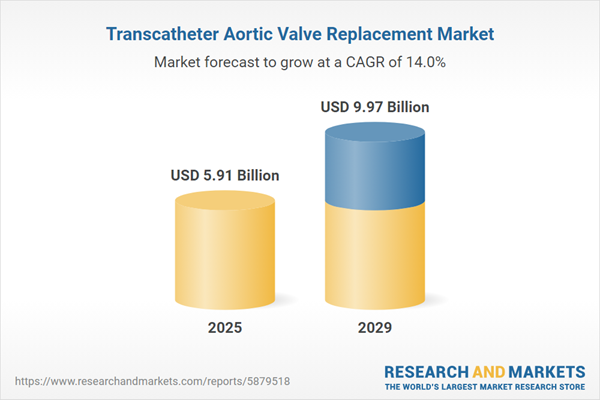

The transcatheter aortic valve replacement market size is expected to see rapid growth in the next few years. It will grow to $9.97 billion in 2029 at a compound annual growth rate (CAGR) of 14%. The growth in the forecast period can be attributed to the increasing prevalence of aortic stenosis, growing adoption of minimally invasive procedures, expansion of indications for TAVR procedures, favorable reimbursement policies, and rising awareness of TAVR as a viable treatment avenue. Major trends in the forecast period include the continuous evolution of device technology, rising prevalence of cardiovascular diseases, global expansion of TAVR procedures, an aging demographic, and rising healthcare expenditure.

The rising prevalence of aortic stenosis is a key factor driving the growth of the transcatheter aortic valve replacement (TAVR) market in the future. Aortic stenosis is a medical condition characterized by the narrowing of the aortic valve in the heart. TAVR offers a less invasive alternative to surgical aortic valve replacement (SAVR), helping to restore blood flow and alleviate the symptoms of aortic valve stenosis. For instance, in May 2024, data from the American Heart Association, a U.S.-based nonprofit organization, indicated that over 12% of older Americans are affected by aortic stenosis, a condition commonly seen in those over 65. If not treated, it can lead to heart failure and can be life-threatening. Additionally, a report published in March 2023 by the National Institute for Health and Care Excellence (NICE), a UK-based public organization, revealed that nearly 1.5% of individuals over 55 in the UK, or about 300,000 people, are living with severe aortic stenosis, with just under 200,000 experiencing symptomatic disease requiring treatment. This contributes to over 380,000 individuals on cardiac waiting lists by March 2023. Therefore, the increasing prevalence of aortic stenosis is driving the transcatheter aortic valve replacement market.

The expanding elderly population is anticipated to propel the growth of the transcatheter aortic valve replacement (TAVR) market. The elderly population, commonly defined as individuals aged 65 years or older, is more susceptible to aortic valve diseases and is often considered high-risk for conventional surgeries. This demographic shift favors transcatheter aortic valve replacement (TAVR) as a preferred and less invasive option, addressing the healthcare needs of the elderly and contributing to market growth. Data from a report by the World Health Organization (WHO) in October 2022 indicates that by the year 2030, one in six people globally is expected to be 60 or older, and by 2050, the worldwide population of individuals aged 60 and older will reach 2.1 billion. Consequently, the expanding elderly population is a significant factor driving the growth of the transcatheter aortic valve replacement (TAVR) market.

Product innovation is a significant trend gaining momentum in the transcatheter aortic valve replacement (TAVR) market. Companies in this sector are concentrating on developing new technologies and innovative solutions to strengthen their market position. For example, in May 2024, Edwards Lifesciences, a U.S.-based medical technology company, introduced the Sapien 3 Ultra Resilia valve in Europe. This valve is notable for being the only TAVR system that features the company’s Resilia tissue technology. This innovative technology is designed to enhance the longevity of the valve by using bovine pericardial tissue that has been treated with anti-calcification methods. By integrating this calcium-blocking technology, the Resilia platform aims to reduce structural valve deterioration, a primary cause of reintervention after valve replacement.

Major companies in the transcatheter aortic valve replacement (TAVR) market are focusing on developing innovative solutions, such as TAVR systems, to reach larger customer bases, boost sales, and increase revenue. TAVR systems are medical devices designed to treat aortic stenosis, a condition marked by the narrowing of the aortic valve in the heart. For example, in September 2022, Medtronic, an Ireland-based medical technology company, launched the latest addition to its Evolut TAVR platform, the Evolut FX TAVR system. This self-expanding, supra-annular TAVR device received FDA approval for treating symptomatic severe aortic stenosis and is suitable for both high- and low-risk patients. The Evolut FX includes several enhancements not found in earlier Evolut systems, such as gold markers for improved commissure alignment, a redesigned catheter tip to ease insertion, and a more flexible delivery system. It is offered in four different valve sizes.

In February 2022, Genesis MedTech Group, a Singapore-based medical device company, successfully acquired JC Medical for an undisclosed amount. Through this strategic acquisition, Genesis expands its portfolio by incorporating J-Valve, a minimally invasive transcatheter aortic valve replacement (TAVR) device, further strengthening its position in the transcatheter aortic valve replacement market.

Major companies operating in the transcatheter aortic valve replacement market include Abbott Laboratories Inc., Medtronic plc, Boston Scientific Corporation, Edwards Lifesciences Corporation, LivaNova PLC, Meril Life Sciences Pvt. Ltd., Venus MedTech HangZhou Inc, Braile Biomedica, Peijia Medical Limited, Direct Flow Medical Inc., Transcatheter Technologies GmbH, Symetis SA, JenaValve Technology Inc., Micro Interventional Devices Inc., Xeltis BV, Tendyne Holdings Inc., MVRx Inc., Keystone Heart Ltd., Colibri Heart Valve LLC, HighLife SAS, Neovasc Inc., Aegis Surgical Limited, Foldax Inc., MValve Technologies Ltd., NaviGate Cardiac Structures Inc.

North America was the largest region in the transcatheter aortic valve replacement market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the transcatheter aortic valve replacement market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the transcatheter aortic valve replacement market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Transcatheter aortic valve replacement (TAVR), also referred to as transcatheter aortic valve implantation (TAVI), is a minimally invasive medical procedure utilized for the replacement of a diseased or dysfunctional aortic valve within the heart. This procedure is applicable to adults whose health is not robust enough for standard valve surgery.

The primary products associated with transcatheter aortic valve replacement include self-expandable transcatheter aortic valves, balloon-expandable transcatheter aortic valves, and mechanically expanded transcatheter aortic valves. Self-expandable transcatheter aortic valves serve as medical devices employed in the minimally invasive procedures known as transcatheter aortic valve replacement (TAVR) or transcatheter aortic valve implantation (TAVI). These devices consist of materials for the valve frame and valve leaflet. Procedures such as transfemoral implantation, transapical implantation, and transaortic implantation can be conducted for conditions such as aortic stenosis, aortic regurgitation, among others. These procedures are carried out by hospitals, independent cardiac catheterization labs, ambulatory surgical centers, and other medical facilities.

The transcatheter aortic valve replacement market research report is one of a series of new reports that provides transcatheter aortic valve replacement market statistics, including transcatheter aortic valve replacement industry global market size, regional shares, competitors with a transcatheter aortic valve replacement market share, detailed transcatheter aortic valve replacement market segments, market trends and opportunities, and any further data you may need to thrive in the transcatheter aortic valve replacement industry. This transcatheter aortic valve replacement market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The transcatheter aortic valve replacement market consists of revenues earned by entities by providing services such as repairing the valve without removing the old damaged valve and placement of a heart valve into the body. The market value includes the value of related goods sold by the service provider or included within the service offering. The transcatheter aortic valve replacement market also includes sales of stainless steel stent, skirt and bovine pericardium leaflets, which are used in providing transcatheter aortic valve replacement services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Transcatheter Aortic Valve Replacement Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on transcatheter aortic valve replacement market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for transcatheter aortic valve replacement? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The transcatheter aortic valve replacement market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Self-Expandable Transcatheter Aortic Valves; Balloon-Expandable Transcatheter Aortic Valves; Mechanically Expanded Transcatheter Aortic Valves2) By Material: Valve Frame Material; Valve Leaflet Material

3) By Procedure: Transfemoral Implantation; Transapical Implantation; Transaortic Implantation

4) By Application: Aortic Stenosis; Aortic Regurgitation; Other Applications

5) By End-User: Hospitals; Independent Cardiac Catheterization Labs; Ambulatory Surgical Centers; Other End-Users

Subsegments:

1) By Self-Expandable Transcatheter Aortic Valves: Nitinol Frame Self-Expandable Valves; Polyester and Polyurethane Coated Valves2) By Balloon-Expandable Transcatheter Aortic Valves: Balloon-Expandable Valves with Stent Design; Resilient Balloon-Expandable Valves

3) By Mechanically Expanded Transcatheter Aortic Valves: Manually Expanded Valves; Mechanically Operated Valve Systems

Key Companies Mentioned: Abbott Laboratories Inc.; Medtronic plc; Boston Scientific Corporation; Edwards Lifesciences Corporation; LivaNova PLC

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Transcatheter Aortic Valve Replacement market report include:- Abbott Laboratories Inc.

- Medtronic plc

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- LivaNova PLC

- Meril Life Sciences Pvt. Ltd.

- Venus MedTech HangZhou Inc

- Braile Biomedica

- Peijia Medical Limited

- Direct Flow Medical Inc.

- Transcatheter Technologies GmbH

- Symetis SA

- JenaValve Technology Inc.

- Micro Interventional Devices Inc.

- Xeltis BV

- Tendyne Holdings Inc.

- MVRx Inc.

- Keystone Heart Ltd.

- Colibri Heart Valve LLC

- HighLife SAS

- Neovasc Inc.

- Aegis Surgical Limited

- Foldax Inc.

- MValve Technologies Ltd.

- NaviGate Cardiac Structures Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 5.91 Billion |

| Forecasted Market Value ( USD | $ 9.97 Billion |

| Compound Annual Growth Rate | 14.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |