Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

System integration within the context of 5G involves the harmonious amalgamation of different hardware and software components into a unified and functional system, ensuring their seamless collaboration to achieve specific objectives or deliver services. This integration covers several key areas:

- 1. Radio Access Network (RAN): This facet revolves around the integration of 5G base stations and related equipment into existing telecommunications infrastructure, ensuring their efficient connectivity with the core network. The 5G core network comprises critical components such as virtualized network functions, network slicing, and edge computing. The successful integration of these elements is pivotal for enabling advanced 5G services and applications.

- 2. Internet of Things (IoT): With 5G poised to play a pivotal role in connecting and managing a multitude of IoT devices, system integrators play a crucial role in helping businesses securely and efficiently deploy IoT solutions on 5G networks.

- 3. Cloud and Edge Computing: Leveraging the capabilities of cloud and edge computing is essential for delivering services with low latency and high performance over 5G. System integrators are instrumental in seamlessly integrating these technologies with 5G networks.

- 4. Security Measures: Given the heightened complexity and potential vulnerabilities of 5G networks, system integrators contribute significantly to ensuring robust security measures, including encryption, authentication, and threat detection, are in place to safeguard data and operations.

- 5. Custom Applications: Many businesses require tailored applications and services to fully harness the capabilities of 5G. System integrators are involved in the development and integration of these bespoke applications into the 5G ecosystem, enhancing functionality and relevance.

Key Market Drivers

The global 5G System Integration market is experiencing remarkable growth, driven by several factors that are reshaping the telecommunications and technology landscape. In this comprehensive analysis, we will delve into the critical drivers behind the expansion of the 5G System Integration market and provide in-depth explanations for each of these drivers.IoT Revolution and Massive Machine Connectivity

The ever-increasing demand for mobile data and bandwidth-hungry applications is a significant driver for 5G system integration. In this section, we'll explore the reasons behind the surge in mobile data usage, including video streaming, gaming, and the IoT, and how 5G addresses these demands. The Internet of Things (IoT) is one of the most promising domains for 5G. This section will explain how the IoT revolution is driving the need for 5G system integration, with a focus on the sheer number of connected devices, low-latency requirements, and the role of 5G in enabling IoT applications.Industry 4.0 and Smart Manufacturing

The Fourth Industrial Revolution, often referred to as Industry 4.0, relies heavily on advanced connectivity and automation. We'll explore how 5G System Integration is a catalyst for smart manufacturing, explaining concepts like network slicing and edge computing and their role in this transformation. Telemedicine and Healthcare Transformation. Telemedicine and remote healthcare services have gained momentum, especially in the wake of global health crises. This section will detail how 5G System Integration supports telemedicine, remote surgery, and other healthcare innovations, enhancing patient care worldwide. The automotive industry is on the cusp of a transformation with the advent of autonomous vehicles. We'll explain how 5G's low latency and high reliability are essential for connected and autonomous vehicles, along with the role of system integrators in this ecosystem.Smart Cities and Urban Development

As cities become more populated and interconnected, the need for smart city solutions becomes paramount. This section will discuss how 5G System Integration contributes to smart city development, including applications in transportation, public safety, and environmental monitoring. 5G offers significantly faster download and upload speeds, improving the user experience for consumers. This section will delve into how 5G System Integration enhances mobile broadband services, enabling augmented reality (AR), virtual reality (VR), and other immersive experiences. Edge computing, enabled by 5G, brings computing resources closer to the data source, reducing latency and improving processing capabilities. We'll explain how this drives the need for 5G System Integration and its impact on various industries. With the increasing complexity of 5G networks and the proliferation of connected devices, security and privacy concerns have become paramount. In this section, we'll explore the role of system integrators in addressing these challenges and ensuring the security of 5G networks. Government policies and regulations play a significant role in shaping the 5G landscape. We'll discuss how government initiatives and regulatory support influence the deployment of 5G networks and the role of system integrators in compliance. In the conclusion section, we'll summarize the key drivers of the global 5G System Integration market and their implications. We'll also provide insights into the outlook of the market and the challenges that system integrators may face in the evolving 5G ecosystem.Key Market Challenges

Infrastructure Deployment and Costs

One of the foremost challenges in 5G System Integration is the massive infrastructure deployment required. In this section, we'll explain the intricacies of building a 5G infrastructure, including the need for new cell towers, small cells, and fiber optics, along with the substantial costs involved. Spectrum Allocation and Regulatory Hurdles The allocation of spectrum and regulatory approvals are critical for 5G deployment. We'll explore the challenges associated with spectrum availability, auctions, and regulatory compliance, and their impact on the system integration market. As 5G networks become more complex and interconnected, security and privacy concerns intensify. In this section, we'll delve into the evolving threats, vulnerabilities, and the need for robust security measures, including encryption, authentication, and threat detection. Ensuring that various components and devices from different manufacturers can work seamlessly together is a significant challenge. We'll explain the importance of interoperability and the role of international standards bodies in addressing this issue.Talent Shortage and Skill Gap

The deployment and maintenance of 5G networks require a highly skilled workforce. We'll discuss the talent shortage and skill gap in the 5G System Integration market and explore potential solutions and training initiatives. The energy consumption of 5G infrastructure is a concern, especially in the context of environmental sustainability. This section will delve into the environmental impact of 5G and discuss strategies for mitigating its carbon footprint. Ensuring that 5G networks reach rural and remote areas is a challenge. We'll explore the digital divide, the economic challenges of deploying 5G in less populated areas, and potential solutions such as government initiatives. As more devices connect to 5G networks, network congestion and quality of service become critical issues. We'll explain how these challenges can affect user experience and the role of system integrators in optimizing network performance. The collection and processing of massive amounts of data in 5G networks raise concerns about data privacy and ethics. Including data ownership, consent, and the responsible use of data. The global nature of 5G technology has led to international competition and geopolitical tensions. We'll explore the role of various countries and companies in the 5G race and the implications for system integrators. In the conclusion section, we'll summarize the key challenges facing the global 5G System Integration market and their potential impact on the market's growth and development. We'll also provide insights into strategies and solutions that can help address these challenges.Key Market Trends

Expansion of 5G Network Coverage

One of the most prominent trends in the 5G System Integration market is the ongoing expansion of 5G network coverage. Telecommunication companies and service providers are aggressively deploying 5G infrastructure to cover more geographical areas. This expansion aims to bring high-speed connectivity to urban, suburban, and rural regions alike, opening up new opportunities for system integrators to support network deployment. As 5G coverage extends, system integrators are tasked with seamlessly integrating 5G infrastructure components, such as base stations and small cells, into existing networks. This trend contributes to market growth as system integrators play a crucial role in ensuring efficient network expansion. The demand for customized 5G network solutions is on the rise. Different industries, from manufacturing to healthcare, have unique connectivity requirements. System integrators are responding by tailoring 5G networks to meet specific needs.For example, in manufacturing, private 5G networks are being deployed to support industrial automation and IoT applications.

One of the most significant trends in the 5G System Integration market is the widespread expansion of 5G infrastructure. Telecommunication companies are rolling out 5G networks in urban and rural areas, creating new opportunities for system integrators. The deployment of 5G infrastructure involves integrating various elements, including hardware, software, and network components, to ensure seamless network operations. Edge computing is gaining prominence as it allows for faster data processing and reduced latency. In the context of 5G, edge computing integration is becoming a crucial trend. System integrators are working to seamlessly integrate edge computing solutions into 5G networks to support real-time applications such as autonomous vehicles, IoT devices, and augmented reality/virtual reality (AR/VR) experiences. Network slicing is another trend that is reshaping the 5G landscape. It involves creating multiple virtual networks within a single physical network infrastructure, each tailored to specific use cases. System integrators play a vital role in developing and managing these network slices, catering to the diverse needs of industries like healthcare, manufacturing, and entertainment.

AI and Automation

With the proliferation of sensitive data being transmitted over 5G networks, security and privacy have become paramount concerns. System integrators are focusing on implementing robust security measures, including encryption, authentication, and intrusion detection systems, to protect data and ensure privacy compliance. The integration of secure 5G systems is critical for businesses and consumers alike. Artificial intelligence (AI) and automation are transforming the 5G System Integration landscape. AI-powered tools are used to optimize network performance, predict and prevent network failures, and enhance the quality of service. System integrators are incorporating AI-driven solutions to streamline the integration process and provide proactive maintenance. The Internet of Things (IoT) is driving a surge in data traffic, and 5G networks are the backbone of IoT connectivity. System integrators are working on integrating IoT devices seamlessly into 5G networks, creating opportunities for smart cities, industrial automation, and connected healthcare solutions. This trend is poised to accelerate as IoT adoption continues to grow.Segmental Insights

Services Insights

With a revenue share of more than 39.0% in 2022, the infrastructure integration segment led the 5G System Integration market. From 2023 to 2030, it is anticipated to see the fastest CAGR of 30%. The increasing desire for the fusion of current network infrastructure with next-generation network infrastructure is to blame for this. Therefore, integrating legacy infrastructure enables users to access the same gear with improved functionalities, lowering the cost of hardware as a result. Additionally, network integration, building management, and data center infrastructure management (DCIM) are all included in the infrastructure system integration services. During the projection period, the consultancy segment is expected to expand at a considerable CAGR. Business businesses first turn to system integrators to design upgraded network architecture for their organizations due to the rapidly increasing need for 5G technology, such as network equipment. With the use of this design, businesses may increase operational output overall more quickly. Additionally, it is predicted that throughout the course of the forecast period, the necessity for application integration services would increase due to the increasing demand for multi-vendor cloud-based applications across companies.Vertical Insights

With a market share of more than 29% in 2022, the IT and telecom sector is expected to grow at a rapid rate between 2023 and 2030. This can be due to the rapidly growing need for 5G integration services among different IT and telecom firms to support new radio (NR) waves. The demand for 5G System Integration services in the IT and telecom sector is expected to expand significantly due to a healthy increase in demand for integrating enterprise network infrastructure and data center network hardware. In addition, 5G network services are anticipated to have significant enterprise adoption over the projection period as a result of a greater emphasis on delivering consistent connectivity during a virtual conference to cut down on a specialist or consultant's overall trip time.Application Insights

With a market share of more than 25.0% in 2022, the home and office broadband segment is anticipated to grow significantly between 2023 and 2030. This is explained by the increased demand for 5G System Integration services to initially connect consumers and businesses via enhanced mobile broadband (eMBB). Additionally, the demand for 5G System Integration services to make these devices compatible with next-generation network services is anticipated to expand due to the notable increase in IoT devices throughout fast growing smart cities around the world. From 2023 to 2030, this factor is predicted to significantly accelerate the expansion of the smart city application category.Regional Insights

The North America region has established itself as the leader in the Global 5G System Integration Market with a significant revenue share in 2022. With a revenue share of more than 35.0% in 2022, North America dominated the global market. This is linked to the presence of major IT and telecom businesses including Cisco Systems, Inc., IBM Corporation, and Microsoft Corporation. A significant need to integrate overall infrastructure and applications across numerous verticals, such as IT and telecom, energy & utilities, and healthcare, is also anticipated as a result of growing investments in the deployment of 5G infrastructure by major market players like AT&T Inc. and Verizon Communications Inc. This element is predicted to accelerate the regional market's overall growth.Key Market Players

- Ericsson

- Nokia

- Huawei

- Samsung Electronics

- Cisco Systems

- IBM

- Accenture

- Infosys

- HCL Technologies

- Wipro

Report Scope

In this report, the Global 5G System Integration Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global 5G System Integration Market, by Services:

- Consulting

- Infrastructure Integration

Global 5G System Integration Market, by Vertical:

- Manufacturing

- Energy & Utility

- Media & Entertainment

- IT & Telecom

- Transportation & Logistics

- BFSI

- Healthcare

- Retail

- Others

Global 5G System Integration Market, by Application:

- Smart City

- Collaborate Robot /Cloud Robot

- Industrial Sensors

- Logistics & Inventory Monitoring

- Wireless Industry Camera

- Drone

- Etc.

Global 5G System Integration Market, by Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global 5G System Integration Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Ericsson

- Nokia

- Huawei

- Samsung Electronics

- Cisco Systems

- IBM

- Accenture

- Infosys

- HCL Technologies

- Wipro

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 181 |

| Published | October 2023 |

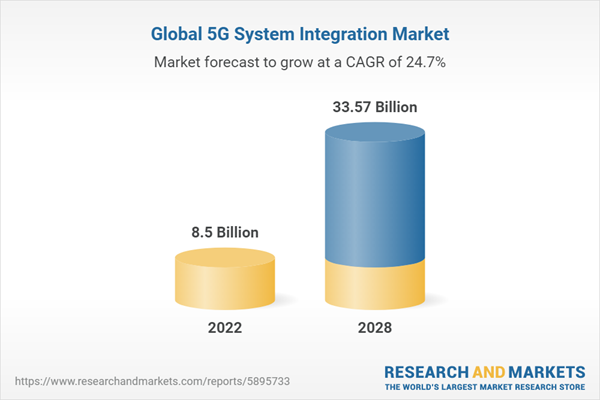

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 8.5 Billion |

| Forecasted Market Value ( USD | $ 33.57 Billion |

| Compound Annual Growth Rate | 24.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |