Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Auto aerodynamic systems are becoming an essential component of light commercial automobiles. The major purposes of this system's incorporation are to reduce the visual appeal and fuel consumption. However, some manufacturers of light commercial vehicles also seek to improve their models to maintain market competitiveness. Thus, the demand for automotive aerodynamics in the market is rising proportionately to the volume of production of light commercial vehicles, which is predicted to propel the industry's growth rate.The aerospace industry is heavily controlled by strict guidelines established by several regulatory agencies around the world. by imposing stricter regulations on the aviation industry for the reduction of carbon emissions, these authorities are pressuring the aerospace sector. The decrease of carbon emissions from automobiles is significantly aided by their aerodynamics.

Key Market Drivers

Regulatory Pressures

Governments worldwide are imposing increasingly stringent regulations on vehicle emissions and fuel efficiency. These regulatory standards are designed to combat climate change and reduce pollution. As a result, automakers are compelled to invest substantially in research and development to meet these standards. For instance, the European Union's Euro 7 emissions standard, scheduled for implementation in the coming years, will necessitate further optimization of vehicle aerodynamics to reduce emissions. Similarly, the United States continues to raise Corporate Average Fuel Economy (CAFE) standards, obliging automakers to develop more aerodynamically efficient vehicles. Compliance with these regulations often entails costly design modifications and the integration of advanced materials and technologies, impacting the overall cost of production.Electric Vehicle (EV) Integration

The surge of electric vehicles represents both an opportunity and a challenge for the Global Automotive Aerodynamic Market. EVs benefit from simplified powertrains and fewer mechanical components, potentially allowing for more streamlined designs. However, they also introduce unique challenges, such as battery cooling and aerodynamic optimization. Efficient cooling systems are necessary to manage the thermal load generated by high-capacity batteries, often requiring intricate airflow designs. Furthermore, as EVs become more prevalent, the market's competitive landscape is evolving. Established automakers are facing competition from new entrants and technology companies with different approaches to vehicle design, including aerodynamics. Adapting to this changing landscape while meeting consumer demands for EVs with extended range and rapid charging capabilities is a critical challenge.Cost Constraints and Return on Investment (ROI)

Optimizing vehicle aerodynamics can be a costly endeavor, and automakers must balance the benefits of improved fuel efficiency and performance against the added production costs. Achieving a satisfactory return on investment (ROI) while delivering vehicles at competitive prices is a constant challenge. Advanced aerodynamic features like active shutters, underbody panels, and specially designed exterior components can increase manufacturing costs. While these features can enhance fuel efficiency, automakers must carefully consider whether consumers are willing to pay a premium for these improvements, especially in price-sensitive market segments. Moreover, realizing ROI on aerodynamic investments often requires a long-term perspective, which may clash with short-term financial pressures and market dynamics. Automakers must navigate this delicate balance by evaluating when and how to implement aerodynamic innovations to maximize their benefits while remaining economically viable.Consumer Preferences and Aesthetics

Automotive consumers are increasingly concerned about the environmental impact of their vehicles, leading to a growing interest in fuel-efficient and eco-friendly models. However, consumer preferences also exert a significant influence on vehicle aesthetics, and finding the right balance between aerodynamics and visual appeal can be challenging. While optimizing aerodynamics can result in sleek, futuristic designs, these may not always align with consumer tastes. Balancing the need for improved aerodynamics with the desire for distinctive, attractive vehicles is a constant dilemma for automotive designers. Moreover, consumers have varying preferences for vehicle types, with some favoring SUVs and trucks over smaller, more aerodynamically efficient cars. This poses a complex challenge for automakers, as larger vehicles typically exhibit higher aerodynamic drag and fuel consumption. Striking a balance between consumer demand for larger vehicles and regulatory pressure for better fuel efficiency is a significant challenge.Material Innovation and Weight Reduction

Aerodynamic optimization often involves reducing a vehicle's weight and incorporating lightweight materials such as carbon fiber and aluminum. While this can improve fuel efficiency, it also presents several challenges for the Global Automotive Aerodynamic Market. Firstly, the adoption of lightweight materials can significantly increase production costs. For example, carbon fiber is more expensive to manufacture and repair than traditional steel or aluminum. Additionally, the production of lightweight materials can have a higher environmental impact, potentially offsetting the gains in fuel efficiency. Secondly, automakers must address safety concerns when reducing vehicle weight. Meeting safety standards while simultaneously achieving weight reduction and aerodynamic efficiency requires innovative engineering solutions, which can be technically challenging and costly.Autonomous Vehicles and Aerodynamics

The development of autonomous vehicles introduces a new layer of complexity to aerodynamic design. Autonomous vehicles often incorporate various sensors and hardware that can disrupt the airflow and add to a vehicle's drag. For instance, the installation of lidar, radar, and camera systems on a vehicle's exterior can create aerodynamic challenges. Integrating these sensors seamlessly while maintaining optimal aerodynamic performance is a significant engineering hurdle. Furthermore, autonomous vehicles may require additional computational power, leading to the need for improved thermal management systems. Cooling these systems efficiently without compromising aerodynamics is a critical challenge. Additionally, the transition to autonomous vehicles may change the way people use cars. Shared autonomous fleets, for instance, might prioritize cost and practicality over traditional aesthetic considerations, altering the aerodynamic design priorities.Technological Advancements in Manufacturing:

Technological advancements in manufacturing processes are revolutionizing the production of aerodynamic vehicle components. Lightweight materials, such as carbon fiber composites, are becoming more accessible and affordable. These materials allow for the creation of streamlined and lightweight body panels, reducing overall vehicle weight. This weight reduction not only improves aerodynamics but also enhances fuel efficiency and performance. Advanced manufacturing techniques are enabling automakers to produce complex and aerodynamic components with precision, contributing to the development of more aerodynamic vehicles.Key Market Challenges

Regulatory Compliance and Emissions Standards

One of the foremost challenges facing the Global Automotive Aerodynamic Market is the ever-tightening regulatory landscape. Governments worldwide are imposing stringent emissions standards and fuel efficiency requirements to combat climate change and reduce pollution. As a result, automotive manufacturers must invest heavily in research and development to meet these standards. For instance, the European Union's stringent Euro 7 emissions standard, slated for introduction in the coming years, will force automakers to optimize vehicle aerodynamics further to reduce emissions. Similarly, the United States continues to raise Corporate Average Fuel Economy (CAFE) standards, requiring automakers to develop more aerodynamically efficient vehicles. Compliance with these regulations often necessitates costly design changes and the integration of advanced materials and technologies, impacting the overall cost of production. Moreover, automakers must navigate a complex web of differing standards across regions, adding to the challenge.Electric Vehicle (EV) Integration

The rise of electric vehicles presents both opportunities and challenges for the Global Automotive Aerodynamic Market. On one hand, EVs benefit from simplified powertrains and reduced mechanical components, potentially allowing for more streamlined designs. However, they also introduce unique challenges, such as battery cooling and aerodynamic optimization.EVs require efficient cooling systems to manage the thermal load generated by high-capacity batteries. This often involves designing intricate airflow patterns, which can be at odds with traditional aerodynamic principles. Balancing these competing demands is a significant challenge for automakers.

Additionally, as EVs become more prevalent, the market's competitive landscape is changing. Established automakers are facing competition from new entrants and tech companies with different approaches to vehicle design, including aerodynamics. Adapting to this shifting landscape while meeting consumer demands for EVs with extended range and quick charging is a critical challenge.

Cost Constraints and ROI

Optimizing vehicle aerodynamics can be expensive, and automakers must balance the benefits of improved fuel efficiency and performance against the added production costs. The challenge lies in achieving an acceptable return on investment (ROI) while delivering vehicles at competitive prices. Advanced aerodynamic features like active shutters, underbody panels, and specially designed exterior components can increase manufacturing costs. While these features can enhance fuel efficiency, automakers must consider whether consumers are willing to pay a premium for these improvements, especially in price-sensitive market segments. Moreover, achieving ROI on aerodynamic investments often requires a long-term perspective, which may clash with short-term financial pressures and market dynamics. Automakers must carefully evaluate how and when to implement aerodynamic innovations to maximize their benefits while remaining economically viable.Consumer Preferences and Aesthetics

Automotive consumers are increasingly concerned about the environmental impact of their vehicles, which has led to a growing interest in fuel-efficient and eco-friendly models. However, consumer preferences also heavily influence vehicle aesthetics, and striking the right balance between aerodynamics and visual appeal can be challenging. While optimizing aerodynamics can lead to sleek, futuristic designs, these may not always align with consumer tastes. Balancing the need for improved aerodynamics with the desire for distinctive, attractive vehicles is a constant challenge for automotive designers. Consumers also have varying preferences for vehicle types, with some favoring SUVs and trucks over smaller, more aerodynamically efficient cars. This poses a dilemma for automakers, as larger vehicles tend to have higher aerodynamic drag and fuel consumption. Striking a balance between consumer demand for larger vehicles and regulatory pressure for better fuel efficiency is a significant challenge.Material Innovation and Weight Reduction

Aerodynamic optimization often involves reducing a vehicle's weight and incorporating lightweight materials like carbon fiber and aluminum. While this can improve fuel efficiency, it also poses several challenges for the Global Automotive Aerodynamic Market.Firstly, the adoption of lightweight materials can significantly increase production costs. Carbon fiber, for example, is more expensive to manufacture and repair than traditional steel or aluminum. Moreover, the production of lightweight materials can have a higher environmental impact, potentially offsetting the gains in fuel efficiency. Secondly, automakers must address safety concerns when reducing vehicle weight. Meeting safety standards while simultaneously achieving weight reduction and aerodynamic efficiency requires innovative engineering solutions, which can be technically challenging and costly.

Autonomous Vehicles and Aerodynamics

The development of autonomous vehicles introduces a new layer of complexity to aerodynamic design. Autonomous vehicles often incorporate various sensors and hardware that can disrupt the airflow and add to a vehicle's drag.For example, the installation of lidar, radar, and camera systems on a vehicle's exterior can create aerodynamic challenges. Integrating these sensors seamlessly while maintaining optimal aerodynamic performance is a significant engineering hurdle. Furthermore, autonomous vehicles may require additional computational power, leading to the need for better thermal management systems. Cooling these systems efficiently without compromising aerodynamics is a critical challenge. Additionally, the transition to autonomous vehicles may change the way people use cars. Shared autonomous fleets, for instance, might prioritize cost and practicality over traditional aesthetic considerations, altering the aerodynamic design priorities.

Global Supply Chain Disruptions and Uncertainties

Global supply chain disruptions, as exemplified by events like the COVID-19 pandemic, have had a profound impact on the automotive industry. The interconnected nature of the industry means that disruptions in one region can have far-reaching consequences. These disruptions can impact the availability of materials and components crucial for aerodynamic enhancements. For instance, a shortage of semiconductor chips, a key component in modern vehicles, can disrupt the production of vehicles with advanced aerodynamic features that rely on electronic controls. Additionally, geopolitical tensions and trade disputes can introduce uncertainties in the supply chain, making it challenging for automakers to plan and implement long-term aerodynamic strategies. The need to diversify supply sources and mitigate risks from potential disruptions is an ongoing challenge.Key Market Trends

Rising Fuel Efficiency Regulations:

Governments worldwide are implementing stringent fuel efficiency and emission standards to combat climate change and reduce dependency on fossil fuels. These regulations are pushing automakers to adopt aerodynamic features that enhance the overall fuel efficiency of their vehicles. Improvements in aerodynamics reduce drag, thereby reducing the energy required to propel the vehicle. This trend is particularly prevalent in the development of electric and hybrid vehicles where maximizing range is crucial.Integration of Active Aerodynamics:

Active aerodynamics systems are gaining traction in the automotive industry. These systems adjust various components of the vehicle's exterior, such as spoilers, flaps, and air vents, to optimize aerodynamic performance in real-time. For instance, some high-performance vehicles deploy active spoilers that can adapt their angles according to driving conditions. This trend enhances both performance and fuel efficiency by minimizing drag when necessary and increasing downforce for stability during high-speed maneuvers.Lightweight Materials and Design Optimization:

Automakers are increasingly incorporating lightweight materials like carbon fiber and aluminum into their vehicles to reduce weight and improve aerodynamic efficiency. Lightweight materials, combined with advanced design optimization techniques, help in streamlining vehicle shapes and reducing air resistance. As a result, automakers can achieve better fuel economy without sacrificing safety or performance.Electric Vehicle Aerodynamics:

Electric vehicles (EVs) present unique aerodynamic challenges due to their distinct designs and the need for efficient cooling systems. EV manufacturers are investing heavily in aerodynamic research to enhance the range of electric vehicles by reducing drag and optimizing airflow around batteries and powertrain components. Efficient EV aerodynamics are vital for maximizing the driving range, which is a key selling point for electric vehicles.Wind Tunnel Testing and Computational Fluid Dynamics (CFD):

Automotive manufacturers are increasingly relying on advanced aerodynamic testing methods such as wind tunnel testing and computational fluid dynamics (CFD) simulations. These tools allow engineers to fine-tune vehicle designs for optimal aerodynamic performance. CFD, in particular, enables virtual testing of various design iterations, leading to cost savings and faster development cycles.Urban Mobility and Autonomous Vehicles:

The rise of urban mobility solutions and the development of autonomous vehicles are influencing automotive aerodynamics. Autonomous vehicles often feature sensors, cameras, and lidar systems that must be carefully integrated into the vehicle's design to minimize drag and maintain aesthetics. Urban mobility solutions like electric scooters and small electric vehicles also benefit from aerodynamic improvements to extend their range and efficiency in city environments.Cross-Industry Collaboration:

Collaboration between automotive manufacturers and other industries, such as aviation and motorsports, is fostering innovation in automotive aerodynamics. Lessons learned from aircraft and Formula 1 racing, where aerodynamics are critical, are being applied to passenger vehicles. These collaborations are resulting in cutting-edge aerodynamic designs and technologies that enhance both performance and fuel efficiency.Segmental Insights

Vehicle & Mechanism Type Analysis

Light commercial vehicles now use aerodynamic application mechanisms as a standard feature, particularly passive aerodynamic systems. Some LCV manufacturers include them in their models to remain competitive in the market, even if their main purposes for inclusion are fuel consumption reduction and aesthetic appeal. As a result, the automobile aerodynamics market is growing in line with LCV production volumes. In the market for automobile aerodynamics, the LCV segment thus commands the largest market share.Application Type Analysis

According to application, the grille sector is predicted to be the largest in this market. This is because all vehicle types, whether they be ICE vehicles (such as LCVs and M&HCVs) or EV kinds (such as BEVs and HEVs), are fitted with grilles that are primarily used to meet the cooling needs of engines. The most widely utilized active aerodynamic device in LCVs is the active grille shutter, the most recent improvement to these grilles. All of these element’s help explain why this application has the biggest market share in the vehicle aerodynamics market.Regional Insights

North America dominates the automotive aerodynamic market in terms of market revenue and share during the forecast period of 2022-2029. This is due to the growth of the automotive industry in this region. Asia-Pacific is expected to be the fastest developing regions due to the large share of china and India along with increasing population, rising disposable income and rising demand of automobile in this regionThe country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Key Market Players

- Magna International Inc.

- Röchling SE & Co. KG

- Plastic Omnium

- SMP

- Valeo

- SRG Global

- Polytec Holding AG

- Plasman

- INOAC Corporation

- Rehau Group

Report Scope

In this report, the Global Automotive Aerodynamic Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Automotive Aerodynamic Market, by Vehicle Type:

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

Automotive Aerodynamic Market, by Mechanism Type:

- Active System

- Passive System

Automotive Aerodynamic Market, by Application Type:

- Air Dam

- Diffuser

- Gap Fairing

- Grille Shutter

- Side Skirts

- Spoiler

- Wind Deflector

Automotive Aerodynamic Market, by Region:

- North America

- Europe & CIS

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Automotive Aerodynamic Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Magna International Inc.

- Röchling SE & Co. KG

- Plastic Omnium

- SMP

- Valeo

- SRG Global

- Polytec Holding AG

- Plasman

- INOAC Corporation

- Rehau Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | October 2023 |

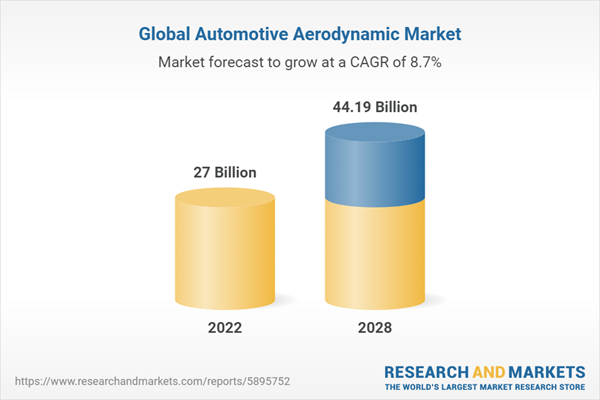

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 27 Billion |

| Forecasted Market Value ( USD | $ 44.19 Billion |

| Compound Annual Growth Rate | 8.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |