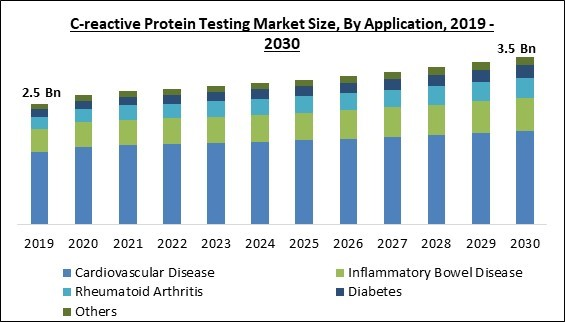

Chronic conditions like cardiovascular conditions are associated with high C-reactive protein levels. Therefore, Cardiovascular Disease segment would capture more than 56% share of the market by 2030. The primary factor advancing the expansion of the segment is the rise in the prevalence of CVDs. CRP is a critical marker for identifying CVD by determining the probability of atherosclerosis. Patients with CVDs often have elevated CRP levels, and assays may identify even the lowest amounts of CRP. As a result, the use of CRP testing for the early diagnosis of cardiovascular disorders has dramatically increased, which has caused this segment's revenue to grow throughout the projection period. Some of the Factors impacting the market are increase prevalence of inflammatory diseases, increasing demand for point-of-care testing, and alternative disease-testing techniques are accessible.

This market is projected to expand as inflammatory diseases grow more widespread. The liver produces CRP, an acute-phase protein, in response to tissue damage, infection, or inflammation. The existence of inflammation in the body, which is associated with various illnesses such as cardiovascular disease, rheumatoid arthritis, inflammatory bowel disease, and several types of cancers, may be indicated by elevated levels of CRP in the blood. Overall, the prevalence of inflammatory diseases is on the rise, and CRP testing methods have advanced in technology, which is expected to propel the market. Moreover, POCT is a medical examination carried out near the patient rather than in a centralized laboratory and offers immediate results. POCT for CRP makes testing fast and simple in primary care settings, ERs, and other point-of-care settings, which is especially beneficial for patients who need diagnosis and treatment immediately. This market is predicted to be boosted by increased demand for POCT since it offers a cost-effective and accessible alternative for laboratory testing, which may benefit patients' outcomes and lower healthcare expenditures.

Additionally, The COVID-19 outbreak assisted the market for C-reactive protein testing. In order to boost hospital capacity for patients diagnosed with COVID-19, many clinics and hospitals worldwide were restructured. C-reactive protein (CRP) was observed as a crucial measure that significantly rose among people with severe COVID-19. It was considered a valuable marker for assessing the severity of the disease and lung lesions because its concentration decreases when the inflammatory stages end and the patient heals. As a result, CRP testing surged during the COVID-19 pandemic, considerably increasing market growth.

However, C-reactive protein is a comprehensive indicator of inflammation. As a result, this test is inadequate for accurately diagnosing any illness. Therefore, the fact that it is not a self-sufficient diagnostic test could prevent this market from growing. Imaging studies like magnetic resonance imaging (MRI), computed tomography (CT), and ultrasound can visualize inflamed tissues and help diagnose conditions such as arthritis, infections, and inflammatory bowel disease. As there are numerous alternative disease diagnostic technologies accessible, the market's expansion might be restricted by their popularity among consumers.

Application Outlook

Based on application, the market is fragmented into diabetes, rheumatoid arthritis, cardiovascular disease, inflammatory bowel disease, and others. The rheumatoid arthritis segment projected a prominent revenue share in the market in 2022. Elevated CRP levels, along with other laboratory tests and clinical evaluations, can aid in diagnosing rheumatoid arthritis, even though no single test can confirm the diagnosis. CRP level reduction over time often indicates that a treatment technique effectively controls RA-related inflammation.Assay Type Outlook

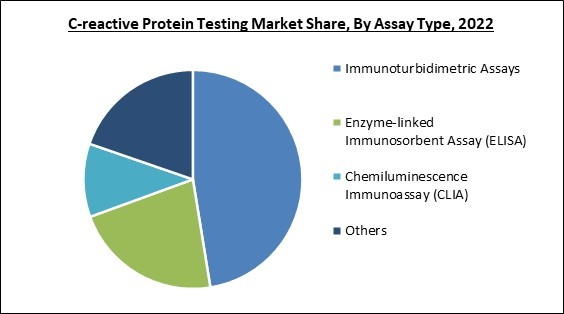

By assay type, the market is segmented into enzyme-linked immunosorbent assay (ELISA), chemiluminescence immunoassay (CLIA), immunoturbidimetric assays, and others. The enzyme-linked immunosorbent assay (ELISA) segment acquired a substantial revenue share in the market in 2022. The precise concentration of CRP in a sample is measured by ELISA, which produces quantitative data. This enables precise monitoring of changes over time and aids in evaluating disease activity and treatment response by healthcare professionals. Since ELISA assays can be designed to be very specific to CRP, there is a low probability that the test results will be affected by any cross-reactivity with other substances in the blood.End-user Outlook

based on end user, the market is divided into hospitals & clinics, diagnostic laboratories, and others. The diagnostics laboratories segment witnessed a remarkable growth rate in the market in 2022. Diagnostic laboratories are essential in veterinary pain management as they provide the foundation for accurate diagnosis, treatment planning, and ongoing monitoring of pain in animals. Their role in improving the quality of life and welfare of animals cannot be overstated, and they are a valuable resource for veterinarians and pet owners alike.Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region registered the highest revenue share in the market. The convenience and rapidity of point-of-care testing are making it a growing trend in the region. Rapid results of POCT for CRP testing can help with rapid diagnosis and therapy. The market in North America is anticipated to be driven by technological advancements that have improved CRP testing's accuracy, efficacy, and affordability. During the forecast period, it is predicted that the market in North America will be driven by the growth in the prevalence of inflammatory diseases unhealthy lifestyles, and the development of new testing kits and solutions for early detection of inflammatory ailments.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Danaher Corporation, F. Hoffmann-La Roche Ltd., Abbott Laboratories, Laboratory Corporation of America Holdings, Randox Laboratories Limited, Thermo Fisher Scientific Inc., Quest Diagnostics Incorporated, Horiba, Ltd., Merck KGaA, and Zoetis, Inc.

Scope of the Study

By Application

- Cardiovascular Disease

- Inflammatory Bowel Disease

- Rheumatoid Arthritis

- Diabetes

- Others

By Assay Type

- Immunoturbidimetric Assays

- Enzyme-linked Immunosorbent Assay (ELISA)

- Chemiluminescence Immunoassay (CLIA)

- Others

By End-user

- Hospitals & Clinics

- Diagnostic Laboratories

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- Abbott Laboratories

- Laboratory Corporation of America Holdings

- Randox Laboratories Limited

- Thermo Fisher Scientific Inc.

- Quest Diagnostics Incorporated

- Horiba, Ltd.

- Merck KGaA

- Zoetis, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Danaher Corporation

- F. Hoffmann-La Roche Ltd

- Abbott Laboratories

- Laboratory Corporation of America Holdings

- Randox Laboratories Limited

- Thermo Fisher Scientific Inc.

- Quest Diagnostics Incorporated

- Horiba, Ltd.

- Merck KGaA

- Zoetis, Inc.