Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

These compounds play a vital role in neutralizing the damaging effects of ultraviolet radiation, which can lead to fading, cracking, surface erosion, and loss of mechanical strength. By integrating UV absorbers into polymers, coatings, adhesives, and skincare products, manufacturers enhance the resilience and visual stability of their offerings, effectively extending product lifespans and improving customer satisfaction.

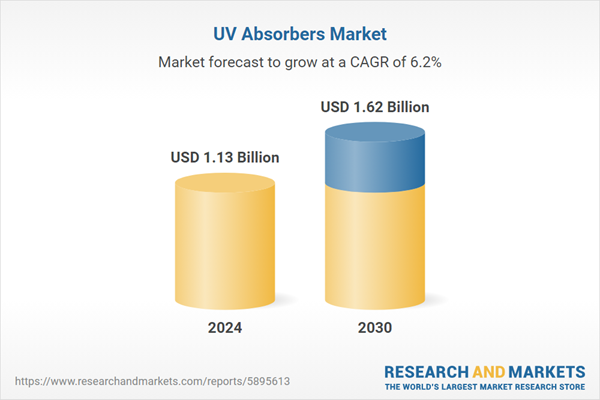

The market is poised for continued growth, supported by expanding downstream industries, rising environmental consciousness, and increasing investments in innovative and eco-compliant UV stabilizing technologies. Asia Pacific leads in terms of volume production and consumption, driven by its robust manufacturing base and infrastructure development. Meanwhile, North America and Europe are focusing on high-performance, specialty-grade formulations tailored to regulatory and sustainability demands. The UV absorbers market is evolving beyond traditional utility positioning itself as a strategic driver of material innovation, brand differentiation, and compliance in increasingly performance-sensitive and regulated global markets.

Key Market Drivers

Growing Demand of UV Absorbers in Automotive Industry

The automotive industry is playing an increasingly pivotal role in accelerating the growth of the global UV absorbers market. As vehicles are exposed to harsh environmental conditions including intense sunlight, heat, and humidity automakers are placing a high premium on material durability, aesthetic retention, and long-term performance. This has significantly increased the demand for UV absorbers, which serve as critical additives in enhancing the life and quality of automotive components. The shift toward lightweighting in automotive design to improve fuel efficiency and reduce emissions has led to an increased use of plastic materials such as polypropylene, polycarbonate, ABS, and polyurethane.These materials, while cost-effective and versatile, are vulnerable to UV-induced degradation, including discoloration, brittleness, and loss of mechanical properties. UV absorbers are essential for stabilizing these polymers, especially in exterior and interior applications, such as: Bumpers, trims, grilles, Dashboards, consoles, and door panels, Headlamp lenses and window seals. By incorporating UV absorbers into these parts, automakers can enhance resistance to fading, cracking, and surface deterioration, thereby improving the longevity and appearance of vehicles factors that directly impact brand perception and resale value.

Modern vehicles rely heavily on advanced coating systems for both aesthetic appeal and surface protection. Automotive paints, clearcoats, and topcoats must withstand extended UV exposure without yellowing, gloss loss, or delamination. UV absorbers, particularly benzotriazoles and triazines, are widely used in these coatings to provide long-term photostability and color fastness. The growing consumer demand for high-gloss finishes and metallic effects in vehicle exteriors makes the role of UV absorbers even more critical. By minimizing UV-induced degradation, these additives help preserve the visual quality and protective function of coatings throughout the vehicle’s lifecycle.

Consumers are increasingly prioritizing interior comfort and safety, which includes reducing UV penetration into vehicle cabins. UV absorbers are integrated into automotive glass (particularly laminated and polycarbonate windows) and sunroof materials to: Block harmful UVA/UVB rays, Minimize heat buildup inside the cabin, Protect passengers from skin damage, Prevent fading of upholstery, dashboards, and electronics. As more vehicles adopt panoramic sunroofs, tinted glass, and smart windows, the use of high-efficiency UV absorbers becomes essential to meet both regulatory and consumer expectations.

The automotive industry is subject to stringent performance and safety standards related to UV exposure, especially in regions with high solar intensity. Regulations require vehicle materials to meet minimum durability and aesthetic performance benchmarks over extended periods. UV absorbers help manufacturers comply with these standards while also reducing warranty claims and maintenance costs related to UV damage. OEM specifications often mandate the use of UV-stabilized components, creating a stable, long-term demand base for UV absorber manufacturers and suppliers.

Key Market Challenges

Stringent Regulatory and Environmental Compliance Requirements

One of the most significant hurdles in the UV absorbers market is the increasingly complex regulatory landscape governing chemical formulations and additives. Regions such as the European Union, North America, and parts of Asia are enforcing tighter controls on the use of certain UV absorber compounds due to concerns over toxicity, environmental persistence, and bioaccumulation.Phasing out of legacy benzophenones and certain benzotriazoles due to potential endocrine-disrupting effects. Compliance costs for REACH (EU), TSCA (U.S.), and other chemical safety frameworks, which can delay product commercialization. Growing demand for food-contact and cosmetic-grade certifications, which require extensive testing and reformulation. These regulatory pressures not only raise the cost of compliance but also limit the availability of high-performance UV stabilizers, forcing manufacturers to invest heavily in alternative chemistries that meet both performance and safety standards.

Key Market Trends

Surge in Demand for Weather-Resistant and Long-Life Plastics Across End-Use Sectors

One of the most significant trends influencing the UV absorbers market is the increased reliance on UV-stabilized plastics across multiple industries particularly automotive, construction, agriculture, packaging, and consumer goods. With the growing need for weatherability, color retention, and mechanical stability, manufacturers are integrating UV absorbers into plastic formulations to extend product life cycles and enhance outdoor performance.Automotive OEMs are increasingly adopting UV absorbers for plastic exteriors, dashboards, and headlights to ensure long-term aesthetic and structural performance. Agricultural films used in greenhouses, mulch, and irrigation systems require UV resistance to withstand prolonged sun exposure. Construction materials such as siding, roofing sheets, and outdoor decking are being engineered with UV absorbers to reduce maintenance costs and degradation. This trend reflects a shift from reactive product protection to proactive material engineering, reinforcing UV absorbers as essential for lifecycle performance and competitive product positioning.

Key Market Players

- Amfine Chemical Corporation

- Anhui Best Progress Imp & Exp Co.,Ltd

- BASF SE

- Clariant AG

- Everlight Chemical Industrial Corp,

- Greenchemicals SpA

- Hangzhou Disheng Import&Export Co., Ltd.

- Hunan Chemical BV

- Huntsman International LLC

- Rianlon Corporation

Report Scope:

In this report, the Global UV Absorbers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:UV Absorbers Market, By Type:

- Benzophenone

- Benzotriazole

- Triazine

UV Absorbers Market, By Application:

- Plastics

- Coatings

- Adhesives

- Personal Care

- Others

UV Absorbers Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global UV Absorbers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- Amfine Chemical Corporation

- Anhui Best Progress Imp & Exp Co.,Ltd

- BASF SE

- Clariant AG

- Everlight Chemical Industrial Corp,

- Greenchemicals SpA

- Hangzhou Disheng Import&Export Co., Ltd.

- Hunan Chemical BV

- Huntsman International LLC

- Rianlon Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.13 Billion |

| Forecasted Market Value ( USD | $ 1.62 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |