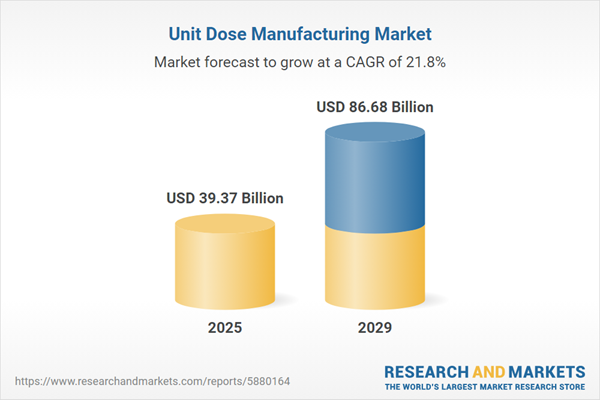

The unit dose manufacturing market size is expected to see exponential growth in the next few years. It will grow to $86.68 billion in 2029 at a compound annual growth rate (CAGR) of 21.8%. The growth in the forecast period can be attributed to the adoption of Industry 4.0 in pharmaceutical manufacturing, emphasis on personalized and precision medicine, regulatory focus on drug safety and efficacy, expansion of pharmaceutical outsourcing, and growing demand for patient-centric drug delivery. Major trends in the forecast period include the implementation of advanced automation in unit dose manufacturing, integration of IoT in pharmaceutical packaging, customization of unit dose packaging for specific drugs, adoption of sustainable and eco-friendly packaging materials, and growth of 3d printing in personalized drug manufacturing.

The forecast of 21.8% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff hikes could impact U.S. pharmaceutical packaging by raising prices of blister packaging machinery and desiccant materials sourced from Italy and Japan, leading to delayed unit dose medication production and higher oral solid dosage form costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increase in healthcare spending is expected to drive the growth of the unit dose manufacturing market in the future. Healthcare spending encompasses all costs related to providing health services, family planning activities, nutrition programs, and emergency health assistance. Rising healthcare expenditure will facilitate the advancement and development of various health-related services, including unit dose manufacturing, thereby supporting the growth of the unit dose manufacturing market. For instance, in September 2024, statistics published by Cross River Therapy, a US-based provider of ABA therapy services, indicated that the U.S. pharmaceutical industry generated $550 billion in revenue. In 2021, Americans spent $576.9 billion on medicine, with projected spending expected to rise to between $605 billion and $635 billion by 2025. Therefore, the increase in healthcare spending is driving the growth of the unit dose manufacturing market.

The burgeoning demand for personalized medicine is poised to be a key driver of growth in the unit dose manufacturing market. Personalized medicine involves the use of knowledge about an individual's genes or proteins to prevent, detect, or treat diseases. Unit dose manufacturing plays a pivotal role in personalized medicine by providing a platform for producing individualized doses tailored to the specific needs of patients. As highlighted by the Personalized Medicine Coalition, approximately 34% of all newly approved therapeutic molecular entities in 2022 were personalized medicines, with 12 such medicines receiving approval from the US Food and Drug Administration (FDA). This surge in demand for personalized medicine is a significant factor propelling the expansion of the unit dose manufacturing market.

Product innovations are a significant trend gaining traction in the unit-dose manufacturing market. Key companies in this sector are developing new products to maintain their competitive edge. For example, in August 2024, Eli Lilly and Company, a US-based pharmaceutical firm, announced the availability of Zepbound (tirzepatide) 2.5 mg and 5 mg single-dose vials for self-pay patients with an on-label prescription, thereby expanding access to meet growing demand. These vials are priced at a discount of 50% or more compared to the list prices of other incretin (GLP-1) obesity treatments. This new option provides affordable access to millions of adults with obesity, including those who are not eligible for the Zepbound savings card, those lacking employer-sponsored coverage, and those paying out-of-pocket without insurance.

Strategic partnerships are emerging as a prominent strategy adopted by major players to sustain and enhance their position in the unit dose manufacturing market. Strategic partnerships involve leveraging each other's strengths and resources to achieve mutual benefits and success. In November 2023, iA, a US-based provider of integrated pharmacy fulfillment platforms, announced a distributor agreement with Euclid Medical Products, a US-based specialist in multi-unit automated packaging and barcoding systems. This collaboration involves integrating Euclid’s Axial Adherence Packaging Technology into iA's NEXiA Enterprise Software Suite, expanding the capabilities of centralized fulfillment solutions. This partnership offers multiple medication dispensing methods, including multi- and unit-dose automated packaging, providing comprehensive solutions to meet diverse healthcare needs.

In August 2022, LTS Lohmann Therapie-Systeme AG, a Germany-based pharmaceutical technology company specializing in drug delivery systems, acquired Tapemark Inc. for an undisclosed amount. This acquisition positions LTS Lohmann Therapie-Systeme AG as a leading contract development and manufacturing organization for transdermal patches and oral thin films while expanding its footprint in the US. Tapemark Inc., based in the US, is a full-service contract development and manufacturing organization specializing in transdermal, oral thin film, and unit-dose products. The acquisition reflects a commitment to growth and diversification within the unit dose manufacturing sector.

Major companies operating in the unit dose manufacturing market include Nipro Corporation, Thermo Fisher Scientific Inc., Amcor plc, Berry Global, CCL Industries, Sealed Air Corporation, Huhtamäki Oyj, Catalent Inc., AptarGroup, Schott AG, West Pharmaceuticals Services Inc., Constantia Flexibles Group GmbH, Gerresheimer AG, RPC Group, Klöckner Pentaplast Group, Stevanato Group, Bemis Company, Corden Pharma GmbH, LTS Lohmann Therapie-Systeme AG, PCI Pharma Services, Comar LLC, Renaissance Lakewood LLC, Mikart LLC, Tapemark Company Inc., Bilcare Research, Medical Packaging Inc, American Health Packaging, Aphena Pharma Solutions.

North America was the largest region in the unit dose manufacturing market in 2024. The regions covered in the unit dose manufacturing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the unit dose manufacturing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The unit dose manufacturing research report is one of a series of new reports that provides unit dose manufacturing market statistics, including the unit dose manufacturing industry's global market size, regional shares, competitors with unit dose manufacturing market share, detailed unit dose manufacturing market segments, market trends and opportunities, and any further data you may need to thrive in the unit dose manufacturing industry. This unit dose manufacturing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Unit dosage manufacturing involves the production of individual pre-packaged doses of drugs or other products containing a specific quantity of medication intended for single-dose administration. These doses are typically presented in easily administered forms such as tablets, capsules, or vials, facilitating patient dispensing.

The primary products of unit dose manufacturing include liquid unit dose, solid unit dose, and others. A liquid unit dose specifically denotes a predetermined and customized amount of liquid medication or chemical enclosed in a single packaging unit, typically designed for single-use delivery. The sourcing methods for unit dose manufacturing include both in-house production and outsourcing, with utilization by various entities such as independent pharmacies, long-term care facilities, hospitals, and others.

The unit dose manufacturing market consists of sales of sachets, small bottles, tubes, and pods. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Unit Dose Manufacturing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on unit dose manufacturing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for unit dose manufacturing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The unit dose manufacturing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Liquid Unit Dose; Solid Unit Dose; Other Products2) By Sourcing: in-House; Outsourcing

3) By End-User: Independent Pharmacies; Long Term Care Facility; Hospitals; Other End-Users

Subsegments:

1) By Liquid Unit Dose: Liquid Vials; Ampoules; Pre-filled Syringes2) By Solid Unit Dose: Tablets; Capsules; Powder Packs

3) By Other Products: Transdermal Patches; Inhalation Doses; Creams and Ointments in Unit Dose Packaging

Companies Mentioned: Nipro Corporation; Thermo Fisher Scientific Inc.; Amcor plc; Berry Global; CCL Industries; Sealed Air Corporation; Huhtamäki Oyj; Catalent Inc.; AptarGroup; Schott AG; West Pharmaceuticals Services Inc.; Constantia Flexibles Group GmbH; Gerresheimer AG; RPC Group; Klöckner Pentaplast Group; Stevanato Group; Bemis Company; Corden Pharma GmbH; LTS Lohmann Therapie-Systeme AG; PCI Pharma Services; Comar LLC; Renaissance Lakewood LLC; Mikart LLC; Tapemark Company Inc.; Bilcare Research; Medical Packaging Inc; American Health Packaging; Aphena Pharma Solutions

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Unit Dose Manufacturing market report include:- Nipro Corporation

- Thermo Fisher Scientific Inc.

- Amcor plc

- Berry Global

- CCL Industries

- Sealed Air Corporation

- Huhtamäki Oyj

- Catalent Inc.

- AptarGroup

- Schott AG

- West Pharmaceuticals Services Inc.

- Constantia Flexibles Group GmbH

- Gerresheimer AG

- RPC Group

- Klöckner Pentaplast Group

- Stevanato Group

- Bemis Company

- Corden Pharma GmbH

- LTS Lohmann Therapie-Systeme AG

- PCI Pharma Services

- Comar LLC

- Renaissance Lakewood LLC

- Mikart LLC

- Tapemark Company Inc.

- Bilcare Research

- Medical Packaging Inc

- American Health Packaging

- Aphena Pharma Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 39.37 Billion |

| Forecasted Market Value ( USD | $ 86.68 Billion |

| Compound Annual Growth Rate | 21.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |