Effervescent Tablet: Introduction

Effervescent tablets are the type of tablets that dissolve easily in water or other liquids while releasing carbon dioxide. The tablet breaks down easily hence it dissolves into a frothy or fizzy solution. With the use of these tablets, various other drugs can be consumed by consumers. Effervescent tablets come with various advantages. The tablets quickly deliver the dosage to the body as the medications are supplied in the form of a readily absorbed solution.Effervescent tablets are manufactured by compressing powdered ingredients into a compact form, which is then packaged either in a blister pack or a hermetically sealed package that includes a desiccant in the cap. To use them, simply drop the tablets into water to create a solution. Alternatively, the powdered ingredients may be sold as effervescent powders or granulated and sold as effervescent granules.

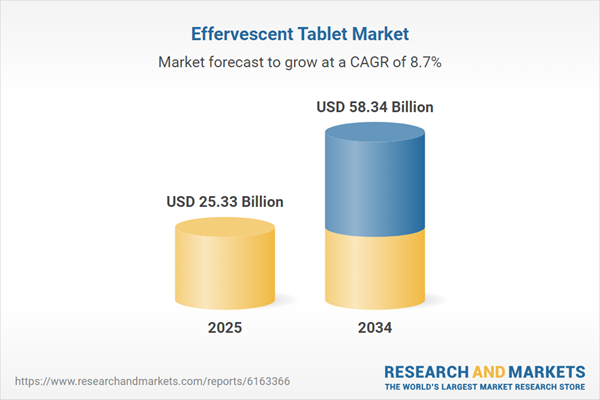

Global Effervescent Tablet Market Analysis

The market is witnessing an increase in the number of research and development activities, which further aids the growth of the market. Major key players in the market are continuously working on developing novel drugs to enhance the health and lifestyle of patients. The innovation in the formulation of these tablets is also responsible for increasing global effervescent tablets market share. For example, effervescent products that quickly transform into beverages are beneficial for the environment as they decrease the use of plastics. The use of various formulations of materials also enhances the process of administration, further increasing the global effervescent tablets market growth.The heavy investments in the development of innovative technologies and novel effervescent products are also expected to majorly boost market growth by providing market opportunities for manufacturers to develop new and innovative effervescent products.

Global Effervescent Tablet Market Segmentations

The report titled “Effervescent Tablet Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Medication

- Supplement

Market Breakup by Type

- Prescription Based

- Over The Counter (OTC)

Market Breakup by Application

- Pharmaceutical

- Dietary Supplements

- Dental Products

- Others

Market Breakup by End User

- Hospitals

- Homecare

- Specialty Clinics

- Others

Market Breakup by Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Effervescent Tablet Market Overview

The growth of the market can be significantly attributed to the increasing prevalence of chronic diseases globally. These tablets are easy to use and only require a drop of water to make a solution. The increased demand for effervescent tablets is driven by various aspects, such as the pleasant taste, distribution more evenly, increased liquid intake, easy alternative to regular tablets, and simple and easy-to-measure. These tablets are even safe to consume comparatively. The easy availability of these tablets over various distribution channels is a major factor driving the global effervescent tablets market growth. For example, the availability of these tablets even as glucose tablets provides a quick energy boost. This acts as a major relief to chronic patients and thus boosts the market growth.The increasing health awareness among people and rising disposable income have also shifted their focus towards healthy products, such as probiotics, vitamins, dietary supplements, and minerals, which further drives the global effervescent tablets market growth.

The widespread availability of effervescent products, such as dietary supplements to prevent diseases, and nutritional deficiencies and improve consumers' overall health and lifestyle, is a major factor fuelling the market growth. The production of new products and launches in the market is expected to drive the market growth further.

Geographically, North America is expected to dominate the market due to the presence of major key players. The increased healthcare expenditure is also expected to boost the growth of the regional market. The market is also driven by the increasing number of research and development activities in the region.

Global Effervescent Tablet Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Pfizer Inc.

- GSK plc

- Novartis AG

- Bayer AG

- Perrigo Company plc

- Reckitt Benckiser Group PLC

- Bristol-Myers Squibb Company

- CHIESI SAS

- Hermes Pharma

- S. G. Biopharm Pvt. Ltd

- Bliss GVS Pharma Limited

- Amerilab Technologies Inc.

- HERMES ARZNEIMITTEL

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Pfizer Inc.

- GSK plc

- Novartis AG

- Bayer AG

- Perrigo Company plc

- Reckitt Benckiser Group PLC

- Bristol-Myers Squibb Company

- CHIESI SAS

- Hermes Pharma

- S. G. Biopharm Pvt. Ltd

- Bliss GVS Pharma Limited

- Amerilab Technologies Inc.

- HERMES ARZNEIMITTEL

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 25.33 Billion |

| Forecasted Market Value ( USD | $ 58.34 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |