Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the industry encounters significant headwinds due to the volatility of raw material costs, especially copper and steel, which causes pricing instability and squeezes manufacturer profit margins. This economic unpredictability, frequently worsened by supply chain limitations, disrupts production consistency and poses a risk to the sector's ability to fully satisfy the growing global demand for efficient power transmission systems. Consequently, these fluctuating input costs impede the industry's capacity to maintain the steady supply levels necessary for meeting rising international requirements.

Market Drivers

The accelerating adoption of Industry 4.0 technologies and industrial automation acts as a primary engine for the global gear motor market. As manufacturing facilities transition toward fully autonomous operations, there is an intensifying demand for precision gear motors to power articulated robotic arms, automated guided vehicles, and smart conveyor systems. These electromechanical components are indispensable for ensuring the high torque and exact positioning required by modern production lines. The scale of this integration is significant; according to the International Federation of Robotics in their 'World Robotics 2024' report from September 2024, the global operational stock of industrial robots hit a record of approximately 4.3 million units, marking a 10% increase over the prior year, which drives sustained order volumes for specialized motion control reduction gears.Simultaneously, the widespread deployment of wind power infrastructure provides substantial momentum to the market, particularly regarding heavy-duty planetary gear motors used in turbine yaw and pitch controls. These mechanisms are vital for optimizing energy capture and maintaining structural stability under fluctuating wind conditions. The impact of this sector is considerable; according to the Global Wind Energy Council's 'Global Wind Report 2024' published in April 2024, the global wind industry installed a record 117 GW of new capacity in 2023, representing a 50% year-over-year increase. Highlighting the financial magnitude of manufacturers supporting such industrial needs, according to WEG S.A., the company achieved net operating revenue of R$32.5 billion for the fiscal year 2023, driven by robust sales across its industrial electrical equipment segments.

Market Challenges

The global gear motor market faces substantial difficulties driven by the unpredictability of raw material costs, particularly for steel and copper, which are essential inputs for manufacturing durable gears, housings, and motor windings. When commodity prices fluctuate, gear motor manufacturers find it challenging to uphold stable pricing structures. This instability forces producers to either absorb the additional costs, which erodes profit margins, or pass these expenses on to end-users, potentially discouraging investment in new automation systems.This cost variance directly hampers the industry's ability to maintain consistent production levels and restricts long-term planning capabilities. The pressure from escalating input expenses is reflected in recent industrial indicators; according to the Institute for Supply Management, the manufacturing Prices Index registered 55.8 percent in March 2024, revealing that raw material costs had risen for the third consecutive month. Such persistent pressure creates an environment where manufacturers may struggle to meet the volume and pricing requirements of the logistics and industrial sectors, thereby restraining the overall expansion of the market.

Market Trends

The integration of Industrial IoT and Smart Diagnostic Systems is transforming the market by facilitating real-time monitoring and predictive maintenance. Manufacturers are increasingly embedding sensors within gearboxes to track temperature and vibration, enabling the creation of digital twins for system optimization. This convergence allows operators to minimize downtime and extend equipment lifecycles through insights derived from data. Demonstrating the viability of this digital-centric strategy, according to Lenze in a November 2024 press release, the company generated revenue of 828.0 million euros in the 2023/2024 financial year, driven by its strategic focus on mechatronic solutions and digital services.Additionally, the transition toward IE4 and IE5 Premium Efficiency Standards is accelerating as industries seek to comply with environmental regulations and reduce operational costs. The market is shifting toward ultra-premium efficiency gear motors that utilize permanent magnet technologies to lower energy consumption in continuous-duty applications. This drive for sustainability is supporting the financial performance of key players; according to Danfoss's 'Annual Report 2023' released in March 2024, the company reported sales of EUR 10.7 billion, a 7% increase in local currency, attributed to the growing demand for energy-efficient solutions in machinery and infrastructure.

Key Players Profiled in the Gear Motor Market

- Bonfiglioli S.P.A.

- Watt Drive Antriebstechnik GmbH

- Bauer Gear GmBH

- Nidec Corporation

- Siemens AG

- Johnson Electric Holdings Limited

- Shanthi Gears Limited

- Emerson Electric Co

- Jiangsu Guomao Reducer Co. Ltd.

- Brevini Power Transmission S.P.A.

Report Scope

In this report, the Global Gear Motor Market has been segmented into the following categories:Gear Motor Market, by Product:

- Gearbox

- Gear Motor

Gear Motor Market, by Rated Power:

- Up to 7.5kW

- 7.5kW to 75kW

- Above 75kW

Gear Motor Market, by Gear Type:

- Helical

- Helical-Bevel

- Planetary

- Worm

Gear Motor Market, by End-User Industry:

- Wind Power

- Material Handling

- Food & Beverage

- Cement & Aggregates

- Others

Gear Motor Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Gear Motor Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Gear Motor market report include:- Bonfiglioli S.P.A.

- Watt Drive Antriebstechnik GmbH

- Bauer Gear GmBH

- Nidec Corporation

- Siemens AG

- Johnson Electric Holdings Limited

- Shanthi Gears Limited

- Emerson Electric Co

- Jiangsu Guomao Reducer Co. Ltd.

- Brevini Power Transmission S.P.A.

Table Information

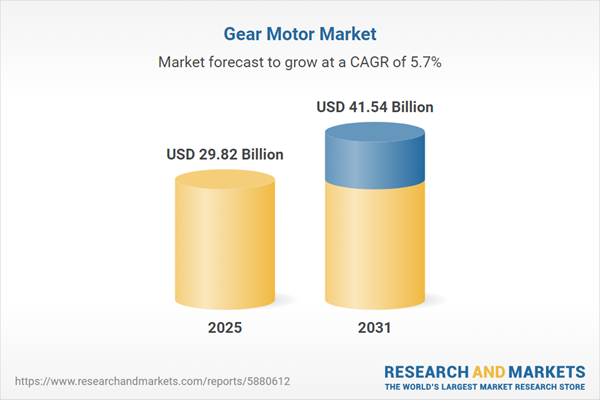

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 29.82 Billion |

| Forecasted Market Value ( USD | $ 41.54 Billion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |