genes involved in cholesterol metabolism, such as PCSK9. These therapies have shown promising results in early-stage clinical trials and may provide a more targeted approach to hyperlipidemia management. These factors can bolster to the growth of the Israel hyperlipidemic drugs market.

Recent Developments

In December 2021, Novartis AG announced the U.S. Food and Drug Administration (FDA) approval of Leqvio (inclisiran). It lowers low-density lipoprotein cholesterol with two doses annually, following a first dose and one after three months, and is the first and only small interfering RNA (siRNA) therapy to do so. Leqvio increases the liver's natural capacity to suppress the production of a protein that contributes to elevated blood cholesterol levels, which lowers LDL-C levels in the bloodstream.Many clinical trials have been conducted by the market players on the study of statin treatment for dyslipidemia.

For instance, in November 2021, Pfizer Ltd announced topline results from the Phase 2b study of vupanorsen (PF-07,285,557), an experimental antisense treatment being researched for indications in cardiovascular (CV) risk reduction and severe hypertriglyceridemia (SHTG), had topline data from the Phase 2b study released by Pfizer. According to the study, vupanorsen significantly reduced non-HDL-C, triglycerides, and other lipoproteins linked to cardiovascular disease.

Additionally, in September 2022, the University of Pennsylvania started a clinical trial to evaluate the efficiency of statins based on non-visit and visit-based interventions for their optimized referral to patients affected by hyperlipidemia. Such studies which focus on the utilization of statins for the lipid disorders are expected to add to the growth of the market segment over the forecast period.

Increasing Prevalence of Hyperlipidemia

The rising prevalence of hyperlipidemia across the globe is estimated to enhance the market's growth. Along with this, the rising awareness among population about the risk of cardiovascular diseases due to persistent hyperlipidemia will propel the growth rate of hyperlipidemia drugs market. According to Current Status of Cardiovascular Medicine in Israel, heart disease is the second cause of mortality (after cancer) and in recent years accounted for 15% of the total number of deaths. Additionally, Israel has one of the lowest age-standardized mortality rates attributable to cardiovascular causes (64 per 100 000 population). Furthermore, cardiac diseases affect 10.2% of Israeli men and 7.1% of women, with a prevalence of coronary artery disease of 7.5% and 4.1%, respectively. Cardiac disorders increase with age, 42% of men and 31% of women aged ≥75 years have a cardiac illness. Therefore, augmenting national measures to prevent heart diseases is one of the biggest challenges and unmet needs of the Israeli healthcare system which further adds on to the growth of Israel hyperlipidemia drugs market.Additionally, there are several factors that contribute to the increasing prevalence of hyperlipidemia in Israel. One of the main factors is a shift towards a western-style diet, which is high in saturated and trans fats and low in fruits, vegetables, and whole grains. This diet has been associated with an increased risk of hyperlipidemia and other chronic health conditions. Another factor is the aging population in Israel. As the population ages, the prevalence of hyperlipidemia increases, as older adults are more likely to have other chronic health conditions and lifestyle factors that contribute to hyperlipidemia. Obesity is also a significant risk factor for hyperlipidemia, and rates of obesity in Israel have been increasing in recent years. According to a report by the Israel’s Ministry of Health, the prevalence of obesity among Israeli adults increased from 14% in 2003 to 26% in 2015 and it has been increased by 62 percent of men and 55% of women. Additionally, there is a genetic predisposition to hyperlipidemia in certain populations, including those of Middle Eastern and North African descent. As Israel has a diverse population, including a considerable proportion of individuals with Middle Eastern and North African ancestry, this may contribute to the higher prevalence of hyperlipidemia in the country.

Furthermore, the growing awareness and support provided by the Israel government includes healthcare facilities and infrastructure. In Israel, approximately 25,000 hospitalizations occur because of myocardial infarction each year; 43,000 patients have coronary angiograms annually, and 23,000 patients undergo percutaneous coronary interventions, mostly in the same setting as diagnostic procedures, but approximately 50% occur during hospitalization because of acute coronary syndrome (ACS). These factors are expected to participate in the growth of Israel hyperlipidemia drugs market.

Market Segmentation

Israel hyperlipidemia drugs market is segmented by drug class, distribution channel, and region. By drug class, the market is segmented into statins, bile acid sequestrants, cholesterol absorption inhibitors, pcsk9 inhibitors, combination, and others. Based on distribution channel, the market can be segmented into hospital pharmacy, retail pharmacy, and online pharmacy.Market Players

Pfizer Pharmaceuticals Israel Ltd, MERCK SERONO LTD., AstraZeneca Israel Inc, Novartis Pharma Israel Ltd, Sanofi-Aventis Israel Ltd, GlaxoSmithKline Israel Ltd., Israel B. Abbott., Takeda Israel Inc., Teva Israel Ltd., and Servier Israel Inc. are some of the leading companies operating in the Israel hyperlipidemia drugs market.Report Scope

In this report, Israel hyperlipidemia drugs market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Israel Hyperlipidemia Drugs Market, by Drug Class

- Statins

- Bile Acid Sequestrants

- Cholesterol Absorption Inhibitors

- PCSK9 Inhibitors

- Combination

- Others

Israel Hyperlipidemia Drugs Market, by Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

Israel Hyperlipidemia Drugs Market, by Region:

- The Mediterranean Coastal Plain

- The Central Hills

- The Jordan Rift Valley

- The Negev Desert

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in Israel hyperlipidemia drugs market.Available Customizations

The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Pfizer Pharmaceuticals Israel Ltd.

- MERCK SERONO LTD.

- AstraZeneca Israel Inc

- Novartis Pharma Israel Ltd.

- Sanofi-Aventis Israel Ltd

- GlaxoSmithKline Israel Ltd.

- Israel B. Abbott.

- Takeda Israel Inc.

- Teva Israel Ltd.

- Servier Israel Inc.

Table Information

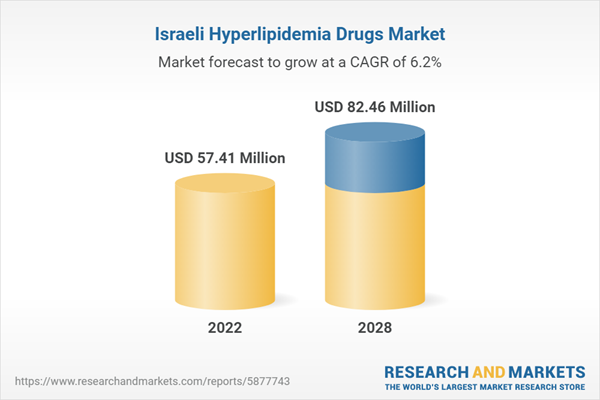

| Report Attribute | Details |

|---|---|

| No. of Pages | 73 |

| Published | August 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 57.41 Million |

| Forecasted Market Value ( USD | $ 82.46 Million |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Israel |

| No. of Companies Mentioned | 10 |