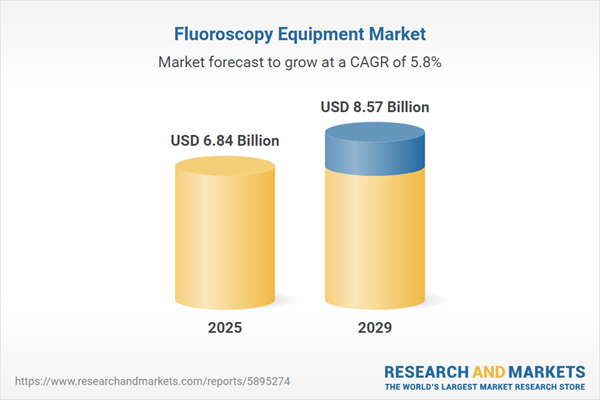

The fluoroscopy equipment market size is expected to see strong growth in the next few years. It will grow to $8.57 billion in 2029 at a compound annual growth rate (CAGR) of 5.8%. The growth in the forecast period can be attributed to rapid growth of ambulatory surgical centers, expansion of cardiovascular interventions, focus on radiation dose reduction, increasing popularity of hybrid operating rooms, integration with other imaging modalities. Major trends in the forecast period include technological innovations in imaging, advancements in imaging technology, remote guidance and collaboration, enhanced data integration and analytics, and focus on ergonomics and user experience.

The anticipated growth of the fluoroscopy equipment market is expected to be propelled by the increasing prevalence of chronic diseases. Chronic diseases, characterized by lasting a year or longer and requiring ongoing medical attention, are on the rise. Fluoroscopy equipment proves valuable in providing real-time functional and anatomic assessments of patients while minimizing radiation exposure when contrast administration is involved. For example, a projection from the National Center for Biotechnology Information (NCBI) in January 2023 estimated that the number of individuals aged 50 years and older with at least one chronic illness would increase to 142.66 million by 2050, representing a 99.5% rise from 71.522 million in 2020. Hence, the growing prevalence of chronic diseases is a significant driver of the fluoroscopy equipment market.

The rising incidence of gastrointestinal disorders is projected to drive the growth of the fluoroscopy equipment market in the future. Gastrointestinal (GI) disorders encompass diseases affecting any part of the gastrointestinal tract. Fluoroscopy is instrumental in diagnosing and managing various GI disorders, utilizing real-time X-rays to visualize internal organs and their movements. This technique is particularly useful for assessing dynamic processes such as swallowing, digestion, and bowel movements. For example, in January 2024, the American Cancer Society, a US-based non-profit organization, estimated that around 26,890 new cases of stomach cancer will be reported in the U.S. in 2024, with 16,160 cases in men and 10,730 in women. This type of cancer is also expected to result in approximately 10,880 deaths, including 6,490 men and 4,390 women. Consequently, the growing prevalence of gastrointestinal disorders is fueling the expansion of the fluoroscopy equipment market.

Product innovation stands out as a prominent trend gaining traction in the fluoroscopy equipment market. Major players within the fluoroscopy equipment market are actively engaged in developing inventive products to fortify their market positions. An illustrative example is Fujifilm Healthcare Americas Corporation, a US-based manufacturer of diagnostic and business imaging solutions, which, in July 2022, introduced the FDR Cross. Recognized as the world’s inaugural two-in-one fluoroscopy and digital radiography system, the FDR Cross represents an advanced portable X-ray and hybrid C-arm solution tailored for medical facilities and ambulatory surgery centers (ASC). This pioneering C-arm is distinguished as the first to offer both mobile radiography and fluoroscopic imaging on a single platform, eliminating the need for additional imaging equipment during essential image-guided procedures.

Major companies in the fluoroscopy equipment market are focusing on developing advanced solutions, such as motorized mobile C-arms, to enhance their competitive position. A motorized mobile C-arm is a versatile imaging system used in medical environments that offers real-time X-ray imaging and is mounted on a wheeled platform for easy maneuverability during surgical and diagnostic procedures. For example, in February 2024, Royal Philips, a technology company based in the Netherlands, introduced the Zenition 90 Motorized mobile C-arm. This device is notable for its impressive speed and user-friendly design, allowing surgeons to easily control it from the table side. Its intuitive controls and time-saving features promote surgical flexibility and independence. The Zenition 90 is engineered to provide exceptional image quality, particularly in complex procedures, especially those involving vascular needs. With automated workflows, a Touch Screen Module for image control, and advanced software solutions, the Zenition 90 Motorized significantly enhances clinical efficiency.

In March 2022, Canon Medical Systems Corporation, a medical equipment manufacturer based in Japan, acquired Nordisk Røntgen Teknik A/S for an undisclosed amount. This acquisition allows Canon Medical to access European technology, development, and manufacturing capabilities for advanced multipurpose and motorized digital radiographic imaging solutions. Nordisk Røntgen Teknik A/S is a Danish company focused on developing and manufacturing multipurpose X-ray fluoroscopy systems and general radiography systems.

Major companies operating in the fluoroscopy equipment market include Hitachi Medical Corporation, Thermo Fisher Scientific Inc., Siemens Healthineers, Fujifilm Holdings Corporation, Koninklijke Philips N.V., GE HealthCare Technologies Inc., Terumo Corporation, Hologic Inc., Varian Medical Systems Inc., Mindray Medical International Limited, Shimadzu Corporation, Agfa-Gevaert N.V., Lepu Medical Tech Co. Ltd., Carestream Health Inc., Varex Imaging Corporation, Canon Medical Systems Corporation, Ziehm Imaging GmbH, Allengers Medical Systems Limited, Orthoscan Inc., Xoran Technologies LLC, Toshiba Medical Systems Corporation, Adani Systems Inc., Trisonics Inc.

North America was the largest region in the fluoroscopy equipment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the fluoroscopy equipment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the fluoroscopy equipment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Fluoroscopy equipment encompasses the tools utilized in the medical fluoroscopy process, a procedure involving the controlled exposure of the body to X-rays over a period to generate a real-time video depicting internal movements within a specific body area. Fluoroscopy serves diagnostic purposes and finds applications in orthopedic surgery, guiding procedures such as implant placement or injections.

The primary products within the category of fluoroscopy equipment include fixed fluoroscopy equipment, mobile C-arms, and fixed C-arms. Fixed fluoroscopy equipment consists of a radiolucent patient examination table featuring an under-table-mounted tube, with an imaging detector positioned over the table. These systems are employed across various applications, including diagnostic and surgical procedures, and are utilized by end-users such as hospitals and diagnostic centers.

The fluoroscopy equipment research report is one of a series of new reports that provides fluoroscopy equipment market statistics, including the fluoroscopy equipment industry's global market size, regional shares, competitors with fluoroscopy equipment market share, detailed fluoroscopy equipment market segments, market trends and opportunities, and any further data you may need to thrive in the fluoroscopy equipment industry. This fluoroscopy equipment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The fluoroscopy equipment market consists of sales of fixed and mobile fluoroscopic systems, remote-controlled systems, and patient-side-controlled systems. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Fluoroscopy Equipment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on fluoroscopy equipment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for fluoroscopy equipment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The fluoroscopy equipment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Fixed Fluoroscopy Equipment; Mobile C-Arms; Fixed C-Arms2) By Application: Diagnostic; Surgical; Other Applications

3) By End-User: Hospitals; Diagnostic Centers; Other End-Users

Subsegments:

1) By Fixed Fluoroscopy Equipment: Conventional Fluoroscopy Systems; Digital Fluoroscopy Systems2) By Mobile C-Arms: Mini C-Arms; Full-Size Mobile C-Arms

3) By Fixed C-Arms: High-Performance Fixed C-Arms; Standard Fixed C-Arms

Key Companies Mentioned: Hitachi Medical Corporation; Thermo Fisher Scientific Inc.; Siemens Healthineers; Fujifilm Holdings Corporation; Koninklijke Philips N.V.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Hitachi Medical Corporation

- Thermo Fisher Scientific Inc.

- Siemens Healthineers

- Fujifilm Holdings Corporation

- Koninklijke Philips N.V.

- GE HealthCare Technologies Inc.

- Terumo Corporation

- Hologic Inc.

- Varian Medical Systems Inc.

- Mindray Medical International Limited

- Shimadzu Corporation

- Agfa-Gevaert N.V.

- Lepu Medical Tech Co. Ltd.

- Carestream Health Inc.

- Varex Imaging Corporation

- Canon Medical Systems Corporation

- Ziehm Imaging GmbH

- Allengers Medical Systems Limited

- Orthoscan Inc.

- Xoran Technologies LLC

- Toshiba Medical Systems Corporation

- Adani Systems Inc.

- Trisonics Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 6.84 Billion |

| Forecasted Market Value ( USD | $ 8.57 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |