X-rays are one of the most prevalent types of radiography for radiation therapy. X-ray apparatus must be installed in adequately shielded rooms to prevent public exposure to X-ray radiation. The type of material and thickness utilized for shielding determines its effectiveness. Shielding can be achieved with various substances. Consequently, the X-ray Rooms segment registered a $108.2 million revenue in 2022. However, brick or concrete are considered ideal materials due to their availability, affordability, and structural strength. Some of the factors impacting the market are increasing demand for nuclear medicine and radiation treatment, growing healthcare expenditures and insufficient healthcare infrastructure.

Nuclear medicine and radiotherapy have numerous applications in cancer treatment; consequently, the rising incidence of the disease will benefit the radiation detection, monitoring, and safety industry. By the World Nuclear Association, more than 40 million nuclear medicine procedures are carried out annually, and the demand for radioisotopes has grown by 5% yearly (data as of May 2020). The most prevalent type of radiography in March 2022 was plain radiography, or X-rays (1.82 million), followed by diagnostic ultrasound (0.85 million), computerized axial tomography (CT scan), and magnetic resonance imaging (MRI, 0.32 million). The market products is anticipated to grow due to the rising use of radiation therapy. The increasing number and size of investments invested in the healthcare industry by governments of different nations are the primary drivers of the market's growth. The WHO reports that healthcare spending reached a record high of US $9 trillion (about 11% of global GDP) due to substantial increases in healthcare spending by governments at all income levels. In general, rising government health spending largely offsets declining personal spending. Increasing spending in the healthcare industry has led to an increase in market innovations. Therefore, the market is expanding as a result of increased investment in the healthcare industry.

However, radiotherapy apparatuses are larger and require ample installation space. The lack of suitable healthcare infrastructure caused by low healthcare spending is one of the main factors preventing the implementation of medical radiation shielding expenditure. Some healthcare institutions in developing and underdeveloped countries can use medical radiation shielding solutions for cancer treatment. Lower adoption of proton therapy may also be caused by the lower healthcare expenditure. As a result of this, the deployment of medical radiation shielding may decline, thereby reducing the market growth. During the COVID-19 outbreak, non-urgent clinical procedures were postponed until the situation stabilized. As a result of the numerous efforts taken to stop the spread of COVID-19, many companies, especially those in the healthcare sector, experienced substantial operational disruption. Staff quarantine, supply-chain failures, and decreases in demand caused significant complications for companies. In addition, private hospital chains significantly declined inpatient and outpatient chains. Consequently, the market was significantly affected.

Radiation Therapy Shielding Outlook

Under radiation therapy shielding, the market is fragmented into linear accelerators, multimodality, cyclotron, brachytherapy, and proton therapy. In 2022 the linear accelerators segment dominated the market with maximum revenue share. Electron linear accelerators are being employed more often globally in numerous significant applications. The most important of these is their use in the treatment of cancer using radiation with photon and electron energies between 4 and 40 MeV.End-user Outlook

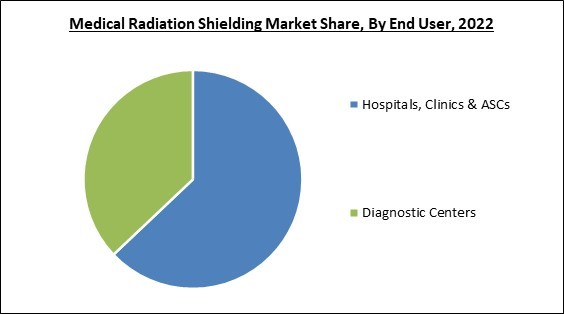

On the basis of end user, the market is categorized into hospitals, clinics, & ASCs and diagnostic centers. In 2022 hospitals, clinics, and ASCs segment registered the maximum revenue share in the market. It is anticipated that hospitals will continue to use a lot of medical radiation shielding throughout the projected period. Hospitals are significantly aiding the expansion of industry. Hospitals are likely to use medical radiation shielding more often as people become more aware of the adverse effects of medical radiation.Product Outlook

By product, the market is classified into MRI shielding products, lead lined glass, doors & windows, lead lined drywalls & plywood, lead sheet, lead bricks, high-density concrete blocks, X-ray rooms, lead curtains, lead acrylic, and others. In 2022 the MRI shielding products segment held the highest revenue share in the market. Due to the growing technological developments in radiation detection, the MRI shielding products segment is anticipated to experience the most significant growth. These products offer a range of benefits that contribute to the safe and efficient operation of MRI equipment and the well-being of patients, healthcare professionals, and the general environment.Solution Outlook

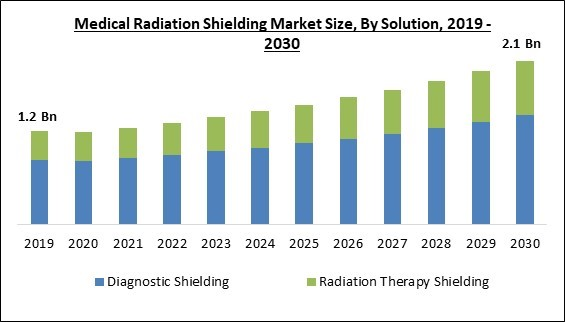

Based on solution, the market is bifurcated into diagnostic shielding and radiation therapy shielding. The radiation therapy shielding segment projected a prominent revenue share in the market in 2022. Due to the increasing need for cancer treatment, developing treatment methods, changing treatment protocols, safety requirements, and the requirement for cutting-edge shielding solutions, the radiation therapy shielding segment is a driving force in the market. As the field of radiation therapy continues to develop, it is anticipated that the demand for innovative and effective radiation shielding products will increase consistently. Radiation therapy is the targeted administration of ionizing radiation to treat cancer and other diseases.Diagnostic Shielding Outlook

Under diagnostic shielding, the market is divided into X-ray, MRI, CT scanners, and nuclear imaging. In 2022 the MRI segment witnessed the largest revenue share in the market. MRI technology may show soft tissues, organs, and bodily structures in incredibly fine detail. It is a useful tool for identifying a variety of illnesses since it is very skilled at differentiating between various soft tissue types. Because they offer comprehensive information about the position, size, and relationships of structures within the body, surgeons frequently use MRI pictures to plan the surgery.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022 the North America region led the market by generating the highest revenue share. In the coming years, there will be abundant growth prospects in the regional market as chronic disease prevalence rises, medical tourism surges, and healthcare expenditure rises. The sophisticated healthcare infrastructure in this region and the rise in diagnostic facilities in the United States and Canada also contribute to its expansion.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Mirion Technologies, Inc., ETS- Lindgren, Inc. (ESCO Technologies, Inc.), Nelco Worldwide, Gaven Industries, Inc. (3RC), MarShield (Marswell Group of companies), Ray-Bar Engineering Corp, Amray Group Ltd., A&L Shielding, Radiation Protection Products, Inc., and Global Partners in Shielding, Inc.

Scope of the Study

Market Segments Covered in the Report:

By Product

- MRI Shielding Products

- High-Density Concrete Blocks

- Lead Lined Glass, Doors & Windows

- Lead Lined Drywalls & Plywood

- Lead Bricks

- X-ray Rooms

- Lead Curtains

- Lead Acrylic

- Lead Sheet

- Others

By Solution

- Diagnostic Shielding

- MRI

- CT Scanners

- X-ray

- Nuclear Imaging

- Radiation Therapy Shielding

- Linear Accelerators

- Multimodality

- Cyclotron

- Brachytherapy

- Proton Therapy

By End-user

- Hospitals, Clinics & ASCs

- Diagnostic Centers

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Mirion Technologies, Inc.

- ETS- Lindgren, Inc. (ESCO Technologies, Inc.)

- Nelco Worldwide

- Gaven Industries, Inc. (3RC)

- MarShield (Marswell Group of companies)

- Ray-Bar Engineering Corp

- Amray Group Ltd.

- A&L Shielding

- Radiation Protection Products, Inc.

- Global Partners in Shielding, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Mirion Technologies, Inc.

- ETS- Lindgren, Inc. (ESCO Technologies, Inc.)

- Nelco Worldwide

- Gaven Industries, Inc. (3RC)

- MarShield (Marswell Group of companies)

- Ray-Bar Engineering Corp

- Amray Group Ltd.

- A&L Shielding

- Radiation Protection Products, Inc.

- Global Partners in Shielding, Inc.