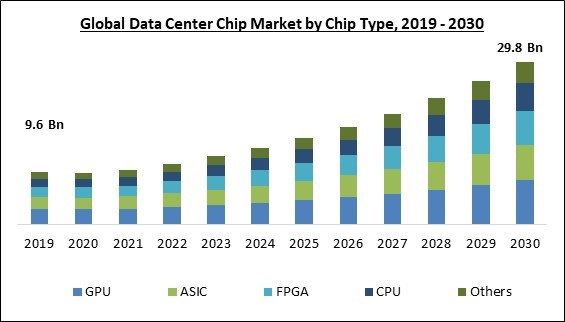

The field-programmable gate array (FPGA) is a semiconductor or integrated circuit frequently utilized in electronic circuits. Therefore, the FPGA segment will capture a 1/5th share by 2030. The market expansion is attributable to the widespread adoption of FPGA chips in data centers to accelerate and improve the performance of large-scale data systems. Many data centers use FPGA to enable high-speed data processing by offering low-latency connections and high-bandwidth solutions to network and storage systems, eventually driving the market's expansion. Additionally, FPGA offers algorithmic acceleration, compression, and data filtering applications to data centers, accelerating the market's expansion.

The major strategies followed by the market participants are Product Launches as the key developmental strategy in order to keep pace with the changing demands of end users. In April, 2023, Qualcomm Technologies, Inc., revealed its latest Qualcomm QCM8550 and Qualcomm QCS8550 Processors, at the pinnacle of performance. In April, 2023, Broadcom Inc. unveiled a fresh chip, named Jericho3-AI, which can connect up to 32,000 GPU chips together.

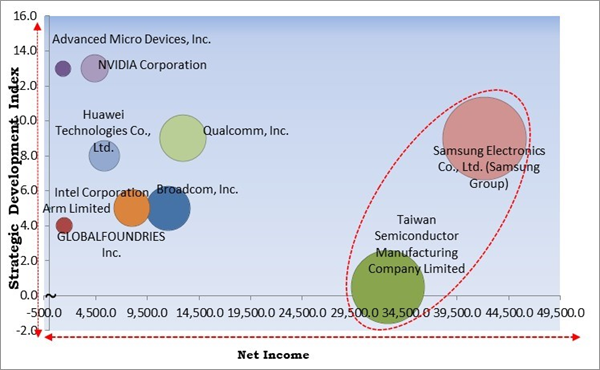

The Cardinal Matrix - Market Competition Analysis

Based on the analysis presented in the The Cardinal Matrix; Samsung Electronics Co., Ltd. (Samsung Group) and Taiwan Semiconductor Manufacturing Company Limited are the forerunners in the Market. In May, 2023, Samsung Electronics Co. Ltd revealed the commencement of mass production for its 16-gigabit (Gb) DDR5 DRAM, utilizing the advanced 12 nanometer (nm)-class process technology. Companies such as Advanced Micro Devices, Inc., Huawei Technologies Co., Ltd., NVIDIA Corporation, and Qualcomm, Inc. are some of the key innovators in the Market.Market Growth Factors

Increasing number of data centers globally

In the past few decades, the generation of digital data has risen dramatically. The growing use of digital devices, including smartphones and computers, in the daily lives of ordinary people is one of the primary causes of this explosion in digital data generation. The rising popularity of the Internet of Things (IoT) and the data generated by numerous IoT devices have also contributed to the data boom. The number of data centers is growing globally due to all the factors above and the rising data generation. In light of this, it is anticipated that the market will also experience development, as data center chips are essential for data centers.Development of cloud computing

Businesses can employ cloud computing to manage operations efficiently and quickly react to shifting market conditions. The expansion of cloud computing and the associated increase in data center demand are driven by the rapid evolution of technology, changing business needs, and societal shifts. As these trends continue, it's likely that the demand for data centers will persist and continue to evolve to meet the growing requirements of a digital and data-driven world. Thus, the development of AI, virtual reality systems, and the 5G network has increased the number of data centers, driving the expansion of the market.Market Restraining Factors

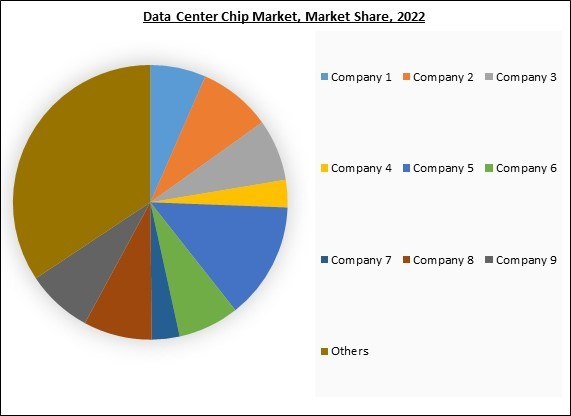

Consolidation of data centers

Many companies seek to reduce the size of their data center infrastructure. Infrastructure as a Service (IaaS) is a crucial concept where numerous companies utilize consolidated data centers. When organizations consolidate their data centers, they often aim to optimize resource utilization and improve efficiency. This can lead to a reduction in the total number of servers and networking equipment required, which, in turn, decreases the overall demand for data center chips, including CPUs, GPUs, and networking chips. This could pose a significant obstacle to the market's growth during the forecast period.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

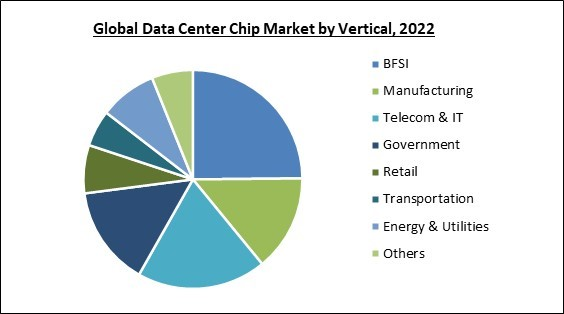

Vertical Outlook

By vertical, the market is segmented into BFSI, manufacturing, government, IT & telecom, retail, transportation, energy & utilities, and others. In 2022, the BFSI segment dominated the market with maximum revenue share. The BFSI sector relies heavily on data centers to securely store and process massive financial transactions, customers’ data, and sensitive data. Supporting various BFSI operations, such as online banking, mobile payments, trading platforms, risk management, fraud detection, and compliance reporting, data centers play a mission-critical role. The demand for reliable and high-performance data centers has surged within the BFSI sector due to the emergence of digital transformation and the expanding usage of financial technology (FinTech) solutions. Due to the sensitive nature of financial data, security, and regulatory compliance are paramount in the BFSI sector.Chip Type Outlook

By chip type, the market is segmented into GPU, ASIC, FPGA, CPU, and others. The CPU segment acquired a promising revenue share in the market in 2022. As more businesses shift their IT infrastructure to the cloud, there is an increase in the demand for data center CPUs. Cloud service providers invest heavily in data centers to accommodate this demand, driving the market's growth. Businesses are collecting and analyzing more data than ever before requiring strong CPUs for processing. Businesses aim to improve their decision-making and derive insights from their data. Thus, it is expected that this trend will continue in the coming years and drive the growth of the market.Data Center Size Outlook

By data center size, the market is fragmented into small & medium size and large. In 2022, the large segment witnessed the largest revenue share in the market. Large data centers are enormous facilities designed to manage massive quantities of data, computing power, and infrastructure requirements. Most of the time, large IT corporations, cloud service providers, and businesses with substantial IT demands own and run these data centers. Large data centers are distinguished by their enormous physical footprint, which may encompass thousands of square meters and contain many servers, networking devices, storage systems, and cooling infrastructure. The demand for massive data centers has increased owing to the quick development of cloud computing services. Furthermore, there is a greater need for huge data centers due to the growth of big data and the need for advanced data analytics.Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. In North America, the demand for data center processors will increase due to increased investments by hyperscale cloud providers, colocation service providers, and enterprises that are improving their IT infrastructure to accommodate edge computing, 5G, multi-cloud services, big data analytics, and the Internet of Things. North America's data center hub is situated in the US. The utilization of data centers has increased over the past few years, and the country has experienced substantial investments in cloud computing. Throughout the projection, these elements will fuel the market's expansion in North America.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Advanced Micro Devices, Inc., Arm Limited, Broadcom, Inc., GLOBALFOUNDRIES Inc., Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), Intel Corporation, NVIDIA Corporation, Samsung Electronics Co., Ltd. (Samsung Group), Taiwan Semiconductor Manufacturing Company Limited, and Qualcomm, Inc.

Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- Jun-2023: GLOBALFOUNDRIES Inc. collaborated with Lockheed Martin, a leading global security and aerospace company, aimed at enhancing semiconductor manufacturing and innovation in the United States. The collaboration intends to bolster the security, reliability, and resilience of national security system supply chains. This joint effort will expedite Lockheed Martin's production of secure solutions, contributing to U.S. competitiveness and national security.

- Jun-2023: Samsung Electronics Co. Ltd. expanded its collaboration with Alphawave Semi, a global leader in high-speed connectivity for the world’s technology infrastructure to include the 3nm process node. Through this expansion, Customers of the Samsung Foundry platform can now utilize Alphawave Semi's cutting-edge connectivity IP and chipset technologies. This includes interfaces like 112 Gbps Ethernet and PCI Express Gen6/CXL 3.0, enabling the creation of complex systems-on-a-chip (SoCs) to meet the demands of data-intensive applications.

- May -2023: Broadcom, Inc. collaborated with Apple, a US manufacturer of personal computers, smartphones, tablet computers, etc. Through this collaboration, Broadcom would create 5G RF parts, including FBAR filters, and advanced wireless components. These filters will be made in key U.S. tech hubs.

- May -2023: NVIDIA Corporation came into collaboration with SoftBank Corp., a Japanese multinational investment holding company. Under the collaboration, SoftBank is in the process of constructing data centres with the capability to accommodate generative AI and wireless applications on a shared multi-tenant server platform, which lowers costs and enhances energy efficiency.

- Apr-2023: Arm Limited came into agreement with Intel Foundry Services, the foundry division of Intel, aimed at enhancing the 18A fabrication process of Intel using ARM chip designs. The companies will collaborate on ARM's mobile chip design, with potential expansion to automotive, IoT, and data centres. Furthermore, Intel's Foundry Services won't manufacture ARM chipsets, but the deal aims to facilitate ARM licensees like Qualcomm and MediaTek to utilize Intel's manufacturing services.

- Oct-2022: Huawei Digital Power Thailand collaborated with Planet Communications Asia Plc, a Digital Technology Provider. Through this collaboration aims to enter the Thai data centre sector by introducing the Prefabricated AIO Data Center FusionModule DC 1000A. The partnership aimed to raise awareness about prefabricated data centre modules in Thailand's markets and was committed to aligning with the country's demand for reliable data centres and the growing zero-carbon trends.

- Oct-2022: Intel Corp teamed up with Alphabet Inc's Google Cloud to introduce a jointly developed chip aimed at enhancing data centre security and efficiency. The E2000 Chip, known as Mount Evans, was designed to handle data packaging for networking, a responsibility typically managed by costly central processing units responsible for primary computing. Additionally, the E2000 provided improved security for customers sharing CPUs in the cloud.

- Oct-2022: NVIDIA Corporation expanded its partnership with Oracle Corp, supplies software for enterprise information management, and added tens of thousands of Nvidia chips into Oracle's cloud infrastructure to enhance artificial intelligence-related computational tasks. According to the companies, Nvidia's A100 and its cutting-edge H100 GPUs were included in the partnership.

- Oct-2022: Samsung Electronics Co., Ltd. and Vodafone, a British multinational telecommunications company, jointly collaborated with Marvell, a major silicon provider, to enlarge the adoption and performance of 5G Open Radio Access Networks (RAN) across Europe. Under the collaboration, Marvell's specialized SoC tech for Open RAN improves 5G for smartphone users via standard COTS servers with open architecture.

- Aug-2022: GlobalFoundries Inc. expanded its partnership with Qualcomm Technologies, the world’s leading wireless technology innovator and the driving force behind the development, launch, and expansion of 5G. The partnership strengthened wafer supply and supports U.S.-based manufacturing, including capacity expansion at GF's advanced facility in Malta, New York. Additionally, GF brought innovation across mobile and IoT on three continents.

- Feb-2022: Qualcomm Technologies, Inc. came into collaboration with Microsoft, an American multinational technology corporation. Under the collaboration, Merging Qualcomm's 5G expertise with Microsoft's cloud leadership, the collaboration streamlined 5G private network setups with an exceptional chip-to-cloud solution.

Product Launches and Product Expansions:

- Aug-2023: Advanced Micro Devices, Inc. launched the MI300 artificial intelligence (AI) chip, the most advanced GPU for AI. Through this Launch, AMD will increase the production of its leading chips in the last quarter of the year. During the unveiling event, there were indications that Amazon might become the inaugural user of these chips for their Amazon Web Services platform.

- Aug-2023: NVIDIA Corporation unveiled the GH200, a fresh chip intended for AI model processing, aiming to maintain its position in the AI hardware sector. This new chip, the GH200, featured the same GPU as Nvidia's top-tier AI chip at the time, the H100. Additionally, the GH200 combined this GPU with 141 gigabytes of advanced memory and a 72-core ARM central processor.

- Jun-2023: Huawei Technologies Co., Ltd. introduced its pioneering data center data infrastructure architecture, F2F2X (Flash-to-Flash-to-Anything). Huawei's F2F2X architecture offers a solid data foundation for financial institutions to manage new data challenges. It includes all-flash storage for primary, backup, and diverse archive needs, efficiently unlocking data potential and enhancing "4+" data centre capabilities.

- May-2023: Samsung Electronics Co. Ltd revealed the commencement of mass production for its 16-gigabit (Gb) DDR5 DRAM, utilizing the advanced 12 nanometer (nm)-class process technology. This new 12nm-class DDR5 DRAM decreases power consumption by approximately 23% and boosts wafer productivity by up to 20%. Additionally, DDR5 DRAM is a great choice for global IT firms aiming to cut energy use and carbon footprint in their servers and data centres.

- Apr-2023: Qualcomm Technologies, Inc. revealed its latest Qualcomm QCM8550 and Qualcomm QCS8550 Processors, at the pinnacle of performance. Both products are built for designers and manufacturers of IOT products. Additionally, both processors demand enterprise tasks, such as compute-intensive multimedia, Edge AI, and retail applications. Moreover, SoC offers advanced features and top-notch performance.

- Apr-2023: Broadcom Inc. unveiled a fresh chip, named Jericho3-AI, which can connect up to 32,000 GPU chips together. Jericho3-AI is designed to connect supercomputers for AI tasks using well-established networking technology. Through this launch, the Jericho3-AI chip will vie with InfiniBand, another advanced technology for supercomputer networking and other AI applications like OpenAI's ChatGPT and Alphabet Inc's (GOOGL.O) Bard. Moreover, the company expanded its footprint in the data centre chip market.

- Nov-2022: Advanced Micro Devices Inc (AMD.O) released its most recent data centre processor and announced that notable clients would include Microsoft Corp's (MSFT.O) Azure, Google Cloud under Alphabet, and Oracle Corp. Dubbed "Genoa," the fourth generation EPYC processor brought substantial enhancements in both performance and energy efficiency compared to its predecessor.

- Nov-2022: Intel Corporation revealed an enhancement to their upcoming server chip, the Data Center GPU Max, and the Xeon CPU Max Series, aiming to secure a competitive edge against rival Advanced Micro Devices (AMD). Despite facing production delays, both the Xeon CPU Max and Data Center GPU were closely monitored in the HPC sector. In late September, Intel confirmed the shipment of blades with Max Series GPUs to Argonne National Laboratory to fuel the Aurora supercomputer.

- Sep-2022: Arm Limited introduced Neoverse V2, its latest data centre chip tech, addressing the surge in data due to 5G and IoT. Firms like Ampere, Amazon, Fujitsu, and Alibaba utilized Arm's tech for their data centre processors. Neoverse V2 enhanced power efficiency, and Nvidia's data centre chip Grace used this design.

Acquisitions and Mergers:

- Apr-2022: Advanced Micro Devices Inc. acquired Pensando Systems Inc., a company developing edge computing and cloud computing services for enterprises and cloud providers. Through this acquisition, Pensando would help AMD broaden its emerging data centre business. Moreover, as per Pensando, enhanced network efficiency is another advantage of its technology.

Geographical Expansions:

- Jul-2023: Taiwan Semiconductor Manufacturing Company expanded its geographical footprint in Hsinchu, Taiwan. This expansion aims to serve researchers developing nanometer technology and sub-2 nanometer, and also other scientists and scholars finding novel materials and transistor structure.

Scope of the Study

By Chip Type(Volume, Thousand Units, USD Million, 2019-2030)

- GPU

- ASIC

- FPGA

- CPU

- Others

By Vertical(Volume, Thousand Units, USD Million, 2019-2030)

- BFSI

- Manufacturing

- Telecom & IT

- Government

- Retail

- Transportation

- Energy & Utilities

- Others

By Data Center Size(Volume, Thousand Units, USD Million, 2019-2030)

- Large

- Small & Medium Size

By Geography(Volume, Thousand Units, USD Million, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Advanced Micro Devices, Inc.

- Arm Limited

- Broadcom, Inc.

- GLOBALFOUNDRIES Inc.

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Intel Corporation

- NVIDIA Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

- Taiwan Semiconductor Manufacturing Company Limited

- Qualcomm, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Advanced Micro Devices, Inc.

- Arm Limited

- Broadcom, Inc.

- GLOBALFOUNDRIES Inc.

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- Intel Corporation

- NVIDIA Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

- Taiwan Semiconductor Manufacturing Company Limited

- Qualcomm, Inc.