Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

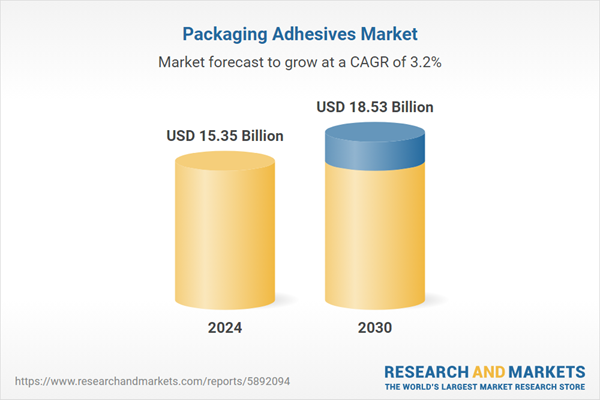

As market dynamics shift, the packaging adhesives sector is rapidly evolving, supported by heightened consumer expectations, regulatory focus on sustainability, and continuous technological innovation. With packaging now playing a pivotal role in brand differentiation and supply chain efficiency, adhesives are set to remain a critical enabler of performance, functionality, and innovation within the global packaging value chain.

Key Market Drivers

Rising Demand of Packaging Adhesives in Flexible Packaging

Flexible packaging has emerged as a transformative force in the packaging industry, driven by its versatility, convenience, and sustainability. This evolution has been accompanied by a burgeoning demand for packaging adhesives tailored to meet the unique requirements of flexible packaging applications. As consumer preferences and market dynamics evolve, the demand for flexible packaging continues to surge, creating a ripple effect in the demand for compatible adhesives. Flexible packaging encompasses a wide spectrum of products, ranging from pouches, sachets, and stand-up pouches to wraps, labels, and more.The appeal of flexible packaging lies in its ability to adapt to various shapes, sizes, and product types, while also providing protection from external elements such as moisture, light, and air. These qualities make it a preferred choice for a diverse array of industries, including food and beverages, pharmaceuticals, cosmetics, and personal care. Within this dynamic landscape, packaging adhesives play an instrumental role in ensuring the integrity of flexible packaging. Adhesives used in flexible packaging serve multiple functions across various processes, including heat and cold sealing, lidding, lamination, blister packaging, horizontal flow wrapping, and form-fill-seal applications. These adhesives provide the necessary bonding strength and seal integrity that are critical to maintaining the freshness, safety, and overall quality of the packaged products.

The food and beverage industry, a major player in the flexible packaging domain, is witnessing a robust demand for adhesives that can address its unique needs. The ability of packaging adhesives to facilitate effective heat sealing and create a strong barrier against external contaminants is paramount in preserving the flavor, aroma, and shelf life of food and beverages.

From ready-to-eat meals to snacks and beverages, flexible packaging equipped with the right adhesives helps maintain product integrity while offering convenience to consumers on-the-go. Furthermore, the rise of e-commerce and online shopping has further propelled the demand for flexible packaging. With the increasing preference for online purchases, brands are focusing on optimizing packaging solutions that ensure the safe transit of products to consumers' doorsteps. Packaging adhesives used in e-commerce applications must possess strong bonding properties to withstand the rigors of transportation and handling, while also ensuring tamper-evident seals to enhance consumer confidence.

Water-based adhesives, known for their eco-friendliness and regulatory compliance, are gaining traction within the flexible packaging realm. The trend toward sustainable packaging solutions has prompted manufacturers to seek adhesives that align with their environmental goals. Water-based adhesives, formulated using natural and soluble synthetic polymers, are finding favor in labeling applications. Clear labels, which are gradually replacing inks in product tagging, are more sustainable and easily recyclable.

This shift toward water-based adhesives not only addresses environmental concerns but also meets consumer demands for transparent and responsible packaging. The proliferation of water-based adhesives is also attributed to their cost-effectiveness and user-friendly application methods. These adhesives can be applied through various techniques, such as roller-coating, screen-printing, and spraying, making them a versatile choice for different types of flexible packaging. This versatility in application methods, combined with their lower environmental impact, positions water-based adhesives as a preferred choice for packaging manufacturers striving to strike a balance between performance and sustainability.

Technological advancements have broadened the scope of applications for packaging adhesives in flexible packaging. Manufacturers are continuously innovating to enhance adhesive performance, durability, and efficiency. The demand for adhesives that offer quick curing times, strong bonding under various conditions, and resistance to external factors like moisture, UV exposure, and temperature fluctuations is on the rise. These advancements empower packaging professionals to design packaging solutions that cater to specific product requirements and end-user expectations, leading to the demand of market in the forecast period.

Key Market Challenges

Cost-Effectiveness and Compatibility with Automation

Balancing cost-effectiveness with product performance and sustainability remains a significant challenge. Developing advanced adhesive formulations, sourcing eco-friendly materials, and meeting regulatory standards can lead to higher production costs. Adhesive manufacturers need to find ways to offer competitive pricing while delivering value to customers.Moreover, automation becomes increasingly prevalent in packaging processes, adhesives must be compatible with automated equipment. This involves factors such as adhesive viscosity, drying time, and dispensing methods. Adhesive manufacturers need to ensure that their products can be seamlessly integrated into automated production lines.

Key Market Trends

Rise of E-commerce and Online Shopping

The rise of e-commerce and online shopping has led to a surge in demand for robust packaging solutions. Packaging adhesives designed for e-commerce applications need to withstand the challenges of long-distance transportation, varying climatic conditions, and rough handling. As of the latest estimates, the global eCommerce landscape is being shaped by a digitally empowered consumer base, with approximately 2.77 billion individuals engaging in online shopping worldwide. In 2025, online channels are projected to account for 21% of total global retail sales, reflecting a structural shift in consumer purchasing behavior. This digital penetration is expected to intensify further, with eCommerce’s share of global retail sales anticipated to reach 22.6% by 2027. Supporting this growth trajectory is a rapidly expanding digital retail infrastructure, evidenced by the presence of over 28 million eCommerce stores operating globally, catering to both niche and mass-market segments across diverse industries.Key Market Players

- 3M Co.

- Arkema Group (Bostik)

- Avery Dennison Corporation

- Ashland Inc

- Dow Chemical Company

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Jowat SE

- Paramelt RMC B.V.

- Wacker Chemie AG

Report Scope:

In this report, the Global Packaging Adhesives Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Packaging Adhesives Market, By Technology:

- Water-based

- Solvent-Based

- Hot Melt

- Others

Packaging Adhesives Market, By Resins:

- PVA

- Acrylics

- Polyurethane

- Others

Packaging Adhesives Market, By Application:

- Cases & Carton

- Corrugated Packaging

- Labeling

- Flexible Packaging

- Folding Cartons

- Speciality Packaging

- Others

Packaging Adhesives Market, By Region:

- Asia-Pacific

- China

- India

- Australia

- Japan

- South Korea

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- North America

- United States

- Mexico

- Canada

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Packaging Adhesives Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- 3M Co.

- Arkema Group (Bostik)

- Avery Dennison Corporation

- Ashland Inc

- Dow Chemical Company

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- Jowat SE

- Paramelt RMC B.V.

- Wacker Chemie AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.35 Billion |

| Forecasted Market Value ( USD | $ 18.53 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |