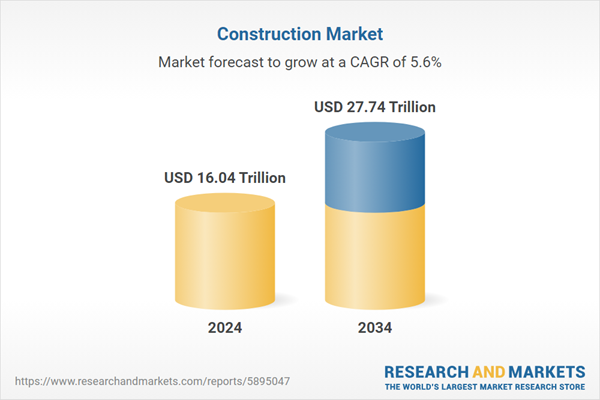

The global construction market reached a value of nearly $16.04 trillion in 2024, having grown at a compound annual growth rate (CAGR) of 5.07% since 2019. The market is expected to grow from $16.04 trillion in 2024 to $20.79 trillion in 2029 at a rate of 5.32%. The market is then expected to grow at a CAGR of 5.94% from 2029 and reach $27.74 trillion in 2034.

Growth in the historic period resulted from the rising smart city initiatives, growing renovation and remodeling activities, rise in FDI and public-private partnerships (PPPs) and favorable government support. Factors that negatively affected growth in the historic period were high material price and stringent environmental regulations.

Going forward, the increasing focus on infrastructure development, increase in demand for green buildings, increasing urbanization and growth in logistics infrastructure will drive the growth. Factor that could hinder the growth of the construction market in the future include labor shortages and skill gaps, limited access to capital and impact of trade war and tariffs.

Asia Pacific was the largest region in the construction market, accounting for 40.26% or $6.46 trillion of the total in 2024. It was followed by North America, Western Europe and then the other regions. Going forward, the fastest-growing regions in the construction market will be Africa and Middle East where growth will be at CAGRs of 13.67% and 9.02% respectively. These will be followed by Eastern Europe and Western Europe where the markets are expected to grow at CAGRs of 6.56% and 5.18% respectively.

The global construction market is fragmented, with a large number of small players operating in the market. The top ten competitors in the market made up to 5.15% of the total market in 2024. China State Construction Engineering Co., Ltd. was the largest competitor with a 1.74% share of the market, followed by China Railway Group Ltd with 0.93%, China Railway Construction Corporation Limited with 0.87%, China Communications Construction Company, Ltd with 0.59%, Vinci S.A with 0.21%, Lennar Corporation with 0.21%, D.R. Horton, Inc with 0.21%, Power Construction Corporation of China with 0.16%, Skanska Group with 0.12% and STRABAG SE with 0.10%.

The construction market is segmented by type of construction into buildings construction, heavy and civil engineering construction, specialty trade contractors and land planning and development. The buildings construction market was the largest segment of the construction market segmented by type of construction, accounting for 46.43% or $7.45 trillion of the total in 2024. Going forward, the land planning and development segment is expected to be the fastest growing segment in the construction market segmented by type of construction, at a CAGR of 8.20% during 2024-2029.

The construction market is segmented by type of contractor into large contractors and small contractors. The large contractors market was the largest segment of the construction market segmented by type of contractor, accounting for 72.03% or $11.55 trillion of the total in 2024. Going forward, the small contractors segment is expected to be the fastest growing segment in the construction market segmented by type of contractor, at a CAGR of 5.67% during 2024-2029.

The construction market is segmented by end-use sector into public and private. The private market was the largest segment of the construction market segmented by end-use sector, accounting for 73.94% or $11.86 trillion of the total in 2024. Going forward, the public segment is expected to be the fastest growing segment in the construction market segmented by end-use sector, at a CAGR of 6.67% during 2024-2029.

The top opportunities in the construction market segmented by type of construction will arise in the specialty trade contractors segment, which will gain $2.08 trillion of global annual sales by 2029. The top opportunities in the construction market segmented by type of contractor will arise in the large contractors segment, which will gain $3.31 trillion of global annual sales by 2029. The top opportunities in the construction market segmented by end-use sector will arise in the private segment, which will gain $3.15 trillion of global annual sales by 2029. The construction market size will gain the most in the USA at $973.08 billion.

Market-trend-based strategies for the construction market include developing innovative ports to enhance global trade efficiency, focusing on modular construction to enhance construction quality management, developing prefabricated buildings to reduce construction time and developing innovative beneficiated ash supports low-carbon building practices.

Player-adopted strategies in the construction market include focus on reinforcing position in global market through various contracts, focus on strengthening business operations through new construction projects.

To take advantage of the opportunities, the analyst recommends the construction market companies to focus on expanding maritime infrastructure through innovative port projects, focus on modular construction and technology integration, focus on prefabricated and modular construction solutions, focus on sustainable materials through beneficiated ash, focus on land planning and development, expand in emerging markets, continue to focus on developed markets, focus on strategic distribution partnerships, focus on balanced pricing models, focus on digital promotion strategies, focus on partnerships for promotional reach and focus on public construction market growth.

Table of Contents

Executive Summary

Construction Global Market Opportunities and Strategies To 2034 provides the strategists; marketers and senior management with the critical information they need to assess the global construction market as it emerges from the COVID-19 shut down.Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description

Where is the largest and fastest-growing market for construction? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The construction market global report answers all these questions and many more.The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider construction market; and compares it with other markets.

The report covers the following chapters:

- Introduction and Market Characteristics - Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by type of construction, by type of contractor and by end-use sector.

- Key Trends - Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Growth Analysis and Strategic Analysis Framework - Analysis on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Regional and Country Analysis - Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation - Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each by type of construction, by type of contractor and by end-use sector in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size and Growth - Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape - Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major and Innovative Companies Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking - Briefs on the financials comparison between major players in the market.

- Competitive Dashboard - Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions - Information on recent mergers and acquisitions in the market is covered in the report. This section gives key financial details of mergers and acquisitions which have shaped the market in recent years.

- Recent Developments - Information on recent developments in the market covered in the report.

- Market Opportunities and Strategies - Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions and Recommendations - This section includes recommendations for construction providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix - This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

1) By Type of Construction: Buildings Construction; Heavy and Civil Engineering Construction; Specialty Trade Contractors; Land Planning and Development2) By Type of Contractor: Large Contractors; Small Contractors

3 By End-Use Sector: Public; Private

Companies Mentioned: China State Construction Engineering Co., Ltd; China Railway Group Ltd.; China Railway Construction Corporation Limited; China Communications Construction Company, Ltd.; Vinci S.A

Countries: Australia; China; India; Indonesia; Japan; South Korea; Bangladesh; Thailand; Vietnam; Malaysia; Singapore; Philippines; Hong Kong; New Zealand; USA; Canada; Mexico; Brazil; Chile; Argentina; Colombia; Peru; France; Germany; UK; Italy; Spain; Austria; Belgium; Denmark; Finland; Ireland; Netherlands; Norway; Portugal; Sweden; Switzerland; Russia; Czech Republic; Poland; Romania; Ukraine; Saudi Arabia; Israel; Iran; Turkey; UAE; Egypt; Nigeria; South Africa.

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; construction indicators comparison.

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

The companies featured in this Construction market report include:- China State Construction Engineering Co., Ltd

- China Railway Group Ltd.

- China Railway Construction Corporation Limited

- China Communications Construction Company, Ltd.

- Vinci S.A

- Lennar Corporation

- D.R. Horton, Inc

- Power Construction Corporation of China

- Skanska Group

- STRABAG SE

- CIMIC Group

- Shimizu Corporation

- Lendlease Group

- L&T Engineering & Construction Division

- Shapoorji Pallonji Group

- PT Wijaya Karya (WIKA)

- Obayashi Corporation

- GS Engineering & Construction (GS E&C)

- Doosan Group

- Hindustan Construction Company (HCC)

- Gammon India Limited

- IRCON International Limited

- Tata Projects Ltd

- Reliance Infrastructure

- DLF

- Samsung C&T Corporation

- SK Ecoplant

- Hyundai Engineering and Construction Co., Ltd.

- Misawa Homes Group

- Megha Engineering & Infrastructures Ltd (MEIL)

- IRB Infrastructure Developers Limited

- Ashoka Buildcon Limited

- Oberoi Realty

- Sobha Ltd

- Afcons Infrastructure Limited

- Essar Projects

- JMC Projects (India) Ltd.

- Turner Construction Company

- Sekisui House Ltd.

- Shanghai Construction Group (SCG)

- Kajima Corporation

- Taisei Corporation

- Haseko Corporation

- Nakano Corporation

- Daewoo Engineering & Construction (Daewoo E&C)

- Anker Hansen & Co. A/S

- Christiansen & Essenbæk A/S

- C.C. Contractor A/S

- EKE-Construction Ltd.

- Colas Group

- Eiffage Construction

- Bauer Group

- Bennett Construction Limited

- Collen Construction Limited

- Casais Group

- Balfour Beatty

- Laing O’ Rourke

- Morgan Sindall

- Kier

- Bouygues Construction

- Eiffage

- Sogea-Satom

- Salini Impregilo

- Hochtief

- Royal BAM Group

- Grupo Avintia

- Skanska AB

- Renaissance Construction

- ALFA Engineering & Construction Co

- Budimex Group

- STRABAG International GmbH

- Acciona

- Comfort Systems USA

- Kraus-Anderson Construction Company

- Construction Partners, Inc

- NXT Construction

- PCL Construction

- Bird Construction

- ACS Group

- EllisDon Corporation

- Aecon Group Incorporated

- Ledcor Group of Companies

- Graham Construction

- Pomerleau Incorporated

- Empresas ICA

- Fluor Corporation

- Kiewit Corporation

- Jacobs Engineering Group

- Bechtel Corporation

- Skanska USA

- Engenharia

- SalfaCorp

- Mourik General Contractors

- Mota-Engil

- Concremat

- Sacyr

- McCrory Construction Company

- MAPNA Group

- Al Habtoor Group LLC

- Al-Naboodah Constructing

- Arabian Construction Company

- Dutco Balfour Beatty LLC

- Shikun & Binui Ltd.

- Danya Cebus Ltd

- Ashtrom Group Ltd

- Saudi BinLadin Group

- Al Ayuni Investment & Contracting Co.

- Arabian Bemco Contracting Co.

- Orascom Construction PLC

- Hassan Allam Construction

- The Arab Contractors (Osman Ahmed Osman & Co.)

- WBHO Construction

- Stefanutti Stocks

- Raubex Group Limited

- Redcon Construction Company

- Estim Construction Co. Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 559 |

| Published | November 2025 |

| Forecast Period | 2024 - 2034 |

| Estimated Market Value ( USD | $ 16.04 Trillion |

| Forecasted Market Value ( USD | $ 27.74 Trillion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 117 |