Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

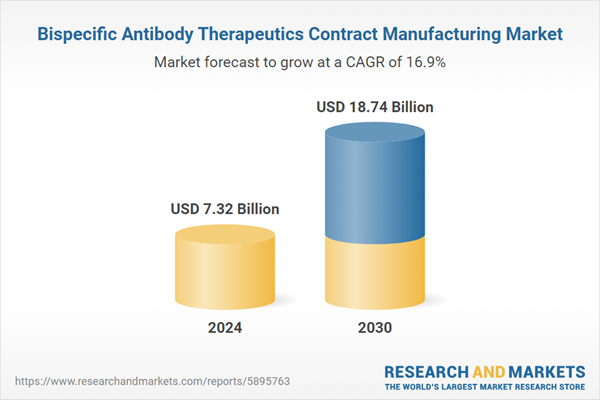

Contract manufacturing organizations (CMOs) play a crucial role in this landscape by providing the infrastructure, technical expertise, and scalability required to manufacture these complex biologics. The market is being driven by a rapidly expanding pipeline of bispecific antibody candidates and the need for specialized manufacturing capabilities that many biopharma companies prefer to outsource. As companies continue to develop innovative bispecific formats and therapeutic applications, the demand for flexible, high-quality manufacturing support is expected to rise steadily, reinforcing the role of CMOs in advancing next-generation biologic therapies.

Key Market Drivers

Ongoing Research Activities in Bispecific Antibody Therapeutics

The Global Bispecific Antibody Therapeutics Contract Manufacturing Market is experiencing strong growth due to intensifying research and development efforts. As of early 2025, there are more than 200 bispecific antibody candidates in various stages of development, with over 50 undergoing clinical trials targeting oncology, autoimmune conditions, and infectious diseases.The structural diversity of bispecific formats - such as BiTEs, DVD-Igs, and tandem diabodies - requires advanced design and production capabilities. CMOs with expertise in bispecific antibody manufacturing are increasingly in demand as they provide essential services like high-throughput analytics, improved purification processes, and scalable production systems. With more than 60% of biologics-focused CMOs having expanded capabilities tailored to bispecifics, the sector is seeing a surge in specialized offerings aimed at supporting the growing complexity and volume of these novel therapeutics.

Key Market Challenges

Challenges Associated with Manufacturing of Bispecific Antibody Therapeutics

Manufacturing bispecific antibody therapeutics presents a unique set of challenges that differentiate them from traditional monoclonal antibodies. The complexity of these molecules - arising from their dual-target structure - necessitates precise control over manufacturing to ensure consistency and efficacy. Post-translational modifications such as glycosylation and oxidation introduce further heterogeneity, requiring robust analytical oversight.Scale-up remains a critical hurdle, as production must transition smoothly from development to commercial levels without compromising quality. Custom purification strategies are often required due to the distinct molecular properties of each bispecific antibody, complicating downstream processing. Additionally, the need for specialized equipment, such as bioreactors and chromatography systems suited for bispecifics, results in higher capital investment. Regulatory compliance adds another layer of complexity, as evolving global guidelines demand rigorous quality and safety controls, further elevating the operational demands for CMOs in this field.

Key Market Trends

Increasing Demand for Bispecific Antibodies

The rising demand for bispecific antibodies is a dominant trend shaping the Global Bispecific Antibody Therapeutics Contract Manufacturing Market. These molecules offer the ability to engage two targets simultaneously, providing novel mechanisms of action in diseases like cancer, autoimmune disorders, and infections. In oncology, bispecific T-cell engagers (BiTEs) have shown strong therapeutic potential by redirecting immune responses toward cancer cells, prompting further clinical exploration.The trend toward personalized medicine is also driving demand for customizable bispecific formats tailored to specific disease subtypes or patient groups. As biopharmaceutical companies seek contract partners capable of delivering precision-engineered therapeutics at scale, the market for CMOs offering flexible and advanced bispecific antibody manufacturing continues to grow. This rising demand, coupled with innovations in therapeutic design, is positioning bispecific antibodies as a key area of growth within the broader biologics manufacturing ecosystem.

Key Market Players

- Lonza Group AG

- Creative Biolabs Inc

- Amgen Inc

- Johnson & Johnson

- Wuxi Biologics Cayman Inc

- Roche Holding AG

- Sino Biological Inc

- IQVIA Inc

- Janssen Pharmaceuticals Inc

- AbbVie Inc

Report Scope:

In this report, the Global Bispecific Antibody Therapeutics Contract Manufacturing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Bispecific Antibody Therapeutics Contract Manufacturing Market, By Indication:

- Cancer

- Infectious Diseases

- Autoinflammatory and Autoimmune Diseases

- CNS Conditions

- Others

Bispecific Antibody Therapeutics Contract Manufacturing Market, By Route of Administration:

- Intravenous

- Subcutaneous

- Others

Bispecific Antibody Therapeutics Contract Manufacturing Market, By End Use:

- Pharmaceutical Companies

- Biopharmaceutical Companies

- Others

Bispecific Antibody Therapeutics Contract Manufacturing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Bispecific Antibody Therapeutics Contract Manufacturing Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Lonza Group AG

- Creative Biolabs Inc

- Amgen Inc

- Johnson & Johnson

- Wuxi Biologics Cayman Inc

- Roche Holding AG

- Sino Biological Inc

- IQVIA Inc

- Janssen Pharmaceuticals Inc

- AbbVie Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.32 Billion |

| Forecasted Market Value ( USD | $ 18.74 Billion |

| Compound Annual Growth Rate | 16.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |