Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

However, the market confronts a major obstacle in the form of severe supply chain limitations within the global shipbuilding industry. The scarcity of dry docks equipped to handle complex hull fabrication and integration, particularly in key Asian manufacturing centers, has caused significant production bottlenecks and lengthened project delivery schedules. This capacity saturation is worsened by fierce competition for construction slots from high-demand LNG carriers, resulting in inflated capital costs that threaten to postpone final investment decisions and restrict the rate of fleet expansion.

Market Drivers

The surge in deepwater and ultra-deepwater exploration activities serves as the primary catalyst propelling the global market forward. As onshore and shallow-water basins become mature, major energy companies are increasingly allocating capital toward deeper reserves, especially within the "Golden Triangle" regions of Latin America, West Africa, and the Gulf of Mexico. This transition requires the deployment of high-capacity units designed to operate in harsh conditions and process complex pre-salt fluids, leading to a rise in shipyard orders for specialized hull fabrication. A clear instance of this aggressive growth is seen in Brazil's pre-salt developments, where Petrobras intends to launch 14 FPSOs between 2024 and 2028 to enhance decarbonized production, as reported by OGV Energy in June 2024.Concurrently, the market is bolstered by the increasing commercial feasibility of remote oil fields, where FPSOs provide a distinct advantage over fixed infrastructure. By removing the requirement for extensive subsea pipeline networks, these vessels facilitate the economic development of frontier areas that lack existing export facilities. This operational flexibility is vital for projects in emerging basins such as Guyana, where rapid production acceleration is favored over building permanent subsea grids. For example, the Society of Petroleum Engineers noted in April 2024 that the $12.7 billion Whiptail project was approved to use the Jaguar FPSO to boost regional capacity. This trend is supported by a general recovery in sector spending, with the International Energy Forum anticipating annual upstream capital expenditures to increase by $26 billion to exceed $600 billion in 2024.

Market Challenges

The Global Floating Production Storage and Offloading (FPSO) Market currently contends with a significant barrier arising from acute supply chain constraints and restricted shipbuilding capacity. As the industry requires increasingly complex deepwater units, the shortage of appropriate dry docks in major Asian manufacturing hubs has generated a critical bottleneck. This capacity saturation is further compounded by strong demand for LNG carriers, which vie for the same limited fabrication slots. Consequently, this logistical gridlock leads to substantial cost increases and prolonged delivery timelines, directly hindering the ability of operators to carry out new projects efficiently.These difficulties result in a tangible deceleration in project sanctions, as operators are compelled to postpone commitments in the face of escalating capital needs and scheduling uncertainties. The challenge of securing construction slots prevents the market from transforming planned developments into active fleet expansion at the necessary speed. According to the Energy Industries Council (EIC), the Final Investment Decision (FID) rate for upstream oil and gas projects was recorded at 33.7% in 2024, suggesting that a vast majority of potential developments are pausing prior to the execution stage. This limited throughput of sanctioned projects constrains the market's growth potential despite the fundamental demand for offshore resources.

Market Trends

The incorporation of low-emission power generation systems, specifically Combined Cycle Gas Turbines (CCGT) and all-electric configurations, marks a crucial technical advancement in the sector. Motivated by strict environmental regulations and corporate net-zero goals, operators are substituting traditional open-cycle turbines with advanced systems that employ waste heat recovery or closed-loop electrification to optimize energy efficiency. This shift enables companies to sustain high production volumes while drastically reducing carbon intensity per barrel, a metric that is becoming vital for regulatory compliance in mature basins. For instance, Seatrium announced in May 2024 that the P-84 and P-85 vessels were engineered with all-electric concepts to decrease greenhouse gas emissions intensity by 30%, highlighting the increasing requirement for greener offshore assets.At the same time, the application of standardized hull designs is transforming procurement strategies to alleviate construction risks and expedite time-to-market. By constructing generic, multi-purpose hulls on speculation before specific field contracts are finalized, contractors can separate the hull construction phase from topside engineering, effectively counteracting the effects of shipyard volatility. This modular philosophy facilitates a plug-and-play method that standardizes interfaces and equipment, permitting repetitive manufacturing benefits and predictable delivery timelines. The success of this strategy was highlighted in SBM Offshore's February 2024 report, which confirmed the order of its eighth Fast4Ward multi-purpose floater hull, underscoring the industry's decisive move toward replicable technical solutions.

Key Players Profiled in the Floating Production Storage and Offloading Market

- SBM Offshore Amsterdam B.V.

- TechnipFMC PLC

- Saipem S.p.A.

- Exxon Mobil Corporation

- Shell PLC

- MODEC, Inc.

- Bumi Armada Berhad

- BW Offshore Group

- Yinson Holdings Berhad

- CNOOC Limited

Report Scope

In this report, the Global Floating Production Storage and Offloading Market has been segmented into the following categories:Floating Production Storage and Offloading Market, by Type:

- Converted

- New-Build

- Redeployed

Floating Production Storage and Offloading Market, by Propulsion:

- Self-Propelled

- Towed

Floating Production Storage and Offloading Market, by Hull Type:

- Single Hull

- Double Hull

Floating Production Storage and Offloading Market, by Application:

- Shallow Water

- Deepwater

- Ultra-Deep Water

Floating Production Storage and Offloading Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Floating Production Storage and Offloading Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Floating Production Storage and Offloading market report include:- SBM Offshore Amsterdam B.V.

- TechnipFMC PLC

- Saipem S.p.A.

- ExxonMobil Corporation

- Shell PLC

- MODEC, Inc.

- Bumi Armada Berhad

- BW Offshore Group

- Yinson Holdings Berhad

- CNOOC Limited

Table Information

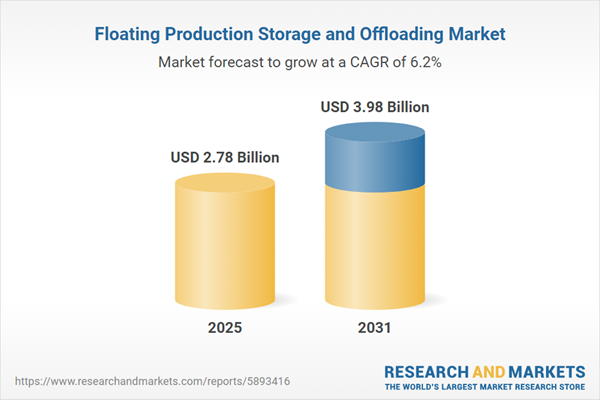

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 2.78 Billion |

| Forecasted Market Value ( USD | $ 3.98 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |