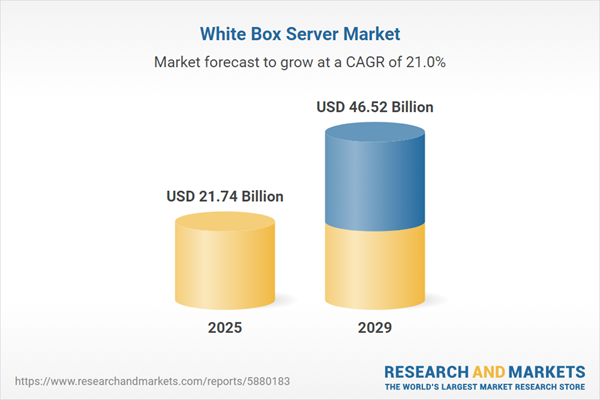

The white box server market size is expected to see exponential growth in the next few years. It will grow to $46.52 billion in 2029 at a compound annual growth rate (CAGR) of 21%. The growth in the forecast period can be attributed to increasing focus on energy efficiency, demand for high-performance computing, focus on security and compliance, market liberalization and competition, and digital transformation initiatives. Major trends in the forecast period include customization and open architecture, GPU acceleration for AI workloads, software-defined infrastructure, transition to 5g networks, and competition with traditional OEMs.

The increasing number of data centers is anticipated to drive the growth of the white box server market in the coming years. Data centers are facilities that provide shared access to applications and data via a sophisticated network, computing, and storage infrastructure. A white box server functions as an operating system and can also serve as virtualization software for data centers. For example, in September 2024, the National Telecommunications and Information Administration, a US government agency, reported that the United States has approximately 5,000 data centers, with demand for these facilities expected to grow by around 9% annually until 2030. Thus, the rising number of data centers is propelling the growth of the white box server market.

The growth of the white box server market is further propelled by an upsurge in cyberattacks and fraud. As organizations face an increased frequency of cybersecurity threats, there is a growing inclination towards white-box servers to enhance security configurations. The use of white-box servers allows organizations to implement customized security measures tailored to their specific requirements, potentially improving resilience against cyber threats. A report by AAG in October 2023 highlighted a significant 125% increase in global cyberattacks, emphasizing the escalating threat landscape faced by individuals and organizations. Consequently, the surge in cyberattacks and frauds is a key driver fostering the growth of the White Box Server market.

Companies in the white box server market are focusing on new product innovations to maintain their competitive edge. For example, in October 2024, Supermicro, a US-based technology firm, introduced Liquid-Cooled SuperClusters designed specifically for AI data centers, powered by the NVIDIA GB200 NVL72 platform. These superclusters are engineered to address the increasing energy demands of AI infrastructures while promoting sustainability through liquid cooling technology. Each rack can accommodate 72 NVIDIA Blackwell GPUs and 32 NVIDIA Grace CPUs, facilitating exascale AI computing capabilities.

Major companies in the white box server market are concentrating on developing advanced, cost-effective solutions, such as Telco Systems’ Edgility, to improve service delivery and address the needs of modern cloud environments. Telco Systems’ Edgility offers a robust framework for deploying and managing edge services, enhancing scalability and performance in dynamic network settings. For instance, in January 2022, Telco Systems, a US-based telecommunications firm, and Advantech, a Taiwan-based company specializing in IoT intelligent systems and embedded platforms, introduced an out-of-the-box platform to streamline the deployment of virtual services at the network edge. This platform aims to simplify the integration of various network functions, allowing service providers to rapidly implement and manage virtualized services. The solution is designed for quick deployment, minimizing the time and complexity associated with setting up virtual services.

In August 2022, DXN Limited, an Australian company specializing in high-quality health and wellness products, particularly those containing ganoderma, partnered with OrionVM. This collaboration aims to develop the DXN Cloud platform by integrating OrionVM's cloud technology with DXN's Tier-III certified data center, providing a reliable and cost-effective hybrid cloud solution. OrionVM, also based in Australia, focuses on delivering cloud infrastructure services powered by white box server technology to enhance performance and flexibility.

Major companies operating in the white box server market include Fujitsu Ltd., Foxconn Electronics Inc., Hon Hai Precision Industry Company Ltd., Dell Inc., Huawei Investment and Holding Co. Ltd., Cisco Systems Inc., Pegatron Corporation, Quanta Computer Inc., Compal Inc., Jabil Inc., Wistron Corporation, Hewlett Packard Enterprise Company, Inventec Corporation, Wiwynn Corporation, Celestica Inc., Super Micro Computer Inc., ASpeed Technology Inc., ZT Systems Co, Hyve Solutions Corp., MiTAC Holdings Corp, Silicon Mechanics Inc., Iron Systems Inc., Equus Computer Systems, Penguin Computing Inc., Servers Direct LLC, Stack Velocity Group.

North America was the largest region in the white box server market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the white box server market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the white box server market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

White box servers are data center computer servers that are not associated with well-known brand names and are constructed using off-the-shelf components from multiple vendors rather than being manufactured and sold by a specific brand or manufacturer.

The primary form factor types in white box servers include rack and tower servers, blade servers, and density-optimized servers. Rack servers are designed to be mounted on a standard equipment rack, which is a metal frame holding multiple servers in a vertical arrangement. These servers find applications across various business types, including data centers and enterprise customers. The processors used in white box servers can be X86 servers or non-X86 servers, and they may run various operating systems such as Linux and others.

The white box server market research report is one of a series of new reports that provides white box server market statistics, including white box server industry global market size, regional shares, competitors with a white box server market share, detailed white box server market segments, market trends and opportunities, and any further data you may need to thrive in the white box server industry. This white box server market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The white box server market consists of sales of chassis, memory, hard disk drives, network interface cards, and cooling solutions. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

White Box Server Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on white box server market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for white box server? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The white box server market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Form Factor: Rack and Tower Servers; Blade Servers; Density Optimized Servers2) By Business Type: Data Centers; Enterprise Customers

3) By Processor: X86 Servers; Non-X86 Servers

4) By Operating System: Linux; Other Operating System

Subsegments:

1) By Rack and Tower Servers: 1U Rack Servers; 2U Rack Servers; 3U and Above Rack Servers; Tower Servers2) By Blade Servers: Half-Height Blade Servers; Full-Height Blade Servers; Vertical Blade Servers

3) By Density Optimized Servers: Microservers; High-Density Servers

Key Companies Mentioned: Fujitsu Ltd.; Foxconn Electronics Inc.; Hon Hai Precision Industry Company Ltd.; Dell Inc.; Huawei Investment and Holding Co. Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Fujitsu Ltd.

- Foxconn Electronics Inc.

- Hon Hai Precision Industry Company Ltd.

- Dell Inc.

- Huawei Investment and Holding Co. Ltd.

- Cisco Systems Inc.

- Pegatron Corporation

- Quanta Computer Inc.

- Compal Inc.

- Jabil Inc.

- Wistron Corporation

- Hewlett Packard Enterprise Company

- Inventec Corporation

- Wiwynn Corporation

- Celestica Inc.

- Super Micro Computer Inc.

- ASpeed Technology Inc.

- ZT Systems Co

- Hyve Solutions Corp.

- MiTAC Holdings Corp

- Silicon Mechanics Inc.

- Iron Systems Inc.

- Equus Computer Systems

- Penguin Computing Inc.

- Servers Direct LLC

- Stack Velocity Group.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 21.74 Billion |

| Forecasted Market Value ( USD | $ 46.52 Billion |

| Compound Annual Growth Rate | 21.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |