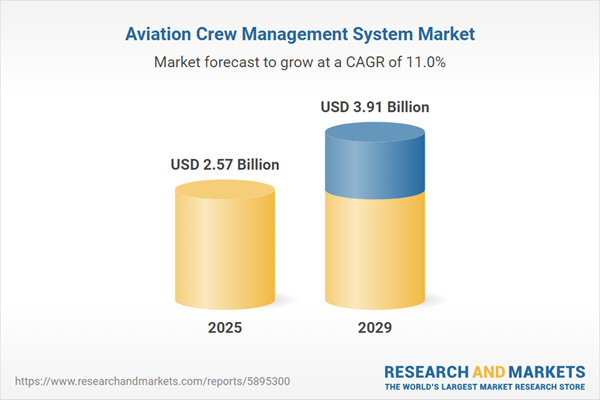

The aviation crew management system market size is expected to see rapid growth in the next few years. It will grow to $3.91 billion in 2029 at a compound annual growth rate (CAGR) of 11%. The growth in the forecast period can be attributed to evolution of airline business models and flexibility, emphasis on crew training and skill development, enhanced crew communication and collaboration, globalization of airline operations, increased focus on crew well-being and fatigue management. Major trends in the forecast period include enhanced crew training and development, data security and privacy measures, automation in crew rostering and scheduling, real-time crew tracking and monitoring, global expansion of airline operations.

The expansion of global air traffic is poised to drive the growth of the aviation crew management system market. As air travel surges, airlines seek effective systems to manage crew members, schedules, qualifications, and compliance. Aviation crew management systems play a pivotal role in optimizing staff utilization, enhancing operational efficiency, and ensuring adherence to regulatory standards. In March 2023, a report from the US Bureau of Transportation Statistics revealed a significant 30% year-on-year increase in passengers transported by US airlines in 2022, amounting to an additional 194 million passengers compared to the previous year. The total number of passengers carried by US airlines for the year reached 853 million.

The global expansion initiatives of airlines are expected to fuel the aviation crew management system market. Airline expansion involves strategic growth through new route introductions, increased flight frequencies, and the establishment of partnerships to serve broader markets. This expansion on a global scale introduces complexities in crew management, necessitating advanced systems to efficiently address diverse crew requirements. In June 2023, Boeing Company projections highlighted the robust demand in the global aviation industry, anticipating a need for 42,595 new commercial jets valued at $8 trillion by 2042. The global fleet is projected to nearly double to 48,600 jets, growing at an annual rate of 3.5%. Notably, over 75% of these deliveries will comprise new single-aisle airplanes, exceeding 32,000 airplanes. The increase in the number of air passengers remains a key driver for the growth of the aviation crew management system market.

Product innovation is a prominent trend gaining traction in the aviation crew management system market. Leading companies in the sector are dedicated to developing inventive products to fortify their market position. A noteworthy example is Lufthansa Systems GmbH & Co. KG, a German IT service provider for the airline industry, which, in March 2022, introduced NetLine/Crew Qualification and Training Management as a web-based solution. This module provides a comprehensive platform for overseeing ground staff and crew member training plans and certifications. It efficiently manages qualifications, recurrence, and training needs, ensuring maximum security and compliance for airlines.

Major companies in the aviation crew management system market are concentrating on technological innovations, such as advanced scheduling and predictive analytics tools, to enhance crew deployment, boost operational efficiency, and ensure regulatory compliance in airline operations. The OAG Airline-Tech Innovation Radar is a platform that showcases key advancements in airline technology, emphasizing new product launches, innovative pilot programs, and significant collaborations, while providing insights into the future direction of the aviation industry. For example, in February 2024, OAG, a UK-based company that offers travel data and analytics, launched the OAG Airline-Tech Innovation Radar. This new monthly feature aims to highlight the most impactful and groundbreaking developments within the Airline Tech sector. Each edition of the Innovation Radar will present up to three key aviation innovations, including new product launches, pilot cases, and collaboration efforts, delivering insights into the industry's future.

In March 2022, CAE Inc., a Canadian aircraft manufacturer, technology, and service provider, successfully completed the acquisition of Sabre's Airline Operations (AirCentre) portfolio for $392.5 million. This strategic acquisition marks a significant expansion for CAE in the realm of digital flight and crew operations, establishing the company as a frontrunner in technology solutions with a comprehensive suite of offerings in crew and flight management. This addition perfectly complements CAE's existing line of simulator and training services. Sabre Corporation, a US-based travel technology company, was the previous provider of crew management solutions now acquired by CAE.

Major companies operating in the aviation crew management system market include Lufthansa Systems AG, Fujitsu Limited, Leonardo S.p.A., The Boeing Company, CAE Inc., Sabre Corporation, SITA, Hexaware Technologies Limited, Jeppesen Sanderson Inc., FlyPal, OSM Aviation Management AS, Navblue S.A.S., Merlot Aero Limited, Ramco Systems, Maureva Ltd., InteliSys Aviation Systems Inc, AAP Aviation, IBS Software Services Pvt. Ltd., ARCOS LLC, LAMINAAR Aviation Infotech (India) Pvt Ltd, Prolog Development Center Holding A/S, PDC Aviation A/S, Aviolinx Communication and Services AB, Hitit Computer Services, SchedAero Inc, AIMS Inc., Advanced Optimization System Inc., Blue One Management S.A., AeroCRS, Leon Software GmbH.

North America was the largest region in the aviation crew management system market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the aviation crew management system market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the aviation crew management system market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Aviation crew management systems are specialized software tools utilized by airlines and companies to streamline crew scheduling, enhance resource utilization, and ensure adherence to regulatory standards. These systems are designed to improve leadership, communication among crew members, and decision-making in the cockpit, ultimately prioritizing aviation safety.

The primary components of aviation crew management systems comprise hardware, software, and services. Hardware includes tangible computer elements facilitating the execution of instructions provided by software. Devices such as biometric time clocks and RFID scanners play a crucial role in accurately recording crew attendance, reducing manual tasks, and elevating data precision in crew management operations. These solutions can be implemented across various devices such as smartphones, personal computers, and tablets. They operate on cloud-based or server-based platforms, catering to crew planning, services, operations, training, and other related functions.

The aviation crew management systems research report is one of a series of new reports that provides aviation crew management systems market statistics, including the aviation crew management systems industry's global market size, regional shares, competitors with an aviation crew management systems market share, detailed aviation crew management systems market segments, market trends and opportunities, and any further data you may need to thrive in the aviation crew management systems industry. This aviation crew management systems market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The aviation crew management systems market consists of revenues earned by entities by providing services such as crew planning and rostering, crew tracking and attendance, and regulatory compliance. The market value includes the value of related goods sold by the service provider or included within the service offering. The aviation crew management system market also includes sales of PDC crew, crew lounge, and ASL aircrews’ software, which are used in providing crew duty time management and crew communication services. Values In this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Aviation Crew Management System Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on aviation crew management system market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for aviation crew management system? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The aviation crew management system market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Solution: Hardware; Software; Services2) By Device: Smartphones; Personal Computers; Tablets

3) By Deployment: Cloud; Server-Based

4) By Application: Crew Planning; Crew Services; Crew Operations; Crew Training; Other Application

Subsegments:

1) By Hardware: Crew Communication Devices; Crew Scheduling Terminals; Data Processing Equipment2) By Software: Crew Scheduling Software; Crew Tracking Software; Reporting and Analytics Software

3) By Services: Implementation Services; Training Services; Support and Maintenance Services

Key Companies Mentioned: Lufthansa Systems AG; Fujitsu Limited; Leonardo S.p.A.; the Boeing Company; CAE Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Lufthansa Systems AG

- Fujitsu Limited

- Leonardo S.p.A.

- The Boeing Company

- CAE Inc.

- Sabre Corporation

- SITA

- Hexaware Technologies Limited

- Jeppesen Sanderson Inc.

- FlyPal

- OSM Aviation Management AS

- Navblue S.A.S.

- Merlot Aero Limited

- Ramco Systems

- Maureva Ltd.

- InteliSys Aviation Systems Inc

- AAP Aviation

- IBS Software Services Pvt. Ltd.

- ARCOS LLC

- LAMINAAR Aviation Infotech (India) Pvt Ltd

- Prolog Development Center Holding A/S

- PDC Aviation A/S

- Aviolinx Communication and Services AB

- Hitit Computer Services

- SchedAero Inc

- AIMS Inc.

- Advanced Optimization System Inc.

- Blue One Management S.A.

- AeroCRS

- Leon Software GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.57 Billion |

| Forecasted Market Value ( USD | $ 3.91 Billion |

| Compound Annual Growth Rate | 11.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |