Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The increasing adoption of injection molding is expected to drive demand for polypropylene grades optimized for this process. Market growth is primarily driven by the rising consumption of polypropylene in key end-use industries, particularly automotive, packaging, and building & construction. In the automotive sector, polypropylene is increasingly used to manufacture lightweight vehicle components, which support improved fuel efficiency and reduced emissions. This trend is likely to further accelerate as automakers continue to prioritize sustainability and cost-efficiency in vehicle design.

The building and construction industry also represents a significant growth avenue for polypropylene. In the United States, the construction sector has experienced favorable growth in recent years, spurred by factors such as large-scale infrastructure development, immigration reforms, and new trade policies. Polypropylene is being increasingly utilized in residential housing and industrial applications, including piping systems, insulation, and protective barriers, due to its durability, resistance to chemicals, and ease of processing. In the United States, the construction industry was valued at approximately USD 2.1 trillion in 2022, making it one of the largest sectors of the national economy.

This vast market encompasses residential, commercial, and infrastructure developments ranging from housing projects to highways. The scale and diversity of construction activities create a substantial demand for advanced building materials, including polypropylene (PP). Known for its durability, chemical resistance, and lightweight properties, polypropylene is increasingly used in construction applications such as piping systems, insulation, protective sheets, and flooring components. As construction volumes expand, especially with growing emphasis on energy efficiency and cost-effective materials, the adoption of polypropylene is expected to accelerate within this multi-trillion-dollar industry supporting sustained market growth over the forecast period.

Despite the positive outlook, the polypropylene market experienced a temporary setback due to the COVID-19 pandemic, which disrupted global supply chains and impacted the availability of raw materials. However, the market has since shown signs of recovery, supported by the revival of manufacturing activity and sustained demand across multiple sectors. Also, continued investment in infrastructure, growing environmental awareness, and advancements in polymer processing technology are expected to fuel further growth in the polypropylene market. The material's versatility, cost-effectiveness, and recyclability make it a key component in the shift towards more sustainable industrial practices. As demand from downstream applications continues to rise, especially in high-growth regions, the global polypropylene market is poised for steady expansion throughout the forecast period.

Key Market Drivers

Surge in Demand from Food and Beverage Packaging Industries

The global polypropylene (PP) market is experiencing strong growth, with the food and beverage packaging sector serving as a major contributor. As consumer preferences evolve toward convenience, hygiene, and sustainability, polypropylene has become an essential material due to its unique performance characteristics and versatility. Polypropylene’s excellent barrier properties protect packaged goods from moisture, oxygen, and light helping to preserve freshness, flavor, and nutritional quality. This makes PP an ideal choice for a wide range of food and beverage products. Its ability to be molded into rigid containers, flexible pouches, and films enables packaging companies to cater to diverse product types and consumer needs.Lightweight and durable, polypropylene reduces shipping costs and minimizes product damage during transportation and handling. These properties contribute to supply chain efficiency while also lowering carbon emissions aligning with the food industry's growing focus on sustainability. The global demand for packaging is expected to reach approximately USD 2.23 trillion by 2050. This growth is primarily driven by expanding global population, urbanization, and rising consumer demand for packaged goods. The increasing need for safe, durable, and efficient packaging solutions across food, beverage, pharmaceutical, and e-commerce sectors is further accelerating market expansion. This trend highlights a strong growth opportunity for materials like polypropylene, which are widely used due to their versatility, lightweight nature, and excellent protective properties.

Polypropylene also supports consumer convenience. It is microwave- and refrigerator-safe, making it suitable for ready-to-eat and frozen meals two segments experiencing high demand globally. Its compatibility with modern food lifestyles further increases its market appeal. The recyclability of polypropylene is a key advantage. Manufacturers are increasingly using recycled PP in packaging applications, reducing reliance on virgin plastics and contributing to circular economy goals.

This supports the broader shift toward eco-friendly packaging solutions, which is gaining momentum across global markets. As regulatory pressures mount and consumer awareness around sustainable packaging grows, polypropylene’s role is expected to expand. Its balance of performance, cost-efficiency, and environmental benefits positions it as a preferred material for next-generation food and beverage packaging. Consequently, rising demand from this sector will continue to be a major growth engine for the global polypropylene market over the forecast period.

Key Market Challenges

Volatility in Prices of Feedstock

Feedstocks, primarily propylene, serve as the fundamental materials necessary to produce polypropylene. Propylene is obtained from fossil fuels like crude oil and natural gas through refining and cracking processes. Sharp increases in feedstock prices can lead to higher production costs, potentially impacting manufacturers' profit margins. Volatility in feedstock prices can also influence the competitive dynamics within the polypropylene market, necessitating adjustments in pricing strategies by manufacturers in response to changing production costs.In periods of elevated feedstock prices, companies may be compelled to pass on cost increases to customers, thereby potentially affecting demand and market share. Fluctuations in feedstock prices can have implications for investment decisions within the polypropylene industry. Manufacturers considering expansion projects, or the establishment of new production facilities may exhibit hesitancy if they are unable to accurately forecast the long-term costs associated with feedstocks.

Key Market Trends

Advancements in Processing Techniques

The evolution of processing techniques is a prominent trend that is reshaping the global polypropylene market, presenting new opportunities for enhanced product performance, sustainability, and efficiency. Advancements in injection molding techniques are unlocking novel design possibilities, precise manufacturing, and material optimization. For instance, micro-injection molding enables the production of intricate micro-sized parts with exceptional precision, finding applications in medical devices and electronics. Advancements in blow molding techniques are facilitating the creation of complex shapes, varying wall thicknesses, and improved product quality. From large industrial containers to intricate medical devices, blow molding is emerging as a versatile method for shaping polypropylene.Polypropylene properties can be tailored by utilizing advanced catalysts and polymerization techniques, such as Ziegler-Natta and metallocene catalysts, enabling precise control over molecular structure and properties. This leads to the development of specialized polypropylene grades optimized for specific applications, including automotive components, medical devices, and textiles.

Key Market Players

- SABIC

- Exxon Mobil Corporation

- Borealis AG

- BASF SE

- INEOS Group

- Reliance Industries Limited

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- Lotte Chemical Corporation

Report Scope:

In this report, the Global Polypropylene Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Polypropylene Market, By Type:

- Homopolymer

- Copolymer

- Others

Polypropylene Market, By Application:

- Injection Moulding

- Fiber & Raffia

- Film & Sheet

- Blow Moulding

- Others

Polypropylene Market, By End-Use Industry:

- Packaging

- Automotive

- Build & Construction

- Medical

- Electrical & Electronics

- Others

Polypropylene Market, By Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Polypropylene Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Polypropylene market report include:- SABIC

- Exxon Mobil Corporation

- Borealis AG

- BASF SE

- INEOS Group

- Reliance Industries Limited

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Corporation

- Lotte Chemical Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

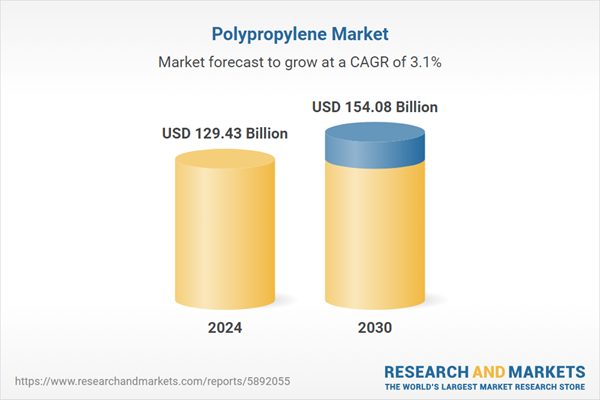

| Estimated Market Value ( USD | $ 129.43 Billion |

| Forecasted Market Value ( USD | $ 154.08 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |