Speak directly to the analyst to clarify any post sales queries you may have.

A comprehensive overview of immersive analytics that clarifies technology intersections, operational value drivers, and adoption priorities for decision-makers

Immersive analytics converges advanced visualization, spatial computing, and interactive data modalities to reshape how organizations derive insights from complex data. This discipline extends beyond novelty; it fuses hardware evolution, software intelligence, and service-level integration to unlock higher-fidelity situational awareness and decision speed across domains such as healthcare diagnostics, industrial operations, and training simulations. The introduction of more powerful processors, refined sensors, and diverse display formats has broadened the palette of design choices available to product teams and solution architects.As organizations evaluate these technologies, the focus shifts from proof-of-concept demonstrations to measurable operational value. Early deployments emphasize reduced cognitive load for analysts, improved training transfer rates, and novel methods for collaborative decision-making. At the same time, concerns around interoperability, privacy, and human factors require deliberate mitigation strategies. These dynamics create both opportunity and complexity for vendors, integrators, and end users.

This report synthesizes cross-disciplinary evidence to provide a clear foundation for stakeholders seeking to understand practical use cases, technology trajectories, and the implementation pathways that translate immersive experiences into sustained performance improvements. Throughout, emphasis remains on actionable insights that guide procurement, R&D prioritization, and organizational change management.

How convergent display advances, sensor fidelity, edge compute, and open interoperability are reshaping immersive analytics deployment strategies and value creation

The landscape for immersive analytics is undergoing transformative shifts driven by converging advances in display technologies, sensing capabilities, and compute architectures. Display innovations such as micro-LED and OLED variants are enabling brighter, more power-efficient experiences while processors optimized for spatial workloads and dedicated AI accelerators are elevating real-time scene understanding. Concurrently, sensor and camera arrays paired with improved tracking and positioning algorithms are reducing latency and improving spatial fidelity, which directly enhances user immersion and task performance.Another pivotal change is the maturation of mixed reality authoring environments and the integration of advanced analytics pipelines. This reduces the friction between data preparation and immersive presentation, enabling subject-matter experts to iterate on visualizations without deep engineering support. Edge computing and distributed rendering paradigms are shifting the locus of compute, allowing hybrid architectures that balance latency, bandwidth, and privacy concerns.

Finally, ecosystem-level shifts around standards, APIs, and cross-vendor interoperability are emerging as decisive factors. Organizations that prioritize open interfaces and modular design gain flexibility to swap display modules, integrate new sensors, or update analytics engines without wholesale platform migrations. Together, these technical and ecosystem trends reshape procurement models and deployment strategies across industries.

Policy-driven supply chain realignment, modular product design, and regional manufacturing strategies that mitigate tariff exposure and preserve product performance

Tariff policy changes enacted through 2025 have produced discernible ripple effects across supply chains, procurement strategies, and product roadmaps for immersive analytics hardware and components. Increased duties on certain imported components have prompted device manufacturers to reassess sourcing strategies, prioritize supplier diversification, and accelerate qualification of alternate vendors. In practice, this has meant extended lead times for some subassemblies while incentivizing investments in regional manufacturing footprints to reduce tariff exposure and logistic complexity.For original equipment manufacturers and integrators, the cumulative impact extends beyond unit cost adjustments. Engineering teams face tighter constraints when substituting components that must meet precise display, sensor, and tracking tolerances. As a result, product roadmaps have increasingly incorporated component modularity, enabling rapid substitution of display modules, processors, or camera arrays with minimal requalification. Procurement functions have also adopted more dynamic hedging strategies and long-term agreements that lock in favorable terms and reduce transaction costs.

On the demand side, enterprise buyers have become more sensitive to total cost of ownership and repairability. Lifecycle management practices emphasize maintainability and regional serviceability, leading to stronger demand for standardized modules and spare parts. Regulatory compliance and customs classification remain active areas for legal and supply chain teams, who now work closely with product groups to ensure that design, labeling, and documentation minimize tariff-related disruptions. Overall, the policy environment has accelerated architectural shifts toward modularity, localization, and resilient supplier networks.

Layered segmentation insights that map component choices, technology types, device configurations, applications, and end-user priorities to real-world implementation constraints

A nuanced segmentation approach clarifies where value is most likely to emerge and where implementation complexity concentrates. When analyzing components, the market divides into hardware, services, and software, with hardware further differentiated into display technologies, processors, sensors and cameras, and tracking and positioning. Display technologies span DLP, LCD and LED, micro-LED, and OLED variants, each offering distinct trade-offs across brightness, power consumption, and manufacturability. Processors concentrate on throughputs for 3D rendering and AI inference, while sensor suites and tracking stacks determine accuracy and latency for spatial interactions.From the perspective of technology type, immersive experiences fall into augmented reality, mixed reality, and virtual reality. Virtual reality itself splits into PC-based, smartphone-based, and standalone platforms, with PC-based systems further associated with discrete hardware ecosystems. Device typologies include cave systems, head-mounted displays, optical see-through glasses, and spatial projectors. Cave systems break down into floor projection and wall projection variants, whereas head-mounted displays appear as smartphone-based, standalone, and tethered models. Optical see-through devices differentiate between retinal projection displays and smart glasses, and spatial projectors manifest as gesture-based systems or projection mapping solutions.

Application-focused segmentation highlights domains such as defense and aerospace, education, gaming, healthcare, industrial use, and retail, with subdomains like console, mobile, and PC gaming and healthcare verticals including diagnostics and imaging, patient care, and surgical simulation. End-user categories cover consumers, education and research institutions, enterprises, and government agencies, where education segments into higher education, K-12, and research institutions; enterprises specialize across automotive, manufacturing, and oil and gas; and government use cases emphasize defense, public safety, and smart cities. This layered categorization helps stakeholders align product investments and go-to-market strategies to the specific technical and operational requirements of each segment.

How regional manufacturing strength, regulatory environments, and market demand patterns shape divergent adoption paths and partnership strategies across global geographies

Regional dynamics shape deployment priorities and partnership models in ways that influence procurement, integration, and aftersales support. In the Americas, adoption often centers on enterprise and consumer demand driven by established ecosystem players, mature commercial channels, and robust venture and corporate investment. This region emphasizes integrated solutions that demonstrate clear ROI and operational performance improvements, particularly in enterprise training, simulation, and gaming sectors.In Europe, Middle East & Africa, regulatory considerations, standards harmonization, and public-sector procurement cycles strongly influence adoption cadence. Public safety, smart city pilots, and defense procurements tend to favor interoperable solutions with clear security and data governance postures. Regional industrial clusters also promote collaborations between manufacturing leaders and software innovators to tailor immersive analytics to localized production systems.

Asia-Pacific continues to lead in manufacturing scale, component specialization, and rapid consumer adoption. Supply chains concentrated in this region provide cost advantages and fast iteration cycles for hardware vendors, while diverse consumer markets drive creative use cases in entertainment and retail. Cross-border partnerships and localized content strategies often determine market traction, with analytics-driven localization and language support becoming key success factors for deployments across varied cultural and regulatory environments.

Competitive and partnership dynamics driven by vertical stack strategies, platform openness, and industry-specific integration capabilities that determine market positioning

Competitive dynamics in immersive analytics reflect a blend of vertical integration, platform specialization, and growing collaboration between hardware and software suppliers. Leaders in hardware invest heavily in display research, sensor integration, and thermal-efficient processors to differentiate product experiences, while software and services firms focus on developer tooling, analytics middleware, and domain-specific content authoring. These parallel investments reflect a strategic choice: control the full stack to optimize performance and margins, or specialize in modular components and cultivate an ecosystem of partners.Strategic partnerships and alliances are increasingly common; hardware vendors seek content and analytics partners to accelerate enterprise adoption, and software providers prioritize hardware certification programs to ensure consistent user experiences. Mergers and acquisitions remain a mechanism to accelerate capability acquisition, particularly for firms aiming to add proprietary tracking techniques, specialized rendering engines, or industry-specific simulation libraries.

Open interfaces and platform certifications function as nonlinear levers that reduce switching costs and expand addressable use cases. Companies that commit to clear developer support, robust SDKs, and transparent roadmaps secure deeper integration with enterprise workflows and institutional buyers. Meanwhile, service providers that combine systems integration with domain expertise in industries like healthcare or manufacturing capture incremental value by reducing time-to-outcome for end users.

Actionable organizational, product, and procurement strategies that combine modular design, developer ecosystems, and capability-building to accelerate adoption and manage risk

Leaders seeking to capture value from immersive analytics should pursue coordinated actions across product design, procurement, and organizational capability building. Begin by prioritizing modular hardware architectures that allow rapid substitution of displays, processors, and sensors; this reduces dependency on single-source suppliers and simplifies tariff mitigation and serviceability. Complement this with rigorous component qualification frameworks and cross-functional supply chain governance that include legal, engineering, and procurement stakeholders.Invest in software ecosystems that lower the barriers for domain experts to author immersive content. This requires developer-friendly SDKs, curated analytics middleware, and integrated data connectors that ensure secure access to enterprise data stores. Operationally, allocate resources to pilot programs that embed measurable performance indicators, and scale successes through standardized deployment playbooks and training curricula that capture lessons learned.

From a commercial perspective, negotiate flexible supplier contracts and cultivate regional manufacturing relationships to balance cost, agility, and compliance. Finally, build internal competencies in human factors, privacy engineering, and measurement science to ensure deployments deliver sustained behavioral and operational improvements. These combined measures will position organizations to accelerate adoption while managing technical and organizational risk.

A rigorous multi-method research framework combining primary testing, expert interviews, secondary evidence synthesis, and scenario analysis to produce defensible actionable insights

This research synthesizes primary and secondary evidence using a multi-method approach designed to ensure validity, reliability, and practical relevance. Primary inputs include structured interviews with practitioners across hardware engineering, UX research, and enterprise procurement, as well as hands-on evaluations of device prototypes and lab-based latency and tracking assessments. These direct observations inform granular comparisons among display technologies, sensor suites, and platform behaviors under representative workloads.Secondary inputs encompass peer-reviewed literature, technical white papers, standards documentation, and vendor technical briefs that provide context for hardware and software trade-offs. Data triangulation techniques reconcile differences among sources, and expert adjudication panels resolve conflicting interpretations. Scenario analysis is applied to explore alternative futures driven by supply chain shocks, rapid component innovation, or shifts in regulatory posture.

Quality controls include source validation protocols, replication of key technical measurements where feasible, and transparent documentation of assumptions and limitations. Where primary measurement was constrained, the methodology flags confidence levels and recommends follow-up testing. The approach balances rigor with pragmatism to deliver insights that are both actionable and defensible for decision-makers.

A synthesis of practical levers and governance priorities that translate immersive analytics capabilities into sustained operational improvements and scalable deployments

Immersive analytics stands at an inflection point where technical maturity, ecosystem alignment, and commercial demand converge to create meaningful opportunities across industries. The technology’s value proposition centers on improving situational understanding, accelerating learning curves, and enabling collaborative decision-making in complex operational contexts. Realizing that value requires deliberate choices about modular product design, open interfaces, and developer enablement, together with robust supply chain strategies that account for policy and tariff changes.Organizations that focus on measurable outcomes and invest in cross-functional capabilities will find a clearer path to scaled deployments. Early wins often come from targeted pilots that solve high-impact operational problems, combined with governance structures that translate lessons into repeatable playbooks. At the same time, continued attention to privacy, accessibility, and standards alignment will determine long-term adoption velocity and public trust.

In sum, this body of research highlights practical levers-product modularity, ecosystem partnerships, regional manufacturing strategies, and developer-focused tooling-that reduce friction and amplify impact. Decision-makers can use these levers to shape roadmaps that deliver sustained performance improvements rather than one-off demonstrations.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Immersive Analytics Market

Companies Mentioned

The key companies profiled in this Immersive Analytics market report include:- Adobe Inc.

- Alphabet Inc.

- Amazon.com, Inc.

- ARSOME Technology, Inc.

- Aventior, Inc.

- BadVR, Inc.

- Cognitive3D, Inc.

- DPVR Technology Co., Ltd.

- IBM Corporation

- Immersion Analytics, Inc.

- JuJu Immersive Ltd.

- Kognitiv Spark Ltd.

- Meta Platforms, Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Oracle Corporation

- PICO Interactive, Inc.

- PTC Inc.

- Salesforce, Inc.

- SAP SE

- SenseGlove B.V.

- Softcare Studios S.r.l.

- Tableau Software, LLC

- Unity Software, Inc.

- Varjo Technologies Oy

- Virtualitics, Inc.

Table Information

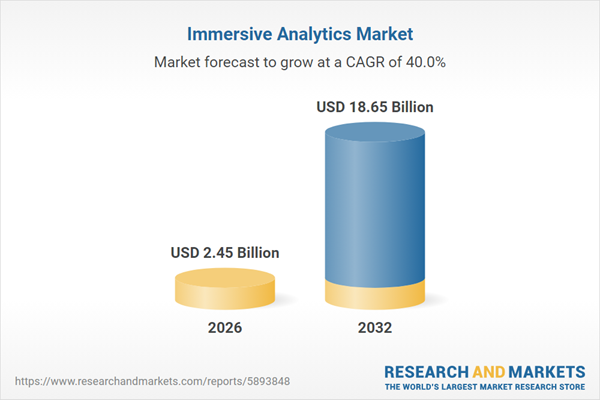

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 2.45 Billion |

| Forecasted Market Value ( USD | $ 18.65 Billion |

| Compound Annual Growth Rate | 39.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |