Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Real-time PCR, valued at approximately USD 4 billion, stands as the dominant segment within this market. It holds this position due to its versatility in quantitatively measuring DNA amplification in real-time. Real-time PCR finds extensive applications in clinical diagnostics, gene expression analysis, and pathogen detection, with industry leaders such as Thermo Fisher Scientific and Bio-Rad Laboratories leading the market.

Digital PCR, although smaller in size with a market value of around USD 450 million, is experiencing rapid growth. This growth is attributed to its precision in nucleic acid quantification and its applications in the detection of rare mutations.

Endpoint PCR, a mature technology with a stable market size, remains crucial for various molecular biology applications, including genotyping, DNA sequencing, and infectious disease diagnostics.

All three PCR techniques are continuously evolving through technological advancements and are witnessing increased demand in healthcare and life sciences. They cater to specific research and diagnostic needs, thereby contributing to the market's growth and diversification.

Key Market Drivers

Rising Incidence Of Chronic Diseases, Infectious Diseases, And Genetic Disorders

The escalating incidence of chronic diseases, infectious diseases, and genetic disorders is significantly propelling the Real-time PCR, Digital PCR, and Endpoint PCR market. The global burden of chronic illnesses such as cancer, cardiovascular diseases, and diabetes is on the rise. These diseases necessitate early detection and precise monitoring. Real-time PCR, with its real-time quantitative capabilities, allows for the timely identification of genetic markers associated with these conditions. Digital PCR, known for its unparalleled precision, aids in detecting rare mutations, facilitating early intervention and personalized treatment strategies. The emergence of infectious diseases, including recent pandemics, emphasizes the need for accurate diagnostics. Real-time PCR has been instrumental in detecting viral, bacterial, and fungal pathogens. Its speed and sensitivity support swift identification and containment of infectious agents. Meanwhile, Digital PCR offers enhanced sensitivity for monitoring viral load, critical for managing infectious diseases.Genetic disorders demand a thorough understanding of an individual's genetic profile. Real-time and Digital PCR are pivotal in genetic testing, enabling the detection of genetic mutations linked to inherited disorders. This assists in early diagnosis, tailored treatment, and genetic counseling. Therefore, the surge in these diseases necessitates advanced diagnostic tools. Real-time PCR, Digital PCR, and Endpoint PCR, with their precision and sensitivity, are indispensable in addressing these healthcare challenges, leading to earlier detection, more targeted treatments, and improved patient outcomes.

Increasing Demand For Rapid Diagnostic Tests And Growing Adoption Of Qpcr & Dpcr

The Real-time PCR, Digital PCR, and Endpoint PCR market are witnessing a significant surge in demand due to two key factors: the increasing need for rapid diagnostic tests and the growing adoption of qPCR (quantitative PCR) and dPCR (digital PCR) technologies. The demand for quick and accurate diagnostic tests is escalating, driven by the need for timely disease detection and monitoring, particularly in the context of infectious diseases. Real-time PCR, with its ability to deliver rapid and precise results, has become a cornerstone in diagnostics. It enables healthcare professionals to swiftly identify pathogens, making it invaluable in situations like the COVID-19 pandemic.Quantitative PCR (qPCR) and digital PCR (dPCR) have gained traction in both research and clinical settings due to their unmatched precision and sensitivity. Researchers are increasingly relying on these techniques to quantify nucleic acids accurately. In diagnostics, dPCR, with its absolute quantification capabilities, is proving to be a game-changer, especially in monitoring viral loads in infectious diseases.The convergence of the need for rapid diagnostics and the adoption of qPCR and dPCR technologies has fueled the growth of the Real-time PCR, Digital PCR, and Endpoint PCR market. These techniques are not only meeting the demand for rapid and accurate testing but are also enabling earlier disease detection, tailored treatments, and improved patient outcomes. As healthcare continues to evolve, these PCR technologies are poised to play pivotal roles in shaping the future of diagnostics and research.

implementation of MIQE (Minimum Information for Publication of Quantitative Real-Time PCR Experiments)

The implementation of MIQE (Minimum Information for Publication of Quantitative Real-Time PCR Experiments) guidelines is exerting a significant influence on the Real-time PCR, Digital PCR, and Endpoint PCR market. These guidelines provide a standardized framework for conducting and reporting quantitative PCR experiments, promoting data accuracy, reproducibility, and reliability. Here's how MIQE is driving the PCR market: MIQE-compliant studies adhere to stringent experimental design and reporting standards, ensuring the accuracy and integrity of PCR-generated data. Researchers and clinicians increasingly prioritize high-quality data in their work, spurring the demand for advanced PCR technologies. MIQE adherence enhances the credibility of PCR-based research, facilitating greater trust in the scientific community. This leads to more collaborative studies and accelerates the pace of scientific discovery, driving the adoption of Real-time PCR, Digital PCR, and Endpoint PCR technologies. In clinical diagnostics, MIQE compliance is critical to guarantee the precision of patient test results. Regulatory bodies and healthcare institutions are increasingly requiring MIQE adherence for PCR-based diagnostic assays, propelling the use of PCR instruments and reagents. The strict standards set by MIQE guidelines necessitate high-quality PCR instruments, reagents, and software. This drives investments in cutting-edge PCR technology, expanding the market for these PCR solutions.Therefore implementation of MIQE guidelines has become a catalyst for the PCR market's growth. Researchers, clinicians, and regulatory bodies increasingly recognize the significance of MIQE compliance, promoting the adoption of Real-time PCR, Digital PCR, and Endpoint PCR technologies across a wide range of scientific and clinical applications.

Technological advancements in PCR (Polymerase Chain Reaction)

Technological advancements in PCR (Polymerase Chain Reaction) are propelling the Real-time PCR, Digital PCR, and Endpoint PCR market into a new era of precision, efficiency, and versatility. These advancements are driving the adoption of PCR techniques across various industries and applications. Continuous research and development efforts have led to PCR systems with greater sensitivity and precision. Real-time PCR and Digital PCR, in particular, can now detect and quantify nucleic acids with unprecedented accuracy, revolutionizing genomics research, clinical diagnostics, and personalized medicine. PCR techniques have evolved to enable multiplexing, allowing the simultaneous analysis of multiple genetic targets in a single reaction. This not only saves time but also conserves resources. High-throughput PCR systems have emerged, meeting the demand for rapid and large-scale testing, especially in clinical diagnostics and drug discovery.PCR instruments are increasingly being integrated with automation systems, streamlining laboratory workflows and minimizing human error. This is vital in clinical settings where reliability and speed are paramount. Miniaturization and portability have resulted in point-of-care PCR devices that can be deployed in remote or resource-limited areas. These compact systems are expanding the use of PCR in infectious disease diagnosis and monitoring. PCR has become an integral component of NGS workflows, facilitating target amplification before sequencing. This integration has accelerated advancements in genomics and molecular biology research. Therefore, technological breakthroughs are reshaping the PCR landscape, fueling the adoption of Real-time PCR, Digital PCR, and Endpoint PCR across diverse sectors. These innovations are broadening the scope of PCR applications, making it an indispensable tool in modern science, medicine, and diagnostics.

Key Market Challenges

High Device Costs Associated With Real Time Pcr

The high device costs associated with Real-time PCR have become a significant challenge for the Real-time PCR, Digital PCR, and Endpoint PCR market. While these technologies offer unparalleled precision and sensitivity, their initial investment and ongoing operational expenses can be substantial, creating several hurdles: The considerable upfront cost of purchasing Real-time PCR, Digital PCR, or Endpoint PCR instruments can deter smaller research laboratories, clinics, and resource-constrained regions from adopting these technologies. This limits their access to advanced molecular diagnostic capabilities. Beyond the initial purchase, PCR instruments require regular maintenance and the use of specialized consumables, such as reagents and disposables. These ongoing expenses can strain budgets, particularly in healthcare settings with tight financial constraints. Proper utilization of PCR systems demands trained personnel with expertise in molecular biology techniques. Investing in staff training adds to the overall cost of implementing and maintaining PCR technologies.The cost per test with PCR-based assays can be higher compared to some other diagnostic methods. This can be a concern for healthcare providers and patients, potentially limiting the widespread adoption of these techniques. The high cost of PCR instruments has led to a competitive market, with manufacturers striving to offer cost-effective solutions. While this benefits consumers, it can pose a challenge for manufacturers in terms of maintaining profitability. Therefore, while Real-time PCR, Digital PCR, and Endpoint PCR offer exceptional diagnostic capabilities, their high device costs present a significant challenge. To overcome this obstacle and promote broader adoption, the industry must continue to explore cost-effective innovations, streamline operational expenses, and facilitate accessibility to these advanced molecular diagnostic technologies across diverse healthcare and research settings.

Stringent Regulatory Policies

Stringent regulatory policies present a considerable challenge for the Real-time PCR, Digital PCR, and Endpoint PCR market. While regulations are essential for ensuring the safety and reliability of diagnostic devices, they often pose several hurdles to the industry's growth and innovation. One of the primary challenges lies in the lengthy and resource-intensive process of obtaining regulatory approvals. Companies must navigate complex and time-consuming procedures, such as FDA clearance in the United States or CE marking in Europe. These approval delays can significantly impede the introduction of new PCR technologies to the market. Compliance costs are another major concern. Meeting stringent regulatory requirements demands substantial investments in testing, documentation, and quality control measures. These expenses can increase the overall cost of PCR technologies, potentially making them less accessible to healthcare providers and patients. The stringent regulatory landscape can also deter smaller, innovative companies from entering the market. Compliance with complex regulations may require significant financial and human resources, limiting the development of novel PCR technologies.Moreover, different regions often have their own regulatory frameworks, resulting in variations and inconsistencies. Adhering to various sets of rules can be burdensome for manufacturers aiming to market their products globally. Therefore, while regulatory policies are crucial for ensuring patient safety and product quality, they create significant challenges for the Real-time PCR, Digital PCR, and Endpoint PCR market. Balancing stringent regulations with innovation and market access is essential to drive the industry forward and provide healthcare providers and patients with advanced diagnostic tools.

Key Market Trends

Genomics research

Genomics research is playing a pivotal role in driving the growth of the Real-time PCR, Digital PCR, and Endpoint PCR market. This field of study, focused on understanding the complete set of an organism's genes (its genome), relies heavily on Polymerase Chain Reaction (PCR) technologies for a multitude of applications.One of the primary drivers is the need for DNA amplification and sequencing, which are fundamental processes in genomics research. PCR techniques enable researchers to selectively amplify specific DNA regions, facilitating the analysis of genetic variations, mutations, and gene expression patterns. Moreover, the emergence of next-generation sequencing (NGS) has further accentuated the importance of PCR. NGS relies on PCR for target amplification before sequencing, making PCR a critical component in the genomics workflow. This synergy between PCR and NGS has propelled genomics research into new dimensions, enabling researchers to explore complex biological questions and uncover genomic insights.

Additionally, genomics research has far-reaching implications in fields such as personalized medicine, agriculture, and evolutionary biology. The demand for accurate, high-throughput, and cost-effective PCR technologies has surged as genomics research expands its horizons. Therefore, genomics research's insatiable appetite for DNA analysis and sequencing has fueled the demand for Real-time PCR, Digital PCR, and Endpoint PCR technologies. These PCR techniques are indispensable tools in the genomics researcher's toolkit, contributing significantly to our understanding of genetics and driving innovations in science, medicine, and beyond.

