Radiotherapy Patient Positioning Accessories Market Overview

Radiotherapy patient positioning accessories are equipment applied in radiation therapy for patient positioning during treatment. They provide reproducible positioning and accurate setup. This way, radiation therapists can restrict and position their patients effectively and in a reliable way for each treatment session, thus executing proper radiation therapy and avoiding compromising the surrounding healthy tissues.Radiotherapy Patient Positioning Accessories Market Growth Drivers

Rising Prevalence of Cancer Driving Demand for Radiotherapy Patient Positioning Accessories

According to the American Cancer Society in the United States, about 1,958,310 new cancer cases and 609,820 cancer deaths were anticipated to occur in 2023. The rising prevalence of cancer is an important factor in boosting the demand for radiotherapy patient positioning accessories because positioning patients is important to enhance the effectiveness of treatment. More complex positioning systems, such as immobilization devices and robotics, help in guaranteeing that the patient’s position during sessions is stable. These accessories favor the effectiveness of radiotherapy and contribute to better outcomes while minimizing side effects, which makes them very important in the treatment of cancer today.Rising Adoption of Radiotherapy to Fuel Radiotherapy Patient Positioning Accessories Market Demand

With the growing popularity and accessibility of radiotherapy, the demand for high-quality positioning accessories is evident because the technique is accurate in placing its effects directly on the desired areas. Successful localization is important since it can enable the delivery of radiation to the target area without affecting the adjacent healthy tissues. Accordingly, there is a raised need for high-end positioning accessories such as immobilization devices and alignment systems.Radiotherapy Patient Positioning Accessories Market Trends

Several trends and developments are being observed in the market to enhance the current situation. Some of the noteworthy trends are as follows:

Technological Advancements

Technological advancements include 3D printing technologies, robotic positioners, and automation in alignments due to enhanced accuracy, better precise positioning, and enhanced patient comfort during treatment. These innovations improve the effectiveness of the treatments and the patient’s adherence, thus contributing to market development and change.Focus on Patient Comfort

Manufacturers are developing smoother, and easily adjustable tools and mold shapes to decrease stressful feeling and unwanted side effects while focusing on accurate radiation delivery. These attributes provide a better patient experience and enhance the treatment results.Integration of Artificial Intelligence (AI)

Artificial intelligence (AI) is a game changer in radiotherapy patient positioning accessories because it involves analyzing patient information and making smart suggestions about the correct positioning of the patient. This technology improves efficiency, significantly reduces errors, optimizes, and structures the health industry’s processes, and positively impacts patients, expanding the market. It also enhances the delivery of radiation treatment outcomes and efficiency for medical personnel.

Growing Demand for Image- Guided Radiotherapy (IGRT)

As the utilization of image-guided radiotherapy (IGRT) is on the rise, they require new real-time imaging methods to change the radiotherapy process for patient positioning accessories. This contributes to the improvement of precision and accuracy since the clinician can adjust the position of the patient or the position of the body part under irradiation to exclude off-target exposure to radiation. Thus, IGRT enhances the outcomes of treatments, the patient’s quality of life, and the demand for the installation of more specialized accessories for positioning patients.

Radiotherapy Patient Positioning Accessories Market Segmentation

Radiotherapy Patient Positioning Accessories Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product Type

- Couch Tops & Overlays

- CT Overlays

- MR Overlays

- Immobilization Solutions

- Thermoplastic Masks & Sheets

- Vacuum Bags

- Markers

- Others

- Tables

- Patient Transfer System

- Other Products

Market Breakup by Application

- Surgeries

- Diagnostic & Imaging

- Cancer Therapy

Market Breakup by End User

- Hospitals

- Radiation Therapy Centers

- Diagnostic Centers

- Others

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Radiotherapy Patient Positioning Accessories Market Share

Cancer Therapy is Anticipated to Have Largest Market Share Based on Application

Based on the application, the radiotherapy patient positioning accessories market is divided into surgeries, diagnostic and imaging, along with cancer therapy. Among these segments, cancer therapy is leading the market share. The rise in cancer cases and the use of newer radiation therapy techniques make accurate positioning of the patient important for therapy. There is an increasing need for positioning accessories in radiotherapy as this improves radiation delivery Localization and destroys cancerous tissues leaving healthy tissues unaffected.Hospitals are Expected to Dominate the Market Segmentation Based on End Users

Based on the end user, the global radiotherapy patient positioning accessories market is divided into hospitals, diagnostic centers, radiation therapy centers, and others. This segment is led by hospitals because of the vast network, sophisticated equipment acquisition, and high treatment turnover of radiotherapies. Their services in cancer care diagnosis, treatment, and post-treatment make them one of the most recommended facilities by patients and the healthcare community. The market share is followed by diagnostic centers, expected to attain a market value of USD 171.81 million by 2034.Radiotherapy Patient Positioning Accessories Market Analysis by Region

Based on the region, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America holds the largest market share because of its well-developed healthcare facilities, high healthcare spending, and increased use of the latest radiotherapy techniques. North America is expected to reach a market value of USD 355.11 million by 2034 from USD 252.89 million in 2024, at a CAGR of 4.3%. The involvement of important stakeholders and R&D initiatives in the region gives added strength to the market. This regional leadership provides the impetus for innovation and the precise and accurate positioning of patients’ accessories.The Asia Pacific region will witness rapid growth during the forecast period of 2025-2034, attaining a market value of USD 159.69 million by 2034. The market growth can be attributed as the incidence of cancer continues to rise, well established healthcare system and the development of advanced technology.

Leading Players in the Radiotherapy Patient Positioning Accessories Market

The key features of the market report include patent analysis, funding and investment analysis, and strategic initiatives by the leading players. The major companies are:BIONIX LLC.

Founded in 1984 and based in Toledo, Ohio, United States, the company deals mainly with various new patient positioning and immobilization products for radiation therapy. Their products are AccuFix Cushions, which provide individual customization of patient positioning and immobilization. AccuForm masks are designed to fit the head and neck region and are planned with thermoplastic for patient positioning all through the treatment period.

CQ Medical

Established in 1982 and is based in Avondale, Pennsylvania, the company offers immobilization systems like thermoplastic masks/sheets, Vac-Lok™ bags for vacuum immobilization. These invasions worked to improve treatment accuracy without influencing the comfort and security of the patients.Orfit Industries

It is a Belgium-based company founded in 1983. Their products are available in the form of thermoplastic masks that easily conform to the shape of the patient, immobilizing the area to be treated for accurate radiation delivery. Head supports and cushions are used in the treatment of the head and neck. These supports give patients confidence for any position in the session and reduce discomfort.CDR Systems

Established in 2002, and based in Alberta, Canada, the company offers various types of patient positioning accessories for radiotherapy purposes. They include the CDR Couchtops, for patient comfort and positioning, the CDR Vacuum Bags, which are used for precise immobilization by utilizing vacuum technology, and the CDR Masks, which are made from thermoplastic to ease the process of immobilizing the head and neck.Other companies include Klarity Medical, IZI Medical Products, and Best Medical International, Inc., among others.

Key Questions Answered in the Radiotherapy Patient Positioning Accessories Market

- What was the global radiotherapy patient positioning accessories market value in 2024?

- What is the global radiotherapy patient positioning accessories market forecast outlook for 2025-2034?

- What are the regional markets covered in the report?

- What is the market breakup based on product type?

- What is the market segmentation based on application?

- What is the market breakup based on the end users?

- What are the major factors aiding the global radiotherapy patient positioning accessories market demand?

- What are the market's major drivers, opportunities, and restraints?

- Which regional market is expected to lead the market share in the forecast period?

- Which country is expected to experience expedited growth during the forecast period?

- What are the major global radiotherapy patient positioning accessories market trends?

- How does the rise in the geriatric population impact the market size?

- Who are the key players involved in the radiotherapy patient positioning accessories market?

- What are the current unmet needs and challenges in the market?

- How are partnerships, collaborations, mergers, and acquisitions among the key market players shaping the market dynamics?

- How is the demand for couch tops and overlays evolving with advancements in radiotherapy techniques?

- How effective are vacuum bags and markers in improving treatment precision?

- What impact do positioning accessories have on the outcomes of surgical procedures?

- What factors make hospitals the largest end-user segment for radiotherapy patient positioning accessories?

- How are positioning accessories tailored to meet the needs of radiation therapy centers?

- What factors contribute to North America's leading position in the radiotherapy patient positioning accessories market?

- What are the growth opportunities in the Asia Pacific market for patient positioning accessories?

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- BIONIX LLC.

- CQ Medical

- Orfit Industries

- CDR Systems

Table Information

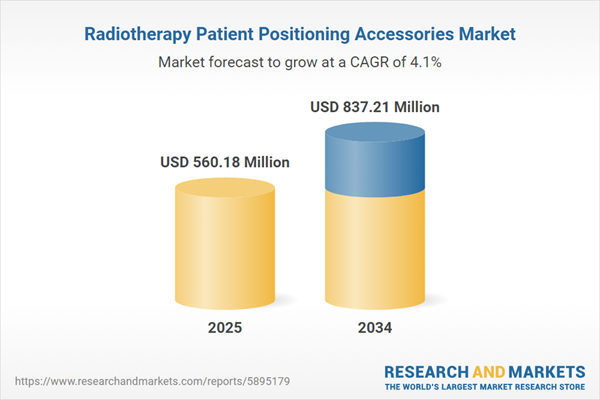

| Report Attribute | Details |

|---|---|

| No. of Pages | 400 |

| Published | June 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 560.18 Million |

| Forecasted Market Value ( USD | $ 837.21 Million |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 4 |