Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Internet Penetration and Affordable Data

One of the most significant drivers of the OTT media services market in India is the rapid increase in internet penetration across the country. India has one of the largest internet user bases in the world, and this number continues to grow year after year. According to a joint report by industry body IAMAI, approximately 759 million people in India are active internet users, accessing the internet at least once a month, with this number expected to increase in the coming years. The widespread availability of affordable mobile data, particularly in rural and semi-urban areas, has been a crucial factor in this expansion.Telecom giants like Reliance Jio have revolutionized the market by providing affordable internet plans, making data consumption cheaper and more accessible to a larger section of the population. The cost of data has dropped drastically, which has led to an increase in the consumption of streaming services. As a result, more Indians are opting for online streaming platforms, such as Netflix, Amazon Prime Video, Disney+ Hotstar, and local players like Zee5, MX Player, and Sony LIV.

Key Market Challenges

Intense Competition and Fragmentation

One of the primary challenges facing the OTT media services market in India is the intense competition and market fragmentation. The Indian OTT space is highly competitive, with a wide range of local and international players vying for market share. Global giants like Netflix, Amazon Prime Video, and Disney+ Hotstar have a strong presence, alongside numerous local platforms such as Zee5, Sony LIV, MX Player, and ALTBalaji. This competition is further complicated by regional platforms targeting specific language segments, such as Sun NXT and Voot, which cater to diverse Indian audiences.The sheer volume of OTT platforms means that consumers have a vast array of options to choose from, often leading to fragmentation in the market. Each platform tries to differentiate itself by offering unique content, but this sometimes results in fragmented subscriber bases. For instance, a single user might need to subscribe to multiple services to access all their preferred content, which can lead to "subscription fatigue." This makes it difficult for platforms to achieve significant customer loyalty or dominance in the market.

Key Market Trends

Increased Investment in Original Content and Web Series

Another key trend in the Indian OTT media services market is the increasing investment in original content, particularly web series. Global OTT players like Netflix, Amazon Prime Video, and Disney+ Hotstar have already made significant strides in producing original Indian content. Web series, in particular, have become one of the most consumed forms of entertainment on OTT platforms, given their flexibility and ability to capture complex narratives over multiple episodes.The success of shows like "Sacred Games" on Netflix, "Mirzapur" on Amazon Prime Video, and "Special Ops" on Hotstar has demonstrated the huge potential of original content in India. These web series not only appeal to the Indian audience but are also gaining recognition on global platforms. As a result, OTT platforms are ramping up their investments in producing high-quality Indian-origin content across multiple genres, including drama, thriller, romance, and crime.

Key Market Players

- Netflix Entertainment Services India LLP

- Zee Entertainment Enterprises Limited

- Sony Pictures Networks India Pvt. Ltd.

- Amazon.com, Inc

- Star India Private Limited

- Xfinite Technologies Pvt Ltd

- Sun TV Network Limited

- Hungama Digital Media Entertainment Pvt Ltd.

- MX Media & Entertainment Pte. Ltd.

- Apple, Inc.

Report Scope:

In this report, the India OTT Media Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India OTT Media Services Market, By Type:

- SVOD

- AVOD

- TVOD

India OTT Media Services Market, By Video Quality:

- HD

- Full HD

- Ultra HD

India OTT Media Services Market, By Number of Screens:

- 1

- 2-3

- More than 3

India OTT Media Services Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India OTT Media Services Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Netflix Entertainment Services India LLP

- Zee Entertainment Enterprises Limited

- Sony Pictures Networks India Pvt. Ltd.

- Amazon.com, Inc

- Star India Private Limited

- Xfinite Technologies Pvt Ltd

- Sun TV Network Limited

- Hungama Digital Media Entertainment Pvt Ltd.

- MX Media & Entertainment Pte. Ltd.

- Apple, Inc.

Table Information

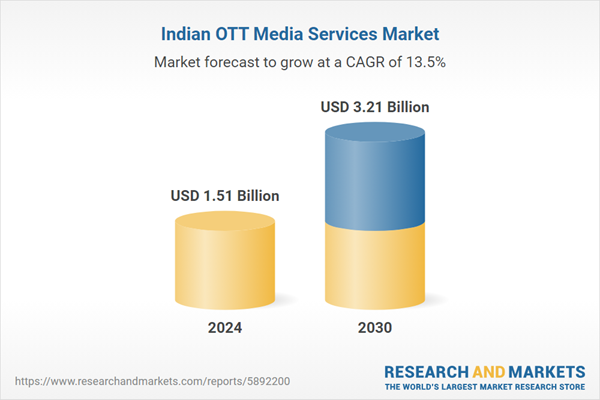

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | February 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.51 Billion |

| Forecasted Market Value ( USD | $ 3.21 Billion |

| Compound Annual Growth Rate | 13.4% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |