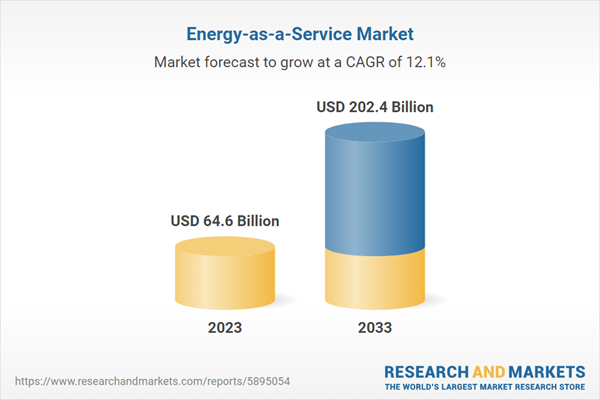

The global energy-as-a-service market reached a value of nearly $64.63 billion in 2023, having grown at a compound annual growth rate (CAGR) of 7.76% since 2018. The market is expected to grow from $64.63 billion in 2023 to $116.21 billion in 2028 at a rate of 12.45%. The market is then expected to grow at a CAGR of 11.74% from 2028 and reach $202.41 billion in 2033.

Growth in the historic period resulted from the surge in energy demand and consumption, rising government support, increasing distributed energy resources, increasing number of smart meters and economic growth in emerging markets. Factors that negatively affected growth in the historic period include rising security concerns in the energy sector.

Going forward, the renewable energy expansion, energy transition policies and investments, rise in digitalization, rapid industrialization, rising urbanization and rising demand for electric vehicles will drive the market. Factors that could hinder the growth of the energy-as-a-service market in the future include high upfront costs of energy-saving devices.

The energy-as-a-service market is segmented by service into energy supply services, operation and maintenance and optimization and efficiency services. The energy supply services market was the largest segment of the energy-as-a-service market segmented by service, accounting for 40.47% or $26.15 billion of the total in 2023. Going forward, the optimization and efficiency services segment is expected to be the fastest growing segment in the energy-as-a-service market segmented by service, at a CAGR of 13.80% during 2023-2028.

The energy-as-a-service market is segmented by provider into utility service provider and third-party provider. The utility service provider market was the largest segment of the energy-as-a-service market segmented by provider, accounting for 62.83% or $40.61 billion of the total in 2023. Going forward, the third-party provider segment is expected to be the fastest growing segment in the energy-as-a-service market segmented by provider, at a CAGR of 13.20% during 2023-2028.

The energy-as-a-service market is segmented by end-user into residential, commercial and industrial. The commercial market was the largest segment of the energy-as-a-service market segmented by end-user, accounting for 58.54% or $37.84 billion of the total in 2023. Going forward, the industrial segment is expected to be the fastest growing segment in the energy-as-a-service market segmented by end-user, at a CAGR of 13.83% during 2023-2028.

North America was the largest region in the energy-as-a-service market, accounting for 44.98% or $29.07 billion of the total in 2023. It was followed by Western Europe, Asia-Pacific and then the other regions. Going forward, the fastest-growing regions in the energy-as-a-service market will be Asia-Pacific and North America, where growth will be at CAGRs of 15.11% and 12.43% respectively. These will be followed by Eastern Europe and Western Europe, where the markets are expected to grow at CAGRs of 11.50% and 11.29% respectively.

The global energy-as-a-service market is fairly fragmented, with a large number of players operating in the market. The top ten competitors in the market made up to 22.1% of the total market in 2023. Veolia Environment S.A. was the largest competitor with a 5.2% share of the market, followed by Enel S.p.A with 4%, Schneider Electric SE with 3.8%, Engie SA with 2.7%, Siemens AG with 2%, EDF Energy with 1.2%, Honeywell International Inc. with 1.1%, Capstone Green Energy Corporation with 1%, AltaGas Ltd with 0.6% and Edison International (Edison Energy, LLC) with 0.5%.

The top opportunities in the energy-as-a-service market segmented by service will arise in the energy supply services segment, which will gain $18.46 billion of global annual sales by 2028. The top opportunities in the energy-as-a-service market segmented by provider will arise in the utility service provider segment, which will gain $30.75 billion of global annual sales by 2028. The top opportunities in the energy-as-a-service market segmented by end-user will arise in the commercial segment, which will gain $27.77 billion of global annual sales by 2028. The energy-as-a-service market size will gain the most in the USA at $18.99 billion.

Market-trend-based strategies for the energy-as-a-service market include focus on artificial intelligence to enhance customer engagement and system efficiency, strategic partnerships and collaborations among market players, launch of virtual power plants to drive renewable integration, focus on battery energy storage to enhance savings and service offerings and use of cloud technology to optimize energy efficiency.

Player-adopted strategies in the energy-as-a-service market include launching new initiatives focused on energy-as-a-service, particularly in the context of their strategic goals for ecological transformation and sustainability, focus on initiating new plans to enhance energy-as-a-service offering, focusing on renewable energy and innovative technologies, strengthening market position through new product developments and strengthening business operations through strategic partnerships.

To take advantage of the opportunities, the analyst recommends the energy-as-a-service companies to focus on integrating AI to enhance service offerings, focus on virtual power plants for renewable integration, focus on battery energy storage systems for cost savings, focus on cloud technology for real-time energy management, focus on optimization and efficiency services, focus on third party provider market, expand in emerging markets, continue to focus on developed markets, focus on strategic partnerships to expand service portfolio, provide competitively priced offerings, participate in trade shows and events and focus on tailoring solutions for diverse end-user segments.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Energy-As-A-Service Global Market Opportunities And Strategies To 2033 provides the strategists; marketers and senior management with the critical information they need to assess the global energy-as-a-service market as it emerges from the COVID-19 shut down.Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description

Where is the largest and fastest-growing market for energy-as-a-service? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The energy-as-a-service market global report answers all these questions and many more.The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider energy-as-a-service market; and compares it with other markets.

The report covers the following chapters

- Introduction and Market Characteristics- Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by service, by provider and by end-user.

- Key Trends- Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Macro-Economic Scenario- The report provides an analysis of the impact of the Russia-Ukraine war, impact of the COVID-19 pandemic and impact of rising inflation on global and regional markets, providing strategic insights for businesses in the energy-as-a-service market.

- Global Market Size And Growth- Global historic (2018-2023) and forecast (2023-2028, 2033F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional And Country Analysis- Historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison by region and country.

- Market Segmentation- Contains the market values (2018-2023) (2023-2028, 2033F) and analysis for each segment by service, by provider and by end-user in the market. Historic (2018-2023) and forecast (2023-2028) and (2028-2033) market values and growth and market share comparison by region market.

- Regional Market Size and Growth- Regional market size (2023), historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape- Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies- Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking- Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Market Opportunities And Strategies- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations- This section includes recommendations for energy-as-a-service providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

1) By Service: Energy Supply Services; Operation And Maintenance; Optimization And Efficiency Services2) By Provider: Utility Service Provider; Third-Party Provider

3) By End-User: Residential; Commercial; Industrial

Key Companies Mentioned: Veolia Environment S.A.; Enel SpA; Schneider Electric SE; Engie SA; Siemens AG

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; Italy; Spain; UK; Russia

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; energy-as-a-service indicators comparison.

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

- Veolia Environment S.A.

- Enel SpA

- Schneider Electric SE

- Engie SA

- Siemens AG

- EDF Energy

- Honeywell International Inc.

- Capstone Green Energy Corporation

- AltaGas Ltd

- Edison International (Edison Energy, LLC)

- Jakson Group

- China Shenhua Energy Company Limited

- Envision Energy

- Ming Yang Wind Power Group Limited

- Shanghai Electric

- Suzlon Energy

- Adani Green Energy Limited

- NEC Corporation

- NTPC Limited

- Australian Energy Market Operator

- Macquarie Group Limited

- Keppel

- Nozomi Energy Limited

- Actis

- The Ricoh Company Ltd

- Alpiq

- Centrica plc

- Wendel

- Ørsted A/S

- Johnson Controls International plc

- EKS Energy

- Recap Energy

- Hitachi Energy Ltd

- BaxEnergy

- Tvinn

- Nano Energies

- CEZ ESCO

- Colliers Poland

- Fuergy

- Amper Market, a.s.

- Innogy Polska

- Gazprom

- Rosneft

- Surgutneftegas

- Novatek

- CEZ

- Diverso Energy Inc

- Centrica Business Solutions

- Fotowatio Renewable Ventures (FRV)

- Budderfly

- Energy Toolbase

- Redaptive

- Contemporary Energy Solutions

- Duke Energy

- General Electric Company

- NextEra Energy

- Green Mountain Energy

- TPI Composites

- Renewable Energy Group Inc

- Clearway Energy

- Tesla

- IOGEN Corporation

- Ag-west Bio

- Innergex/Alterra Power

- Bullfrog Power

- 3G Energy

- KEPCO Energy Service Company

- Shell

- Baker hughes

- Eletrobras

- Enphase Energy Inc

- Colbún SA

- Celsia

- Sempra Infraestructura

- Moka Power

- SOLARVIEW

- FLEXIMETAL BRASIL

- GreenStudio Energy Efficiency

- Startup Oika Tecnologia & Inovação

- Mubadala Investment Company

- Sirius Energy

- Yellow Door Energy

- Enova

- Alfanar Energy

- Solar Africa

- Rensource Distributed Energy Ltd

- Juwi Renewable Energies

- Powergen Renewable Energy

- Powerhive

- Daystar Power

- Juabar

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 312 |

| Published | September 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 64.6 Billion |

| Forecasted Market Value ( USD | $ 202.4 Billion |

| Compound Annual Growth Rate | 12.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 91 |