Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

A UPS is an electrical device that provides emergency power for essential systems and equipment in a facility when the main source of power fails or is switched off. It is essential for both commercial and residential use, as it provides additional protection for critical electrical apparatuses, such as computers. UPS units are usually powered by a battery, which makes it competent of supplying power even when the main power is switched off. It is an important instrument for critical installations such as hospitals, banks, and computer server rooms.

Increasing Demand for Power

The increasing demand for power in South Africa is fuelling the demand for UPS systems. With the expansion of industries, businesses, and residential areas, there is a significant rise in electricity consumption, leading to an increased need for reliable power backup solutions. This trend has paved the way for the flourishing UPS market in South Africa. The South African economy has been witnessing substantial growth in various sectors, including manufacturing, IT, telecommunication, healthcare, and retail. These sectors heavily rely on uninterrupted power supply to ensure smooth operations and prevent financial losses caused by power outages. As a result, there is a surging demand for UPS systems to safeguard critical equipment and systems against power disruptions and voltage fluctuations.Furthermore, the rising penetration of digital technologies and the proliferation of data centers have significantly contributed to the increased power requirements in the country. Data centers necessitate continuous power supply to ensure uninterrupted operation and prevent data loss. UPS systems play a crucial role in providing reliable backup power to these facilities, making them indispensable in the digital era. The unstable power infrastructure and frequent electricity shortages in some regions of South Africa have further emphasized the need for robust power backup solutions. UPS systems act as a reliable defence mechanism against power fluctuations, voltage spikes, and blackouts, offering protection to sensitive electronic equipment, such as servers, routers, switches, and communication systems. To meet the escalating demand, both local and international UPS manufacturers and suppliers are actively expanding their presence in the South African market. They are introducing technologically advanced UPS systems with higher power capacities, improved efficiency, and advanced monitoring capabilities. These developments are aimed at providing customers with tailored solutions to address their specific power backup requirements.

In conclusion, the increasing power demand driven by the growth of various industries and the need for reliable power supply in South Africa has positively impacted the growth of the South Africa UPS market. The rising adoption of digital technologies, expansion of data centers, and concerns over power infrastructure stability have further fuelled the demand for UPS systems. As the country continues to develop and modernize its infrastructure, the South Africa UPS market is expected to witness sustained growth in the coming years.

Growing IT and Telecom Sector

The IT and telecom sector in South Africa is poised for remarkable growth, and this expansion is expected to drive the demand for UPS systems in the country. As South Africa increasingly embraces digital transformation and experiences a surge in internet connectivity, the IT and telecom sector is becoming a significant contributor to the country's economy. This rapid growth is generating a need for reliable power backup solutions, thereby propelling the UPS market in South Africa. The IT industry in South Africa is witnessing a robust expansion, with an increasing number of businesses relying on technology-driven processes for their operations. From small enterprises to large corporations, IT infrastructure forms the backbone of their day-to-day activities. To ensure uninterrupted operations, businesses require reliable power backup systems to safeguard critical equipment, such as servers, data storage devices, networking devices, and communication systems. UPS systems play a crucial role in providing uninterrupted power supply during blackouts, voltage fluctuations, or any other power-related issues, minimizing downtime and protecting sensitive IT infrastructure.Furthermore, the growing telecom sector in South Africa is driving the demand for UPS systems. With the proliferation of smartphones, the adoption of high-speed internet, and the expansion of digital services, the telecom sector is experiencing exponential growth. Telecommunication networks need to maintain uninterrupted connectivity to support voice calls, data services, and emerging technologies such as 5G. UPS systems offer reliable backup power, ensuring continuous operation of telecom infrastructure, including base stations, switches, routers, and data centers. The increasing investment in data centers is also contributing to the growth of the South Africa UPS market. Data centers require constant power supply to ensure the smooth running of servers, storage systems, and networking equipment. Any disruption in power can lead to data loss, downtime, and financial losses. UPS systems provide an immediate and seamless transition to backup power during power outages, protecting the critical infrastructure of data centers and preventing data loss.

To meet the rising demand, both local and international UPS manufacturers are focusing on expanding their presence in the South Africa UPS market. They are introducing advanced UPS systems with higher power capacities, improved efficiency, and intelligent features for remote monitoring and management. These solutions cater to the specific needs of the IT and telecom sector, enabling businesses to maintain operational continuity and safeguard their investments. In conclusion, the growing IT and telecom sector in South Africa, driven by digital transformation and increased connectivity, is expected to fuel the demand for UPS systems. The reliance on technology, the expansion of data centers, and the need for uninterrupted power supply are key factors propelling the growth of the South Africa UPS market. As the sector continues to thrive, UPS manufacturers will continue to innovate and provide tailored solutions to meet the evolving power backup requirements of businesses in South Africa.

Increasing Awareness of Power Quality

The awareness of power quality issues is steadily increasing in South Africa, and this growing consciousness is expected to drive the demand for UPS systems in the country. Power quality problems, such as voltage fluctuations, surges, sags, and harmonics, can lead to equipment damage, data loss, and operational disruptions for businesses and industries. As a result, there is a rising emphasis on ensuring stable and high-quality power supply, thereby fueling the UPS market in South Africa. Businesses are becoming more aware of the detrimental impact of power disturbances on their operations, including productivity losses, equipment downtime, and potential financial implications. This awareness has prompted organizations across various sectors, including manufacturing, healthcare, finance, and telecommunication, to invest in UPS systems to mitigate power quality issues and maintain uninterrupted operations.In addition, the increasing digitization of processes and the reliance on sensitive electronic equipment have further highlighted the importance of power quality. The prevalence of computers, servers, data storage devices, and communication systems in modern workplaces necessitates a stable and clean power supply to ensure the longevity and optimal performance of these assets. UPS systems act as a protective barrier, providing a constant and regulated power source, shielding critical equipment from voltage fluctuations and disturbances.

Furthermore, the rise of renewable energy sources, such as solar and wind power, has brought attention to the intermittent nature of these energy systems. In South Africa, where renewable energy adoption is gaining momentum, the need for reliable backup power solutions to bridge the gap during intermittent power supply has become crucial. UPS systems are capable of seamlessly transitioning to battery power during power outages, ensuring a continuous and stable power supply to essential equipment. As the awareness of power quality issues continues to grow, businesses and industries are expected to invest in UPS systems to safeguard their operations and mitigate the risks associated with power disturbances. This increasing demand for UPS systems in South Africa is likely to drive market growth, prompting manufacturers to develop advanced and efficient UPS solutions to meet the evolving needs of customers.

In conclusion, the rising awareness of power quality issues and their impact on business operations is expected to drive the demand for UPS systems in South Africa. Businesses across various sectors are recognizing the importance of stable and clean power supply to ensure uninterrupted operations and protect sensitive equipment. The prevalence of renewable energy sources and the need for reliable backup power solutions further contribute to the growing UPS market. As a result, manufacturers are likely to focus on developing innovative UPS systems to cater to the increasing demand and address power quality concerns in South Africa.

Market Segmentation

The South Africa UPS Market is divided into type, rating, organization size and industry vertical and region. Based on type, the market is divided into online, offline, and line interactive. Based on rating, the market is divided into less than 5kVA and 5.1 kVA - 50 kVA, 50.1 kVA - 200 kVA, and others. Based on organization size, the market is divided into large enterprise and small & medium enterprise. Based on industry vertical, the market is divided into BFSI, consumer goods, IT & Telecom, manufacturing, healthcare, energy & utilities, and others. The market analysis also studies the regional segmentation to devise regional market segmentation, divided among Gauteng, KwaZulu-Natal, Western Cape, Eastern Cape, Mpumalanga, Limpopo, North West, Free State, and Northern Cape.Market Players

Major market players in the South Africa UPS market are Powertron Technologies Cc, Core Power Technologies A/V, ABB South Africa, Mecer (Pty) Ltd, AEG South Africa, Schneider Electrical Sa (Proprietary) Limited, Eaton South Africa, Socomec South Africa (Pty) Ltd, Syntech Distribution (Pty) Ltd., and Riello Power Solutions (Pty) Ltd. To achieve good market growth, businesses that are active in the market employ organic tactics such as product launches, mergers, and partnerships.Report Scope:

In this report, the South Africa UPS market has been segmented into following categories, in addition to the industry trends which have also been detailed below:South Africa UPS Market, By Type:

- Online

- Offline

- Line Interactive

South Africa UPS Market, By Rating:

- Less than 5kVA

- 5.1 kVA - 50 kVA

- 50.1 kVA - 200 kVA

- Others

South Africa UPS Market, By Organization Size:

- Large Enterprise

- Small & Medium Enterprise

South Africa UPS Market, By Industry Vertical:

- BFSI

- Consumer Goods

- IT & Telecom

- Manufacturing

- Healthcare

- Energy & Utilities

- Others

South Africa UPS Market, By Region:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Eastern Cape

- Mpumalanga

- Limpopo

- North West

- Free State

- Northern Cape

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the South Africa UPS market

Available Customizations:

South Africa UPS market with the given market data, the publisher offers customizations according to a company’s specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Powertron Technologies Cc

- ABB South Africa.

- Core Power Technologies A/V

- AEG South Africa

- Schneider Electrical Sa (Proprietary) Limited

- Socomec South Africa (Pty) Ltd

- Eaton South Africa

- Syntech Distribution (Pty) Ltd

- Mecer (Pty) Ltd

- Riello Power Solutions (Pty) Ltd.

Table Information

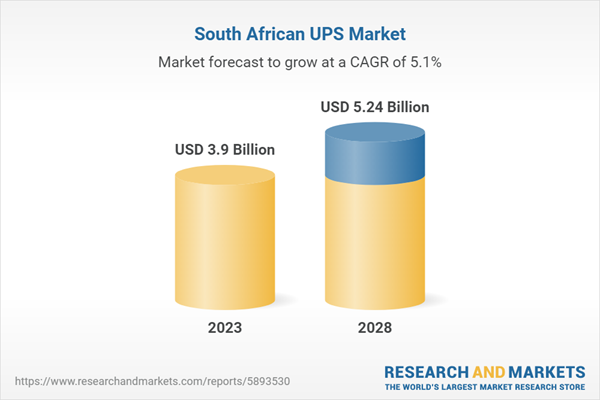

| Report Attribute | Details |

|---|---|

| No. of Pages | 81 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 3.9 Billion |

| Forecasted Market Value ( USD | $ 5.24 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | South Africa |

| No. of Companies Mentioned | 10 |