Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Companies are progressively harnessing the expertise and infrastructure of third-party service providers to unlock the potential of data analytics while sidestepping the challenges associated with in-house infrastructure development and skill acquisition. Moreover, as industries such as finance, healthcare, and retail continue to pivot toward data-centric operations, outsourcing analytics functions has evolved into a strategic necessity for unearthing valuable insights and driving innovation.

This market's upward trajectory is expected to persist as organizations seek to fully exploit the value of their data assets and gain actionable insights to navigate an increasingly intricate business landscape.

Key Market Drivers

Evolution in Data Analytics Technologies

The Global Data Analytics Outsourcing Market is propelled by the dynamic evolution of data analytics technologies. This evolution represents a pivotal driver reshaping how businesses harness the power of data for strategic decision-making. As data volumes continue to surge, data analytics has transformed from traditional descriptive analytics to advanced techniques such as predictive analytics, machine learning, artificial intelligence (AI), and natural language processing (NLP). These cutting-edge technologies are at the forefront of the outsourcing market's growth, offering organizations the ability to glean deeper, more actionable insights from their data assets. Outsourcing service providers, equipped with the latest analytical tools and expertise, are well-positioned to deliver tangible value to their clients. Businesses across sectors are increasingly recognizing that staying competitive necessitates embracing these advanced analytics capabilities. by outsourcing data analytics functions, organizations can tap into the expertise of providers at the forefront of technology, ensuring access to the most up-to-date solutions and methodologies. This evolution in data analytics technologies is not only enriching the insights derived from data but also redefining how businesses make data-driven decisions, positioning the data analytics outsourcing market as a strategic partner in the era of data-driven innovation and business transformation.Increasing Data Complexity and Volume

The Global Data Analytics Outsourcing Market is being driven by the relentless increase in data complexity and volume. In today's data-driven landscape, businesses are inundated with vast and diverse datasets from numerous sources, including customer interactions, social media, IoT devices, and more. This exponential growth in data poses significant challenges for organizations in terms of data management, analysis, and extraction of meaningful insights. Handling such massive datasets requires not only advanced analytical capabilities but also scalable resources. Here, data analytics outsourcing emerges as a strategic solution. Outsourcing service providers are equipped with the infrastructure, tools, and expertise to manage and analyze large and complex datasets efficiently. This scalability ensures that organizations can keep pace with the ever-expanding universe of data without the burden of building and maintaining costly in-house data analytics teams. As data complexity and volume continue to surge, the outsourcing market stands as a valuable partner for businesses seeking to navigate the data landscape effectively, uncover valuable insights, and maintain a competitive edge in a data-driven world.Cost Efficiency and Resource Optimization

Cost efficiency and resource optimization are fundamental drivers propelling the Global Data Analytics Outsourcing Market. Building and maintaining an in-house data analytics team can be financially prohibitive for many organizations, particularly small and mid-sized enterprises. The costs associated with recruiting, training, and retaining data analytics talent, along with the investments required in infrastructure and cutting-edge analytical tools, can be substantial. In contrast, outsourcing data analytics services offers a cost-effective alternative. Businesses can tap into specialized expertise without incurring the overhead costs associated with an internal team. This approach enables organizations to allocate their resources more efficiently, concentrating on core competencies while relying on dedicated experts to handle data analytics tasks. by optimizing resources in this manner, companies enhance productivity and cost-effectiveness, positioning themselves to extract maximum value from their data assets. As a result, data analytics outsourcing becomes not only a practical choice for organizations seeking analytical insights but also a strategic one for those aiming to achieve a competitive advantage while managing costs and resources judiciously. This drive for cost efficiency and resource optimization underscores the pivotal role of outsourcing in today's data-driven business landscape, fostering a more agile, productive, and cost-effective approach to data analytics.Global Adoption of Cloud Computing

The Global Data Analytics Outsourcing Market is significantly influenced by the widespread adoption of cloud computing across industries. Cloud platforms have emerged as the linchpin for data analytics operations, offering scalability, flexibility, and accessibility that are crucial for modern data-driven businesses. Data analytics outsourcing service providers harness cloud infrastructure to deliver cutting-edge analytics solutions that are easily deployable and scalable. This cloud-based approach reduces the complexity and costs associated with managing on-premises data centers, allowing organizations to access analytics tools and insights from anywhere, at any time. Cloud computing's global adoption, driven by its ability to support rapid data processing and storage at a fraction of the cost and effort, has given outsourcing providers a robust platform to deliver analytical solutions efficiently and cost-effectively. As the cloud continues to be the foundation for data analytics operations, the outsourcing market is poised to thrive, providing businesses with seamless access to cloud-based data analytics capabilities that enhance their agility, competitiveness, and data-driven decision-making processes.Key Market Challenges

Data Privacy and Security Concerns

The Global Data Analytics Outsourcing Market grapples with data privacy and security concerns as organizations increasingly rely on third-party service providers to handle their sensitive data. With the proliferation of data breaches and privacy regulations, businesses are wary of entrusting their data to outsourcing partners. Maintaining confidentiality, integrity, and compliance of data becomes a paramount challenge for outsourcing service providers. It necessitates rigorous data encryption, access controls, and comprehensive cybersecurity measures to protect against unauthorized access and data breaches. Additionally, ensuring compliance with data protection laws, such as GDPR and CCPA, adds complexity to the outsourcing process. As data privacy and security concerns continue to intensify, the market's ability to address these challenges and build trust among clients becomes essential for sustained growth.Data Quality and Accuracy

The quality and accuracy of data are fundamental challenges faced by the Data Analytics Outsourcing Market. Data analytics relies heavily on the integrity of the data inputs. Inaccurate or incomplete data can lead to flawed insights and misguided business decisions. Ensuring data quality involves data cleansing, validation, and integration, which can be labor-intensive and time-consuming. Data from disparate sources must be harmonized to provide a cohesive and accurate view. Furthermore, managing the veracity of data in real-time analytics poses an additional challenge. Organizations expect outsourcing partners to deliver data-driven insights based on accurate, up-to-date information. Overcoming these data quality and accuracy challenges is crucial to maintaining the credibility and effectiveness of data analytics outsourcing services.Data Governance and Compliance

Effective data governance and compliance are key challenges in the Data Analytics Outsourcing Market. Organizations must adhere to an array of regulations and industry standards governing data usage, retention, and sharing. Outsourcing service providers must align their practices with these complex and evolving regulatory frameworks to avoid legal and reputational risks. Establishing robust data governance frameworks that encompass data classification, access controls, and audit trails becomes imperative. Moreover, ensuring that data analytics processes are compliant with industry-specific regulations, such as HIPAA in healthcare or Basel III in finance, requires meticulous attention to detail. Navigating the intricate landscape of data governance and compliance is pivotal for outsourcing providers to instill confidence in their clients and offer solutions that adhere to the highest standards of data ethics and legality.Managing Data Integration Challenges

Data integration complexities are substantial challenges faced by the Data Analytics Outsourcing Market. Organizations accumulate data from diverse sources, including legacy systems, cloud applications, and IoT devices. Integrating these disparate datasets into a cohesive analytics environment poses technical and logistical challenges. Ensuring that data flows seamlessly, is standardized, and can be accessed in real-time for analysis is a complex undertaking. Data integration issues encompass data cleansing, transformation, and ETL (extract, transform, load) processes, which demand substantial investments in infrastructure and expertise. Additionally, managing data integration in rapidly evolving technological landscapes, such as the migration to cloud-based environments, introduces further complexities. Successfully addressing data integration challenges is essential to deliver comprehensive and actionable insights to clients, underpinning the market's growth by providing value-added services that harness the full potential of data analytics.Key Market Trends

Advanced Analytics and Predictive Modeling

An influential trend shaping the Global Data Analytics Outsourcing Market revolves around the accelerated adoption of advanced analytics and predictive modeling. Organizations are increasingly seeking to extract actionable insights from their data, moving beyond descriptive analytics to predictive and prescriptive analytics. This shift is driven by the need for data-driven decision-making, enhanced customer experiences, and operational efficiency. Data analytics outsourcing providers are at the forefront of this trend, offering expertise in machine learning, artificial intelligence, and data science. They enable businesses to harness the power of predictive models for forecasting, risk assessment, and personalization. This trend not only fosters data-driven innovation but also amplifies the demand for specialized analytics services, positioning data analytics outsourcing as a crucial enabler of business success in the data-driven era.Cloud-Native Analytics Solutions

The adoption of cloud-native analytics solutions is a prominent trend in the Global Data Analytics Outsourcing Market. Organizations are migrating their data analytics workloads to cloud platforms to leverage scalability, flexibility, and cost-efficiency. Cloud-native analytics services offer the advantage of on-demand computing resources, enabling businesses to handle large datasets and complex analytics tasks with ease. Data analytics outsourcing providers are aligning with this trend by offering cloud-based analytics services and leveraging platforms like AWS, Azure, and Google Cloud. This shift towards cloud-native solutions simplifies infrastructure management, accelerates time-to-insight, and facilitates remote access to data analytics tools. It also enables organizations to scale their analytics capabilities according to their needs, making it a cost-effective and agile approach to data analysis. The cloud-native analytics trend is set to continue its growth trajectory as businesses recognize the advantages of cloud-based data analytics, positioning data analytics outsourcing providers as integral partners in their digital transformation journeys.Data Visualization and Interactive Dashboards

Data visualization and interactive dashboards are emerging as essential components of the Global Data Analytics Outsourcing Market. In an era characterized by information overload, organizations are prioritizing data presentation and accessibility. Data analytics outsourcing providers are leveraging advanced visualization tools and techniques to transform raw data into insightful visuals, making complex information more digestible for decision-makers. Interactive dashboards offer real-time insights and enable users to explore data, uncover patterns, and make data-driven decisions intuitively. This trend aligns with the growing demand for self-service analytics, empowering users across various business functions to access and interact with data independently. As organizations continue to invest in data visualization and interactive dashboards, data analytics outsourcing services evolve to meet these needs, facilitating data democratization and enhancing data-driven decision-making across the enterprise.AI-Powered Analytics and Natural Language Processing (NLP)

AI-powered analytics and Natural Language Processing (NLP) are transformative trends in the Global Data Analytics Outsourcing Market. Artificial intelligence and NLP technologies are being integrated into data analytics processes to automate tasks, uncover deeper insights, and enhance user experiences. AI-driven analytics solutions can perform advanced data mining, anomaly detection, and sentiment analysis at scale, augmenting human capabilities and accelerating data analysis. NLP enables the analysis of unstructured data sources such as text and speech, opening new avenues for understanding customer sentiment, extracting valuable information from documents, and automating text-based tasks. Data analytics outsourcing providers are incorporating AI and NLP capabilities into their service offerings, enabling organizations to harness the power of these technologies without extensive in-house expertise. This trend signifies a shift towards augmented analytics, where AI augments human decision-making by providing actionable insights and automating routine analytics tasks, positioning data analytics outsourcing as a conduit for AI-driven innovation in data analysis and interpretation.Segmental Insights

Type Insights

In 2022, within the Global Data Analytics Outsourcing Market, the"Financial Analytics" segment stood out as the dominant type segment, and it is anticipated to maintain its supremacy throughout the forecast period. Financial analytics plays a pivotal role in enabling organizations to extract valuable insights from their financial data, optimize their financial processes, and make informed decisions related to investments, budgeting, and risk management. The financial sector, including banking, insurance, and investment firms, relies heavily on data analytics outsourcing services to gain a competitive edge, enhance fraud detection, and ensure compliance with regulatory requirements. Moreover, the increasing complexity of financial transactions and the need for real-time insights drive the demand for specialized financial analytics expertise. As organizations across industries recognize the significance of financial data in shaping their strategies and operations, the demand for financial analytics outsourcing is expected to continue growing steadily. This trend is fueled by the quest for financial stability, cost-effectiveness, and the pursuit of data-driven financial decision-making, making"Financial Analytics" the dominant type segment in the Global Data Analytics Outsourcing Market.End-user Insights

In 2022, the"BFSI (Banking, Financial Services, and Insurance)" segment emerged as the dominant end-user segment in the Global Data Analytics Outsourcing Market, and it is poised to maintain its leadership throughout the forecast period. The BFSI sector relies heavily on data analytics outsourcing to gain actionable insights from vast volumes of financial data, detect fraudulent activities, assess risk, and personalize financial services for customers. With the ever-increasing volume and complexity of financial transactions, data analytics is indispensable for decision-making, compliance, and customer-centric services. Additionally, regulatory mandates and the need for real-time data-driven decision-making have driven the BFSI sector's dependence on data analytics outsourcing services. As the industry continues to prioritize data security, operational efficiency, and enhancing customer experiences, the demand for data analytics outsourcing in BFSI is expected to remain robust. The BFSI sector's reliance on data analytics as a strategic asset for growth and risk management solidifies its dominance in the Global Data Analytics Outsourcing Market, making it the leading end-user segment.Regional Insights

In 2022, North America emerged as the dominant region in the Global Data Analytics Outsourcing Market, and it is expected to maintain its leadership throughout the forecast period. North America's dominance can be attributed to several key factors. Firstly, the region houses a vast number of established data analytics outsourcing service providers and tech giants with extensive experience and expertise in handling complex data analytics projects across various industries. Secondly, North American businesses across sectors such as finance, healthcare, technology, and retail are early adopters of data analytics solutions to drive business growth, enhance customer experiences, and gain a competitive edge. The presence of a mature and diverse client base fosters thriving data analytics outsourcing ecosystem. Moreover, North America benefits from a strong regulatory framework that prioritizes data security and privacy, aligning well with the growing concerns around data protection. This regulatory compliance enhances the trustworthiness of North American data analytics service providers, making them preferred partners for global businesses seeking outsourcing services. Additionally, the region's robust technological infrastructure, including cloud computing capabilities, facilitates efficient data management and analysis. Furthermore, North America's leadership in research and development in data analytics technologies ensures a continuous stream of innovations, further bolstering its position in the global market. As data analytics outsourcing becomes increasingly vital for businesses worldwide, North America's established market presence, technological prowess, and regulatory alignment are expected to sustain its dominance in the Global Data Analytics Outsourcing Market.Key Market Players

- Accenture plc

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Genpact Limited

- Infosys Limited

- International Business Machines Corporation (IBM)

- Tata Consultancy Services Limited (TCS)

- Wipro Limited

- ExlService Holdings, Inc.

- ZS Associates, Inc.

- Mu Sigma Inc.

- Fractal Analytics Inc.

- HCL Technologies Limited

- Larsen & Toubro Infotech Limited

Report Scope

In this report, the Global Data Analytics Outsourcing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Data Analytics Outsourcing Market, by Type:

- CRM Analytics

- Supply Chain Analytics

- Risk Analytics

- Financial Analytics

Global Data Analytics Outsourcing Market, by End-user:

- Automotive

- Manufacturing

- Retail

- BFSI

- IT

- Telecom

- Oil & Gas

Global Data Analytics Outsourcing Market, by Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Data Analytics Outsourcing Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Accenture PLC

- Capgemini SE

- Cognizant Technology Solutions Corporation

- Genpact Limited

- Infosys Limited

- International Business Machines Corporation (IBM)

- Tata Consultancy Services Limited (TCS)

- Wipro Limited

- ExlService Holdings, Inc.

- ZS Associates, Inc.

- Mu Sigma Inc.

- Fractal Analytics Inc.

- HCL Technologies Limited

- Larsen & Toubro Infotech Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | October 2023 |

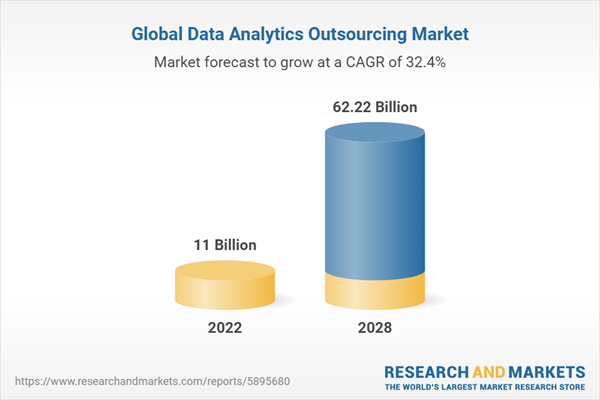

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 11 Billion |

| Forecasted Market Value ( USD | $ 62.22 Billion |

| Compound Annual Growth Rate | 32.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |