In North America, there is growing interest in microgrids, notably for vital infrastructure, military sites, and remote communities. Hence, the North America region captured $171.7 million revenue in the market in 2022. Microgrid solutions integrating grid-forming inverters are becoming more popular due to the growing emphasis on grid resilience and natural disaster preparedness. Grid-forming inverters are essential for microgrids because they enable them to function independently or in conjunction with the main grid. Some of the factors impacting the market are rising renewable energy investment, effective outage, grid reliability, and inherent operational efficiency, and higher costs than grid-following inverters.

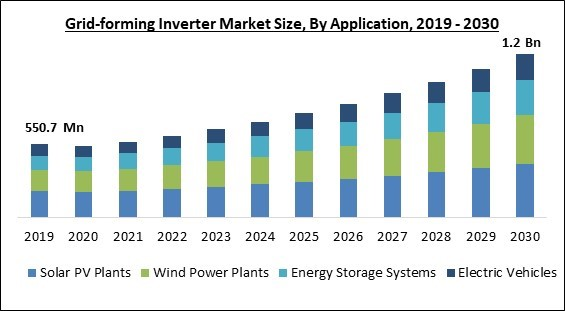

The market is driven primarily by rising investments in the renewable power sector. Investments in renewable power generating technologies, including solar, wind, and hydropower, have significantly increased as the world transitions toward a more sustainable energy future. In conclusion, the need for grid-forming inverters will grow because of the expanding use of renewable energy sector, which will drive the growth of the market. Additionally, the grid is an advanced electricity supply network that uses digital communications technology to identify in real-time, react to local changes in usage, and enable automatic network self-healing in the event of a power outage. It is a sophisticated addition to the current electrical grid network that offers advanced feedback options, including, among others, active network management (ANM) systems and demand response management systems (DRMS). As a result of the rising effective outage, grid reliability, and inherent operational efficiency, the market is expected to grow in the coming years.

However, Grid-forming inverters are more complicated than grid-following inverters because they must actively regulate the voltage and frequency of the grid. This requires more sophisticated hardware and control algorithms. On the other hand, grid-following inverters just need to be able to watch the grid's voltage and frequency, which may be accomplished with less sophisticated hardware and control algorithms. Therefore, due to the extra complexity, grid-forming inverters are often costlier than grid-following inverters. Therefore, these obstacles may impede the market's growth in the coming years.

Application Outlook

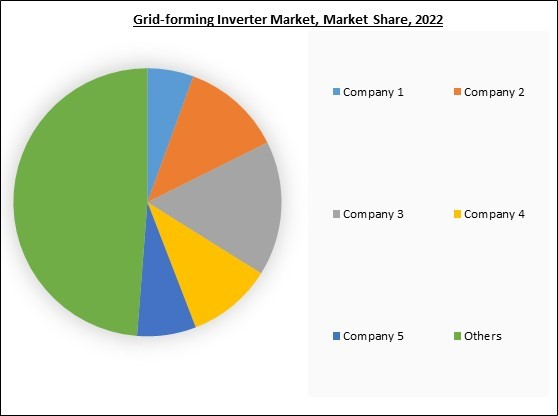

Based on application, the market is classified into solar PV plants, wind power plants, energy storage systems, and electric vehicles. The wind power plants segment acquired a substantial revenue share in the market in 2022. Wind power plants increasingly use grid-forming inverters to promote grid stability and improve the integration of wind energy into the electrical grid. These specialized inverters play a vital role in establishing and sustaining a stable grid environment, allowing wind power plants to operate in grid-forming mode instead of relying solely on the stability of the existing grid.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies to cater to demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

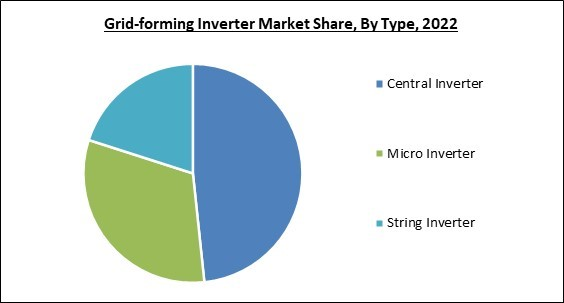

Type Outlook

By type, the market is categorized into micro inverter, string inverter, and central inverter. In 2022, the string inverter segment covered a considerable revenue share in the market. String inverters are typically more cost-effective for smaller-scale solar PV installations. They provide a good balance of performance and cost, making them an attractive option for residential and small commercial projects. When compared to other types of grid-forming inverters, which are more sophisticated, string grid-forming inverters are often easier to install and maintain.Voltage Outlook

On the basis of voltage, the market is divided into 100-300 V, 300-500 V, and above 500 V. The 300 - 500 V segment garnered a significant revenue share in the market. Grid-forming inverters with input voltage levels between 300 to 500 V are versatile components used in a wide range of applications, including residential solar installations, commercial projects, microgrids, energy storage systems, and off-grid solutions. Grid-forming inverters operating with input voltage levels between 300 to 500 volts (V) are commonly used in various renewable energy and microgrid applications. These inverters play a critical role in converting the DC power generated by sources such as solar panels and batteries into AC power that can be synchronized with the grid or operate in islanded mode.Power Rating Outlook

By power rating, the market is segmented into below 50 KW, 50-100 KW, and above 100 KW. The below 50 KW segment registered the maximum revenue share in the market in 2022. Grid-forming inverters with capacities below 50 kW serve as building blocks for smaller-scale energy systems. They enable energy generation, distribution, and control in a variety of contexts, ranging from residential solar installations to microgrids in remote communities and beyond. These inverters contribute to the decentralization and democratization of energy production, enhancing energy efficiency and sustainability.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region led the market by generating the highest revenue share. In the Asia Pacific region, the adoption of energy storage technologies, such as battery storage, is increasing momentum. Energy storage facilitates system stability and improves renewable energy integration by storing excess renewable energy and releasing it when demand is high. Governments are revising and implementing new policies and regulations that promote renewable energy grid integration.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.), SolarEdge Technologies, Inc., Enphase Energy, Inc., Schneider Electric SE, General Electric Company, Delta Electronics, Inc., Sungrow Power Supply Co., Ltd., Fimer Group, KACO new energy GmbH and GoodWe.

Strategies Deployed in the Market

- Jul-2023: Huawei Digital Power came into collaboration with Sembcorp Industries, an energy and urban development company. Under the Collaboration, the firms will research and apply methods to ensure power grid resilience, and stability, and improve PV integration using grid-forming ESS. Additionally, the company will persist in digitally transforming energy, creating novel power systems centered around renewable sources.

- Jul-2023: SolarEdge Technologies, Inc. signed an agreement with Infineon Technologies AG, a global leader in power semiconductors. Under this agreement, both companies aim to advance upcoming technologies and innovative solar products, leveraging wide bandgap materials crucial for worldwide green energy provision.

- Feb-2023: Enphase Energy, Inc. partnered with Lumio, a leader in personalized renewable energy. The partnership broadens Enphase's portfolio of Enphase® IQ8™ Microinverters and IQ™ Batteries across the United States. Moreover, Lumio enhances Enphase Energy Systems' reach, providing homeowners with increased access to dependable, sustainable, and off-grid power solutions.

- Jan-2023: Enphase Energy, Inc. partnered with Enerix, a service provider for distributed energy systems, to expand Enphase product offerings in Europe. Through this partnership, Enerix will offer Enphase Energy Systems, to its partners across Germany and Austria. Additionally, the partnership will expand the footprints of Enphase Energy, Inc. in Germany and Austria.

- May-2022: Huawei came into an agreement with SolarEdge Technologies Inc., a developer of a DC-optimized inverter system. Under this agreement, both companies would utilize each other's patented technology through acknowledgment of their collective innovation prowess. Additionally, the deal involves a reciprocal patent license for both firms' products and additional rights. Moreover, Huawei offers comprehensive Smart PV solutions, featuring inventive products like Smart String Inverter, Smart String ESS, and more.

- Oct-2021: Enphase Energy, Inc. launched its latest Enphase Energy System in North America with IQ8™ solar microinverters. Unlike rivals, IQ8 can create a microgrid using sunlight alone during outages, offering backup power without needing a battery. The IQ8 microinverter is a true game-changer for the industry, pioneering microgrid technology.

- Jul-2021: FIMER Group came into partnership with Peel Renewable Energy, Avora Energy, Sunrise Energy Group, Jarrah Solutions, and DevelopmentWA to design and manufacture the one-of-a-kind solar, battery, and microgrid solution. The project involved meticulous custom engineering by FIMER, spanning a year of collaborative planning between Australian and European teams.

Scope of the Study

Market Segments Covered in the Report:

By Application

- Solar PV Plants

- Wind Power Plants

- Energy Storage Systems

- Electric Vehicles

By Type

- Central Inverter

- Micro Inverter

- String Inverter

By Voltage

- Above 500 V

- 300 - 500 V

- 100 - 300 V

By Power Rating

- Below 50 KW

- 50 - 100 KW

- Above 100 KW

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- SolarEdge Technologies, Inc.

- Enphase Energy, Inc.

- Schneider Electric SE

- General Electric Company

- Delta Electronics, Inc.

- Sungrow Power Supply Co., Ltd.

- Fimer Group

- KACO new energy GmbH

- GoodWe

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Huawei Technologies Co., Ltd. (Huawei Investment & Holding Co., Ltd.)

- SolarEdge Technologies, Inc.

- Enphase Energy, Inc.

- Schneider Electric SE

- General Electric Company

- Delta Electronics, Inc.

- Sungrow Power Supply Co., Ltd.

- Fimer Group

- KACO new energy GmbH

- GoodWe