Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Rising consumer loans are supported by strong purchasing power, while small and medium-sized enterprises (SMEs) continue to drive demand for business financing. Green financing is gaining traction, fueled by policy measures focused on sustainability. The real estate sector remains a significant contributor, with mortgage lending showing consistent growth.

Key Market Drivers

Low-Interest Rates Fueling Loan Demand

A major driver of the German loan market is the continued low-interest-rate environment. The European Central Bank (ECB) has maintained historically low rates to encourage economic activity and borrowing. This accommodative monetary policy has significantly reduced borrowing costs, thereby stimulating loan demand across consumer and business segments.Key Market Challenges

Stringent Regulatory Framework

Germany's banking and financial sector operates within a tightly regulated environment, with rigorous compliance obligations enforced by national and EU-level authorities. While these regulations are intended to ensure financial stability and safeguard consumers, they also pose operational challenges for lenders.A notable challenge is compliance with the Basel III framework, which mandates higher capital reserves to mitigate risk exposure. These stricter capital requirements can constrain the volume of credit banks are able to extend. Additionally, institutions must adhere to comprehensive anti-money laundering (AML) and know-your-customer (KYC) protocols, further increasing operational complexity and administrative costs.

Key Market Trends

Rise of Alternative Lending Solutions

Alternative lending models - including peer-to-peer (P2P) lending, crowdfunding, and buy now, pay later (BNPL) services - are gaining momentum in Germany. These innovative platforms offer borrowers greater flexibility and access, particularly for those who may not meet traditional bank criteria.P2P lending facilitates direct connections between investors and borrowers, often providing more competitive rates and simplified application processes. This model is especially advantageous for SMEs seeking rapid financing solutions without the constraints of conventional banking.

BNPL services are transforming consumer finance by enabling interest-free installment payment options at the point of sale. Fintech firms at the forefront of the BNPL market are forming strategic partnerships with retailers, accelerating growth in both e-commerce and retail lending.

Key Market Players

- Deutsche Bank AG

- DZ BANK AG

- KfW Group

- Commerzbank AG

- UniCredit Bank GmbH

- Landesbank Baden-Württemberg

- smava GmbH

- BNP Paribas SA

- Santander Consumer Bank AG

- TARIFCHECK24 GmbH

Report Scope:

In this report, the Germany Loan Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Germany Loan Market, By Type:

- Secured Loan

- Unsecured Loan

Germany Loan Market, By Provider Type:

- Banks

- NBFCs

- Others

Germany Loan Market, By Interest Rate:

- Fixed

- Floating

Germany Loan Market, By Tenure:

- Less than 5 Years

- 5-10 Years

- 11-20 Years

- More than 20 Years

Germany Loan Market, By Region:

- South-West

- North-West

- North-East

- South-East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Germany Loan Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Deutsche Bank AG

- DZ BANK AG

- KfW Group

- Commerzbank AG

- UniCredit Bank GmbH

- Landesbank Baden-Württemberg

- smava GmbH

- BNP Paribas SA

- Santander Consumer Bank AG

- TARIFCHECK24 GmbH

Table Information

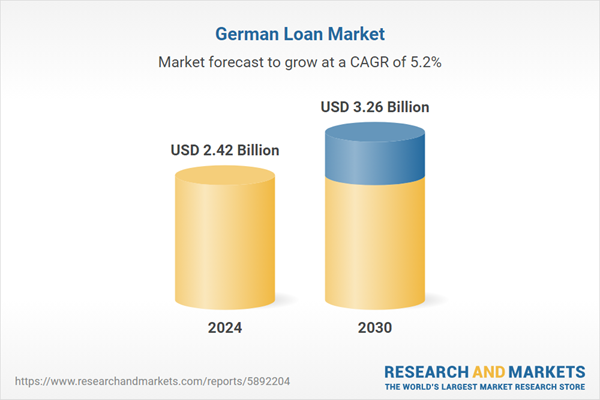

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | April 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.42 Billion |

| Forecasted Market Value ( USD | $ 3.26 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Germany |

| No. of Companies Mentioned | 10 |