Edible oils are common vegetable oils including soybean oil, sunflower oil, and others. At room temperature, oils are liquid, while fats are partially solid. Edible oils are mainly sourced from soybean, coconut, rapeseed, palm, sunflower, and cottonseed. Oils and fats improve taste of the food and provide good texture to the final product. Edible oils are commonly used in industrial food manufacturing and home cooking worldwide and are the primary source of unsaturated fats and vitamin E in human diets. The growing importance of edible oils and fats as a key source of several nutrients, including vitamin E, selenium, phytosterols, and magnesium, in the food & beverages industry is expected to remain a favorable factor in the coming years. These factors are expected to drive the market in the US during the forecast period.

The demand for plant-based and low-fat products is increasing with rising health consciousness among consumers. Thus, manufacturers are developing plant-based shortenings and low-fat oils to cater to the rising demand. Plant-based shortenings are non-hydrogenated and contain no cholesterol and trans-fat. Thus, it is considered a healthier alternative. Moreover, the increasing problems of cardiovascular diseases, obesity, and diabetes over the years have triggered the demand for low-fat products and are expected to boost the demand for low-fat oils among various industries such bakery & confectioneries, dairy & frozen desserts, snacking, etc.

Consumers have been inclined toward plant-based products as they consider them healthier than conventional products. In addition, rising awareness regarding animal protection and environmental sustainability are the major factors creating the popularity of these plant-based products. As per the data published by “Veganuary”-a nonprofit organization encouraging people to go vegan for the whole month of January-in 2021, ~5.8 million people registered for the “Veganuary Campaign.” Thus, the rising veganism trend and increasing demand for plant-based shortening and low-fat oils among various end-use industries to cater to the rising demand from consumers is creating lucrative growth opportunities in the edible oils and fats market.

Bunge Ltd, Archer-Daniels-Midland Co, Fuji Oil Co Ltd, Kao Corp, AAK AB, J-Oil Mills Inc, Cargill Inc, Olam Group Ltd, ConnOils LLC, and Louis Dreyfus Co BV are the key players operating in the US edible oils and fats market. These market players are focusing on providing high-quality, innovative products to fulfill customers' demands and increase their US edible oils and fats market share.

The overall US edible oils and fats market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information about the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights into the topic. Participants in this process include industry experts, such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants, such as valuation experts, research analysts, and key opinion leaders, specializing in the US edible oils and fats market.

Reasons to Buy

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the US edible oils and fats market, thereby allowing players to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation, and industry verticals.

Table of Contents

Companies Mentioned

- Bunge Ltd

- Archer-Daniels-Midland Co

- Fuji Oil Co Ltd

- Kao Corp

- AAK AB

- J-Oil Mills Inc

- Cargill Inc

- Olam Group Ltd

- ConnOils LLC

- Louis Dreyfus Co BV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 114 |

| Published | September 2023 |

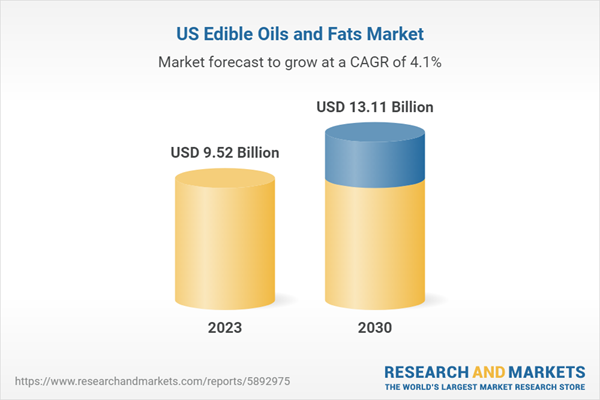

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 9.52 Billion |

| Forecasted Market Value ( USD | $ 13.11 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |

![US Edible Oils and Fats Market Size and Forecasts, Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Type [Oils and Fats], Application [Food and Beverages, Pharmaceuticals and Nutraceuticals, and Animal Nutrition], and Geography- Product Image](http://www.researchandmarkets.com/product_images/12573/12573983_115px_jpg/market_research_report.jpg)