Free Webex Call

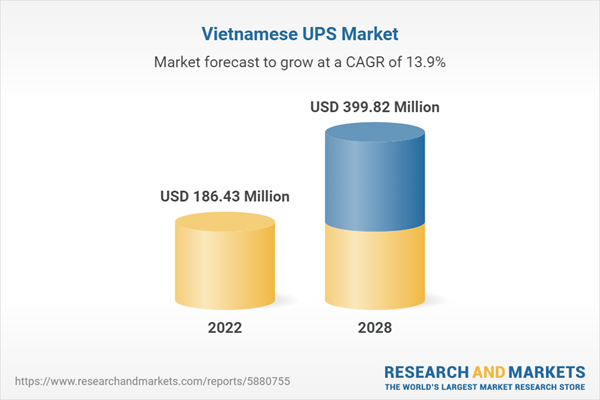

Vietnam UPS (Uninterruptible Power Supply) Market is anticipated to register a steady CAGR during the forecast period of 2024-2028. An uninterruptible power supply (UPS) is a component that enables a computer to continue operating for at least a brief period when the power supply is interrupted. Utility electricity maintains and replenishes the energy storage if it is in use. The longer electricity can be sustained, the more energy can be stored. Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A UPS is intended to safeguard electrical equipment such as computers, data centers, telecommunications systems, and other devices where an unanticipated power outage might result in harm, death, or data loss. A typical UPS may supply a 15-20-minute power backup once charged and connected to the device until it runs out entirely. Moreover, it aids in preventing internal hardware damage in the event of unequal power current changes.

The number of data centres in Vietnam is growing, remote work or work from home (WFH) is getting more popular, the manufacturing industry is developing, and there is a growing need for Uninterruptible Power Supply (UPS) systems in the residential and commercial sectors. Data centers are becoming increasingly common, which is driving market growth due to increased urbanization and infrastructure development. Furthermore, the growing healthcare and tourism industries are increasing Vietnam UPS Market Revenue.

Power Outage in the Country

Due to the frequent power outages in the area, the UPS market is booming. Despite several government endeavours, developing countries have not yet achieved their goal of becoming nations with an abundance of energy. As a result, UPS systems continue to be essential in the region. Sales of electrical appliances such as refrigerators, air conditioners, televisions, and microwaves are also increasing in Vietnam due to increased disposable family incomes, and customers are likely to purchase UPS batteries as a result of a shortage of electricity. As a result, the Vietnam UPS market is anticipated to grow quickly throughout the course of the projected period.Increasing Usage of Green UPS Systems

The cost of energy has increased significantly recently, and consumers have also become more environment friendly. Owing to these problems, several businesses have created energy-efficient green UPS technology. The power consumption of UPS systems may be reduced by up to 75% when green UPS solutions are compared to conventional UPS designs. As a result, when buyers evaluate UPS devices, one of the key factors they consider is energy efficiency. In addition, green UPS systems' better monitoring and thermal design technologies cut down on heat production. Owing to a growth in the use of green UPS devices in several applications, such as IT networks and telecommunications, the demand for green UPS is anticipated to rise significantly over the course of the projected period.Market Segments

Vietnam UPS Market is divided on the basis of product, rating, sector and application. Based on product, the market is further split into online, offline, and line interactive. Based on rating, the market is further divided into less than 5kVA, 50.1 kVA - 200 kVA, and others, Based on sector, the market is further segmented into BFSI, OEM (manufacturing), oil & gas, power, healthcare, IT, housing, and others. Based on application, the market is further segmented into commercial, residential, government, and industrial.The Vietnam UPS Market stood at USD XX Million in 2022 and is expected to register a steady CAGR during the forecast period.

Market Players

Major market players in Vietnam UPS Market are ABB Limited (Vietnam), General Electric Company, Schneider Electric Vietnam, Toshiba International Corporation, Eaton Corporation PLC, Legrand SNC FZE, Socomec Asia Pacific Pte. Ltd, Tripp Lite, Vertiv Group Corp, and Riello UPS Singapore Pte. Ltd.Report Scope:

In this report, Vietnam UPS Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Vietnam UPS Market, By Type:

- Online

- Offline

- Line Interactive

Vietnam UPS Market, By Rating:

- Less than 5kVA

- 5.1 kVA - 50 kVA

- 50.1 kVA - 200 kVA

- Others

Vietnam UPS Market, By Sector:

- BFSI

- OEM(Manufacturing)

- Oil & Gas

- Power

- Healthcare

- IT

- Housing

- Others

Vietnam UPS Market, By Application:

- Commercial

- Residential

- Government

- Industrial

Vietnam UPS Market, By Region:

- North Vietnam

- Central Vietnam

- South Vietnam

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in Vietnam UPS Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs.This product will be delivered within 1-3 business days.

Table of Contents

1. Product Overview

2. Research Methodology

6. Vietnam UPS Market Outlook

7. Northern Vietnam UPS Market Outlook

8. Central Vietnam UPS Market Outlook

9. Southern Vietnam UPS Market Outlook

10. Market Dynamics

14. Company Profiles

Companies Mentioned

- ABB Limited (Vietnam)

- General Electric Company

- Schneider Electric Vietnam

- Delta Electronics Inc

- Eaton Corporation PLC

- Socomec Asia Pacific Pte. Ltd

- Riello UPS Singapore Pte. Ltd

- Vertiv Group Corp

- Tripp Lite

- Toshiba International Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | September 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 186.43 Million |

| Forecasted Market Value ( USD | $ 399.82 Million |

| Compound Annual Growth Rate | 13.8% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |