According to International Diabetes Federation, 2021, 1 in 11 adults have diabetes - 61 million. The European region has the highest number of children and adolescents that suffer from type 1 diabetes ~295,000. The top 5 countries for age-adjusted prevalence of people with diabetes (20-79 years) were Turkey, Spain, Andorra, Portugal, and Serbia.

As per a white paper by Economist Impact, funded and initiated by AstraZeneca, Chronic kidney disease (CKD) affects about 1 in 10 adults across Europe. An estimated 100 million people in Europe are living with this long-term, progressive disease, and a further 300 million individuals will be at risk in 2023.

Prostate cancer (PCa) is European men's most common non-cutaneous cancer. It is anticipated to exhibit declining mortality in the European Union (EU) due to various recent improvements in treatment. The incidence of PCa in Europe is high compared to other geographical areas such as Africa or Asia due to comparably high rates of prostate-specific antigen (PSA) screening, which were reported to be increasing in Eastern and Southern Europe. A biopsy helps in cancer detection in which a small amount of tissue from the area of the body where cancer may be present is taken, and that tissue is sent to a laboratory.

Thus, the increasing cases of chronic diseases such as diabetes, CKD, and cancer in the Europe is simultaneously propelling the demand for medical supplies and positively influencing the Europe medical courier market growth.

Several giants operating in the industry are taking strategic initiatives such as partnerships, mergers and acquisitions, and collaborations, as well as unveiling new products to expand their foothold, support the end users in faster delivery of medical supplies, offer value-based care, and maintain a competitive edge in the market.

For instance, in April 2023, UPS Healthcare has opened its first dedicated healthcare logistics facility in Giessen, Germany. This new facility will be proficient of supporting storage of a range healthcare products at 2C to 8C, 15C to 25C and up to -20C degrees. Throughout 2023, UPS Healthcare will add over 2 million square feet of warehouse space, of which about half will be in Europe.

A consortium led by AGS Airports launched its next phase-Care and Equity - Healthcare Logistics UAS Scotland (CAELUS)-in partnership with NHS Scotland in September 2022. It secured US$ 12.56 million in funding from the Future Flight Challenge at UK Research and Innovation in August 2022. CAELUS brings together 16 partners, including the NATS, University of Strathclyde, Atkins, and NHS Scotland. Together they are work to deliver blood, essential medicines, and other medical supplies in Scotland, including country’s remote communities, through the first national drone network to transport. By securing US$ 1.86 million in January 2020, the CAELUS consortium has designed various drone landing stations for NHS sites in Scotland and has developed a virtual model of the planned delivery network, that connects pathology laboratories, hospitals, distribution centers, and GP surgeries in Scotland. Further, the second phase will involve live flight trials and remove remaining barriers to safely use drones at scale within Scotland's airspace.

By Product Type, Medical Courier Market-Based Insights

The medical courier market, by product type, is segment into lab specimens, medical supplies and equipment, blood and organs, medical notes, and others. The medical supplies and equipment segment held the largest share of the market in 2022. The lab specimens segment is anticipated to register the highest CAGR in the market during the forecast period.By Destination, Medical Courier Market-Based Insights

The medical courier market, by destination, is segment into domestic and international. The domestic segment held the largest market share in 2022 and international is anticipated to register the highest CAGR during the forecast period.By Service, Medical Courier Market-Based Insights

The medical courier market, by service, is bifurcated into standard services and rush and on-demand services. The standard services segment held a larger market share in 2022 and rush and on-demand services are estimated to register the highest CAGR during the forecast period.By End User, Medical Courier Market-Based Insights

The medical courier market, by end user, is segment into hospitals and clinics, diagnostic labs, pharmaceutical and biotechnology companies, blood and tissue banks, in-home support, and others. The hospitals and clinics segment held the largest share of the market in 2022 and in home support is predicted to register the highest CAGR in the market during the forecast period.Key players in the medical courier market secure growth through various strategies. In October 2022, Med Logistics Group Ltd partnered with Skyfarer and University Hospitals Coventry and Warwickshire (UHCW) NHS Trust to conduct a trial for Beyond Visual Line of Sight (BVLOS) drone in the UK. The drone is first-of-its-kind, and the trial was completed under secure CAA-approved airspace called 'The Medical Logistics UK Corridor'.

The National Health Service, National Health Services Blood and Transplant, Essex Partnership University NHS Foundation Trust, British Medical Association, and Department of Health and Social Care are a few key primary and secondary sources referred to while preparing the report on the medical courier market.

Reasons to Buy

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the medical courier market.

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the medical courier market, thereby allowing players across the value chain to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth market trends and outlook coupled with the factors driving the medical courier market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution.

Table of Contents

Companies Mentioned

- ERS Transition Ltd

- Send Direct Ltd

- Med Logistics Grp

- Citysprint Ltd

- United Parcel Services

- FedEx Corp

- MNX Global Logistics

- Reliant Couriers & Haulage Ltd

- ZIPLINE International Inc

- Deutsche Post AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | September 2023 |

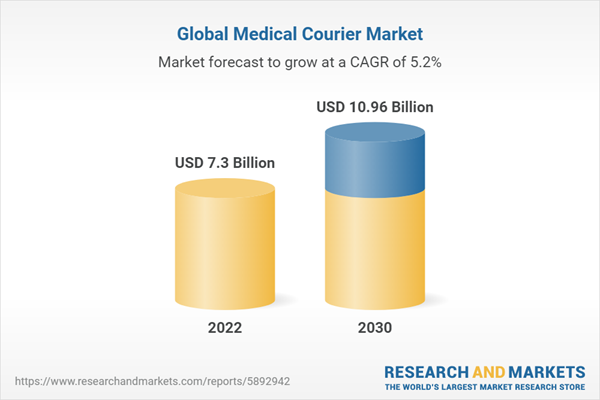

| Forecast Period | 2022 - 2030 |

| Estimated Market Value ( USD | $ 7.3 Billion |

| Forecasted Market Value ( USD | $ 10.96 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |