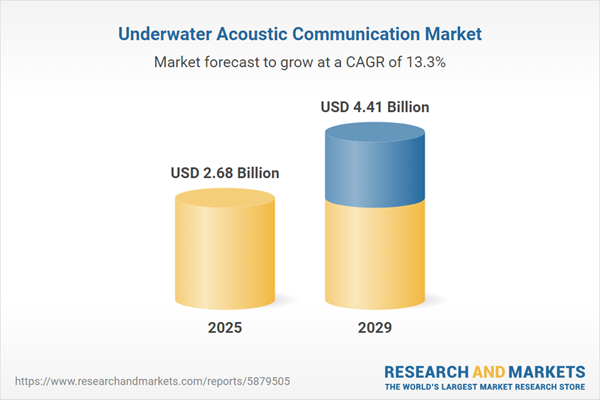

The underwater acoustic communication market size is expected to see rapid growth in the next few years. It will grow to $4.41 billion in 2029 at a compound annual growth rate (CAGR) of 13.3%. The growth in the forecast period can be attributed to rising demand in offshore renewable energy, expansion of underwater robotics, commercial subsea exploration, underwater data centers, environmental monitoring and conservation, increasing applications in environmental monitoring, military and defense applications. Major trends in the forecast period include underwater navigation systems, strategic collaborations, commercial offshore infrastructure, research and development in underwater acoustics.

The increasing demand for environmental protection is anticipated to drive the growth of the underwater acoustic communication market in the future. Environmental protection encompasses efforts aimed at conserving and preserving the natural environment, preventing pollution, and promoting sustainable practices to safeguard the Earth's ecosystems and resources. Underwater acoustic communication plays a crucial role in supporting conservation initiatives and fostering sustainable practices in aquatic environments, including underwater noise monitoring and marine protected area (MPA) management. For example, in May 2023, a publication by the International Energy Agency (IEA), a France-based intergovernmental organization, reported a significant rise in global energy investment in clean energy, increasing from $1.4 trillion in 2021 to $1.74 trillion in 2023. This clearly illustrates the growing commitment to environmentally sustainable practices. Thus, the rising demand for environmental protection is propelling the growth of the underwater acoustic communication market.

The growing military and defense industries are expected to drive the growth of the underwater acoustic communication market in the future. This sector is dedicated to the research, development, production, and maintenance of military equipment, technologies, and services. Underwater acoustic communication is utilized by the military and defense sectors to create secure and covert communication channels beneath the water's surface, enhancing naval operations and surveillance capabilities. This technology enables reliable data transmission, submarine navigation, and coordination of underwater assets, contributing to improved situational awareness and strategic operations in maritime environments. For instance, in April 2024, the UK Defence in Numbers 2023 report published by the Ministry of Defence, a UK-based government ministry, indicated that £2.3 billion was allocated for military support in both 2022 and 2023, with plans to increase this to £2.5 billion in the following year. Additionally, defense spending rose from £52.8 billion in 2022/23 to £54.2 billion in 2023/24. Thus, the expansion of the military and defense industries is driving the growth of the underwater acoustic communication market.

The adoption of innovative technologies emerges as a prominent trend in the underwater acoustic communication market. Leading companies in the market are actively integrating new technologies to maintain their competitive edge. For instance, in March 2022, Kongsberg Maritime, a maritime technology company based in Norway, introduced the cNODE MiniS transponder, designed for applications such as placing remotely operated vehicles (ROVs), autonomous underwater vehicles (AUVs), and towed bodies. The transponder units are well-suited for tasks requiring depth data, making them particularly suitable for activities such as subsea structure detection and windfarm installation assistance. The launch of advanced transponder units exemplifies the commitment of companies to adopting new technologies to enhance underwater acoustic communication capabilities.

Major players in the underwater acoustic communication market are actively pursuing technological advancements and product innovations, as evidenced by DSIT Solutions Ltd.'s introduction of the WhitePointer system in March 2022. This state-of-the-art underwater acoustic communication system supports covert operational missions for multiple maritime vessels, tactical missions, and search and rescue operations. The WhitePointer system adheres to NATO standards and enables reliable voice and data communication among various underwater and surface platforms, including submarines, surface ships, divers, and underwater drones. The system's capacity for underwater acoustic networked communication and seamless integration with onboard communication systems positions it as a cutting-edge solution in the market.

In January 2023, Teledyne Technologies Incorporated, a US-based industrial conglomerate company, completed the acquisition of ChartWorld International Ltd. for an undisclosed amount. This strategic move aims to fortify Teledyne's presence in the marine navigation market and enhance its capabilities for commercial marine operations. ChartWorld International Ltd., based in Germany, is recognized for its expertise in digital marine navigation services, underwater acoustic communication services, and provision of digital maritime data.

Major companies operating in the underwater acoustic communication market include Thales Group, L3Harris Technologies Inc., Teledyne Technologies Inc., Saab AB, Moog Inc., Ultra Electronics Ocean Systems Inc., Kongsberg Maritime, Channel Technologies Group, Sonardyne International Ltd., Mistral Solutions Pvt. Ltd., Tritech International Ltd., EdgeTech Marine, Aquatec Group Limited, Guralp Systems Ltd., Gavial Engineering & Manufacturing Inc, Advanced Navigation, Trelleborg Applied Technologies, Ocean Technology Systems, Xeos Technologies Inc., Blueprint Subsea, DSPComm, EvoLogics GmbH, BaltRobotics Sp.z.o.o., J W Fishers Manufacturing Co., RJE International Inc., LinkQuest Inc., Hydroacoustics Inc., Ocean Sonics Ltd., FarSounder Inc., Subnero Pte Ltd, Nortek Group.

North America was the largest region in the underwater acoustic communication market in 2024. The regions covered in the underwater acoustic communication market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the underwater acoustic communication market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Underwater acoustic communication involves the transmission of information or data through sound waves in an aquatic environment. This communication method is specifically designed for use in water, where traditional radio waves or electromagnetic signals are ineffective due to their limited propagation capabilities.

The primary interface platforms for underwater acoustic communication include the sensor interface, acoustic modem, and other components. A sensor interface serves as the connection and communication interface between a sensor and a system or device that processes the sensor's data. This enables the transfer of information from the sensor to the system, allowing the system to collect, interpret, and utilize the sensor data for various purposes. Underwater acoustic communication systems can operate at varying water depths, such as shallow water, medium water, long water, and full ocean communication depths. These systems find applications in environmental monitoring, pollution monitoring, climate recording, hydrography, oceanography, and other fields. Industries such as oil and gas, military and defense, scientific research and development, homeland security, and marine sectors are among the end-users employing underwater acoustic communication technology.

The underwater acoustic communications research report is one of a series of new reports that provides underwater acoustic communications market statistics, including the underwater acoustic communications industry's global market size, regional shares, competitors with an underwater acoustic communications market share, detailed underwater acoustic communications market segments, market trends and opportunities, and any further data you may need to thrive in the underwater acoustic communications industry. This underwater acoustic communications market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The underwater acoustic communication market consists of revenues earned by entities by providing services such as earthquake monitoring, environmental monitoring, ocean current monitoring, network planning and optimization, data transmission, protocol development, and system design and integration services. The market value includes the value of related goods sold by the service provider or included within the service offering. The underwater acoustic communication market also includes sales of underwater acoustic modems, hydrophones, transducers, signal processing units, buoyancy modules, and power management systems, which are used in providing underwater acoustic communication services. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Underwater Acoustic Communication Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on underwater acoustic communication market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for underwater acoustic communication? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The underwater acoustic communication market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Interface Platform: Sensor Interface; Acoustic Modem; Other Interface Platforms2) By Communication Depth: Shallow Water; Medium Water; Long Water; Full Ocean

3) By Application: Environmental Monitoring; Pollution Monitoring; Climate Recording; Hydrography; Oceanography; Other Applications

4) By End-User: Oil and Gas; Military and Defense; Scientific Research and Development; Homeland Security; Marine

Subsegments:

1) By Sensor Interface: Environmental Sensors; Sonar Systems; Oceanographic Sensors2) By Acoustic Modem: Wireless Acoustic Modems; Underwater Communication Modems; Integrated Acoustic Modems

3) By Other Interface Platforms: Data Acquisition Systems; Communication Protocol Interfaces; Network Management Systems

Key Companies Mentioned: Thales Group; L3Harris Technologies Inc.; Teledyne Technologies Inc.; Saab AB; Moog Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Thales Group

- L3Harris Technologies Inc.

- Teledyne Technologies Inc.

- Saab AB

- Moog Inc.

- Ultra Electronics Ocean Systems Inc.

- Kongsberg Maritime

- Channel Technologies Group

- Sonardyne International Ltd.

- Mistral Solutions Pvt. Ltd.

- Tritech International Ltd.

- EdgeTech Marine

- Aquatec Group Limited

- Guralp Systems Ltd.

- Gavial Engineering & Manufacturing Inc

- Advanced Navigation

- Trelleborg Applied Technologies

- Ocean Technology Systems

- Xeos Technologies Inc.

- Blueprint Subsea

- DSPComm

- EvoLogics GmbH

- BaltRobotics Sp.z.o.o.

- J W Fishers Manufacturing Co.

- RJE International Inc.

- LinkQuest Inc.

- Hydroacoustics Inc.

- Ocean Sonics Ltd.

- FarSounder Inc.

- Subnero Pte Ltd

- Nortek Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.68 Billion |

| Forecasted Market Value ( USD | $ 4.41 Billion |

| Compound Annual Growth Rate | 13.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |