To preserve product quality, increase shelf life, and guarantee food safety, cooling systems with hygienic features, clean-in-place (CIP) capabilities, and accurate temperature control are desired. Therefore, the Food & Beverage segment will acquire approximately 85% share in the market by 2030, as it’s crucial in refrigeration, fermentation, cold storage, and product chilling. The expansion of the market is anticipated to be driven by hygienic design and adherence to food safety laws. Some of the factors impacting the market are growing demand for energy efficiency, government assistance for improving cold chain infrastructure, and costly installations and complicated installation-related issues.

Advancements in technology have given rise to industrial cooling systems that are more effective and environmentally benign. These developments include creating sophisticated cooling materials, clever cooling systems, and enhanced exchangers for heat, all of which draw companies eager to streamline their operations. Aside from the numerous environmental advantages of optimizing cooling and refrigeration systems, cutting-edge technology and knowledge of best practices can result in more than 15% energy savings with free or low capital investments. Moreover, Food loss and wastage are primarily caused by inadequate cold chain infrastructure. Due to issues including incorrect handling, inadequate infrastructure, lack of access to cold chains, a lack of energy resources to power these cold chain facilities, and other issues, the shelf life of vegetables, fish, meat, fruits, and dairy products is drastically reduced. Thus, to comply with requirements and reduce their carbon footprints, businesses are adopting greener cooling solutions at an increasing rate and the increasing demand for cold chain infrastructure is propelling the growth of the market.

However, Industrial cooling systems are relatively expensive to construct for the cold storage and supply chain. Setting up sensors and network connections is expensive. Additionally, considerable investment is required to move high-value cargo over long distances while maintaining the proper temperature. The biggest obstacle to implementing such systems is cost, particularly for small and medium-sized organizations. This barrier is particularly important for these businesses because many companies in the food industry are SMEs and sometimes operate on thin margins. As a result, it could be challenging to identify the sorts of errors, solve scale visualization issues, and develop fixes. Thus, the aforementioned problems could limit the market's expansion in the upcoming years.

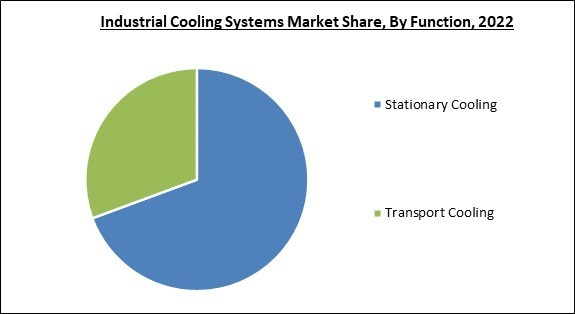

Function Outlook

By function, the market is divided into stationary cooling and transport cooling. The transport cooling segment procured a remarkable growth rate in the market in 2022. Transport cooling systems, or refrigeration units, are necessary when transporting perishable commodities. Transport cooling units are mounted on vans, shipping containers, semi-vehicles, pickup trucks, and rail carts. Insulation material, a condenser, a compressor, and an evaporator make up these systems, which are placed in automobiles.End-user Outlook

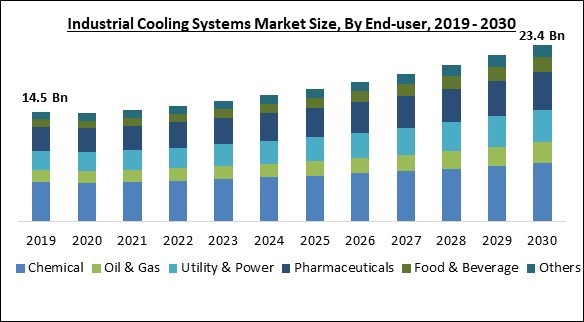

Based on end-user, the market is characterized into food & beverage, chemical, pharmaceuticals, utility & power, oil & gas, and others. The chemical segment garnered the highest revenue share in the market in 2022. A facility used to generate or purify chemicals is known as a chemical process plant. For the plant to adequately chill the water and maintain a smooth manufacturing process, a dependable and effective cooling system is necessary. Any chemical processing facility needs a cooling tower because it ensures that the right amount and cold-water temperature are always delivered, maintaining the ideal process conditions.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

Product Type Outlook

On the basis of product type, the market is classified into air cooling, evaporative cooling, water cooling, and hybrid cooling. The evaporative cooling segment recorded the largest revenue share in the market in 2022. Due to its many advantages, such as energy savings, economic effectiveness, and low maintenance requirements, evaporative process cooling is becoming increasingly popular. These systems are eco-friendly because they don't use hazardous chemicals or refrigerants and can deliver efficient cooling while using much less energy. Industries trying to lower their operational costs as well as environmental implications find this energy efficiency particularly enticing.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment acquired the highest revenue share in the market in 2022. The market in the Asia Pacific region is predicted to grow quickly due to the substantial development potential of cold chain storage infrastructure in countries like Japan, India, and China. China is the largest producer of vegetables and fruits worldwide, followed by India. Crops from China and India are sold all over the world. The various governments have started several initiatives to expand cold storage management and enhance refrigeration as well as refrigerated warehouse administration in their respective countries.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Airedale International Air Conditioning Ltd. (Modine Manufacturing Company), Emerson Electric Co., GEA Group AG, Johnson Controls International PLC, Schneider Electric SE, SPX Technologies, Inc., Baltimore Aircoil Company, Inc. (Amsted Industries), Brentwood Industries, Inc., Star Cooling Tower Pvt Ltd. and Rittal GmbH & Co. KG (Friedhelm Loh Stiftung & Co. KG).

Strategies Deployed in the Market

- Jul-2023: Airedale by ModineTM, announced an enhancement to its series of cooling solutions with the launch of MultiChill, a new modular for efficient and malleable cooling solution. Through the launch of MultiChill, Airedale will be able to deliver extensible and more efficient cooling solutions in urban areas where the space and approach are Limited.

- Jun-2023: Johnson Controls International plc took over M&M Carnot, a natural refrigeration solutions provider. With this acquisition, Johnson Controls will be able to accelerate the development of safer and more legitimate natural cooling solutions and services. In addition, M&M Carnot's industrial refrigeration equipment will be added to the product portfolio of Johnson Controls.

- May-2023: Johnson Controls International plc announced the acquisition of Gordon Brothers Industries (GBI), a manufacturer of industrial refrigeration solutions that also serves in the Meat, Beverage, and Dairy Industries. This acquisition would empower Johnson Controls' growth across the region and beyond to provide the best product and solutions to the customers. Moreover, Johnson Controls will deliver more efficient and ultra-low global warming potential (GWP) cooling solutions.

- May-2023: SPX Technologies, Inc. is acquiring ASPEQ Heating Group, a provider and manufacturer of hybrid electric heating and thermal management technologies for industries, Markets, and also the military. With this acquisition, SPX Technologies will be able to enlarge its product portfolio. In addition, this acquisition will intensify the development of new, innovative, and more efficient heating solution products for customers through shared technologies and resources.

- Jan-2023: Johnson Controls International plc completed the acquisition of Hybrid Energy AS, a provider of hybrid and efficient Heat Pumps. The acquisition would help Johnson Controls to help customers reduce their energy consumption problems. Further, the development of new technology of hybrid energy would deliver more efficient and environment-friendly heating solutions.

- Aug-2021: Emerson Electric Co. launched Copeland 110cc variable speed scroll compressor and 36kW inverter drive solution, a new Variable Speed Scroll Compressor Solution, and a speed scroll Compressor Solution for commercial ACs to increase efficiency and provide environment-friendly enhancement. Further, the new variable speed scroll compressor will reduce the 30% energy consumption as compared to the standard fixed-speed technology.

- Jun-2021: Baltimore Aircoil Company Inc. acquired Eurocoil SPA, a manufacturing company of Heat exchangers, Condensers, Dry coolers, and other cooling solutions. Through this acquisition, Baltimore will be able to increase its manufacturing capability in the region. Moreover, Baltimore would also be able to boost the development of evaporative hybrid and adiabatic technologies in cooling solutions.

- Oct-2019: Schneider Electric SE. signed a partnership with Avnet, an electronics component distributor with a large-scale supplier network, and Iceotope, a liquid cooling solution provider company. Through this partnership, Schneider Electric aims to provide advanced and innovative cooling solutions for the set-up of applications like AI and IoT. Moreover, the companies would combine their expertise and innovative technologies, to accelerate the development of hybrid and efficient cooling solutions for data centers.

- Jun-2019: SPX Technologies, Inc. took over SGS Refrigeration Inc, a manufacturer of cooling towers, air-cooled heat exchangers, etc. having patents in many cooling solution technologies. Through this acquisition, both companies are looking for the development and expansion of their industrial refrigeration solution products, by combining their resources and patented technologies.

Scope of the Study

Market Segments Covered in the Report:

By End-user

- Chemical

- Oil & Gas

- Utility & Power

- Pharmaceuticals

- Food & Beverage

- Others

By Function

- Stationary Cooling

- Transport Cooling

By Product Type

- Evaporative Cooling

- Air Cooling

- Water Cooling

- Hybrid Cooling

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Airedale International Air Conditioning Ltd. (Modine Manufacturing Company)

- Emerson Electric Co.

- GEA Group AG

- Johnson Controls International PLC

- Schneider Electric SE

- SPX Technologies, Inc.

- Baltimore Aircoil Company, Inc. (Amsted Industries)

- Brentwood Industries, Inc.

- Star Cooling Tower Pvt Ltd.

- Rittal GmbH & Co. KG (Friedhelm Loh Stiftung & Co. KG)

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Airedale International Air Conditioning Ltd. (Modine Manufacturing Company)

- Emerson Electric Co.

- GEA Group AG

- Johnson Controls International PLC

- Schneider Electric SE

- SPX Technologies, Inc.

- Baltimore Aircoil Company, Inc. (Amsted Industries)

- Brentwood Industries, Inc.

- Star Cooling Tower Pvt Ltd.

- Rittal GmbH & Co. KG (Friedhelm Loh Stiftung & Co. KG)