Chapter 1. Methodology and Scope

1.1. Market Segmentation

1.1.1. Product

1.1.2. End Use

1.1.3. Region

1.2. Estimates and Forecast Timeline

1.3. Research Methodology

1.3.1. Information procurement

1.3.2. Purchased Database

1.3.3. Analyst's internal database

1.3.4. Secondary Sources

1.3.5. Primary Research

1.3.6. Details of Primary Research

1.4. Information or Data Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Validation

1.5.1. Volume Price Analysis

1.6. List of Secondary Sources

1.7. List of Abbreviations

1.8. Research Objectives

1.8.1. Objective - 1

1.8.2. Objective - 2

1.8.3. Objective - 3

Chapter 2. Executive Summary

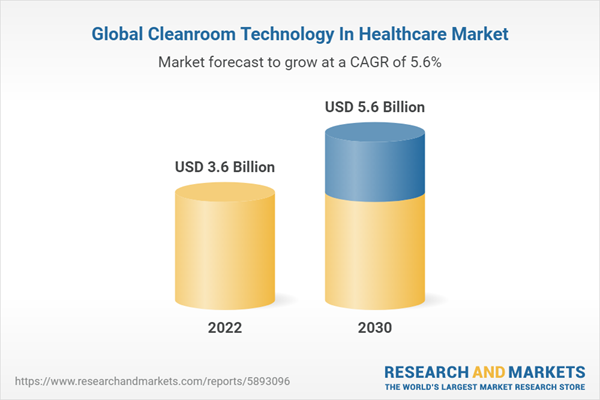

2.1. Market Snapshot

2.2. Segment Snapshot

2.2.1. Product

2.2.2. End Use

2.2.3. Region

2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, & Scope

3.1. Market Lineage Outlook

3.1.1. Parent Market Outlook

3.1.2. Related/Ancillary Market Outlook

3.2. Market Dynamics

3.2.1. Market driver analysis

3.2.1.1. Stringent regulatory standards

3.2.1.2. Increasing need for cleanroom technology to develop quality products

3.2.1.3. Growing incidence of hospital acquired infections

3.2.2. Market restraint analysis

3.2.2.1. High initial installation cost of cleanrooms

3.2.2.2. Challenges in designing cleanrooms

3.3. Industry Analysis Tools

3.3.1. PORTER’S Five Forces Analysis

3.3.2. PESTLE Analysis

Chapter 4. Cleanroom Technology in Healthcare Market: Product Analysis

4.1. Cleanroom Technology in Healthcare Market Product Movement Analysis, 2022 & 2030

4.2. Segment Dashboard

4.3. Cleanroom Technology in Healthcare Market Estimates & Forecasts, By Product (USD Million)

4.3.1. Equipment

4.3.1.1. Equipment market, 2018 - 2030 (USD Million)

4.3.1.2. Heating Ventilation and Air Conditioning System (HVAC)

4.3.1.2.1. Heating Ventilation and Air Conditioning System (HVAC) market, 2018 - 2030 (USD Million)

4.3.1.3. Cleanroom air filters

4.3.1.3.1. Cleanroom air filters market, 2018 - 2030 (USD Million)

4.3.1.4. Air shower and diffuser

4.3.1.4.1. Air shower and diffuser market, 2018 - 2030 (USD Million)

4.3.1.5. Laminar air flow unit

4.3.1.5.1. Laminar air flow unit market, 2018 - 2030 (USD Million)

4.3.1.6. Others

4.3.1.6.1. Others market, 2018 - 2030 (USD Million)

4.3.2. Consumables

4.3.2.1. Consumables market, 2018 - 2030 (USD Million)

4.3.2.2. Gloves

4.3.2.2.1. Gloves market, 2018 - 2030 (USD Million)

4.3.2.3. Wipes

4.3.2.3.1. Wipes market, 2018 - 2030 (USD Million)

4.3.2.4. Disinfectants

4.3.2.4.1. Disinfectants market, 2018 - 2030 (USD Million)

4.3.2.5. Apparels

4.3.2.5.1. Apparels market, 2018 - 2030 (USD Million)

4.3.2.6. Cleaning products

4.3.2.6.1. Cleaning products market, 2018 - 2030 (USD Million)

Chapter 5. Cleanroom Technology in Healthcare Market: End Use Analysis

5.1. Cleanroom Technology in Healthcare Market End Use Movement Analysis, 2022 & 2030

5.2. Segment Dashboard

5.3. Cleanroom Technology in Healthcare Market Estimates & Forecasts, By End Use (USD Million)

5.3.1. Pharmaceutical industry

5.3.1.1. Pharmaceutical industry market, 2018 - 2030 (USD Million)

5.3.2. Biotechnology industry

5.3.2.1. Biotechnology industry market, 2018 - 2030 (USD Million)

5.3.3. Medical device industry

5.3.3.1. Medical device industry market, 2018 - 2030 (USD Million)

5.3.4. Hospital and diagnostic centers

5.3.4.1. Hospital and diagnostic centers market, 2018 - 2030 (USD Million)

Chapter 6. Cleanroom Technology in Healthcare Market: Regional Analysis

6.1. Cleanroom Technology in Healthcare Regional Market Share Analysis, 2022 & 2030

6.2. Regional Market Snapshot (Market Size, CAGR)

6.3. North America

6.3.1. North America cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.3.2. U.S.

6.3.2.1. Key country dynamics

6.3.2.2. Healthcare facilities statistics

6.3.2.3. Regulatory scenario

6.3.2.4. Competitive scenario

6.3.2.5. U.S. cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.3.3. Canada

6.3.3.1. Key country dynamics

6.3.3.2. Healthcare facilities statistics

6.3.3.3. Regulatory scenario

6.3.3.4. Competitive scenario

6.3.3.5. Canada cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.4. Europe

6.4.1. Europe cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.4.2. Germany

6.4.2.1. Key country dynamics

6.4.2.2. Healthcare facilities statistics

6.4.2.3. Regulatory scenario

6.4.2.4. Competitive scenario

6.4.2.5. Germany cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.4.3. UK

6.4.3.1. Key country dynamics

6.4.3.2. Healthcare facilities statistics

6.4.3.3. Regulatory scenario

6.4.3.4. Competitive scenario

6.4.3.5. UK cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.4.4. France

6.4.4.1. Key country dynamics

6.4.4.2. Healthcare facilities statistics

6.4.4.3. Regulatory scenario

6.4.4.4. Competitive scenario

6.4.4.5. France cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.4.5. Italy

6.4.5.1. Key country dynamics

6.4.5.2. Healthcare facilities statistics

6.4.5.3. Regulatory scenario

6.4.5.4. Competitive scenario

6.4.5.5. Italy cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.4.6. Spain

6.4.6.1. Key country dynamics

6.4.6.2. Healthcare facilities statistics

6.4.6.3. Regulatory scenario

6.4.6.4. Competitive scenario

6.4.6.5. Spain cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.4.7. Sweden

6.4.7.1. Key country dynamics

6.4.7.2. Healthcare facilities statistics

6.4.7.3. Regulatory scenario

6.4.7.4. Competitive scenario

6.4.7.5. Sweden cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.4.8. Norway

6.4.8.1. Key country dynamics

6.4.8.2. Healthcare facilities statistics

6.4.8.3. Regulatory scenario

6.4.8.4. Competitive scenario

6.4.8.5. Norway cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.4.9. Denmark

6.4.9.1. Key country dynamics

6.4.9.2. Healthcare facilities statistics

6.4.9.3. Regulatory scenario

6.4.9.4. Competitive scenario

6.4.9.5. Denmark cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.5. Asia Pacific

6.5.1. Asia Pacific cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.5.2. Japan

6.5.2.1. Key country dynamics

6.5.2.2. Healthcare facilities statistics

6.5.2.3. Regulatory scenario

6.5.2.4. Competitive scenario

6.5.2.5. Japan cleanroom technology in healthcare market, 2018 - 2030 (USD Million).

6.5.3. China

6.5.3.1. Key country dynamics

6.5.3.2. Healthcare facilities statistics

6.5.3.3. Regulatory scenario

6.5.3.4. Competitive scenario

6.5.3.5. China cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.5.4. India

6.5.4.1. Key country dynamics

6.5.4.2. Healthcare facilities statistics

6.5.4.3. Regulatory scenario

6.5.4.4. Competitive scenario

6.5.4.5. India cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.5.5. Australia

6.5.5.1. Key country dynamics

6.5.5.2. Healthcare facilities statistics

6.5.5.3. Regulatory scenario

6.5.5.4. Competitive scenario

6.5.5.5. Australia cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.5.6. South Korea

6.5.6.1. Key country dynamics

6.5.6.2. Healthcare facilities statistics

6.5.6.3. Regulatory scenario

6.5.6.4. Competitive scenario

6.5.6.5. South Korea cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.5.7. Thailand

6.5.7.1. Key country dynamics

6.5.7.2. Healthcare facilities statistics

6.5.7.3. Regulatory scenario

6.5.7.4. Competitive scenario

6.5.7.5. Thailand cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.6. Latin America

6.6.1. Latin America cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.6.2. Brazil

6.6.2.1. Key country dynamics

6.6.2.2. Healthcare facilities statistics

6.6.2.3. Regulatory scenario

6.6.2.4. Competitive scenario

6.6.2.5. Brazil cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.6.3. Mexico

6.6.3.1. Key country dynamics

6.6.3.2. Healthcare facilities statistics

6.6.3.3. Regulatory scenario

6.6.3.4. Competitive scenario

6.6.3.5. Mexico cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.6.4. Argentina

6.6.4.1. Key country dynamics

6.6.4.2. Healthcare facilities statistics

6.6.4.3. Regulatory scenario

6.6.4.4. Competitive scenario

6.6.4.5. Argentina cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.7. Middle East & Africa

6.7.1. Middle East & Africa cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.7.2. South Africa

6.7.2.1. Key country dynamics

6.7.2.2. Healthcare facilities statistics

6.7.2.3. Regulatory scenario

6.7.2.4. Competitive scenario

6.7.2.5. South Africa cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.7.3. Saudi Arabia

6.7.3.1. Key country dynamics

6.7.3.2. Healthcare facilities statistics

6.7.3.3. Regulatory scenario

6.7.3.4. Competitive scenario

6.7.3.5. Saudi Arabia cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.7.4. UAE

6.7.4.1. Key country dynamics

6.7.4.2. Healthcare facilities statistics

6.7.4.3. Regulatory scenario

6.7.4.4. Competitive scenario

6.7.4.5. UAE cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

6.7.5. Kuwait

6.7.5.1. Key country dynamics

6.7.5.2. Healthcare facilities statistics

6.7.5.3. Regulatory scenario

6.7.5.4. Competitive scenario

6.7.5.5. Kuwait cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Chapter 7. Competitive Analysis

7.1. Company Categorization

7.2. Company Market Position Analysis

7.3. Strategy Mapping

7.3.1. Merger& Acquisition

7.3.2. Collaborations

7.3.3. New Product Launch

7.4. Company Profiles/ Listing

7.4.1. Cleanroom Air Products

7.4.1.1. Company overview

7.4.1.2. Financial performance

7.4.1.3. Product benchmarking

7.4.1.4. Strategic initiatives

7.4.2. Kimberly-Clark Corporation

7.4.2.1. Company overview

7.4.2.2. Financial performance

7.4.2.3. Product benchmarking

7.4.2.4. Strategic initiatives

7.4.3. DuPont

7.4.3.1. Company overview

7.4.3.2. Financial performance

7.4.3.3. Product benchmarking

7.4.3.4. Strategic initiatives

7.4.4. Terra Universal, Inc.

7.4.4.1. Company overview

7.4.4.2. Financial performance

7.4.4.3. Product benchmarking

7.4.4.4. Strategic initiatives

7.4.5. Labconco

7.4.5.1. Company overview

7.4.5.2. Financial performance

7.4.5.3. Product benchmarking

7.4.5.4. Strategic initiatives

7.4.6. Clean Room Depot

7.4.6.1. Company overview

7.4.6.2. Financial performance

7.4.6.3. Product benchmarking

7.4.6.4. Strategic initiatives

7.4.7. ICLEAN Technologies

7.4.7.1. Company overview

7.4.7.2. Financial performance

7.4.7.3. Product benchmarking

7.4.7.4. Strategic initiatives

7.4.8. Abtech

7.4.8.1. Company overview

7.4.8.2. Financial performance

7.4.8.3. Product benchmarking

7.4.8.4. Strategic initiatives

7.4.9. Exyte GmbH

7.4.9.1. Company overview

7.4.9.2. Financial performance

7.4.9.3. Product benchmarking

7.4.9.4. Strategic initiatives

List of Tables

Table 1 List of Secondary Sources

Table 2 List of Abbreviations

Table 3 Global cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 4 Global cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 5 Global cleanroom technology in healthcare market, by region, 2018 - 2030 (USD Million)

Table 6 North America cleanroom technology in healthcare market, by country, 2018 - 2030 (USD Million)

Table 7 North America cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 8 North America cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 9 US cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 10 US cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 11 Canada cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 12 Canada cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 13 Europe cleanroom technology in healthcare market, by country, 2018 - 2030 (USD Million)

Table 14 Europe cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 15 Europe cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 16 UK cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 17 UK cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 18 France cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 19 France cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 20 Italy cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 21 Italy cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 22 Spain cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 23 Spain cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 24 Norway cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 25 Norway cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 26 Sweden cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 27 Sweden cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 28 Denmark cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 29 Denmark cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 30 Asia Pacific cleanroom technology in healthcare market, by Country, 2018 - 2030 (USD Million)

Table 31 Asia Pacific cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 32 Asia Pacific cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 33 China cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 34 China cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 35 Japan cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 36 Japan cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 37 India cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 38 India cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 39 Australia cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 40 Australia cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 41 South Korea cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 42 South Korea cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 43 Thailand cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 44 Thailand cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 45 Latin America cleanroom technology in healthcare market, by Country, 2018 - 2030 (USD Million)

Table 46 Latin America cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 47 Latin America cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 48 Brazil cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 49 Brazil cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 50 Mexico cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 51 Mexico cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 52 Argentina cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 53 Argentina cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 54 Middle East & Africa cleanroom technology in healthcare market, by Country, 2018 - 2030 (USD Million)

Table 55 Middle East & Africa cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 56 Middle East & Africa cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 57 South Africa cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 58 South Africa cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 59 Saudi Arabia cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 60 Saudi Arabia cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 61 UAE cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 62 UAE cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

Table 63 Kuwait cleanroom technology in healthcare market, by product, 2018 - 2030 (USD Million)

Table 64 Kuwait cleanroom technology in healthcare market, by end use, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Cleanroom technology in healthcare market segmentation

Fig. 2 Market research process

Fig. 3 Information procurement

Fig. 4 Primary research pattern

Fig. 5 Market research approaches

Fig. 6 Value chain-based sizing & forecasting

Fig. 7 QFD modeling for market share assessment

Fig. 8 Market formulation & validation

Fig. 9 Market snapshot

Fig. 10 Market segmentation (USD Million)

Fig. 11 Competitive landscape

Fig. 12 Cleanroom technology in healthcare market lineage

Fig. 13 Related market outlook

Fig. 14 Cleanroom technology in healthcare market dynamics

Fig. 15 Cleanroom technology in healthcare market: Porter’s five forces analysis

Fig. 16 Cleanroom technology in healthcare market: PESTLE analysis

Fig. 17 Cleanroom technology in healthcare market: Product movement share analysis, (USD Million)

Fig. 18 Cleanroom technology product market outlook: Key takeaways

Fig. 19 Equipment market, 2018 - 2030 (USD Million)

Fig. 20 Heating Ventilation and Air Conditioning System (HVAC) market 2018 - 2030 (USD Million)

Fig. 21 Cleanroom air filters market 2018 - 2030 (USD Million)

Fig. 22 Air shower and diffuser market 2018 - 2030 (USD Million)

Fig. 23 Laminar air flow unit market 2018 - 2030 (USD Million)

Fig. 24 Others market 2018 - 2030 (USD Million)

Fig. 25 Consumables market 2018 - 2030 (USD Million)

Fig. 26 Gloves market 2018 - 2030 (USD Million)

Fig. 27 Wipes market 2018 - 2030 (USD Million)

Fig. 28 Disinfectants market 2018 - 2030 (USD Million)

Fig. 29 Apparels market 2018 - 2030 (USD Million)

Fig. 30 Cleaning products market 2018 - 2030 (USD Million)

Fig. 31 Cleanroom technology in healthcare market: End use movement share analysis, (USD Million)

Fig. 32 Cleanroom technology in healthcare end use market outlook: Key takeaways

Fig. 33 Pharmaceutical industry market, 2018 - 2030 (USD Million)

Fig. 34 Biotechnology industry market 2018 - 2030 (USD Million)

Fig. 35 Medical devices industry market, 2018 - 2030 (USD Million)

Fig. 36 Hospital and diagnostic centers market 2018 - 2030 (USD Million)

Fig. 37 Regional market place: Key takeaways

Fig. 38 North America cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 39 US cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 40 US key country dynamics

Fig. 41 Healthcare facilities statistics

Fig. 42 Canada cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 43 Canada key country dynamics

Fig. 44 Healthcare facilities statistics

Fig. 45 Europe cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 46 Germany cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 47 Germany key country dynamics

Fig. 48 Healthcare facilities statistics

Fig. 49 UK cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 50 UK key country dynamics

Fig. 51 Healthcare facilities statistics

Fig. 52 France cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 53 France key country dynamics

Fig. 54 Healthcare facilities statistics

Fig. 55 Italy cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 56 Italy key country dynamics

Fig. 57 Healthcare facilities statistics

Fig. 58 Spain cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 59 Spain key country dynamics

Fig. 60 Healthcare facilities statistics

Fig. 61 Sweden cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 62 Sweden key country dynamics

Fig. 63 Healthcare facilities statistics (2020)

Fig. 64 Norway cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 65 Norway key country dynamics

Fig. 66 Healthcare facilities statistics (2020)

Fig. 67 Denmark cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 68 Denmark key country dynamics

Fig. 69 Healthcare facilities statistics (2020)

Fig. 70 Asia Pacific cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 71 Japan cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 72 Japan key country dynamics

Fig. 73 Healthcare facilities statistics

Fig. 74 China cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 75 China key country dynamics

Fig. 76 Healthcare facilities statistics

Fig. 77 India cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 78 India key country dynamics

Fig. 79 Healthcare facilities statistics

Fig. 80 Australia cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 81 Australia key country dynamics

Fig. 82 Healthcare facilities statistics

Fig. 83 South Korea cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 84 South Korea key country dynamics

Fig. 85 Healthcare facilities statistics

Fig. 86 Thailand cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 87 Thailand key country dynamics

Fig. 88 Healthcare facilities statistics

Fig. 89 Latin America cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 90 Brazil cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 91 Brazil key country dynamics

Fig. 92 Healthcare facilities statistics

Fig. 93 Mexico cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 94 Mexico key country dynamics

Fig. 95 Healthcare facilities statistics

Fig. 96 Argentina cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 97 Argentina key country dynamics

Fig. 98 Healthcare facilities statistics

Fig. 99 Middle East & Africa cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 100 South Africa cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 101 South Africa key country dynamics

Fig. 102 Healthcare facilities statistics

Fig. 103 Saudi Arabia cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 104 Saudi Arabia key country dynamics

Fig. 105 Healthcare facilities statistics

Fig. 106 UAE cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 107 UAE key country dynamics

Fig. 108 Healthcare facilities statistics

Fig. 109 Kuwait cleanroom technology in healthcare market, 2018 - 2030 (USD Million)

Fig. 110 Kuwait key country dynamics

Fig. 111 Healthcare facilities statistics

Fig. 112 Company/competition categorization

Fig. 113 Company market position analysis

Fig. 114 Strategy mapping