This report describes and explains the veterinary pharmaceuticals market and covers 2018-2023, termed the historic period, and 2023-2028, 2033F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

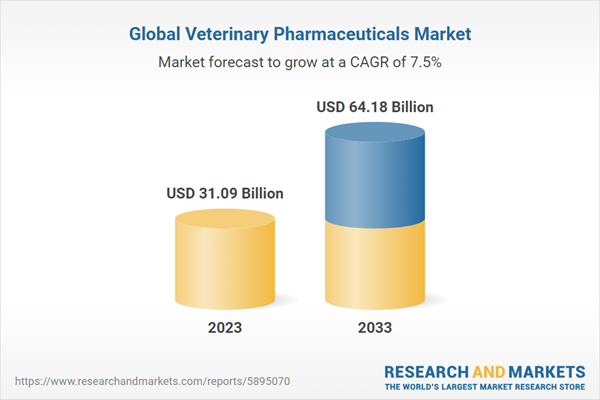

The global veterinary pharmaceuticals market reached a value of nearly $31.09 billion in 2023, having grown at a compound annual growth rate (CAGR) of 6% since 2018. The market is expected to grow from $31.09 billion in 2023 to $43.91 billion in 2028 at a rate of 7.1%. The market is then expected to grow at a CAGR of 7.9% from 2028 and reach $64.18 billion in 2033.

Growth in the historic period resulted from the increased pet population, increased overall spending by individuals on pets, growing penetration of e-commerce platforms promoting online pharmacies and emerging markets growth. Factors that negatively affected growth in the historic period include coronavirus (COVID-19) outbreak, a lack of awareness, inappropriate use of medicines and high cost of animal treatment.

Going forward, the increasing pet ownership, rising disposable income, increasing urbanization, increasing penetration of pet insurance and growing government support will drive the market. Factors that could hinder the growth of the veterinary pharmaceuticals market in the future include a shortage of veterinarians, lack of infrastructure for providing emergency veterinary services, stringent rules and regulations in animal testing and restrictions, high cost associated with animal healthcare drugs in low-middle income countries and increasing influx of counterfeit drugs.

The veterinary pharmaceuticals market is segmented by type into veterinary vaccines, veterinary antibiotics, veterinary parasiticides and other veterinary pharmaceuticals. The veterinary parasiticides market was the largest segment of the veterinary pharmaceuticals market segmented by type, accounting for 42.6% or $13.25 billion of the total in 2023. Going forward, the veterinary antibiotics segment is expected to be the fastest growing segment in the veterinary pharmaceuticals market segmented by type, at a CAGR of 9.9% during 2023-2028.

The veterinary pharmaceuticals market is segmented by type of animal into livestock animals and companion animals. The companion animals market was the largest segment of the veterinary pharmaceuticals market segmented by type of animal, accounting for 51% or $15.86 billion of the total in 2023. Going forward, the companion animals segment is expected to be the fastest growing segment in the veterinary pharmaceuticals market segmented by type of animal, at a CAGR of 9% during 2023-2028.

The veterinary pharmaceuticals market is segmented by route of administration into oral, parenteral, topical and other routes of administration. The parenteral market was the largest segment of the veterinary pharmaceuticals market segmented by route of administration, accounting for 45.6% or $14.18 billion of the total in 2023. Going forward, the oral segment is expected to be the fastest growing segment in the veterinary pharmaceuticals market segmented by route of administration, at a CAGR of 7.4% during 2023-2028.

The veterinary pharmaceuticals market is segmented by type of vaccine into inactivated vaccines, attenuated vaccines, recombinant vaccines and other vaccines. The attenuated vaccines market was the largest segment of the veterinary pharmaceuticals market segmented by type of vaccine, accounting for 39.1% or $12.14 billion of the total in 2023. Going forward, the recombinant vaccines segment is expected to be the fastest growing segment in the veterinary pharmaceuticals market segmented by type of vaccine, at a CAGR of 7.4% during 2023-2028.

The veterinary pharmaceuticals market is segmented by end-user into veterinary hospitals, veterinary clinics and pharmacies and drug stores. The veterinary hospitals market was the largest segment of the veterinary pharmaceuticals market segmented by end-user, accounting for 49.7% or $15.44 billion of the total in 2023. Going forward, the veterinary clinics segment is expected to be the fastest growing segment in the veterinary pharmaceuticals market segmented by end-user, at a CAGR of 9% during 2023-2028.

North America was the largest region in the veterinary pharmaceuticals market, accounting for 46.4% or $14.42 billion of the total in 2023. It was followed by Asia-Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the veterinary pharmaceuticals market will be South America and the Middle East, where growth will be at CAGRs of 20.3% and 18.9% respectively. These will be followed by Africa and Eastern Europe, where the markets are expected to grow at CAGRs of 12.4% and 7.7% respectively.

The global veterinary pharmaceuticals market is highly concentrated, with a few large players operating in the market. The top ten competitors in the market made up 60.3% of the total market in 2022. Merck & Co Inc was the largest competitor with a 15.5% share of the market, followed by Boehringer Ingelheim International GmbH with 13.4%, Elanco Animal Health Incorporated with 9.2%, Zoetis Inc with 8.5%, Ceva Sante Animale with 4.7%, Virbac SA with 3.6%, Vetoquinol S.A with 2%, Dechra Pharmaceuticals PLC with 1.8%, Evonik Industries AG with 1.4% and Zydus Animal Health with 0.3%.

The top opportunities in the veterinary pharmaceuticals market segmented by type will arise in the veterinary parasiticides segment, which will gain $4.73 billion of global annual sales by 2028. The top opportunities in the veterinary pharmaceuticals market segmented by type of animal will arise in the companion animals segment, which will gain $8.58 billion of global annual sales by 2028. The top opportunities in the veterinary pharmaceuticals market segmented by type of vaccine will arise in the attenuated vaccines segment, which will gain $5.13 billion of global annual sales by 2028. The top opportunities in the veterinary pharmaceuticals market segmented by route of administration will arise in the parenteral segment, which will gain $5.82 billion of global annual sales by 2028. The top opportunities in the veterinary pharmaceuticals market segmented by end-user will arise in the veterinary hospitals segment, which will gain $5.67 billion of global annual sales by 2028. The veterinary pharmaceuticals market size will gain the most in the USA at $2 billion.

Market-trend-based strategies for the veterinary pharmaceuticals market include focus on stem cell therapy to treat animals, focus on application of nanotechnology in veterinary medicines to tackle antibiotic resistance, focus on development of chewable tablets to improve convenience and compliance in animals, focus on use of telemedicine platforms, focus on development of advanced vaccines to reduce disease burden in animals, focus on development of super-combo parasiticides to help control parasites, focus on use of subunit and virus-like particle (VLP)-based vaccines and focus on strategic partnerships and collaborations among market players.

Player-adopted strategies in the veterinary pharmaceuticals market include focus on expanding business capabilities through new product launches and focus on strengthening business operations through strategic partnerships.

To take advantage of the opportunities, the analyst recommends the veterinary pharmaceuticals companies to focus on adopting stem cell therapy for orthopedic conditions in high-value species, focus on leveraging nanotechnology for veterinary pharmaceuticals, focus on developing chewable tablets for enhanced treatment compliance, focus on integrating telemedicine platforms for enhanced veterinary care, focus on advancing vaccine development for animal health, focus on developing combination parasiticides for enhanced parasite control, focus on veterinary antibiotics segment, focus on companion animals segment, focus on recombinant vaccines segment, expand in emerging markets, focus on strategic partnerships for market expansion, focus on diversifying distribution channels, provide competitively priced offerings, focus on educational content marketing, participate in trade shows and events, continue to use B2B promotions and focus on building strong partnerships with veterinary professionals.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Veterinary Pharmaceuticals Global Market Opportunities and Strategies to 2033 provides the strategists; marketers and senior management with the critical information they need to assess the global veterinary pharmaceuticals market as it emerges from the COVID-19 shut down.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 16 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description

Where is the largest and fastest-growing market for veterinary pharmaceuticals? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The veterinary pharmaceuticals market global report answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider veterinary pharmaceuticals market; and compares it with other markets.

The report covers the following chapters:

- Introduction and Market Characteristics - Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by type, by type of animal, by type of vaccine, by route of administration and by end-user.

- Key Trends - Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Macro-Economic Scenario - The report provides an analysis of the impact of the Russia-Ukraine war, impact of the COVID-19 pandemic and impact of rising inflation on global and regional markets, providing strategic insights for businesses in the veterinary pharmaceuticals market.

- Global Market Size and Growth - Global historic (2018-2023) and forecast (2023-2028, 2033F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional and Country Analysis - Historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison by region and country.

- Market Segmentation - Contains the market values (2018-2023) (2023-2028, 2033F) and analysis for each segment by type, by type of animal, by type of vaccine, by route of administration and by end-user in the market. Historic (2018-2023) and forecast (2023-2028) and (2028-2033) market values and growth and market share comparison by region market.

- Regional Market Size and Growth - Regional market size (2023), historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape - Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major and Innovative Companies - Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking - Briefs on the financials comparison between major players in the market.

- Competitive Dashboard - Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions - Information on recent mergers and acquisitions in the market is covered in the report. This section gives key financial details of mergers and acquisitions which have shaped the market in recent years.

- Market Opportunities and Strategies - Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions and Recommendations - This section includes recommendations for veterinary pharmaceuticals providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.

- Appendix - This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

1) by Type: Veterinary Vaccines; Veterinary Antibiotics; Veterinary Parasiticides; Other Veterinary Pharmaceuticals

2) by Type of Animal: Livestock Animals; Companion Animals

3) by Type of Vaccine: Inactivated Vaccines; Attenuated Vaccines; Recombinant Vaccines; Other Vaccines

4) by Route of Administration: Oral; Parenteral; Topical; Other Routes of Administration

5) by End-User: Veterinary Hospitals; Veterinary Clinics; Pharmacies and Drug Stores

Key Companies Mentioned: Merck & Co., Inc.; Boehringer Ingelheim International GmbH; Elanco Animal Health Incorporated; Zoetis Inc; Ceva Sante Animale

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Ontario; Brazil; France; Germany; Italy; Spain; UK; Russia

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; veterinary pharmaceuticals indicators comparison.

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

- Merck & Co., Inc.

- Boehringer Ingelheim International GmbH

- Elanco Animal Health Incorporated

- Zoetis Inc

- Ceva Sante Animale

- Virbac SA

- Dechra Pharmaceuticals PLC

- Vetoquinol S.A.

- Evonik Industries AG

- Zydus Animal Health

- Milma

- Immunologix India Pvt Ltd (IGY)

- DCC Animal Hospital

- Sun Pharmaceuticals Industries Limited

- Vivaldis Health and Foods Pvt Ltd

- Zenex Animal Health India Private Limited (Zenex)

- New Ruipeng Group (NRP Group)

- National Meditek

- Fartovet Industry Limited

- Hebei Chengshengtang Animal Pharmaceutical

- Shijiazhuang Fengqiang Animal Pharmaceutical Co Ltd

- Vvaan Lifesciences Private Limited

- Century Pharmaceuticals Limited

- Cargill India Pvt Ltd

- Jurox Pty Ltd

- IDT Biologika GmbH

- Scil Animal Care

- Heska Corporation

- Heiland GmbH

- Global Stem Cell Technology

- Inovet

- Ceva Santé Animale

- Bayer

- Veteq

- Nimrod Veterinary Products Ltd

- Bimeda

- Vetoquinol SA

- Orion Animal Health

- Laboratorios Calier SA

- Petmedix

- Eco Animal Health

- Teknofarma

- Farmavet

- Candioli Pharma

- Suanfarma

- Marino Ibericamed

- MPA veterinary

- Lamons Laboratories SA

- Swetrade Pharmaceuticals AB

- Animalcare

- AVZ LTD

- Nasr Pharmaceutical Company

- VIC Group

- VET-AGRO Sp. z o. o

- CANPOLAND SA

- Cymedica

- NITA-FARM

- Apicenna LLC

- Delos Medica

- Provet Group

- VitOMEK LCC

- Bioveta AS

- Veterinarski Zavod Subotica

- Biowet Puławy sp. z o.o

- PharmaGal s.r.o

- Bond Vet

- VetStrategy

- Diamond Animal Health

- Phibro Animal Health Corporation

- VetNova

- Piedmont Animal Health

- Modern Animal

- Merck & Co Inc

- Trifecta Pharmaceuticals USA LLC

- Alberta Veterinary Laboratories Ltd

- Virbac

- Veterinary Purchasing Co Ltd

- Maure

- Ouro Fino Saúde Animal Participações

- Peru Animal Hospital

- Miami County Veterinary Clinic

- Cindy Fouts

- Vetanco

- Chemo Argentina

- Brouwer

- Agrovet Market Animal Health

- Lemavet

- Primo Veterinary Medicines Trading LLC

- Eurovets Veterinary Suppliers

- Physio Evolution

- Herzliya Veterinary Hospital

- Oron Veterinary Center

- Saudi Pharmaceutical Industries (SPI)

- DBK Pharma S.A.E

- MSD Animal Health

- Afrivet

- Dawa Limited

- Aesthetics Limited

- Neimeth International Pharmaceuticals

- Osy-Adamu Pharmaceutical Co

- M S J Afro Agro Pharmacy

- Global Vet (U) Ltd

- Multivet Ghana Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2024 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 31.09 Billion |

| Forecasted Market Value ( USD | $ 64.18 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 103 |