Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Meanwhile, stricter regulations on emissions and safety standards are accelerating the evolution of automotive components to ensure compliance with new norms. The rise of connected vehicle technologies is creating fresh opportunities, with components such as telematics, sensors, and electronic control units seeing heightened demand as manufacturers pursue smarter and more automated vehicles. Rapid progress in electric vehicle (EV) technology is also reshaping the market, requiring adaptations in key parts like battery packs, electric motors, and regenerative braking systems. Lightweight materials like carbon fiber and aluminum are increasingly adopted, delivering performance gains and improved fuel efficiency.

Additionally, digitalization of manufacturing processes is enhancing efficiency and enabling greater customization in parts production. Supporting this growth, the Indian government has extended the Production Linked Incentive (PLI) Scheme for Automobile and Auto Components by one year, offering incentives based on sales over five consecutive financial years from 2023-24 to 2027-28. This initiative has attracted proposed investments totaling USD 8.1 billion (INR 67,690 crore), surpassing the original target of USD 5.1 billion (INR 42,500 crore), with USD 1.6 billion (INR 13,037 crore) already invested as of December 31, 2023.

Market Drivers

Increasing Demand for Electric Vehicles (EVs)

The global shift toward sustainable mobility is fueling strong growth in electric vehicle adoption. As governments worldwide introduce stringent emission targets and offer incentives for clean vehicles, automakers are compelled to redesign automotive parts and components to cater to EV-specific requirements. Components such as electric drivetrains, high-capacity batteries, thermal management systems, and lightweight body structures are increasingly in demand. Electrification requires new material innovations to optimize energy efficiency and range, further encouraging significant R&D investments.The automotive parts and components sector is thus positioned to capitalize on this paradigm shift, with suppliers adjusting product lines and manufacturing capabilities to support the EV revolution. In 2024, global EV sales reached a record 17.1 million units, marking a 25% increase from 2023, with more than 1 in 5 new cars sold globally being electric. Electric vehicle adoption in India has surged by 47%, creating a new demand for EV-specific spare parts, including batteries, powertrain components, and charging accessories.

Key Market Challenges

Supply Chain Disruptions

Supply chain resilience has become a critical concern for automotive parts manufacturers. Geopolitical tensions, trade barriers, and labor shortages are causing delays in sourcing raw materials and delivering finished components. Natural disasters and pandemic-induced shutdowns have highlighted vulnerabilities in global supply networks, creating unpredictability and cost inflation across the automotive industry. Manufacturers are increasingly looking to diversify their supplier bases and relocate production closer to demand centers, but these strategies require time and significant capital investments, adding layers of complexity to operations.Key Market Trends

Shift Toward Modular Component Designs

Manufacturers are increasingly embracing modular component designs that offer greater flexibility across different vehicle models and platforms. Modularization allows for cost-effective scalability, easier customization, and faster time-to-market. Suppliers benefit from economies of scale and simplified logistics, while automakers can cater to a wider array of consumer preferences without a complete redesign. This trend is reshaping product development strategies across the automotive components industry and enabling quicker adaptation to market changes.Key Market Players

- Denso Corporation

- Aisin Corporation

- BorgWarner Inc.

- Samvardhana Motherson International Limited

- Tenneco Inc.

- Hella GmbH & Co. KGaA

- American Axle & Manufacturing Holdings Inc.

- Lear Corporation

- Autoliv Inc.

- Visteon Corporation

Report Scope:

In this report, the Global Automotive Parts and Components Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Automotive Parts and Components Market, By Type:

- Driveline and Powertrain

- Interiors and Exteriors

- Electronics

- Bodies & Chassis

- Tires

- Others

Automotive Parts and Components Market, By Demand Category:

- OEM

- Replacement

Automotive Parts and Components Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- Germany

- France

- U.K.

- Spain

- Italy

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Brazil

- Argentina

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Parts and Components Market.Available Customizations:

With the given market data, the publisher offers customizations according to the company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- DENSO Corporation

- Aisin Corporation

- BorgWarner Inc.

- Samvardhana Motherson International Limited

- Tenneco Inc.

- Hella GmbH & Co. KGaA

- American Axle & Manufacturing Holdings Inc.

- Lear Corporation

- Autoliv Inc.

- Visteon Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | August 2025 |

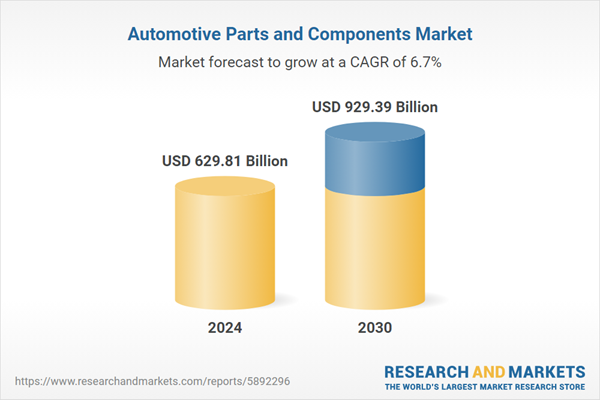

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 629.81 Billion |

| Forecasted Market Value ( USD | $ 929.39 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |