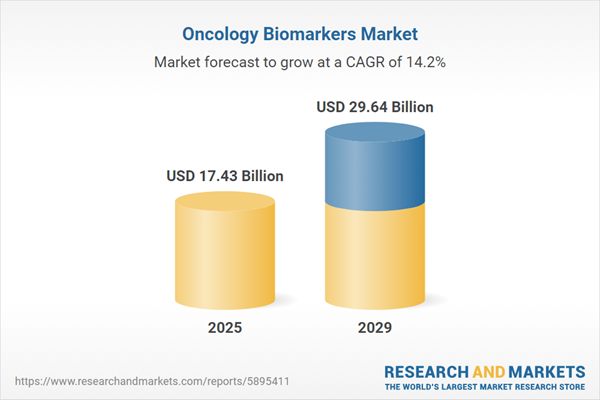

The oncology biomarkers market size is expected to see rapid growth in the next few years. It will grow to $29.64 billion in 2029 at a compound annual growth rate (CAGR) of 14.2%. The growth in the forecast period can be attributed to integration of next-generation sequencing (ngs), expansion of biomarker informatics, focus on predictive pharmacogenomics, rapid development of exosome-based biomarkers, adoption of spatial transcriptomics. Major trends in the forecast period include standardization and quality assurance, shift towards functional biomarkers, role of biomarkers in clinical trials, expanded applications in immunotherapy, real-time monitoring of treatment responses.

The increasing incidence of cancer is expected to drive the growth of the oncology biomarker market in the coming years. Cancer is characterized by the uncontrolled growth of certain cells, which can then spread throughout the body. Oncological biomarkers provide valuable insights into the type of cancer by analyzing genes, proteins, and other substances in an individual's body. For example, in January 2024, the National Library of Medicine, a U.S. government institution, projected that there would be 2,001,140 new cancer cases and 611,720 cancer-related deaths in the United States in 2024. Additionally, incidence rates for cervical cancer among individuals aged 30 to 44 and colorectal cancer in those under 55 have been rising by 1% to 2% annually among young adults. Thus, the rising incidence of cancer is poised to significantly impact the oncology biomarker market.

The significant factor contributing to the growth of oncology biomarkers is the increasing adoption of personalized medicine. Personalized medicine is an innovative healthcare approach that tailors medical treatment to the individual characteristics of each patient. In the context of oncology biomarkers, personalized medicine utilizes specific biomarkers to identify unique genetic or molecular characteristics of an individual's cancer. As an illustration, in 2022, the Food and Drug Administration’s Center for Drug Evaluation and Research (CDER) approved 37 new molecular entities (NMEs), with approximately 34% (12 of them) classified as personalized medicines by the Personalized Medicine Coalition (PMC). Hence, the growing adoption of personalized medicine serves as a driving force for the expansion of the oncology biomarker market.

The adoption of innovative and advanced technologies stands out as a prominent trend in the oncology biomarker market. Leading companies in this market are actively introducing new and groundbreaking technologies to enhance their position. In 2022, OncoDNA, a Belgium-based precision medicine company in oncology, launched OncoDEEP, a distinctive kit designed for laboratories to conduct comprehensive biomarker testing. OncoDEEP utilizes Next-generation sequencing (NGS) technology and cloud-based software tools, empowering laboratories to perform large-panel sequencing, acquire the molecular characterization of tumors, analyze raw data, and access robust quality controls.

Major players in the oncology biomarkers market are also focused on developing innovative products, such as clinical assays, to gain a competitive advantage. Clinical assays are biochemical tests used in healthcare to measure the presence or amount of a specific substance in biological samples such as blood, tissue, or urine. For instance, in December 2022, Adaptive Biotechnologies, a US-based biotechnology company, introduced the clonoSEQ Assay for detecting minimal residual disease (MRD) in blood for patients with diffuse large B-cell lymphoma (DLBCL). Leveraging circulating tumor DNA (ctDNA), clonoSEQ enables the assessment of MRD status in DLBCL, providing clinicians with a sensitive and quantitative measure of disease burden for earlier relapse detection and more precise treatment planning. Notably, it is the first and only MRD test in DLBCL with Medicare coverage across all lines of therapy, treatment regimens, and timepoints.

In May 2023, Freenome, a US-based biotech company, completed the acquisition of Oncimmune Ltd., a UK-based company specializing in developing immunodiagnostics. This strategic acquisition is poised to enhance Freenome's cancer screening efforts by providing additional clinical and commercial resources. Moreover, it will contribute to augmenting Freenome's multi-omics platform, offering a more comprehensive view of the tumor microenvironment.

Major companies operating in the oncology biomarkers market include F Hoffmann-La Roche AG, Novartis AG, Thermo Fisher Scientific Inc., Abbott Laboratories, Eli Lilly and Company, Merck KGaA, Siemens Healthcare GmbH, Becton Dickinson and Company, GE Healthcare Technologies Inc., Eurofins Scientific SE, Agilent Technologies Inc., Hologic Inc., Illumina Inc., Charles River Laboratories International Inc., bioMerieux SA, Bio-Rad Laboratories Inc., Bruker Corporation, QIAGEN NV, Exact Sciences Corporation, Sysmex Corporation, PerkinElmer Inc., Leica Biosystems, Myriad Genetics Inc., Guardant Health Inc., Enzo Biochem Inc., Biocartis Group NV, Bristol -Myers Squibb Company, Agendia Inc., Epigenomics AG, OncoDNA SA.

North America was the largest region in the oncology biomarkers market in 2024. The regions covered in the oncology biomarkers market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the oncology biomarkers market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Italy, Spain, Canada.

Oncology biomarkers are biological indicators, such as genes, proteins, or other molecules, that can indicate the presence of cancer or its progression. They play a crucial role in diagnosing cancer, predicting treatment responses, and monitoring disease progression or recurrence. By analyzing these biomarkers, healthcare providers can create personalized treatment plans tailored to individual patients.

The primary categories of oncology biomarkers include protein biomarkers, genetic biomarkers, and others. Protein biomarkers involve the use of one or multiple proteins for diagnosing diseases, understanding prognosis, and monitoring a patient's biological response to treatment. Profiling technologies encompass omics technologies, imaging technologies, immunoassays, bioinformatics, and others. Cancer types covered by oncology biomarkers include breast cancer, lung cancer, colorectal cancer, prostate cancer, melanoma, leukemia, ovarian cancer, liver cancer, and others. These biomarkers find various applications such as diagnostics, research and development, prognostics, risk assessment, and more, predominantly utilized in hospitals, academic and cancer research institutes, ambulatory surgical centers, and diagnostic laboratories.

The oncology biomarkers market research report is one of a series of new reports that provides oncology biomarkers market statistics, including oncology biomarkers industry global market size, regional shares, competitors with a oncology biomarkers market share, detailed oncology biomarkers market segments, market trends and opportunities, and any further data you may need to thrive in the oncology biomarkers industry. This oncology biomarkers market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The oncology biomarkers market consists of sales of epigenetic biomarkers, metabolic biomarkers and proteomic biomarkers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Oncology Biomarkers Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on oncology biomarkers market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for oncology biomarkers? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The oncology biomarkers market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Biomarker Type: Protein Biomarkers; Genetic Biomarkers; Other Cancer Biomarkers2) By Profiling Technologies: Omics Technologies; Imaging Technologies; Immunoassay; Bioinformatics; Other Profiling Technologies

3) By Cancer Type: Breast Cancer; Lung Cancer; Colorectal Cancer; Prostate Cancer; Melanoma; Leukemia; Ovarian Cancer; Liver Cancer; Other Cancer Types

4) By Application: Diagnostics; Research and Development; Prognostics; Risk Assessment; Other Applications

5) By End-User: Hospitals; Academic and Cancer Research Institutes; Ambulatory Surgical Centers; Diagnostic Laboratories

Subsegments:

1) By Protein Biomarkers: Tumor-Specific Antigens; Circulating Tumor Cells (CTCs); Enzymatic Biomarkers2) By Genetic Biomarkers: DNA Mutations; Gene Expression Profiles; Single Nucleotide Polymorphisms (SNPs)

3) By Other Cancer Biomarkers: Metabolomic Biomarkers; Epigenetic Biomarkers; MicroRNA Biomarkers

Key Companies Mentioned: F Hoffmann-La Roche AG; Novartis AG; Thermo Fisher Scientific Inc.; Abbott Laboratories; Eli Lilly and Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- F Hoffmann-La Roche AG

- Novartis AG

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Eli Lilly and Company

- Merck KGaA

- Siemens Healthcare GmbH

- Becton Dickinson and Company

- GE Healthcare Technologies Inc.

- Eurofins Scientific SE

- Agilent Technologies Inc.

- Hologic Inc.

- Illumina Inc.

- Charles River Laboratories International Inc.

- bioMerieux SA

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- QIAGEN NV

- Exact Sciences Corporation

- Sysmex Corporation

- PerkinElmer Inc.

- Leica Biosystems

- Myriad Genetics Inc.

- Guardant Health Inc.

- Enzo Biochem Inc.

- Biocartis Group NV

- Bristol -Myers Squibb Company

- Agendia Inc.

- Epigenomics AG

- OncoDNA SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 17.43 Billion |

| Forecasted Market Value ( USD | $ 29.64 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |