Utilization of Cocoa as Sustainable Beauty Ingredient in Cosmetics Industry Drive South & Central America Cocoa Derivatives Market

Cocoa is one of the most beneficial beauty ingredients promoting healthy skin and, thus, is commonly employed in the cosmetic industry. It is rich in omega-6 fatty acids, polyphenols, flavonoids, and antioxidants, and can be used to make a variety of skincare and cosmetic products. For instance, cocoa butter is widely used in moisturizers, lip balm, and body butter due to its high fatty acid content. It helps reduce wrinkles, scars, and other marks on human skin. Cocoa butter helps to protect against sunburn. Moreover, cocoa butter exhibits therapeutic benefits against skin irritations, hair loss, and other health concerns. Its unsaturated fat and monounsaturated oleic acid content contributes to hair and skin health. Similarly, cocoa powder can be used to make many do-it-yourself (DIY) natural beauty recipes, including dry shampoo and eye shadow. Cocoa is also used significantly as a coloring and flavoring agent in cosmetics. With the increasing consumer demand for cocoa-based cosmetics due to their beneficial properties, manufacturers are utilizing this substance as a sustainable beauty ingredient. Such product innovation by manufacturers boosts the demand for cocoa derivatives, thereby bolstering the market growth.South & Central America Cocoa Derivatives Market Overview

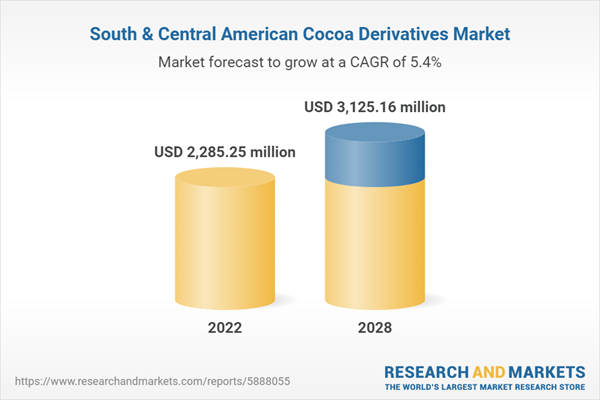

The South & Central America cocoa derivatives market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil stands as the seventh-largest cocoa producer and fifth-largest chocolate consumer in the world. According to the National Association of the Cocoa Processing Industry (AIPC), total grinding in 2021 reached 224,168 tons, 4.4% more than in 2020. According to Nasdaq - Cargill, Incorporated, Olam International, and Barry Callebaut are the major processors in the country, with the cumulative capacity to grind cocoa beans 275,000 tons per year. With such an increase in cocoa grinding by the processors across the region, the adoption of cocoa powder, cocoa butter, cocoa liquor, and cocoa beans is growing in South & Central American countries. According to the Observatory of Economic Complexity (OEC), Argentina exported chocolate worth US$ 74.3 million in 2020. The leading destinations of chocolate exports for Argentina are Brazil, Uruguay, Chile, and Paraguay, with exports worth US$ 35.1 million, US$ 8.48, US$ 4.94M, and US$ 4.61M, respectively. This increased in export and increased demand for cocoa and cocoa products is backed by the factors such as the cocoa consumers in the South & Central America are not generally price sensitive. The consumers in the region are highly aware of the benefits of consuming cocoa and its derivatives, which propels the demand for cocoa derivatives in the food & beverages industry. Also, the demand for cosmetics infused with plant-based ingredients is fueling the cocoa derivatives sales in the cosmetics and personal care industry in the region, in turn, bolstering the South & Central America cocoa derivatives market growth.South & Central America Cocoa Derivatives Market Revenue and Forecast to 2028 (US$ Million)

South & Central America Cocoa Derivatives Market Segmentation

The South & Central America Cocoa Derivatives Market is segmented into type, category, application, and country.Based on type, the South & Central America Cocoa Derivatives Market is segmented into cocoa butter, cocoa beans, cocoa powder, and others. In 2022, the cocoa beans segment registered a largest share in the South & Central America cocoa derivatives market.

Based on category, the South & Central America Cocoa Derivatives Market is bifurcated into organic and conventional. In 2022, the conventional segment registered a larger share in the South & Central America cocoa derivatives market.

Based on application, the South & Central America Cocoa Derivatives Market is segmented into food and beverages, personal care, and other. In 2022, the food and beverages segment registered a largest share in the South & Central America cocoa derivatives market. The food and beverages segment is further segmented into bakery and confectionery, dairy and frozen desserts, beverages, and other food and beverages.

Based on country, the South & Central America Cocoa Derivatives Market is segmented into Brazil, Argentina, and the Rest of South & Central America. In 2022, Brazil segment registered a largest share in the South & Central America cocoa derivatives market.

Barry Callebaut AG, Cargill, Inc, Ecuakao Group Ltd, Indcre SA, JB Foods Ltd, MONERA COCOA SA, Natra SA, and Olam Groupe Ltd are the leading companies operating in the South & Central America cocoa derivatives market.

Table of Contents

Companies Mentioned

- Barry Callebaut AG

- Cargill, Inc

- Ecuakao Group Ltd

- Indcre SA

- JB Foods Ltd

- MONERA COCOA SA

- Natra SA

- Olam Groupe Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 119 |

| Published | August 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 2285.25 million |

| Forecasted Market Value ( USD | $ 3125.16 million |

| Compound Annual Growth Rate | 5.4% |

| No. of Companies Mentioned | 8 |