Global Venous Stents Market Overview

Venous stents are metal mesh-like tubes that expand against narrowed or blocked vein walls in order to maintain the blood flow. These stents are used in the treatment of conditions like chronic venous insufficiency (CVI) and deep vein thrombosis (DVT) to ensure proper blood flow through the affected vein. The market is driven by increasing advancements in venous stent design, rising healthcare expenditure and initiatives to boost awareness around early detection of diseases across the globe.Global Venous Stents Market Growth Drivers

Increasing Prevalence of Venous Diseases to Affect the Market Landscape Significantly

The increase in prevalence of venous diseases like deep vein thrombosis, venous thromboembolism, and May-Thurner syndrome among others which can be attributed to lifestyle changes and increasing obesity cases in the population is driving growth for venous stents. The economic burden of the disease is also significant due to the cost of medical care.Adoption of Wallstent Technology to Meet Rising Venous Stents Market Demand

With a rising need to combat venous diseases, the market is witnessing several innovations in products and technology to offer improved solutions to patients. Self-expending stents are taking over the market with the products like Vici, Venovo Venous Stent System, and Abre Venous Self-Expanding Stent System launched by the major market players. Wallstent technology offers multiple advantages such as reduction in complications, improved central venous luminal diameter and provides treatment of symptomatic venous outflow obstruction. Venous Wallstent provides compression resistance as well as fracture resistance. The integration of such technologies is expected to drive market growth and provide a better quality of life to patients.Global Venous Stents Market Trends

The market is witnessing several trends and developments to improve the current global scenario. Some of the notable trends are as follows:Increasing Obesity Rates

Obesity is a major risk for venous diseases, as the body weight can pressurize veins, leading to damage to valves. Along with these, sedentary lifestyle and diabetes can exacerbate the risk of DVT in individuals. In addition, older people are more susceptible to venous conditions due to reduced mobility.Advancements in Technology

Development of advanced venous stents provides superior performance. They are made more flexible without compromising strength. Incorporation of new materials and coatings are being developed taken into consideration the biocompatibility. To prevent restenosis, drug eluting stents are being developed which locally release drug over a period of time. Bioresorbable stents, intended to be dissolved in the body are also emerging.Increasing Demand for Minimally Invasive Procedures

There is a shift from traditional open surgeries to minimally invasive surgeries. The shift can be accredited to several benefits such has smaller incisions and faster recovery time. Minimally invasive surgeries also provide reduced risk of complications and pain. Advancements in surgical tools and imaging technology improves efficacy and safety.Increased Public Awareness

Education campaigns by healthcare personnel and manufacturers targets to educate the public regarding the symptoms and risks associated with venous diseases. Spreading awareness to emphasize the importance and benefit of recognizing signs and early diagnosis to prevent worsening of conditions, along with information around minimally invasive procedures is another market trend.Global Venous Stents Market Segmentation

Venous Stents Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Technology

- Iliac Vein Stent Technology

- Wallstent Technology

- Others

Market Breakup by Indication

- Chronic Deep Vein Thrombosis

- Post Thrombotic Syndrome

- May-Thurner Syndrome

- Pelvic Congestion Syndrome (PCS)

- Others

Market Breakup by Application

- Leg

- Chest

- Abdomen

- Others

Market Breakup by End User

- Hospitals

- Ambulatory Surgery Centers

- Specialty Clinics

- Cardiac Catheterization Labs

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Venous Stents Market Share

Wallstent Technologies Expected to Lead the Market Share Based on Technology

Based on technology, the market segmentation includes iliac vein stent technology, wallstent technology, and others. Wallstent technology is popular for its high adaptability as well as structural flexibility to venous anatomy and holds a notable market share. Iliac vein stent technology is experiencing rapid growth. The growth is propelled by its vital role in treatment of iliac vein obstruction. It is further fueled by advancements in imaging technologies and procedural techniques which enhances safety and precision of stent placements.Market Segmentation Based on Disease Areas is Anticipated to Witness Substantial Growth

Based on disease, the market constitutes acute deep vein thrombosis (DVT), chronic DVT/ post-thrombotic syndrome (PTS), non-thrombotic iliac vein lesions (NIVL)/May-Thurner Syndrome (MTS) among others. Out of these, acute DVT is estimated to hold a significant market share. NIVL/MTS is also projected to witness substantial growth, owing to advancements in diagnostic technology which are enhancing the specificity of treatment for the condition. As awareness regarding this conditions rise, the demand for specialized stents is also expected to increase.Global Venous Stents Market Analysis by Region

On the basis of region, the market report offers an insight into North America, Europe, Asia Pacific, Latin America, Middle East, and Africa. North America boasts an advanced healthcare infrastructure along with presence of key healthcare companies. As a result, it leads the market share. In addition, investments in research and development and medical devices are boosting this region's market growth. Europe follows closely, with growth driven by governmental support for healthcare innovations and growing prevalence of venous conditions. Focus on improving healthcare outcomes and adoption of new technologies are the major factors for the market's expansion.Leading Players in the Global Venous Stents Market

The key features of the market report include patent analysis, grants analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Abbott Laboratories

- Becton, Dickinson and Company

- Bentley

- Boston Scientific Corporation

- Cardinal Health

- Cook Group Incorporated

- Koninklijke Philips N.V.

- Medtronic

- W.L Gore & Associates, Inc.

- Shanghai MicroPort Endovascular MedTech (Group)Co., Ltd.

- Jotec GmbH

- Optimed Medizinische Instrumente GmbH

- MicroPort Scientific Corporation

- Medica Germany GMBH & Co.KG

- Cordis Inc.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Becton, Dickinson and Company

- Bentley

- Boston Scientific Corporation

- Cardinal Health

- Cook Group Incorporated

- Koninklijke Philips N.V.

- Medtronic

- W.L Gore & Associates, Inc.

- Shanghai MicroPort Endovascular MedTech (Group)Co., Ltd.

- Jotec GmbH

- Optimed Medizinische Instrumente GmbH

- MicroPort Scientific Corporation

- Medica Germany GMBH & Co.KG

- Cordis Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

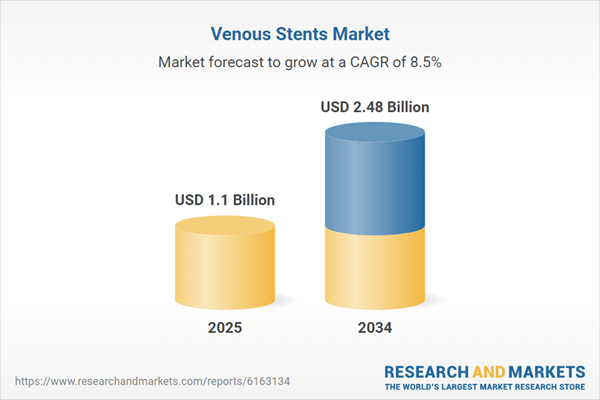

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 2.48 Billion |

| Compound Annual Growth Rate | 8.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |