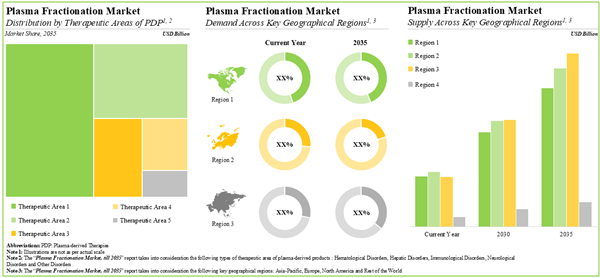

The global plasma fractionation market is estimated to grow from $ 4.8 billion in 2024 to reach $ 5.3 billion in 2025 and $ 12.7 billion by 2035, representing a higher CAGR of 9.2% during the forecast period.

Plasma Fractionation Market: Growth and Trends

The plasma fractionation market is primarily driven by the growing demand for plasma-derived therapies for treating several disease indications, such as oncological disorders, hematological disorders, pulmonary disorders and immunological disorders. Plasma fractionation is a critical step to ensure the separation and purification of key blood plasma components, such as immunoglobulins, albumins, anticoagulant factors and protease inhibitors. The refined blood plasma components can then be used for the formulation of therapeutics. It is interesting to note that among all the plasma-derived therapies, demand for immunoglobulins is anticipated to be the highest. The anticipated growth of the market can be hindered by challenges, such as limited blood plasma supply and a lack of proper regulatory framework.

Despite several challenges, owing to a broader spectrum of target disease indications (specifically rare and chronic diseases), improved diagnosis rates, and higher standards of healthcare in emerging markets, the popularity of plasma-derived therapies is rapidly increasing. Driven by the growing demand for blood plasma therapies and the ongoing advancements in fractionation manufacturing technologies, the plasma fractionation market is expected to grow at a noteworthy pace in the foreseen future.

Plasma Fractionation Market: Key Insights

The report delves into the current state of the plasma fractionation market and identifies potential growth opportunities within the industry.

Some key findings from the report include:

- Currently, more than 35 companies claim to have the expertise for blood plasma fractionation, required for the development of plasma-derived therapies; of which, nearly 50% of the players have facilities in developed regions.

- Majority of the plasma fractionators are well-established players; ~75% of the players have the capabilities for offering formulation services.

- In recent years, the domain witnessed a steady growth in partnership activity; the majority of the initiatives were mergers and acquisitions carried out by players based in Europe.

- Owing to the growing demand for plasma-derived therapies, plasma fractionators are investing in expanding their existing capabilities across various regions; of these, ~30% of the initiatives were undertaken in North America.

- Over 90% of the global installed plasma fractionation capacity is dedicated to the manufacturing of albumins and immunoglobulins for commercial applications.

- With the growing focus on the development of efficacious plasma-derived therapies, the plasma fractionation market is anticipated to witness an annualized growth of ~10%, over the next decade.

- In the long term, the plasma-derived therapies for immunological disorders are likely to emerge as the key growth drivers of the plasma fractionation market; Asia-Pacific is anticipated to be the fastest growing region.

The market sizing and opportunity analysis has been segmented across the following parameters:

Type of Company

- In-house Manufacturers

- Contract Service Providers

Scale of Operation

- Preclinical

- Clinical

- Commercial

Type of Plasma-derived Therapeutic Products Manufactured

- Albumins

- Coagulation Factors

- Immunoglobulins

- Protease Inhibitors

- Other Plasma-derived Products

Therapeutic Areas of Plasma-derived Products

- Hematological Disorders

- Hepatic Disorders

- Immunological Disorders

- Neurological Disorders

- Other Disorders

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

Plasma Fractionation Market: Key Segments

In-House manufacturers Occupy the Largest Share of the Plasma Fractionation Market

Based on the type of company, the market is segmented into in-house manufacturers and contract service providers. At present, in-house manufacturers capture the highest share of the plasma fractionation market. It is worth highlighting that the plasma fractionation market for contract service providers is likely to grow at a relatively higher CAGR.

By Scale of Operation, Commercial Scale is Likely to Dominate the Plasma Fractionation Market During the Forecast Period

Based on the scale of operation, the market is segmented into preclinical, clinical and commercial scale. Currently, the commercial scale holds the highest share of the plasma fractionation market. This trend is unlikely to change in the near future.

Immunoglobulins Segment Occupies the Largest Share of the Plasma Fractionation Market

Based on the type of plasma-derived therapeutic products manufactured, the market is segmented into albumin, coagulation factors, immunoglobulins, protease inhibitors and other plasma-derived products. At present, immunoglobulins hold the maximum share of the plasma fractionation market. This trend is likely to remain the same in the forthcoming years.

Oncological Disorders Account for the Largest Share of the Plasma Fractionation Market

Based on the therapeutic areas of plasma-derived products, the market is segmented into hematological disorders, hepatic disorders, immunological disorders, neurological disorders and other disorders. While immunological disorders account for a relatively higher market share, it is worth highlighting that neurological disorders are expected to witness substantial growth in the coming years.

Europe Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the world. The majority share is expected to be captured by players based in Europe. It is worth highlighting that, over the years, the market in Asia-Pacific is expected to grow at a higher CAGR.

Key Players in the Plasma Fractionation Market, Profiled in the Report Include:

- Baxter

- Grifols

- Kedrion

- Octapharma

- CSL

- Takeda Pharmaceutical

Plasma Fractionation Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the plasma fractionation market, focusing on key market segments, including type of company, scale of operation, type of plasma-derived therapeutic products manufactured, therapeutic areas of plasma-derived products and key geographical regions.

- Market Landscape: A comprehensive evaluation of plasma fractionation companies, considering various parameters, such as year of establishment, company size (in terms of number of employees), location of headquarters, type of company, location of plasma fractionation facilities, location of plasma collection facility, availability of patented / proprietary technology, additional fractionation capabilities, scale of operation, type of plasma-derived therapeutic products manufactured, therapeutic areas of plasma-derived products and end users.

- Company Competitiveness Analysis: A comprehensive competitive analysis of plasma fractionation companies based in North America, Europe, Asia-Pacific and rest of the world, examining factors, such as company strength and portfolio strength.

- Company Profiles: In-depth profiles of key plasma fractionation service providers, focusing on company overviews, financial information (if available), plasma fractionation portfolio, recent developments and an informed future outlook.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2018, based on several parameters, such as year of partnership, type of partnership, purpose of agreement, type of plasma-derived therapeutic products manufactured, type of partner, most active players and regional distribution of the companies involved in these agreements.

- Recent Expansions: An examination of the different expansion efforts made by plasma fractionation companies in this field to enhance their capabilities, since 2018. This analysis considers various factors, including the year of expansion, type of expansion, type of facility, location of expanded facility, type of plasma-derived therapeutic products manufactured and most active players.

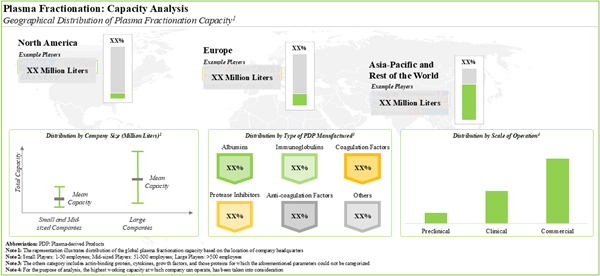

- Capacity Analysis: Estimation of global fractionation capacity, derived from data provided by various stakeholders in the public domain. This analysis emphasizes the distribution of the available capacity on the basis of company size (small, mid-sized and large), type of plasma-derived therapeutic products manufactured (albumins, anti-coagulation factors, coagulation factors, immunoglobulins, protease inhibitors and other plasma-derived products), scale of operation (preclinical, clinical and commercial) and key geographical region (North America, Europe, Asia-Pacific and rest of the world).

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What is the annual plasma fractionation capacity?

- What kind of partnership models are commonly adopted by industry stakeholders?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 10% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Baxter

- Grifols

- Kedrion

- Octapharma

- CSL

- Takeda Pharmaceutical

Methodology

LOADING...