Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The government's initiatives to promote modern farming techniques, including precision agriculture and hydroponics, are further accelerating the adoption of liquid fertilizers. Additionally, the expansion of greenhouse farming and controlled-environment agriculture supports market growth. Technological advancements in fertilizer formulation, ensuring balanced nutrient content, also contribute to the sector's expansion. Moreover, the shift towards sustainable farming practices and organic liquid fertilizers is gaining traction, further propelling the market’s development.

Key Market Drivers

Growing Population and Rising Food Demand

Egypt’s population is growing rapidly, crossing 110 million people, and is projected to continue increasing. This demographic surge is putting immense pressure on the agricultural sector to produce more food to meet national consumption needs. As urbanization expands, arable land is becoming increasingly scarce, making it critical for farmers to enhance crop yields through efficient agricultural inputs. In July 2023, Egyptian President Abdel-Fattah al-Sisi held discussions with Chinese and Italian companies regarding the development of the country’s third industrial fertilizer production complex. During the meeting, he praised the ongoing collaboration with China’s Wuhuan Engineering Co. and Italy’s Ballestra Group, urging the immediate commencement of the complex's construction.Liquid fertilizers play a crucial role in this scenario by providing plants with readily available nutrients, which boost productivity and improve crop quality. Unlike traditional granular fertilizers, liquid variants ensure uniform nutrient distribution, allowing farmers to maximize the output of their limited farmland. This makes liquid fertilizers an attractive solution for addressing Egypt’s food security concerns.

Additionally, changing dietary preferences among Egyptians, including increased demand for fresh vegetables, fruits, and high-value crops, necessitate efficient fertilization techniques. Liquid fertilizers support this shift by enhancing the growth of nutrient-rich crops in a shorter time frame. As Egypt continues to depend on agricultural imports to meet domestic food demand, there is an urgent need to improve self-sufficiency. Government policies encouraging local production and reducing dependency on imports further drive the adoption of liquid fertilizers as an essential component of modern agriculture.

Key Market Challenges

High Cost of Liquid Fertilizers

One of the primary challenges in the Egyptian liquid fertilizer market is the high cost associated with these products compared to traditional granular fertilizers. While liquid fertilizers offer better nutrient absorption and efficiency, their production, storage, and transportation costs are significantly higher.Many small and medium-scale farmers, who make up a large portion of Egypt’s agricultural sector, struggle with limited financial resources. They often prefer more affordable granular fertilizers, even if they are less efficient. The initial investment required for liquid fertilizer systems, such as drip irrigation and fertigation equipment, can also deter farmers from switching to liquid-based solutions.

Additionally, price volatility in raw materials used for fertilizer production, such as nitrogen, phosphorus, and potassium (NPK), can further drive up costs. This fluctuation makes liquid fertilizers less accessible to many farmers, especially those in rural areas with lower profit margins. To overcome this challenge, government subsidies, financial aid programs, and training initiatives could help farmers transition to liquid fertilizers without facing significant financial burdens.

Key Market Trends

Growing Awareness of Sustainable and Organic Farming

Sustainability has become a priority in Egypt’s agricultural sector due to concerns about soil degradation, water pollution, and environmental impact. Farmers are increasingly adopting organic and bio-based fertilizers to improve soil fertility and reduce dependence on synthetic chemicals. Egyptian fertilizer manufacturer Biogrand plans to establish a factory in Saudi Arabia by the end of February 2025. The project will be developed in collaboration with Saudi investors.Organic liquid fertilizers, derived from plant and animal waste, provide a sustainable alternative while maintaining high crop yields. They also improve soil structure and microbial activity, leading to long-term benefits for farmers. Consumer demand for organic produce is also rising, creating a market incentive for farmers to shift towards organic liquid fertilizers. This trend is expected to grow as more consumers prioritize health-conscious and environmentally friendly food choices.

Key Market Players

- Yara Agri Trade Egypt

- Abu Qir Fertilizers and Chemical Industries Company

- El-Nasr Company for Fertilizers and Chemical Industries

- Ferchem Masr for Fertilizers and Chemicals

- Agro Egypt International Company

- Helwan Fertilizers Company

- Misr Fertilizers Production Company

- AlexFert, Inc.

- Suez Company (SCFP)

- KGS Fertilizers Co.

Report Scope:

In this report, the Egypt Liquid Fertilizer Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Egypt Liquid Fertilizer Market, By Type:

- Nitrogen

- Phosphorus

- Potash

- Micronutrients

Egypt Liquid Fertilizer Market, By Crop Type:

- Cereals & Grain

- Pulses & Oilseeds

- Fruits & Vegetables

- Commercial Crops

- Others

Egypt Liquid Fertilizer Market, By Mode of Application:

- Soil

- Foliar

- Fertigation

- Others

Egypt Liquid Fertilizer Market, By Ingredient Type:

- Organic

- Synthetic

Egypt Liquid Fertilizer Market, By Region:

- Cairo

- Alexandria

- Giza

- Qalyubia

- Port Said

- Suez

- Rest of Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Egypt Liquid Fertilizer Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Yara Agri Trade Egypt

- Abu Qir Fertilizers and Chemical Industries Company

- El-Nasr Company for Fertilizers and Chemical Industries

- Ferchem Masr for Fertilizers and Chemicals

- Agro Egypt International Company

- Helwan Fertilizers Company

- Misr Fertilizers Production Company

- AlexFert, Inc.

- Suez Company (SCFP)

- KGS Fertilizers Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | February 2025 |

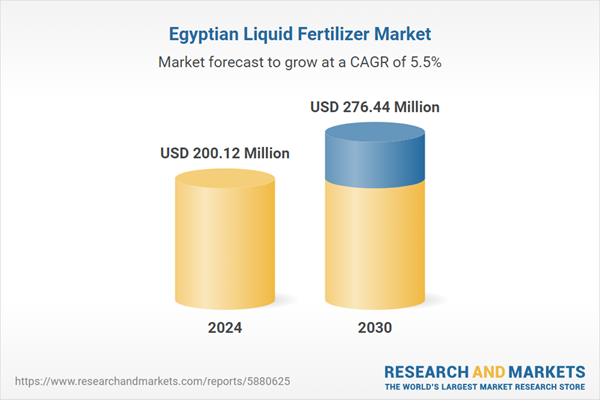

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 200.12 Million |

| Forecasted Market Value ( USD | $ 276.44 Million |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Egypt |

| No. of Companies Mentioned | 10 |