Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Government Support to Strengthen the Sector

Government initiatives are playing a pivotal role in propelling Vietnam’s health insurance market. As of January 2025, the Vietnam Social Security (VSS) convened a national conference to implement updated legislation under Decree No. 02/2025/ND-CP and Circular No. 01/2025/TT-BYT. These reforms include simplified eligibility for serious illnesses and clarified roles for the Ministry of Health and VSS.The government continues to promote Universal Health Coverage (UHC) through the Vietnam Social Health Insurance Scheme (VSI), expanding insurance access to rural and low-income populations. Additionally, policy frameworks encouraging private sector participation have led to more diverse insurance products. Subsidies, tax incentives, and awareness campaigns are increasing citizen engagement and enrollment in health insurance programs. These coordinated efforts by the public sector are essential for the sustained development and accessibility of Vietnam’s health insurance system.

Key Market Challenges

Low Awareness & Education

Limited public understanding and awareness pose a considerable challenge in the Vietnam health insurance market. Despite broader insurance availability, many individuals - particularly in rural areas - remain unaware of available options or the financial protection that health insurance offers. Misconceptions and distrust about insurance services contribute to low enrollment, as individuals may view premiums as avoidable expenses. The complexity of policy structures and insufficient outreach exacerbate the issue, further limiting adoption. To address this challenge, both government and private stakeholders must invest in robust educational campaigns to raise awareness, demystify insurance products, and emphasize the value of health insurance in reducing out-of-pocket healthcare costs.Key Market Trends

Growing Adoption of Digital Platform

The increasing use of digital platforms is a defining trend in the Vietnam health insurance market. With rising internet penetration and smartphone usage, consumers are increasingly relying on digital tools to manage their health coverage. Online platforms provide convenient access to policy information, plan comparisons, and insurance purchases. Mobile applications and web portals also facilitate smooth premium payments, claims processing, and real-time support, significantly enhancing user experience. Additionally, insurers are leveraging digital platforms to gather data analytics for customer segmentation and personalized offerings. This shift not only improves service delivery but also reduces operational costs and expands market reach, particularly in remote and underserved areas. The digital transformation of health insurance is expected to continue, driving increased efficiency and customer satisfaction across the sector.Key Market Players

- AIA Group Limited

- Manulife (Vietnam) Company Limited

- Chubb Group Holdings Inc.

- AXA Global Healthcare

- Cigna Corporation

- MSH International

- Luma

- Allianz SE

- HSBC Bank (Viet Nam) Ltd

- Star Health

Report Scope:

In this report, the Vietnam Health Insurance Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below.Vietnam Health Insurance Market, By Type of Insurance Provider:

- Public

- Private

Vietnam Health Insurance Market, By Type of Coverage:

- Individual

- Family

Vietnam Health Insurance Market, By Mode of Purchase:

- Insurance Companies

- Insurance Agents/Brokers

- Others

Vietnam Health Insurance Market, By End User:

- Minor

- Adult

- Senior Citizen

Vietnam Health Insurance Market, By Region:

- Southern

- Northern

- Central

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Vietnam Health Insurance Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AIA Group Limited

- Manulife (Vietnam) Company Limited

- Chubb Group Holdings Inc.

- AXA Global Healthcare

- Cigna Corporation

- MSH International

- Luma

- Allianz SE

- HSBC Bank (Viet Nam) Ltd

- Star Health

Table Information

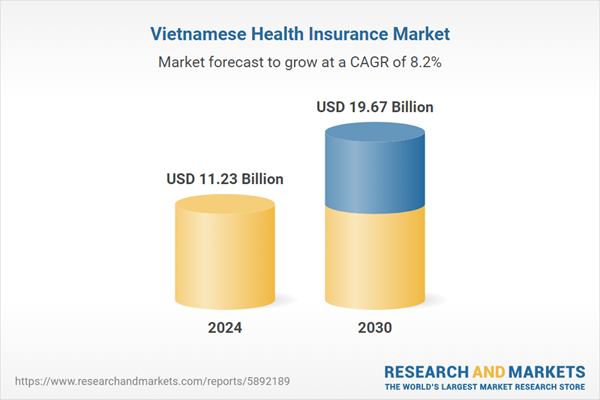

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 11.23 Billion |

| Forecasted Market Value ( USD | $ 19.67 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Vietnam |

| No. of Companies Mentioned | 10 |