The usage of 3D models in military operations is very beneficial. Often, military personnel might utilize them for various purposes, including training and evaluating the efficacy of a new weapon. Therefore, the Government & Defense segment would acquire approximately 11% share of the market by 2030. Airport facilities benefit from interior 3D mapping in the same ways as any other vertical asset management company, with the bonus of incorporating priceless spatial data into their tenant and lease management workflow. Because they give the military a realistic image of its intended projects, military 3D modeling services are growing in popularity. Decision-makers can better comprehend a proposed site's capabilities by utilizing realistic visuals. Often, military personnel might utilize them for various purposes, including training and evaluating the efficacy of a new weapon.

The major strategies followed by the market participants are Partnerships as the key developmental strategy in order to keep pace with the changing demands of end users. In March, 2023, Dassault Systemes SE partnered with MapmyIndia Mappls to provide digital twins for the development of India's urban infrastructure and facilitate public and private companies in India for better infrastructure planning. In June, 2023, Hexagon AB came into partnership with NVIDIA to develop solutions for industrial digital twins.

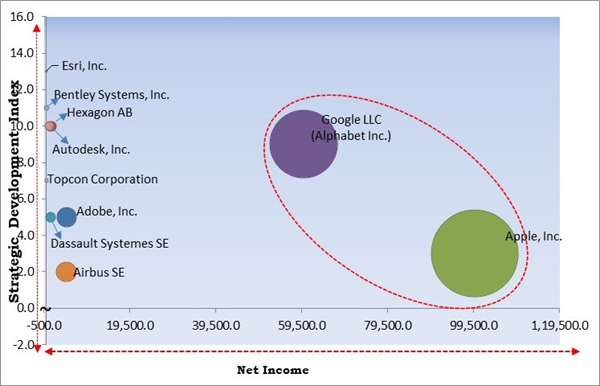

The Cardinal Matrix - Market Competition Analysis

Based on the analysis presented in the The Cardinal Matrix; Apple, Inc. and Google LLC are the forerunners in the Market. In March, 2023, Google LLC signed a partnership with NASA to develop 3D models of planets in the solar system for Google Arts & Culture. Companies such as Adobe, Inc., Airbus SE, Hexagon AB are some of the key innovators in the Market.Market Growth Factors

Development of 3D-Enabled Display Devices

3D display technology is currently widespread, especially in televisions and smartphones. Major makers of TVs, smartphones, computer monitors, and gaming consoles, including Samsung, Sony, and LG, have jumped on the 3D bandwagon to increase their market share. The popularity of VR gaming consoles is rising in developed nations, including the United States, the United Kingdom, China, and Japan. Sales of projectors and monitors - the two main uses for 3D displays - are expected to increase dramatically as a result of shifting consumer preferences and the desire for high-definition visuals. The market is anticipated to expand as 3D-enabled gadgets become more prevalent.Expanding Gaming Industry

Players in the business have been prompted to emphasize device compatibility and efficiency as they shift their attention from physical to online gaming. A significant factor in the expansion of the video game industry has been the growing use of video games by young adults worldwide to occupy time. To mimic realistic lighting conditions and effects, such as shadows, reflections, refractions, and ambient occlusion, 3D modeling for video games must be lighted and shaded. As a result, game models must employ more sophisticated shaders (the software used to determine color and appearance) and more dynamic lighting. With the gaming industry's increasing popularity and the use of visual effects, the market is expected to expand soon.Market Restraining Factors

Rising Concerns About Piracy and Corruption

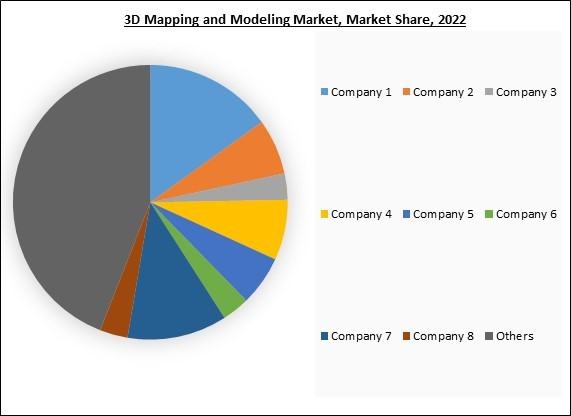

Corruption and piracy risks remain a concern for the animation industry. Targeted software installations for businesses are sold in the black market. As a result, the sector suffers enormous financial losses. Companies have created surveillance and monitoring technologies to prevent the unauthorized distribution of 3D mapping and modeling software to combat piracy. For instance, in India, states like Tamil Nadu and Maharashtra have launched campaigns to raise awareness among the general population about piracy. However, blocking websites and punishing illegal users in certain nations is the sole governmental measure to stop piracy. It is predicted that the market may decline as a result of the risk and privacy issues.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

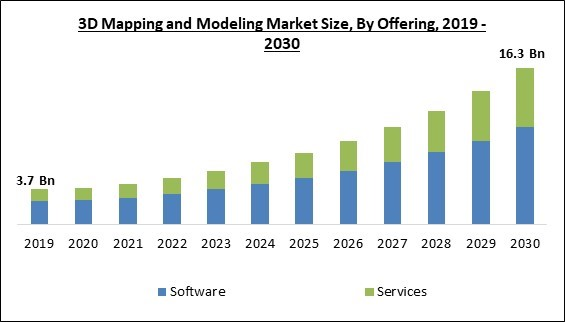

Offering Outlook

On the basis of offering, the market is fragmented into software and services. In 2022, the software segment dominated the market with the maximum revenue share. Software for 3D modeling and mapping is a component of the solutions. A group of technologies, programs, and tools known as 3D mapping and modeling solutions make it possible to create, view, and manipulate three-dimensional (3D) representations of actual items, scenery, environments, or virtual entities. 3D modeling software enables easy modification and iteration of designs. Engineers, architects, and designers can quickly test different options, make adjustments, and assess the impact on the final outcome.Technology Outlook

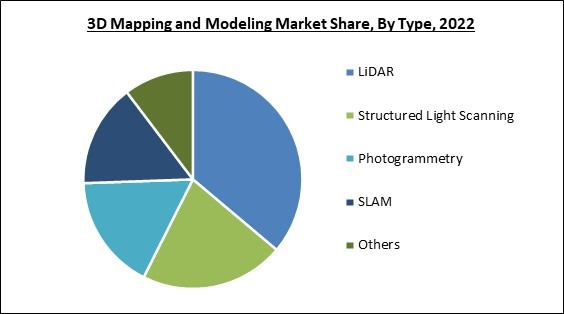

Based on technology, the market is classified into LiDAR, photogrammetry, structured light scanning, SLAM, and others. In 2022, the photogrammetry segment recorded a remarkable revenue share in the market. A cutting-edge technology called photogrammetry is significantly advancing 3D modeling and mapping. It entails extracting precise 3D information from 2D photos to produce detailed and realistic 3D representations of objects and environments. The number of applications for photogrammetry has increased as technology has developed, fueling the need for this ground-breaking solution across numerous industries.Software Type Outlook

Under the software, the 3D market is further segmented into 3D mapping and 3D modeling. The 3D mapping segment registered the highest revenue share in the market in 2022. With machine vision, 3D mapping technology profiles objects in three dimensions to be mapped in the actual world using the most up-to-date data collection and visualization methods. To map items in the actual world, 3D mapping necessitates using the three-dimensional profiling of those objects.3D modeling software Type Outlook

The 3D modeling software segment is further subdivided into wireframe modeling, solid modeling, surface modeling, and others. The wireframe modeling segment procured the largest revenue share in the market in 2022. Wireframe models provide a clear and uncluttered representation of the underlying structure of an object. This simplicity makes it easier to understand the basic form and layout of the object. Wireframe models provide a clear and uncluttered representation of the underlying structure of an object. This simplicity makes it easier to understand the basic form and layout of the object.Vertical Outlook

On the basis of vertical, the market is segmented into architecture, engineering & construction (AEC), manufacturing, automotive & transportation, healthcare & life sciences, media & entertainment, government & defense, education, agriculture, energy & utilities, and others. In 2022, the architecture, engineering and construction (AEC) segment registered the highest revenue share in the market. Building designs and architectural requirements seem to improve steadily due to the quick infrastructural development occurring in many parts of the world. Architects may be able to concentrate more on original design concepts as they don't have to worry about the technical details of 3D modeling. Creating novel architectural buildings is also made simple by 3D modeling software. They are also better able to experiment with approaches or picture structures.Regional Outlook

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region generated the highest revenue share in the market. North America, which consists of the United States and Canada, is a center for adopting these technologies due to its reputation for having a sophisticated technical infrastructure and innovative industries. Many major gaming and entertainment industries are also based in North America, and 3D mapping and modeling tools are essential for producing aesthetically attractive and realistic gaming worlds. As these technologies develop and find new uses in various industries, 3D mapping and modeling solutions in North America are expected to increase.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Google LLC (Alphabet Inc.), Dassault Systemes SE, Adobe, Inc., Hexagon AB, Bentley Systems, Inc., Airbus SE, Topcon Corporation, Autodesk, Inc., Apple, Inc., and Esri, Inc.

Strategies Deployed in the Market

Partnerships, Collaborations and Agreements:

- Jun-2023: Hexagon AB came into partnership with NVIDIA, a US-based software company, to develop solutions for industrial digital twins. The partnership would create solutions that would facilitate the customers in creating and comparing real- and virtual-world models.

- Mar-2023: Google LLC signed a partnership with NASA, a US-based government agency, to develop 3D models of planets in the solar system for Google Arts & Culture. The partnership creates a better experience for astronomy students by providing them with live models of planets for studies.

- Mar-2023: Dassault Systemes SE partnered with MapmyIndia Mappls, an Indian digital map data provider, to provide digital twins for the development of India's urban infrastructure. The solutions developed by the partnership would facilitate public and private companies in India in better infrastructure planning.

- Mar-2023: Adobe, Inc. announced a partnership with Autodesk, a software company, to develop solutions for 3D assets interoperability. The partnership would provide developers with powerful tools for maximum portability and open standards.

- Mar-2023: Bentley Systems, Inc. signed a partnership with WSB, an engineering firm, to provide digital twin solutions for the construction industry. The partnership would facilitate the adoption of digital twins across the construction industry.

- Oct-2022: Hexagon AB partnered with LocLab, a digital twin specialist, to develop digital twin solutions for applications in operations and construction processes. The partnership involves the integration of offerings of the two companies and the resulting offering would facilitate the customers to gain asset insights through 3D models for efficient operations.

- Oct-2022: Autodesk, Inc. partnered with Epic Games, a video game developer, to integrate its Revit with Epic Games' Twinmotion. The integration of the two offerings would provide the customers with tools for accurate visualizations of their planned space.

- Sep-2022: Bentley Systems, Inc. entered a partnership with Genesys International, a geospatial content services provider, to integrate its OpenCities 365 with Genesys’ 3D City Digital Twin Solutions. The partnership would create solutions for public and private companies in India for effective management of infrastructure projects.

- Jul-2022: Esri, Inc. partnered with Genesys International, a geospatial mapping solutions provider, to develop digital twins of Indian cities. The partnership would provide the companies in Indian market with digital twin solutions for better project management.

- Aug-2021: Hexagon AB signed a partnership with Ecopia AI, a digital twin specialist, to develop a high-precision 3D vector map of the US. The partnership would allow the two companies to create a high-definition national dataset of the entire United States.

- Mar-2021: Airbus SE came into partnership with Ecopia AI, a digital twin specialist, to develop global digital maps. The partnership features the integration of offerings of the two companies that would provide the customers with highly accurate mapping features.

Product Launches and Product Expansions:

- Jun-2023: Dassault Systemes SE announced the launch of GEOVIA, a mining software that facilitates the creation and management of 3D models of mine operations. The solution features Geology Modeler, a feature used to create 3D models of multiple pits for operations management, and Pit Optimizer which creates and simulates multiple possible scenarios of the mines to ensure maximum Net Present Value (NPV).

- May-2023: Google LLC introduced Aerial View API, a digital imaging and mapping solution. The solution features Photorealistic 3D Tiles for creating customized 3D visualization of the real world and Markers for adding checkpoints on the map. Additionally, the solution has Routes API for the creation and management of transit routes.

- Apr-2023: Topcon Corporation introduced the IP-S3 digital imaging solution. The solution leverages the GNSS receiver and Inertial Measurement Unit (IMU) along with a vehicle’s onboard electronics for the creation of high-definition digital imaging. The solution features a six-lens digital camera for providing 30 MP panoramic imagery.

- Feb-2023: Esri, Inc. announced the launch of ArcGIS Reality, a reality mapping solution. ArcGIS Reality includes ArcGIS Reality Studio for reality mapping based on the aerial images of the cities and Site Scan for ArcGIS, a software used for drone image data collection.

- Nov-2022: Bentley Systems, Inc. announced new capabilities for its iTwin Platform, a platform used for the creation and analysis of digital twins of different assets. The new capabilities include iTwin Capture for the creation of 3D images of infrastructure assets and iTwin IoT which uses IoT to gain insights on sensor data for efficient asset management.

- Oct-2022: Adobe, Inc. updated Substance 3D Modeler, a 3D model creation tool. The new features include AI and photogrammetry technologies for capturing real-world objects and a Substance 3D Sampler for generating the 3D image of the object captured. Additionally, the tool can now be used with Adobe Aero’s iOS App.

- Sep-2021: Apple, Inc. released new features for Apple Maps. The new features include improvised public transit route facilities and new walking guidance in augmented reality.

Acquisitions and Mergers:

- Mar-2023: Topcon Corporation announced the acquisition of Digital Construction Works (DCW), a software company. With the acquisition, Topcon would be better positioned to offer end-to-end workflow solutions.

- Oct-2022: Google LLC announced the acquisition of Alter, a virtual identity creator. The acquisition aids Google in strengthening its capabilities in delivering virtual identity-based avatars to users.

- Sep-2022: Hexagon AB acquired iConstruct Pty Ltd, a Building Information Modelling (BIM) solutions provider. The acquisition adds iConstruct's digital modeling portfolio to Hexagon's digital reality offerings and would allow Hexagon to provide its customers with solutions for better infrastructure management.

- Jul-2021: Bentley Systems, Inc. took over Aarhus GeoSoftware, a geophysical software developer based in Denmark. The acquisition enhances Bentley's offerings for operational groundwater and infrastructure management capabilities.

- Feb-2021: Autodesk, Inc. acquired Innovyze, Inc., a water infrastructure management solutions provider. The acquisition strengthens Autodesk's capabilities in end-to-end water infrastructure solutions.

Scope of the Study

By Offering

- Software

- Software Deployment Type

- On-premise

- Cloud

- Software Type

- 3D Modeling

- Wireframe Modeling

- Solid Modeling

- Surface Modeling

- Others

- 3D Mapping

- 3D Projection Mapping

- GIS Mapping

- Satellite & Aerial Imaging

- Drone Mapping

- Others

- 3D Modeling

- Software Deployment Type

- Services

By Technology

- LiDAR

- Structured Light Scanning

- Photogrammetry

- SLAM

- Others

By Vertical

- Architecture, Engineering & Construction

- Energy & Utilities

- Media & Entertainment

- Government & Defense

- Agriculture

- Healthcare & Lifesciences

- Education

- Automotive & Transportation

- Manufacturing

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Google LLC (Alphabet Inc.)

- Dassault Systemes SE

- Adobe, Inc.

- Hexagon AB

- Bentley Systems, Inc.

- Airbus SE

- Topcon Corporation

- Autodesk, Inc.

- Apple, Inc.

- Esri, Inc.

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Google LLC (Alphabet Inc.)

- Dassault Systemes SE

- Adobe, Inc.

- Hexagon AB

- Bentley Systems, Inc.

- Airbus SE

- Topcon Corporation

- Autodesk, Inc.

- Apple, Inc.

- Esri, Inc.