Point-of-care testing (POCT)

Point-of-care testing (POCT) has emerged as a prominent trend in the Real-time PCR, Digital PCR, and Endpoint PCR market, transforming the landscape of diagnostic and healthcare practices. This shift is driven by several key factors. The need for rapid and on-the-spot diagnostics has never been more critical, particularly in scenarios like infectious disease outbreaks, where quick and accurate results can be a matter of life and death. PCR technologies, including Real-time PCR and Digital PCR, have evolved to meet this demand. Portable and compact PCR devices are now available, allowing healthcare professionals to perform molecular diagnostics at the patient's bedside or in remote locations. Secondly, the COVID-19 pandemic highlighted the significance of POCT using PCR techniques. Real-time PCR, in particular, played a central role in mass testing efforts, emphasizing the technology's adaptability for rapid and widespread diagnostics. Furthermore, the decentralization of testing facilities is a growing trend in healthcare. POCT reduces the need for sending samples to centralized laboratories, saving time and resources. This decentralization also promotes early diagnosis and treatment, improving patient outcomes. In addition, as PCR devices become more user-friendly and require less technical expertise, their adoption in POCT settings becomes more feasible for healthcare providers beyond traditional laboratories. Overall, the trend towards point-of-care testing using PCR technologies is driven by the demand for quick, accurate, and accessible diagnostics. As these technologies continue to evolve, they are expected to play an increasingly significant role in healthcare, offering timely insights and improving patient care.Segmental Insights

Product Insights

The consumables and reagents segment emerged as the dominant revenue contributor, accounting for a substantial share of over 56.51% in 2022 within the Real-time PCR, Digital PCR, and Endpoint PCR market. This dominance can be attributed to several key factors that have shaped its growth trajectory. The outbreak of the COVID-19 pandemic created an unprecedented demand for diagnostic testing, where PCR technologies played a pivotal role. Consumables and reagents are fundamental components of PCR assays, and the surge in testing requirements significantly boosted their consumption. The need for early and accurate disease detection during the pandemic further fueled demand. Secondly, the multitude of companies engaged in the manufacturing of digital PCR consumables and reagents contributed to the segment's prominence. Competition in this sector led to product innovation and a wider range of offerings, catering to diverse research and diagnostic needs.Moreover, the extensive use of consumables and reagents across various domains, including healthcare, research, and other scientific applications, has sustained the segment's large market share. These consumables are integral to routine laboratory practices, ensuring the continuity of research and diagnostics. Furthermore, the rising prevalence of chronic diseases has led to increased utilization of PCR technologies, consequently bolstering the demand for consumables and reagents. Additionally, the pharmaceutical and healthcare sectors' growing acceptance of technological advancements and increased research and development activities are set to create significant growth opportunities for this segment in the foreseeable future. In conclusion, the consumables and reagents segment's dominance in the Real-time PCR, Digital PCR, and Endpoint PCR market is the result of a confluence of factors, including the COVID-19 pandemic, competitive manufacturing landscape, widespread application, and the ever-expanding realm of research and healthcare. This dominance is poised to persist as the market continues to evolve.

Technology Insights

The quantitative PCR segment established its dominance in the market, capturing a substantial revenue share of over 88.63% in 2022. Several driving forces have propelled this segment to the forefront, shaping its remarkable growth trajectory. Firstly, the rapid pace of technological advancements has been a catalyst for the quantitative PCR segment's ascent. These advancements have led to the development of more sophisticated and user-friendly PCR systems, catering to the evolving needs of researchers and diagnosticians. Secondly, there is a growing demand for automated PCR systems and point-of-care diagnostics. The convenience and efficiency offered by automated systems have garnered significant interest, further propelling the quantitative PCR segment's growth. Additionally, the segment has experienced an exponential surge in demand due to the global response to the COVID-19 pandemic. The introduction of real-time PCR-based products for COVID-19 screening and diagnosis has played a pivotal role in this growth. For example, Huwel Lifesciences unveiled a portable RT-PCR machine in February 2023 designed to test various virus types, enhancing accessibility to testing.Furthermore, distribution agreements, such as the one announced by Bruker Corporation in March 2020 for the distribution of genesig real-time PCR coronavirus assay, have facilitated the widespread adoption of quantitative PCR technologies. These agreements have expanded the availability of critical diagnostic tools in regions including the U.S., the U.K., Spain, France, and Germany. In conclusion, the quantitative PCR segment's ascendancy in the market can be attributed to a confluence of factors, including technological innovations, increased demand for automation and point-of-care diagnostics, and the pivotal role it has played in COVID-19 testing. This segment is poised to maintain its strong growth trajectory in the foreseeable future.

Regional Insights

In 2022, North America took the lead on the global market stage, capturing a significant revenue share of over 36.10%. This strong position is expected to persist throughout the forecast period, and several key factors are responsible for this continued dominance. One of the primary drivers is the presence of favorable regulations and government-led initiatives aimed at advancing healthcare infrastructure. North America has actively promoted the development of healthcare technologies, including PCR diagnostics, through supportive regulatory frameworks. Additionally, the region grapples with a high prevalence of diseases, necessitating reliable and efficient diagnostic solutions.Moreover, North America boasts a robust presence of leading PCR technology manufacturers, further cementing its status as a hub for innovation and production in this sector. This homegrown expertise ensures that the region can meet the escalating demand for rapid and precise diagnostic tests. Shifting the focus to Asia Pacific, this region emerges as the most promising and lucrative market. China and Japan stand out for their notable advancements in integrating PCR technology into various applications. Furthermore, emerging economies like India and Australia are actively developing their healthcare, research, and clinical frameworks, contributing to the region's growth potential.

Overall, North America's dominance is attributed to regulatory support, government initiatives, and disease prevalence, while the Asia Pacific region shines with technological integration and expanding healthcare and research sectors. These factors position both regions for substantial growth in the PCR market in the foreseeable future.

Key Market Players

- Abbott Laboratories Inc

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific, Inc.

- BIOMÉRIEUX SA

- Fluidigm Corporation

- F. Hoffmann-La Roche Ltd

- GE Healthcare

- Agilent Technologies, Inc.

- Qiagen NV

- Microsynth Ag

Report Scope

In this report, the Global Real-time PCR, Digital PCR & End-point PCR Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Real-time PCR, Digital PCR & End-point PCR Market, by Technology:

- Quantitative

- Digital

- Endpoint

Real-time PCR, Digital PCR & End-point PCR Market, by Product:

- Consumables & Reagents

- Instruments

- Software & Services

Real-time PCR, Digital PCR & End-point PCR Market, by Application:

- Clinical

- Research

Real-time PCR, Digital PCR & End-point PCR Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Real-time PCR, Digital PCR & End-point PCR Market.Available Customizations

The following customization option is available based on your specific needs: Detailed analysis and profiling of additional market players (up to five).This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Abbott Laboratories Inc.

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific, Inc.

- BIOMÉRIEUX SA

- Fluidigm Corporation

- F. Hoffmann-La Roche Ltd.

- GE Healthcare

- Agilent Technologies, Inc.

- Qiagen NV

- Microsynth AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 172 |

| Published | October 2023 |

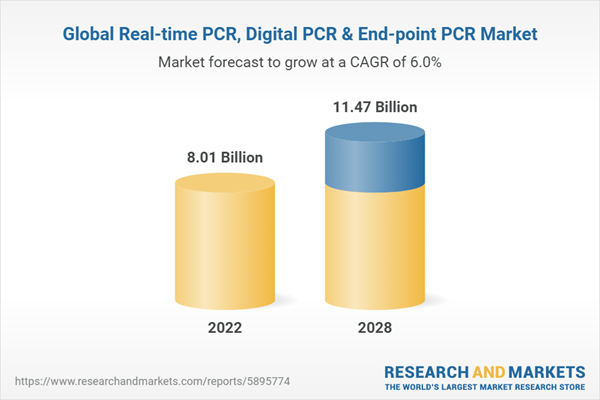

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 8.01 Billion |

| Forecasted Market Value ( USD | $ 11.47 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |