Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Rainwater harvesting is the process of collecting, storing, and utilizing rainwater for various purposes, rather than allowing it to runoff and be wasted. This sustainable technique involves capturing rainfall from rooftops, land surfaces, or other catchment areas, channelling it through gutters or pipes, and storing it in tanks, cisterns, or reservoirs. It is an ancient practice that has gained renewed importance in modern times due to increasing water scarcity and environmental challenges.

The harvested rainwater can be used for irrigation, household needs, industrial processes, and groundwater recharge. By reducing reliance on municipal water supplies and mitigating stormwater runoff, rainwater harvesting helps conserve water, prevent soil erosion, and reduce urban flooding. Additionally, it promotes self-sufficiency and provides a reliable water source in regions with erratic or limited rainfall.

This eco-friendly approach is particularly beneficial in arid and semi-arid areas, where water resources are scarce. It is also a cost-effective and simple method that can be adopted on both small and large scales, ranging from individual homes to community projects. By integrating rainwater harvesting systems into urban and rural planning, societies can address water shortages and contribute to sustainable water management.

Key Market Drivers

Government Policies and Incentives

Government intervention has been a major driver for the rainwater harvesting market in India. The government, recognizing the urgent need for sustainable water management, has launched several initiatives and regulations promoting rainwater harvesting. For instance, the Atal Mission for Rejuvenation and Urban Transformation (AMRUT) includes rainwater harvesting as a key component to address urban water challenges.States like Tamil Nadu have made rainwater harvesting mandatory in all buildings, a policy that has been widely emulated across the country. Additionally, local municipalities often provide tax rebates or financial incentives to encourage the installation of rainwater harvesting systems. Public-private partnerships have also played a role, facilitating large-scale community projects in rural and urban areas. The integration of rainwater harvesting systems into smart city projects further highlights the government's commitment to sustainable water management. These policy measures not only promote awareness but also create a supportive ecosystem for manufacturers, service providers, and end-users.

Rising Awareness of Environmental Sustainability

As environmental concerns gain prominence, there is growing awareness about sustainable practices, including rainwater harvesting. The effects of climate change, such as erratic rainfall patterns and prolonged droughts, have underscored the need for efficient water management. Educational campaigns by NGOs, schools, and environmental organizations have successfully demonstrated the benefits of rainwater harvesting for long-term water security and ecological balance.The role of media in showcasing success stories from water-stressed regions has further inspired individuals and communities to adopt rainwater harvesting. Urban residents, in particular, are increasingly aware of the benefits of reducing their dependency on municipal water supplies while mitigating stormwater runoff and urban flooding. This cultural shift toward sustainability has boosted demand for affordable and efficient rainwater harvesting solutions. As of 2024, India’s renewable energy capacity stands at approximately 175 GW, with an ambitious target to reach 500 GW of non-fossil fuel-based capacity by 2030. India generates around 62 million tonnes of waste annually, with around 70-80% of waste going uncollected or untreated. India aims to increase its waste recycling capacity and reduce plastic use through initiatives like the Plastic Waste Management Rules.

Growing Urbanization and Industrial Demand

India’s rapid urbanization and industrial growth have significantly increased water demand, straining already limited resources. Urban areas, with their concrete landscapes, have limited natural recharge of groundwater, making rainwater harvesting systems critical. Industries, particularly those with high water requirements such as manufacturing, pharmaceuticals, and textiles, are increasingly adopting rainwater harvesting to ensure a stable water supply while meeting regulatory requirements.Housing societies and real estate developers are also integrating rainwater harvesting systems as part of green building certifications, adding value to their projects and appealing to environmentally conscious buyers. As urban infrastructure continues to expand, the need for innovative, scalable rainwater harvesting solutions is expected to grow, further driving the market. India's urban population is projected to reach 600 million by 2031, up from around 500 million in 2021. This means approximately 40% of India’s population will live in urban areas by 2031, compared to 34% in 2021.

Key Market Challenges

Lack of Awareness and Technical Knowledge

One of the significant challenges hindering the growth of the rainwater harvesting market in India is the lack of widespread awareness and technical knowledge. Despite increasing efforts by governments and environmental organizations, a large portion of the population remains unaware of the importance and benefits of rainwater harvesting. This is particularly true in rural and semi-urban areas, where educational campaigns have not reached effectively. Misconceptions about the cost, complexity, and maintenance of rainwater harvesting systems further discourage adoption.A lack of technical expertise among stakeholders - ranging from homeowners to construction professionals - creates barriers to proper implementation. Many individuals and communities do not understand how to design, install, or maintain efficient systems, leading to poorly functioning setups that fail to deliver long-term benefits. Without adequate knowledge, issues such as water contamination, leakage, and system inefficiency become prevalent, reducing confidence in the practice.

The absence of a standardized approach to rainwater harvesting is another hurdle. While some states like Tamil Nadu have successfully implemented mandatory regulations, others lag in providing clear guidelines or technical support. This inconsistency in policy and implementation has slowed market growth and limited the scalability of successful models. Addressing this challenge requires sustained awareness campaigns, capacity-building programs, and simplified technical solutions.

Financial Constraints and Maintenance Challenges

Financial constraints are another major obstacle in the adoption of rainwater harvesting systems, particularly for economically weaker sections of society and small-scale farmers. The initial cost of setting up rainwater harvesting structures, including tanks, pipes, and filtration systems, can be prohibitive for many. Although government subsidies and incentives exist, they are often insufficient or inaccessible due to bureaucratic hurdles, lack of awareness, or inadequate distribution mechanisms. This leaves potential adopters reliant on personal savings or costly loans, which further discourages investment.Maintenance challenges also pose a significant problem. Many people fail to recognize that rainwater harvesting systems require regular cleaning, repair, and monitoring to remain effective. Neglecting maintenance can lead to water contamination, blockages, and system breakdowns, resulting in a loss of interest in the practice. In urban areas, limited space for installing or maintaining systems, coupled with a lack of professional service providers, exacerbates the issue.

To address these challenges, innovative financing models such as microloans, community funding, and public-private partnerships could make rainwater harvesting more accessible. Additionally, promoting low-cost and low-maintenance designs, along with training programs for system upkeep, can ensure the long-term viability of rainwater harvesting in India.

Key Market Trends

Integration of Smart Technology in Rainwater Harvesting Systems

The adoption of smart technologies is becoming a prominent trend in the Indian rainwater harvesting market. With advancements in the Internet of Things (IoT) and sensor-based systems, modern rainwater harvesting solutions now incorporate real-time monitoring, automated controls, and data analytics. These systems allow users to track water levels, monitor quality, and optimize storage and usage efficiently.For instance, sensors installed in storage tanks can alert users when the water level is low or when maintenance is required. Automated systems connected to weather data can regulate water collection and distribution based on rainfall predictions, ensuring maximum efficiency. These smart technologies are especially beneficial for urban areas, where space is limited, and systems must be highly efficient.

The increasing availability of affordable smart devices is making these solutions accessible to a wider range of consumers. As environmental consciousness grows, both residential and commercial users are investing in intelligent rainwater harvesting systems to enhance sustainability and operational efficiency. This trend is expected to further drive innovation and competitiveness in the market.

Rising Adoption of Decentralized Rainwater Harvesting

Another emerging trend is the shift toward decentralized rainwater harvesting systems, particularly in urban areas. Unlike large-scale centralized systems, decentralized setups cater to individual buildings, housing complexes, or small communities. These systems are gaining popularity due to their flexibility, cost-effectiveness, and ability to address local water scarcity issues directly.Decentralized rainwater harvesting is particularly useful in cities with limited infrastructure for water supply and drainage. By enabling on-site collection and usage of rainwater, these systems reduce dependency on municipal water supply and mitigate the risk of urban flooding. They are also easier to maintain and customize according to specific needs.

With increasing urbanization, more real estate developers are incorporating decentralized rainwater harvesting systems into their projects. Government mandates for green building certifications and incentives for eco-friendly construction have further fueled this trend, making it a key growth driver in the market.

Segmental Insights

Type Insights

The Wet System held the largest market share in 2024. The Wet System dominated the Indian rainwater harvesting market due to its versatility, scalability, and alignment with the country’s water conservation needs. This system allows rainwater to flow through pipes directly into storage tanks or underground reservoirs while keeping water available for long-term use. Its design, which accommodates both storage and groundwater recharge, makes it particularly suitable for India’s diverse water demands.One of the key reasons for its dominance is its effectiveness in areas with high or moderate rainfall, where significant amounts of water can be collected and stored for extended periods. India’s water scarcity issues, coupled with increasing urbanization and industrial growth, have driven demand for reliable water sources, making the Wet System a preferred choice in both urban and rural settings.

Government mandates and incentives further reinforce the popularity of Wet Systems. Many states require the installation of rainwater harvesting systems in residential, commercial, and industrial buildings, with the Wet System often being the most practical and efficient option for compliance. Additionally, it supports groundwater recharge, a critical solution for addressing the alarming depletion of aquifers in many parts of the country.

The system’s adaptability to large-scale projects, such as smart cities and housing complexes, also contributes to its widespread use. Its ability to manage stormwater runoff while reducing urban flooding makes it highly relevant for cities facing infrastructural challenges. Moreover, technological advancements, such as automated filtering and smart monitoring systems, have enhanced its efficiency and reduced maintenance concerns, further driving adoption.

Regional Insights

South India held the largest market share in 2024. South India dominates the rainwater harvesting market due to several key factors, including water scarcity, government initiatives, and cultural practices that prioritize sustainable water management.Southern states like Tamil Nadu, Karnataka, Andhra Pradesh, and Telangana face significant water scarcity due to irregular rainfall patterns, insufficient natural water bodies, and excessive dependence on groundwater for agriculture and domestic use. Groundwater depletion is particularly severe in urban areas, where population growth and industrial activities further strain water resources. In response to this, rainwater harvesting has emerged as an effective solution to recharge groundwater and provide a reliable, localized source of water.

South India has been a frontrunner in implementing policies to promote rainwater harvesting. Tamil Nadu, in particular, made rainwater harvesting mandatory for all buildings in urban areas as early as 2003. This policy, combined with robust government support, has led to widespread adoption of rainwater harvesting systems across both urban and rural sectors. Other southern states have followed suit by introducing similar regulations, providing subsidies, and offering incentives for installation. The political will to tackle water issues through rainwater harvesting has made these states leaders in the market.

The cultural inclination towards water conservation in South India also contributes to its dominance in the rainwater harvesting market. Many ancient architectural designs in the region incorporated rainwater harvesting systems such as step-wells and traditional ponds, which allowed communities to collect and store rainwater. This historical precedent has fostered an enduring commitment to sustainable water practices.

Non-governmental organizations (NGOs) and local communities in South India have been instrumental in educating people about the importance of rainwater harvesting and supporting its implementation. These grassroots efforts, often in collaboration with government bodies, have further accelerated the adoption of rainwater harvesting systems in the region.

Key Market Players

- Cactus, Inc.

- Water Field Technologies Pvt. Ltd.

- Kingspan Holdings (Ireland) Limited

- Infiltrator Water Technologies

- GRAF UK Limited

- Rheem Manufacturing Company

- Watts Water Technologies, Inc.

- Bristol Water Systems

Report Scope:

In this report, the India Rainwater Harvesting Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Rainwater Harvesting Market, By Type:

- Rain Barrel System

- Dry System

- Wet System

- Green Roof System

India Rainwater Harvesting Market, By Harvesting Method:

- Above Ground

- Under Ground

India Rainwater Harvesting Market, By Application:

- Residential

- Commercial

- Industrial

- Agricultural

India Rainwater Harvesting Market, By Region:

- South India

- North India

- West India

- East India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Rainwater Harvesting Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Cactus, Inc.

- Water Field Technologies Pvt. Ltd.

- Kingspan Holdings (Ireland) Limited

- Infiltrator Water Technologies

- GRAF UK Limited

- Rheem Manufacturing Company

- Watts Water Technologies, Inc.

- Bristol Water Systems

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | January 2025 |

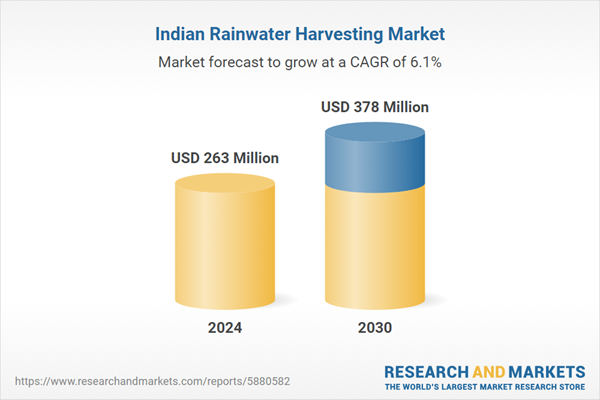

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 263 Million |

| Forecasted Market Value ( USD | $ 378 Million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | India |

| No. of Companies Mentioned | 8 |