2 Research Methodology

2.1 Research Data

Figure 1 Metabolism Assays Market: Research Design Methodology

2.1.1 Secondary Data

2.1.1.1 Secondary Sources

2.1.2 Primary Data

Table 2 Key Data from Primary Sources

Figure 2 Key Industry Insights

2.1.2.1 Breakdown of Primary Interviews

Figure 3 Breakdown of Primary Interviews: Supply-Side and Demand-Side Participants

Figure 4 Breakdown of Primary Interviews: by Company Type, Designation, and Region

2.2 Market Size Estimation

Figure 5 Bottom-Up Approach: Revenue-Based Approach

2.2.1 Growth Forecast

2.2.2 CAGR Projections

Figure 6 CAGR Projections: Supply-Side Analysis

2.2.3 Top-Down Approach

Figure 7 Metabolism Assays Industry: Top-Down Approach

2.3 Market Breakdown and Data Triangulation

Figure 8 Data Triangulation Methodology

2.4 Market Share/Ranking Analysis

2.5 Study Assumptions

2.6 Risk Assessment

2.7 Impact of Recession

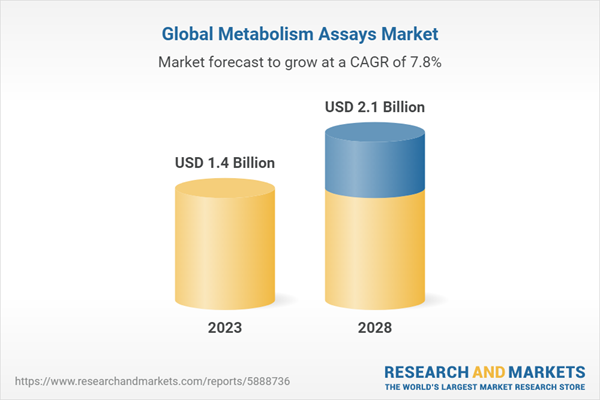

3 Executive Summary

Figure 9 Metabolism Assays Market, by Product, 2023 Vs. 2028 (USD Billion)

Figure 10 Metabolism Assays Industry, by Technology, 2023 Vs. 2028 (USD Billion)

Figure 11 Market, by Application, 2023 Vs. 2028 (USD Billion)

Figure 12 Market, by End-user, 2023 Vs. 2028 (USD Billion)

Figure 13 Regional Snapshot of Market

4 Premium Insights

4.1 Metabolism Assays Market Overview

Figure 14 Increased Prevalence of Obesity and Diabetes to Drive Metabolism Assays Industry

4.2 Asia-Pacific: Market, by Product (2022)

Figure 15 Assay Kits & Reagents Accounted for Largest Share in 2022

4.3 Regional Growth Opportunities in Market

Figure 16 Germany to Register Highest Growth Rate During Forecast Period

4.4 Market: Regional Mix

Figure 17 Asia-Pacific Market to Witness Fastest Growth During Forecast Period

4.5 Market: Developed Vs. Emerging Economies

Figure 18 Developing Economies to Register Higher Growth During Forecast Period

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

Figure 19 Drivers, Restraints, Opportunities, and Challenges in Metabolism Assays Market

5.2.1 Drivers

5.2.1.1 Increasing Funding and Investments in Metabolic Research

5.2.1.2 Drug Discovery and Development

5.2.1.3 Rise in Prevalence of Chronic Diseases

5.2.1.4 Increased Use of Metabolism Assays in Fitness and Sports

5.2.1.5 Growing Demand for Personalized Medicines

5.2.2 Restraints

5.2.2.1 High Cost of Metabolism Assay Analyzers

5.2.2.2 Presence of Alternative Methods and Techniques

5.2.3 Opportunities

5.2.3.1 Integration with Wearable Devices

5.2.3.2 Growing Life Science Research in Emerging Economies

5.2.4 Challenges

5.2.4.1 Complexity of Assay Development

5.3 Pricing Analysis

Table 3 Average Selling Price of Product, by Key Players

5.4 Patent Analysis

Figure 20 Patent Analysis for Metabolism Assays (January 2013-December 2022)

5.4.1 List of Key Patents

5.5 Value Chain Analysis

Figure 21 Value Chain Analysis: Major Value Addition During Manufacturing & Assembly Phases

5.6 Supply Chain Analysis

Figure 22 Market: Supply Chain Analysis

5.7 Ecosystem Analysis

Figure 23 Market: Ecosystem Analysis

5.7.1 Market: Role in Ecosystem

Figure 24 Key Players in Market

5.8 Porter's Five Forces Analysis

Table 4 Porter's Five Forces Analysis: Market

5.8.1 Threat of New Entrants

5.8.2 Threat of Substitutes

5.8.3 Bargaining Power of Suppliers

5.8.4 Bargaining Power of Buyers

5.8.5 Intensity of Competitive Rivalry

5.9 Regulatory Analysis

5.9.1 North America

5.9.1.1 US

Table 5 Us Fda: Medical Device Classification

5.9.1.2 Canada

Table 6 Canada: Level of Risk, Time, Cost, and Complexity of Registration Process

5.9.2 Europe

5.9.3 Asia-Pacific

5.9.3.1 Japan

Table 7 Japan: Medical Device Classification Under Pmda

5.9.3.2 China

Table 8 China: Classification of Medical Devices

5.9.3.3 India

5.10 Trade Analysis

Table 9 Import Data for Diagnostic or Laboratory Reagents on a Backing, Prepared Diagnostic or Laboratory Reagents Whether or Not on a Backing, and Certified Reference Materials, by Country, 2018-2022 (USD Million)

Table 10 Export Data for Diagnostic or Laboratory Reagents on a Backing, Prepared Diagnostic or Laboratory Reagents Whether or Not on a Backing, and Certified Reference Materials, by Country, 2018-2022 (USD Million)

5.11 Technology Analysis

5.12 Key Conferences and Events in 2023-2024

Table 11 Market: Detailed List of Key Conferences and Events, 2023-2024

5.13 Trends/Disruptions Impacting Businesses

5.13.1 Revenue Shift in Metabolism Assays

5.14 Key Stakeholders and Buying Criteria

5.14.1 Key Stakeholders in Buying Process

Figure 25 Influence of Stakeholders on Buying Process of Metabolism Assays

Table 12 Influence of Stakeholders on Buying Process of Metabolism Assays

5.14.2 Buying Criteria

Figure 26 Key Buying Criteria for Metabolism Assays

Table 13 Key Buying Criteria for Metabolism Assays

6 Metabolism Assays Market, by Product

6.1 Introduction

Table 14 Metabolism Assays Industry, by Product, 2021-2028 (USD Million)

6.2 Assay Kits & Reagents

6.2.1 Cost-Effectiveness to Increase Adoption in Drug Discovery

Table 15 Assay Kits Available in Market

Table 16 Market: Assay Kits & Reagents, by Region, 2021-2028 (USD Million)

6.3 Instruments & Analyzers

6.3.1 Automation in Instruments, Along with Adoption of Software, to Drive Segmental Growth

Table 17 Instruments & Analyzers Available in Market

Table 18 Market: Instruments & Analyzers, by Region, 2021-2028 (USD Million)

7 Metabolism Assays Market, by Technology

7.1 Introduction

Table 19 Metabolism Assays Industry, by Technology, 2021-2028 (USD Million)

7.2 Colorimetry

7.2.1 Cost-Effectiveness to Drive Market

Table 20 Market for Colorimetry, by Region, 2021-2028 (USD Million)

7.3 Fluorimetry

7.3.1 High Sensitivity and Specificity to Drive Market

Table 21 Market for Fluorimetry, by Region, 2021-2028 (USD Million)

7.4 Spectrometry

7.4.1 Increased Importance in Research and Clinical Diagnostics to Drive Market

Table 22 Market for Spectrometry, by Region, 2021-2028 (USD Million)

8 Metabolism Assays Market, by Application

8.1 Introduction

Table 23 Metabolism Assays Industry, by Application, 2021-2028 (USD Million)

8.2 Diagnostics

8.2.1 Growing Prevalence of Metabolic and Chronic Diseases to Drive Market

Table 24 Diagnostics: Market, by Type, 2021-2028 (USD Million)

Table 25 Market for Diagnostics, by Region, 2021-2028 (USD Million)

8.2.2 Diabetes

Table 26 Diagnostics: Market for Diabetes, by Region, 2021-2028 (USD Million)

8.2.3 Obesity

Table 27 Diagnostics: Market for Obesity, by Region, 2021-2028 (USD Million)

8.2.4 Cancer

Table 28 Diagnostics: Market for Cancer, by Region, 2021-2028 (USD Million)

8.2.5 Cardiovascular Diseases

Table 29 Diagnostics: Market for Cardiovascular Diseases, by Region, 2021-2028 (USD Million)

8.2.6 Other Diagnostics

Table 30 Diagnostics: Market for Other Diagnostics, by Region, 2021-2028 (USD Million)

8.3 Research

8.3.1 Increase in Awareness of Metabolism Assay in Disease Research

Table 31 Research: Market, by Region, 2021-2028 (USD Million)

9 Metabolism Assays Market, by End-user

9.1 Introduction

Table 32 Metabolism Assays Industry, by End-user, 2021-2028 (USD Million)

9.2 Hospitals

9.2.1 Affordability and Convenience to Drive Segment

Table 33 Market for Hospitals, by Region, 2021-2028 (USD Million)

9.3 Diagnostic Laboratories

9.3.1 Increased Outsourcing of Laboratory Diagnoses for Reduction in Costs to Drive Market

Table 34 Market for Diagnostic Laboratories, by Region, 2021-2028 (USD Million)

9.4 Pharmaceutical & Biotechnology Companies and Cros & Academic Research Institutes

9.4.1 Pharmaceutical & Biopharmaceutical Companies to Dominate Market During Forecast Period

Table 35 Market for Pharmaceutical & Biotechnology Companies and Cros & Academic Research Institutes, by Region, 2021-2028 (USD Million)

10 Metabolism Assays Market, by Region

10.1 Introduction

Table 36 Metabolism Assays Industry, by Region, 2021-2028 (USD Million)

10.2 North America

Figure 27 North America: Market Snapshot

Table 37 North America: Market, by Country, 2021-2028 (USD Million)

Table 38 North America: Market, by Product, 2021-2028 (USD Million)

Table 39 North America: Market, by Technology, 2021-2028 (USD Million)

Table 40 North America: Market, by Application, 2021-2028 (USD Million)

Table 41 North America: Market, by End-user, 2021-2028 (USD Million)

10.2.1 Recession Impact

10.2.2 US

10.2.2.1 High Rate of Drug Discovery and Toxicity Testing to Drive Market

Table 42 US: Metabolism Assays Market, by Product, 2021-2028 (USD Million)

Table 43 US: Market, by Technology, 2021-2028 (USD Million)

Table 44 US: Market, by Application, 2021-2028 (USD Million)

Table 45 US: Market, by End-user, 2021-2028 (USD Million)

10.2.3 Canada

10.2.3.1 High Prevalence of Obesity to Fuel Market Growth

Table 46 Canada: Market, by Product, 2021-2028 (USD Million)

Table 47 Canada: Market, by Technology, 2021-2028 (USD Million)

Table 48 Canada: Market, by Application, 2021-2028 (USD Million)

Table 49 Canada: Market, by End-user, 2021-2028 (USD Million)

10.3 Europe

Table 50 Europe: Metabolism Assays Market, by Country, 2021-2028 (USD Million)

Table 51 Europe: Market, by Product, 2021-2028 (USD Million)

Table 52 Europe: Market, by Technology, 2021-2028 (USD Million)

Table 53 Europe: Market, by Application, 2021-2028 (USD Million)

Table 54 Europe: Market, by End-user, 2021-2028 (USD Million)

10.3.1 Recession Impact

10.3.2 Germany

10.3.2.1 Growth of Pharmaceutical Companies to Drive Market

Table 55 Germany: Market, by Product, 2021-2028 (USD Million)

Table 56 Germany: Market, by Technology, 2021-2028 (USD Million)

Table 57 Germany: Market, by Application, 2021-2028 (USD Million)

Table 58 Germany: Market, by End-user, 2021-2028 (USD Million)

10.3.3 UK

10.3.3.1 Growing Cancer Research Funding to Drive Market

Table 59 UK: Metabolism Assays Market, by Product, 2021-2028 (USD Million)

Table 60 UK: Market, by Technology, 2021-2028 (USD Million)

Table 61 UK: Market, by Application, 2021-2028 (USD Million)

Table 62 UK: Market, by End-user, 2021-2028 (USD Million)

10.3.4 France

10.3.4.1 Rising Obese Population and Prevalence of Metabolic Disorders to Drive Market

Table 63 France: Market, by Product, 2021-2028 (USD Million)

Table 64 France: Market, by Technology, 2021-2028 (USD Million)

Table 65 France: Market, by Application, 2021-2028 (USD Million)

Table 66 France: Market, by End-user, 2021-2028 (USD Million)

10.3.5 Spain

10.3.5.1 Increasing Prevalence of Aging Population and Diabetes to Drive Market

Table 67 Spain: Metabolism Assays Market, by Product, 2021-2028 (USD Million)

Table 68 Spain: Market, by Technology, 2021-2028 (USD Million)

Table 69 Spain: Market, by Application, 2021-2028 (USD Million)

Table 70 Spain: Market, by End-user, 2021-2028 (USD Million)

10.3.6 Italy

10.3.6.1 Growth of Pharmaceutical Industry to Boost Market

Table 71 Italy: Market, by Product, 2021-2028 (USD Million)

Table 72 Italy: Market, by Technology, 2021-2028 (USD Million)

Table 73 Italy: Market, by Application, 2021-2028 (USD Million)

Table 74 Italy: Market, by End-user, 2021-2028 (USD Million)

10.3.7 Rest of Europe

Table 75 Rest of Europe: Metabolism Assays Market, by Product, 2021-2028 (USD Million)

Table 76 Rest of Europe: Market, by Technology, 2021-2028 (USD Million)

Table 77 Rest of Europe: Market, by Application, 2021-2028 (USD Million)

Table 78 Rest of Europe: Market, by End-user, 2021-2028 (USD Million)

10.4 Asia-Pacific

Figure 28 Asia-Pacific: Market Snapshot

10.4.1 Recession Impact

Table 79 Asia-Pacific: Market, by Country, 2021-2028 (USD Million)

Table 80 Asia-Pacific: Market, by Product, 2021-2028 (USD Million)

Table 81 Asia-Pacific: Market, by Technology, 2021-2028 (USD Million)

Table 82 Asia-Pacific: Market, by Application, 2021-2028 (USD Million)

Table 83 Asia-Pacific: Market, by End-user, 2021-2028 (USD Million)

10.4.2 Japan

10.4.2.1 Government Initiatives to Drive Market

Table 84 Japan: Metabolism Assays Market, by Product, 2021-2028 (USD Million)

Table 85 Japan: Market, by Technology, 2021-2028 (USD Million)

Table 86 Japan: Market, by Application, 2021-2028 (USD Million)

Table 87 Japan: Market, by End-user, 2021-2028 (USD Million)

10.4.3 China

10.4.3.1 Increasing Health Awareness to Drive Demand

Table 88 China: Market, by Product, 2021-2028 (USD Million)

Table 89 China: Market, by Technology, 2021-2028 (USD Million)

Table 90 China: Market, by Application, 2021-2028 (USD Million)

Table 91 China: Market, by End-user, 2021-2028 (USD Million)

10.4.4 India

10.4.4.1 Prevalence of Chronic Diseases to Fuel Demand

Table 92 India: Metabolism Assays Market, by Product, 2021-2028 (USD Million)

Table 93 India: Market, by Technology, 2021-2028 (USD Million)

Table 94 India: Market, by Application, 2021-2028 (USD Million)

Table 95 India: Market, by End-user, 2021-2028 (USD Million)

10.4.5 Rest of Asia-Pacific

Table 96 Rest of Asia-Pacific: Market, by Product, 2021-2028 (USD Million)

Table 97 Rest of Asia-Pacific: Market, by Technology, 2021-2028 (USD Million)

Table 98 Rest of Asia-Pacific: Market, by Application, 2021-2028 (USD Million)

Table 99 Rest of Asia-Pacific: Market, by End-user, 2021-2028 (USD Million)

10.5 Rest of the World

10.5.1 Recession Impact

Table 100 Rest of the World: Metabolism Assays Market, by Product, 2021-2028 (USD Million)

Table 101 Rest of the World: Market, by Technology, 2021-2028 (USD Million)

Table 102 Rest of the World: Market, by Application, 2021-2028 (USD Million)

Table 103 Rest of the World: Market, by End-user, 2021-2028 (USD Million)

11 Competitive Landscape

11.1 Overview

11.2 Key Player Strategies/Right to Win

Table 104 Overview of Strategies Deployed by Key Companies

11.3 Revenue Share Analysis of Top Market Players

Figure 29 Revenue Share Analysis of Top Players in Metabolism Assays Market

11.4 Market Ranking Analysis

Figure 30 Metabolism Assays Industry Ranking Analysis, by Key Player (2022)

11.5 Company Evaluation Quadrant (2022)

11.5.1 Stars

11.5.2 Emerging Leaders

11.5.3 Pervasive Players

11.5.4 Participants

Figure 31 Metabolism Assays Industry: Company Evaluation Quadrant for Key Players, 2022

11.6 Company Evaluation Quadrant for Startups/Smes (2022)

11.6.1 Progressive Companies

11.6.2 Starting Blocks

11.6.3 Responsive Companies

11.6.4 Dynamic Companies

Figure 32 Metabolism Assay Market: Company Evaluation Quadrant for Startups/Smes, 2022

11.7 Competitive Benchmarking

Table 105 Metabolism Assays Industry: Competitive Benchmarking of Key Players

Table 106 Product Footprint of Key Players

Table 107 Regional Footprint of Key Players

Table 108 Metabolism Assays Market: Detailed List of Key Startups/Smes

11.8 Competitive Scenario

11.8.1 Product Launches

Table 109 Product Launches, January 2020-August 2023

11.8.2 Deals

Table 110 Deals, January 2020-August 2023

11.8.3 Other Developments

Table 111 Other Developments, January 2020-August 2023

12 Company Profiles

12.1 Key Players

(Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 Thermo Fisher Scientific Inc.

Table 112 Thermo Fisher Scientific, Inc.: Business Overview

Figure 33 Thermo Fisher Scientific, Inc.: Company Snapshot (2022)

12.1.2 Merck KGaA

Table 113 Merck KGaA: Business Overview

Figure 34 Merck KGaA: Company Snapshot (2022)

12.1.3 Abcam plc.

Table 114 Abcam plc.: Business Overview

Figure 35 Abcam plc.: Company Snapshot (2022)

Table 115 Abcam plc.: Deals

12.1.4 Agilent Technologies Inc.

Table 116 Agilent Technologies Inc.: Business Overview

Figure 36 Agilent Technologies Inc.: Company Snapshot (2022)

Table 117 Agilent Technologies Inc.: Product Launches

12.1.5 Kaneka Eurogentec S.A.

Table 118 Kaneka Eurogentec S.A.: Business Overview

Figure 37 Kaneka Eurogentec S.A.: Company Snapshot (2022)

12.1.6 Sartorius Ag

Table 119 Sartorius Ag: Business Overview

Figure 38 Sartorius Ag: Company Snapshot (2022)

Table 120 Sartorius Ag: Product Launches

12.1.7 Promega Corporation

Table 121 Promega Corporation: Business Overview

12.1.8 Elabscience Biotechnology Inc.

Table 122 Elabscience Biotechnology Inc.: Business Overview

12.1.9 Raybiotech Life, Inc.

Table 123 Raybiotech Life, Inc.: Business Overview

12.1.10 Bmg Labtech

Table 124 Bmg Labtech: Business Overview

Table 125 Bmg Labtech: Product Launches

12.1.11 Biotrend Chemikalien GmbH

Table 126 Biotrend Chemikalien GmbH: Business Overview

12.2 Other Players

12.2.1 3H Biomedical Ab

12.2.2 Bioassay Systems

12.2.3 Emelca Bioscience

12.2.4 Creative Bioarray

12.2.5 Tempo Bioscience, Inc.

12.2.6 Ncardia

12.2.7 Novocib

12.2.8 Eton Bioscience, Inc.

12.2.9 Cayman Chemical Company

12.2.10 Enzo Life Sciences, Inc.

12.2.11 Abnova Corporation

*Details on Business Overview, Products Offered, Recent Developments, and Analyst's View (Key Strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) Might Not be Captured in Case of Unlisted Companies.