Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The ceramic tiles market refers to the global industry involved in the production, distribution, and sale of ceramic tiles, which are extensively used in construction for flooring, walls, and other surfaces. Ceramic tiles are made from natural materials like clay, sand, and minerals, which are shaped and then fired at high temperatures to create a hard, durable surface. This market encompasses a variety of tile types, including glazed, unglazed, porcelain, and terracotta tiles, each offering different aesthetic and functional properties.

Key Market Drivers

Rising Disposable Income and Changing Consumer Preferences

A significant driver of the UAE ceramic tiles market is the rising disposable income and changing consumer preferences. With a high per capita income and a growing middle class, consumers in the UAE are increasingly willing to invest in premium home improvement products, including ceramic tiles. This trend is further fueled by a growing interest in interior design and home aesthetics, driven by social media influence and the proliferation of home improvement shows. Over 55% of UAE households in urban areas have shown increased spending on home improvement and interior design in the last 2 years, driven by rising disposable incomes and lifestyle upgrades.Consumers are now more knowledgeable and discerning about the materials used in their homes, seeking out tiles that not only offer durability but also enhance the visual appeal of their living spaces. The demand for stylish, high-quality ceramic tiles with unique patterns, textures, and finishes has therefore increased. Additionally, there is a growing preference for tiles that mimic natural materials like wood and stone, offering the same aesthetic appeal with added durability and lower maintenance requirements. Approximately 40% of UAE consumers indicate a preference for sustainable tiles made from recycled materials, reflecting growing environmental awareness in home and commercial renovations.

Manufacturers are responding to these changing preferences by introducing innovative designs and technologically advanced products. For example, digital printing technology has enabled the creation of highly detailed and customizable tile designs, catering to the diverse tastes of UAE consumers. The combination of rising disposable income and evolving consumer tastes continues to drive the growth of the ceramic tiles market in the UAE. Over the past decade, disposable income in the UAE has been steadily rising. It is expected to continue growing at an average rate of 3-5% per year as the country’s economy diversifies and the labor market expands. The average disposable income of households in the UAE is estimated to be around USD 40,000 - USD 45,000 per year.

Key Market Challenges

Intense Competition and Market Saturation

One of the primary challenges facing the UAE ceramic tiles market is intense competition and market saturation. The UAE is home to a plethora of both local and international manufacturers, all vying for market share in an environment characterized by high demand for construction materials. While this competitive landscape can drive innovation and improve product quality, it also leads to price wars and reduced profit margins for manufacturers and suppliers.Local manufacturers face stiff competition from well-established international brands that often benefit from economies of scale and advanced production technologies. These international companies can offer a wide range of high-quality products at competitive prices, making it difficult for smaller local firms to compete. Additionally, international brands often have stronger brand recognition and established distribution networks, further tilting the playing field in their favor.

Market saturation exacerbates this challenge. With numerous players offering similar products, differentiation becomes increasingly difficult. Companies must continuously invest in research and development to introduce unique designs and innovative products to stand out. However, this requires significant financial resources, which may not be feasible for smaller manufacturers.

The influx of cheap imports from countries with lower production costs, such as China and India, poses a significant threat to the local ceramic tiles industry. These imported tiles are often priced lower than locally produced ones, appealing to cost-conscious consumers and developers. To compete, local manufacturers may be forced to lower their prices, further squeezing profit margins.

Key Market Trends

Growing Demand for Eco-Friendly and Sustainable Tiles

One of the most significant trends in the UAE ceramic tiles market is the growing demand for eco-friendly and sustainable tiles. As environmental concerns become increasingly important, both consumers and developers are prioritizing sustainability in their construction projects. This trend is driven by the UAE government's strong emphasis on sustainable development, as seen in initiatives like the UAE Vision 2021 and the Estidama Pearl Rating System, which promote the use of green building materials. More than 70% of real estate developers in the UAE now request eco-certified or low-VOC (volatile organic compound) tiles for large-scale residential and hospitality projects.Eco-friendly ceramic tiles are manufactured using sustainable practices, such as incorporating recycled materials, reducing water and energy consumption during production, and minimizing waste. These tiles not only contribute to a smaller environmental footprint but also align with the preferences of environmentally conscious consumers and businesses. The use of non-toxic glazes and natural pigments further enhances the appeal of these sustainable products.

Manufacturers in the UAE are responding to this trend by innovating and expanding their product lines to include a wider variety of eco-friendly options. These include tiles made from recycled glass, reclaimed ceramic materials, and other sustainable sources. Additionally, advancements in technology have enabled the production of tiles that mimic natural materials like wood and stone, providing the aesthetic benefits without the associated environmental impact.

Key Market Players

- Mohawk Industries Inc.

- SCG Ceramics Public Company Limited

- Grupo Lamosa, SAB de CV,

- RAK Ceramics PJSC

- Gruppo Concorde SpA

- Kajaria Ceramics Ltd.

- China Ceramics Co., Ltd.

- Porcelanosa Grupo AIE

- Florida Tile, Inc.

Report Scope:

In this report, the UAE Ceramic Tiles Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UAE Ceramic Tiles Market, By Application Area:

- Floor

- Walls

- Others

UAE Ceramic Tiles Market, By End-Use:

- Residential

- Non-Residential

UAE Ceramic Tiles Market, By Construction:

- New Construction

- Renovation & Replacement

UAE Ceramic Tiles Market, By Type:

- Glazed Tiles

- Unglazed

UAE Ceramic Tiles Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest of UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Ceramic Tiles Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Mohawk Industries Inc.

- SCG Ceramics Public Company Limited

- Grupo Lamosa, SAB de CV,

- RAK Ceramics PJSC

- Gruppo Concorde SpA

- Kajaria Ceramics Ltd.

- China Ceramics Co., Ltd.

- Porcelanosa Grupo AIE

- Florida Tile, Inc

Table Information

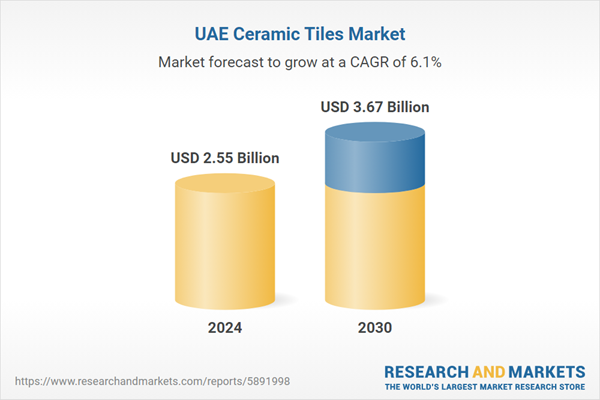

| Report Attribute | Details |

|---|---|

| No. of Pages | 89 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.55 Billion |

| Forecasted Market Value ( USD | $ 3.67 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 9 |