Enteric Disease Testing: Introduction

Diseases that are caused by microorganisms such as bacteria, parasites, and virus through the consumption of contaminated food or water are known as enteric diseases. Enteric disease could be air-borne, thus they are capable of spreading from one person to another. The common symptoms associated with these diseases include vomiting, nausea, diarrhoea, fever, abdominal cramps, chills, and loss of appetite, among others. The symptoms can appear as soon as thirty minutes or within a span of about 7 to 10 days. The official records for the number of cases associated with enteric diseases are not completely accurate because the symptoms are same as flu, and it often takes longer to identify as enteric disease.Global Enteric Disease Testing Market Analysis

The increasing awareness about consuming safe and clean food and water is primarily driving the growth of the market. People are increasingly focusing on frequent hand washing, eating properly cooked food, and drinking water from reliable sources only, especially after the COVID-19 pandemic. This has also increased the enteric diseases testing market because people have started taking these symptoms more seriously and prefer getting a proper checkup done if the symptoms last longer than three days.The increasing investments from pharmaceutical companies and research institutions to help in the development of novel therapies for enteric diseases is directly influencing the global enteric disease testing market growth. Additionally, the increasing focus on improved diet intake in the form of balanced diets and health supplements to improve the immune system to fight against such diseases is also aiding the market growth. The rise in demand for the development of vaccines against these enteric viruses is also a major trend. New vaccines with enhanced efficacy for enteric diseases are currently under development and might aid the market growth in the coming years if they attain approval.

Global Enteric Disease Testing Market Segmentations

Enteric Disease Testing Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market by Technology

- Traditional

- Rapid

Market Breakup by Applications

- Food

- Dairy Products

- Processed Food

- Food and Vegetable

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Enteric Disease Testing Market Overview

The market has been witnessing a substantial rise and is expected to continue growing gradually. Factors such as rising prevalence of bacterial diseases and viruses, including gastroenteritis, food poisoning, and infections, caused by pathogens such as Salmonella, E.coli, and norovirus, are significantly driving the enteric disease testing market growth. There has been a substantial awareness about enteric diseases among governments which is resulting in various educational initiatives and campaigns by healthcare organizations with the support of government has helped creating awareness about the impact of enteric diseases and how to prevent it. Such initiatives are directly contributing to the growth of the market.Enteric Disease Testing Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- Biomerica, Inc.

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Cepheid (Danaher Corporation)

- CorisBioconcept SPRL

- DiaSorin S.p.A.

- Meridian Bioscience, Inc.

- Quest Diagnostics Incorporated

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- Abbott Laboratories

- Becton, Dickinson and Company (BD)

- Biomerica, Inc.

- bioMérieux SA

- Bio-Rad Laboratories, Inc.

- Cepheid (Danaher Corporation)

- CorisBioconcept SPRL

- DiaSorin S.p.A.

- Meridian Bioscience, Inc.

- Quest Diagnostics Incorporated

Table Information

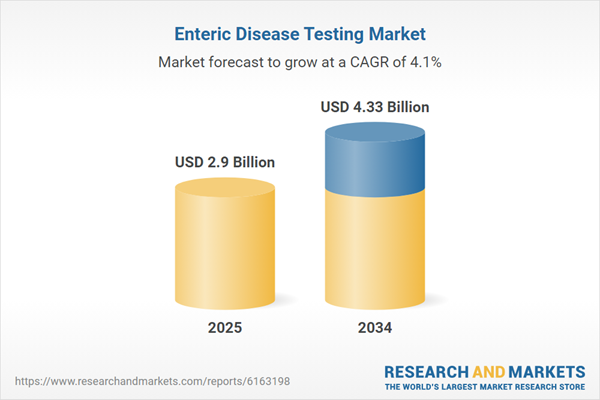

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 4.33 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |