Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Diatomite, also known as diatomaceous earth, is a naturally happening, sedimentary rock that is composed of the fossilized remains of diatoms. These microscopic single-celled algae are a type of phytoplankton that thrives in aquatic environments such as lakes, rivers, and oceans. Diatomite is known for its unique physical and chemical properties, which make it useful in a variety of industrial and consumer applications. Diatomite has several unique physical and chemical properties that make it a valuable industrial material. One of the most notable properties is its high porosity, which allows it to absorb liquids and gases up to several times its own weight. This makes diatomite useful as an absorbent material in a variety of applications, such as in kitty litter, industrial spill cleanup, and as a filtration medium for beer, wine, and other beverages.

Diatomite's high porosity and unique structure make it an excellent filtration medium. It is used in a variety of industries, such as the production of beer, wine, and other beverages, as well as in the filtration of swimming pool water, pharmaceuticals, and industrial wastewater. Diatomite's high absorbency makes it useful as an absorbent material in a variety of applications, such as in kitty litter, industrial spill cleanup, and as a drying agent in food processing.

Key Market Drivers

Rising Demand for Filtration Media

The global diatomite market is witnessing robust growth, primarily driven by the increasing demand for efficient and sustainable filtration media across multiple industries. Diatomite, a naturally occurring, silica-rich sedimentary rock formed from the fossilized remains of diatoms, offers superior porosity, low density, and high surface area, making it an ideal candidate for use in filtration applications. These properties enable it to effectively remove impurities from liquids and gases, making it indispensable in water treatment plants, food and beverage processing, pharmaceuticals, and industrial filtration systems.One of the major growth drivers for the diatomite market is the expanding water treatment industry. With rising concerns over water quality and stringent environmental regulations, municipalities and industries alike are increasingly adopting advanced filtration technologies that incorporate diatomite. Its ability to filter fine particles without the use of chemicals makes it an environmentally friendly choice, particularly attractive in regions with growing water scarcity issues. Additionally, the food and beverage sector relies heavily on diatomite for clarifying products like beer, wine, fruit juices, and edible oils. As consumer demand for clean-label and contaminant-free products increases, so too does the need for effective, natural filtration materials.

The pharmaceutical and biotechnology industries are also contributing significantly to the demand for diatomite-based filtration media. Diatomite ensures product purity and compliance with regulatory standards by filtering out microbial contaminants during drug production. Its usage in biofiltration and chromatography further supports its relevance in this sector. Moreover, as global pharmaceutical production ramps up to meet the needs of an aging population and increased healthcare access, the demand for reliable filtration solutions is growing proportionately. According to the India Brand Equity Foundation (IBEF), India's pharmaceutical exports reached ₹1.8 trillion (US$23.04 billion) in FY22.

In industrial applications, diatomite is used for filtering oils, chemicals, and solvents. The surge in chemical manufacturing, petroleum refining, and food ingredient production worldwide is creating new opportunities for diatomite producers. Furthermore, with industries prioritizing sustainability and seeking alternatives to synthetic filter aids, diatomite - being naturally occurring and biodegradable - is emerging as a preferred choice.

The global diatomite market is experiencing strong momentum due to its pivotal role as a filtration medium in various critical sectors. As industries seek more sustainable and efficient methods for purification and quality control, the demand for high-performance diatomite products is expected to continue its upward trajectory. This trend is likely to encourage further investment in diatomite mining, processing technologies, and application development in the years to come.

Key Market Challenges

Limited Availability of High-Quality Diatomite Deposits

One of the major challenges faced by the diatomite market is the limited availability of high-quality diatomite deposits. Diatomite deposits are geographically restricted and are not uniformly distributed across the globe. This creates logistical challenges in transportation and can cause supply chain disruptions. Diatomite mining is a costly process, especially in areas where the deposits are deep underground or located in remote regions. The high cost of mining and transportation can impact the overall profitability of diatomite producers, leading to price fluctuations and supply chain disruptions.Diatomite faces competition from several substitute products such as perlite, vermiculite, and activated carbon, which can perform similar functions in many applications. This competition can impact the overall demand for diatomite, leading to price fluctuations and supply chain disruptions. The mining and processing of diatomite can have a negative impact on the environment, particularly if the mining is done using open-pit mining methods. Environmental regulations and concerns about sustainability are increasingly becoming a factor in the diatomite market, which could lead to increased scrutiny and regulatory compliance costs for producers. The demand for diatomite is driven by several end-use markets such as filtration, agriculture, personal care, and industrial applications. Fluctuations in these end-use markets can impact the overall demand for diatomite, leading to price fluctuations and supply chain disruptions.

Key Market Trends

Technological Advancements

The global diatomite market is witnessing significant growth, fueled by rapid technological advancements across various end-use industries. Diatomite, also known as diatomaceous earth, is a naturally occurring, soft, siliceous sedimentary rock that can be easily crumbled into a fine white powder. It possesses unique physical properties such as high porosity, low density, high surface area, and excellent filtration capabilities. These characteristics have made it increasingly valuable in sectors such as agriculture, water treatment, pharmaceuticals, construction, and food and beverage processing.One of the major technological developments impacting the diatomite market is the advancement in filtration technologies. Diatomite is widely used as a filtration aid due to its superior permeability and particle retention capabilities. Innovations in membrane and bio-filtration systems have enhanced the demand for diatomite as a cost-effective and natural filter medium. Additionally, improvements in processing technologies have allowed manufacturers to develop customized grades of diatomite with enhanced filtration performance, further expanding its application in breweries, pharmaceuticals, and industrial wastewater treatment.

In agriculture, the integration of nanotechnology with diatomite-based soil amendments has opened new avenues for improved soil health and crop yield. Diatomite’s ability to retain moisture and nutrients makes it an ideal additive in sustainable farming practices. The development of precision agriculture tools has also enabled more efficient application of diatomite-based products, boosting productivity and reducing environmental impact.

The construction industry is adopting diatomite as an eco-friendly additive in lightweight concrete and insulation materials. Advancements in material science have enabled diatomite to be used in the production of energy-efficient building materials with better thermal and acoustic insulation properties. These innovations are particularly relevant in the context of green building standards and sustainable construction practices.

The pharmaceutical and personal care industries are also contributing to market growth, with diatomite being utilized as an excipient and abrasive in tablets and toothpaste. Technological progress in formulation science has improved the compatibility and safety profile of diatomite in these applications, supporting broader adoption. The growing focus on environmental sustainability has led to increased use of diatomite in pollution control technologies.

Emerging solutions in air purification and oil spill cleanup are utilizing diatomite for its absorbent and chemical inertness properties. As environmental regulations become stricter, diatomite is being explored as a sustainable alternative to synthetic materials in environmental remediation. Continuous technological innovations across filtration, agriculture, construction, pharmaceuticals, and environmental applications are driving the expansion of the global diatomite market. As industries prioritize efficiency, sustainability, and cost-effectiveness, the role of technologically refined diatomite products is expected to strengthen, positioning the market for robust growth in the coming years.

Key Market Players

- Imerys S.A.

- Calgon Carbon Corporation

- Showa Chemical Industry Co.

- Diatomit CJSC

- Dicalite Management Group, Inc.

- Jilin Yuan Tong Mineral Co., Ltd.

- Qingdao Best diatomite Co.Ltd.,

- EP Minerals LLC

- U.S. SILICA Holdings Inc.

- Shenzhou Xinglong Products of Diatomite Co,.Ltd.

Report Scope

In this report, global Diatomite market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Diatomite Market, By Source:

- Fresh Water Diatomite

- Saltwater Diatomite

Diatomite Market, By Application:

- Filter Media

- Cement Additive

- Filler

- Adsorbent

- Insecticides

- Others

Diatomite Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Spain

- Italy

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Singapore

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive landscape

Company Profiles: Detailed analysis of the major companies present in Global Diatomite market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Diatomite market report include:- Imerys S.A.

- Calgon Carbon Corporation

- Showa Chemical Industry Co.

- Diatomit CJSC

- Dicalite Management Group, Inc.

- Jilin Yuan Tong Mineral Co., Ltd.

- Qingdao Best diatomite Co.Ltd.,

- EP Minerals LLC

- U.S. SILICA Holdings Inc.

- Shenzhou Xinglong Products of Diatomite Co,.Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

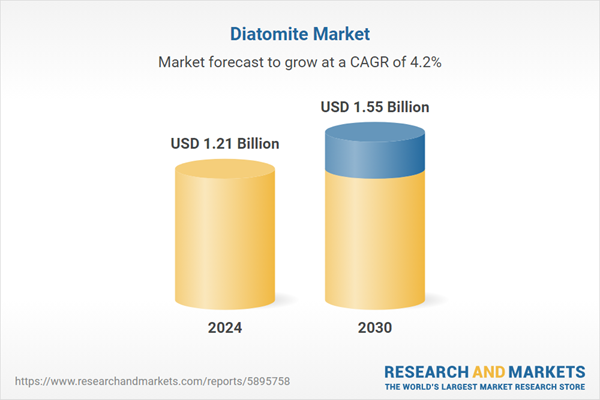

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.21 Billion |

| Forecasted Market Value ( USD | $ 1.55 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |