Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Technological innovations, such as high-resolution imaging, humanized models, and AI-based predictive tools, are revolutionizing in-vivo research capabilities. The surge in personalized medicine is further transforming the field, with CROs tailoring research to match patient-specific genetic profiles. Collaborations among CROs, academic institutions, and healthcare providers are fostering innovation and expanding the research pipeline. As oncology remains central in drug development, in-vivo CROs are set to play an increasingly vital role in reshaping cancer care.

Key Market Drivers

Rising Prevalence of Cancer

The growing incidence of cancer is significantly accelerating the expansion of the oncology-based in vivo CRO market. According to WHO 2024 data, there were 20 million new cancer cases and 9.7 million deaths in 2022, with over 53.5 million individuals living within five years of a diagnosis. This widespread impact, particularly in underserved populations, underscores a pressing need for timely and effective treatment development. As cancer’s complexity increases, so does the demand for highly specialized research capabilities offered by in vivo CROs.These organizations support pharmaceutical and biotech firms in executing intricate studies that address the multifactorial nature of cancer. With advancements in personalized medicine, there's a growing reliance on CROs to develop models tailored to specific genetic profiles. The outsourcing trend is further intensified by the race to launch new therapies, pushing companies to partner with CROs to boost efficiency. In this rapidly evolving research environment, in vivo CROs provide critical infrastructure, expertise, and innovation, driving their continued growth and importance in cancer therapy development.

Key Market Challenges

Complexity of Cancer Research

The inherent complexity of cancer research presents a significant challenge to the growth of the oncology-based in vivo CRO market. With numerous cancer types, genetic mutations, and constantly shifting treatment paradigms, delivering accurate and relevant in vivo results requires a high level of specialization. Conducting studies that replicate the complex behavior of tumors within living organisms demands advanced methodologies, cutting-edge equipment, and interdisciplinary knowledge - all of which can burden the operational capacities of CROs and their clients.Furthermore, staying aligned with rapidly emerging scientific discoveries increases pressure on these organizations to continuously adapt. Successfully navigating the intricacies of genetic interactions, tumor microenvironments, and treatment responses necessitates not only technological sophistication but also a deep understanding of oncological mechanisms. This complexity limits the availability of skilled professionals, escalates costs, and lengthens research timelines, thereby posing considerable obstacles to scalability and market expansion.

Key Market Trends

Personalized Medicine

The evolution of personalized medicine is significantly influencing the growth of the oncology-based in vivo CRO market. As treatment strategies increasingly account for individual genetic and molecular profiles, the need for tailored preclinical research has grown substantially. In vivo CROs are instrumental in this shift, providing animal models that closely replicate patient-specific genetic markers and tumor behaviors. These models enable precise analysis of treatment efficacy and safety, paving the way for more accurate and effective therapeutic solutions.The complexity of this approach requires advanced tools and scientific expertise, both of which CROs are well-equipped to offer. As pharmaceutical and biotech companies aim to develop more targeted therapies with fewer side effects, they increasingly rely on CROs to conduct studies that serve as a bridge between early-stage research and clinical application. This trend highlights the expanding role of in vivo CROs in advancing precision oncology, cementing their strategic importance in the era of personalized healthcare.

Key Market Players

- Charles River Laboratories, Inc.

- ICON PLC

- Thermo Fisher Scientific Inc.

- Eurofins Scientific SE

- Taconic Biosciences, Inc.

- Crown Biosciene, Inc.

- LabCorp

- WuXi AppTec Co., Ltd.

- Evotec SE

- The Jackson Laboratory

Report Scope:

In this report, the global Oncology Based In-vivo CRO Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Oncology Based In-vivo CRO Market, By Indication:

- Blood Cancer

- Solid Tumor

Oncology Based In-vivo CRO Market, By Model:

- Syngeneic Model

- Patient Derived Xenograft

- Xenograft

Oncology Based In-vivo CRO Market, By Region:

- North America

- Europe

- South America

- Asia Pacific

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Oncology Based In-vivo CRO Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Charles River Laboratories, Inc.

- ICON PLC

- Thermo Fisher Scientific Inc.

- Eurofins Scientific SE

- Taconic Biosciences, Inc.

- Crown Biosciene, Inc.

- LabCorp

- WuXi AppTec Co., Ltd.

- Evotec SE

- The Jackson Laboratory

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2025 |

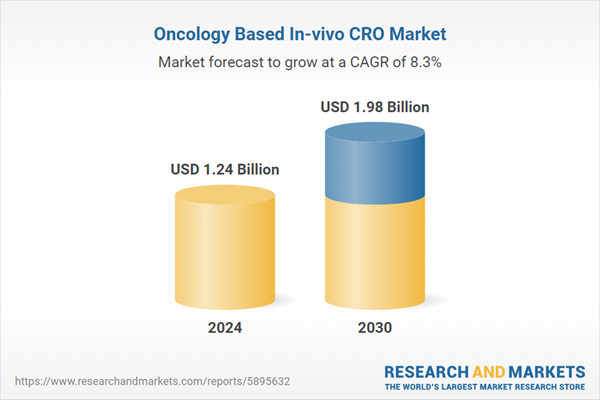

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.24 Billion |

| Forecasted Market Value ( USD | $ 1.98 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |